What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Who Is Eligible For A Va Loan

VA loan eligibility is based on your length of service, your duty status, and the character of your service. Current service members generally must have 90 continuous days of service to be eligible for a Certificate of Eligibility . Former military members must have served for at least 24 continuous months or a certain number of days of active duty.

Va Mortgage Rates Faq

Are VA loans lower interest?

You bet. Theyre consistently the lowest among all the major mortgage programs. If youre eligible for a VA loan, its highly likely youll save a lot of money by getting one.

Who has the lowest VA refinance rates?

The lender with the lowest VA refinance rates varies every day and from one borrower to the next. You need to get quotes from multiple lenders to find the one offering the best deal for you when you apply.

What are current VA IRRRL rates?

VA IRRRL rates are typically in line with VA home purchase rates. That is to say, theyre among the lowest refinance rates on the market. Scroll to the top of this page to see current VA mortgage rates today.

What is the current VA funding fee?

The current VA funding fee is 2.3 percent of the loan amount for first-time home buyers with zero down 0.5 percent for the VA Streamline Refinance and 2.3-3.6 percent for a VA cash-out refinance. The amount of the funding fee depends on your loan type, your down payment, and whether or not youve used a VA loan before.

Do you pay closing costs with a VA loan?

Yes, VA loans have closing costs just like any other mortgage. These typically range from 2-5% of the total loan amount. Unlike other loan types, the VA caps lender origination fees at 1 percent of the loan amount. This protects borrowers from overpaying on lender fees. If you choose to pay the VA funding fee upfront instead of rolling it into the loan amount, this will increase your closing costs.

Recommended Reading: How Does Usaa Auto Loan Work

How Are Va Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

Best Jumbo Loan: Usaa

-

No loans over $3 million

-

No auto pay discount

USAA is an organization that offers military members and their families a comprehensive range of financial products and services that are competitively priced. They offer benefits, insurance, advice, banking, investment products, specialized financial resources, and member discounts.

USAA lends nationwide to veteran borrowers seeking a jumbo home loan up to $3 million without needing to pay private mortgage insurance, and wrapping the VA funding fee into the loan.

USAAs VA loan products include a fixed-rate 30-year purchase loan with rates starting at 2.625%, a jumbo fixed-rate purchase loan at 2.828%, and a VA refinance option: the VA interest rate reduction refinance loan at 2.625%. USAA also has non-VA loan options.

To service your loan, USAA offers an autopay process, however, there are no discounts for using the program. Customer service is available through online chat, mobile app, and by telephone at 800-531-USAA .

You May Like: Does Usaa Do Auto Loans

What Is The Va Funding Fee

The VA funding fee is an upfront fee charged on all VA loans for veterans. For members and veterans of the regular military getting their first VA loan, it is 2.15 percent of the amount borrowed for mortgages with less than 10 percent down, including those with no down payment.

Overall, the fee ranges from 0.5 3.3 percent, with the lowest fee charged to those who are refinancing an existing VA loan. Otherwise, the fee varies according to the size of the down payment, whether the borrower is a member or veteran of the Reserve or National Guard, and whether the borrower has previously used a VA loan. The fee is waived for those with certain disabilities and surviving spouses of those who died in service.

On manufactured homes, the VA funding fee is 1 percent.

The fee may be rolled into the loan amount, so you don’t have to pay it up front.

Locking Your Interest Rate

Once you choose your lender and go through the approval process, you can choose to lock in your interest rate. A lock holds your interest rate for a certain time period, usually 30 to 60 days. Lenders will often do this free of charge for an initial period, but if you want to hold the rate longer there is a charge to do so. On the surface, this sounds like a no brainer. However, there are some drawbacks. For one thing, if the rate goes down you would lose out on that lower interest rate. You also need to take into account how long it will take you to find a house. Often times, people choose to wait until they have a Purchase and Sale agreement, and then lock in the rate at that time. Do your research and see what the experts say. Talk to your lender as well. The more information you have the more confidant youll feel about your decision.

Read Also: Credit Score Needed For Usaa Personal Loan

How To Apply With The Best Va Loan Lenders

The worst thing you can do when applying for a VA loan is to go with a Lender who isnt specialized in VA Loans.

Its also not a great Idea to go with some of the larger VA Lenders that dont always close on time.

We have a solid 3 step plan called the Tactical Va Loan Blueprint that we take each of our customers through.

What Determines My Va Loan Rate

There are lots of factors that influence your unique VA loan interest rate, including the larger economy, inflation, and more. Your credit score, payment history , your down payment, and your debt-to-income ratio also factor in. Higher credit scores and larger down payments typically qualify you for a lower interest rate.

Recommended Reading: Is Loan Lease Payoff Worth It

Va Loan Borrowing Costs

Interest rates reflect the cost of borrowing money. Your credit score, the type of loan youre seeking, the lender youre talking with and other factors can all play a role in what rate you get quoted. Every buyers situation is different.

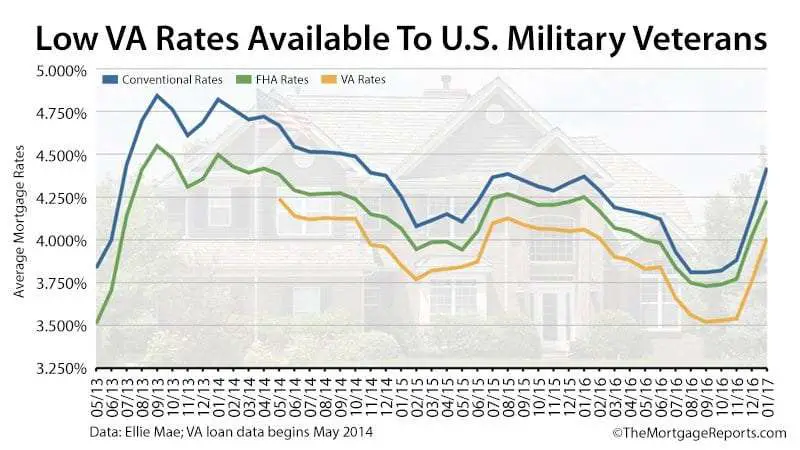

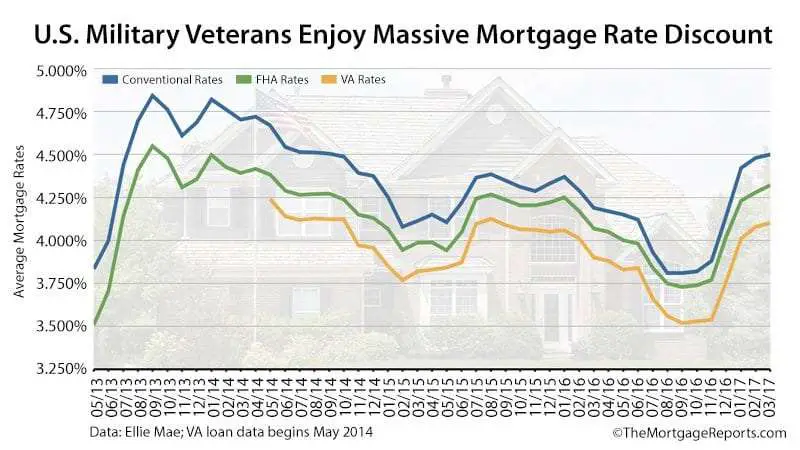

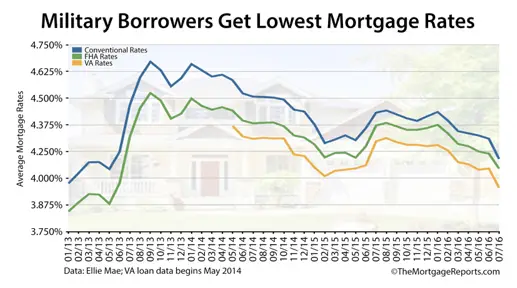

One of the benefits of VA loans is they typically feature lower average interest rates than other loans, including conventional. The interest rate will directly affect your monthly payment.

Its important to understand that the VA doesnt set interest rates. Lenders set their own rates, based in part on whats happening in the mortgage bond market. VA loan rates can change multiple times in a single day, and two different lenders may quote you two very different rates.

When youre talking with lenders about rates, its also key to make sure youre comparing apples to apples. Make sure lenders are quoting you a rate based on the same credit score and loan amount, and ask for the rate without paying any discount points. A discount point is equal to 1 percent of the loan amount, and its cash paid at closing to buy a lower interest rate.

You can for qualifying Veterans United borrowers.

Va Home Improvement Loans

The VA does not support any conventional home improvement loans. You can obtain funds for home improvements by a cash-out refinance backed by the VA, but the VA does not offer an option for taking out a second lien specifically for home improvements or any other purpose. See the explanation of home equity loans, above.There is the Energy Efficient Mortgage for funding energy efficiency improvements but that must be included with the VA home loan used to pay for the property .

Read Also: Becu Auto Loan Early Payoff Penalty

Quicken Loans: Best Online Experience

Quicken Loans provides the best online experience for military members seeking a more self-service approach to banking, with available access to live mortgage experts when needed. In order to qualify for a VA loan through Quicken Loans, veterans and military members will need to provide a certificate of eligibility and prove that they have a minimum FICO® score of 620 or higher. In addition, the debt-to-income ratio should be no more than 60%.

Currently, Quicken Loans offers 30-year, 25-year, and 15-year fixed VA loans with VA home loan rates of 3.75%, 3.75% and 3.125%, respectively. The APR for 30-year, 25-year and 15-year fixed loans is 4.21%, 4.282% and 3.931%, respectively.

Calculate A Va Monthly Mortgage Payment

Enter your homeâs purchase price, down payment , loan term, and interest rate to calculate a monthly VA loan payment. Select whether or not you receive VA disability and if this is your first VA loan for more accurate results. Include annual homeowners insurance and property taxes to complete your VA mortgage payment calculations.

For special circumstances like tier 2 entitlement and refinancing, choose from the following calculators.

You May Like: Car Loan Calculator Usaa

Why Choose A Va Loan

You probably know there are significant advantages to VA loans compared to other types of mortgages. One of the most popular benefits is that VA loans do not always require a down payment. That allows you to purchase a home with less cash upfront. Also, VA loans have attractive low-interest rates. With all these significant advantages, you might have another question: Who sets the rates? The Department of Veterans Affairs or the lender?

Allowed Uses For Va Loans

A VA mortgage loan can be used for a wide range of purposes related to home ownership. You can use one to buy a single-family home, a unit in a residential condominium or a manufactured home and lot.

A VA cash-out refinance lets eligible veterans and service members borrow money for any purpose, including home repairs and improvements, or as a military consolidation loan to pay off existing bills. There’s also a VA Energy Efficient Mortgage that lets you borrow up to $6,000 for energy efficiency improvements on top of what you need to purchase or refinance your home.

There’s a VA Streamline Refinance option that makes it easy to refinance an existing VA loan to a lower mortgage rate. Eligible veterans can also use a VA mortgage loan to refinance another existing mortgage, even if the current mortgage is not a military loan.

Here’s a look at the various types of home loans for veterans that are available with VA backing.

Read Also: Can I Refinance My Upstart Loan

How Do Va Loan Rates Compare

Overall, VA loan rates are typically lower and depend on factors like credit score and loan type. To get a better handle on rate comparisons, you can use a tool where you plug in different loan types based on your unique answers. With our mortgage calculator, you can get a quote that is specific to your financial needs.

The Va Loan Guaranty Explained

The amount veterans can borrow without a down payment is based on the VA Loan Guaranty, which is the key to how VA home loans work. The VA doesn’t actually make loans for veterans itself, but instead guarantees part of the loan amount on approved mortgages issued by authorized lenders. This typically is 25 percent of the purchase price, up to the limits described above. So if a VA borrower defaults on a $400,000 mortgage, the VA will pay the insurer up to $100,000 to cover losses not recovered through foreclosure.

For the lender, the VA’s guaranty is like having a 25 percent down payment as a hedge against default. So the VA borrower gets all the benefits of a hefty down payment low interest rate, easier qualifying, no recurring fees for private mortgage insurance without having to put out the cash. Of course, he or she is still responsible for paying off 100 percent of the loan.

If you don’t borrow the maximum you’re allowed without a down payment, you’ll still have some of your VA Loan Guaranty remaining, which you could apply toward buying a second or vacation home. The formula for figuring how much of your guaranty you have left is fairly complicated though, as it depends on the lending limits for the county where you bought your first home and the one where you plan to buy a second. A VA lender can help you with this calculation.

More information: The VA Entitlement explained

Read Also: Diy Loan Agreement

Improve Your Credit Score

Your credit score may affect the mortgage rate that the lender offers you. Generally, the higher your credit score, the lower the interest rate will be on your home loan. Before applying for a mortgage, review your credit score and get it in the best shape possible.Learn more about how to improve your credit score.

What Is A Va Home Loan

Military service members and their families are in the unique position to build equity through real estate at a lower cost than typical homebuyers.

VA loans provide affordable mortgage options for military veterans, active service members and their families by easing some of the financial burdens associated with buying a home. Since its creation in the 1940s, the VA mortgage program has helped millions of service men and women get a foothold in the housing market and build a stable financial future.

Provided by the U.S. Department of Veterans Affairs, this program allows lenders to issue financing with more flexible eligibility standards and repayment plans. As an eligible VA loan applicant, youll get the benefits of zero down payment requirements, lower credit score minimums, comparatively lower interest rates, and other purchasing perks that can only be accessed with a VA loan.

While the VA does not provide the financing used in a home purchase, they do cooperate with private lenders to build an affordable mortgage plan. The VA guarantees private lenders that home loans for qualified military members will be backed up should the home fall into foreclosure. This guarantee only extends to the lender and does not assist the borrower or prevent them from falling into foreclosure. This added government assurance grants lenders with the flexibility to expand homebuying opportunities for service members looking to apply for a mortgage.

Read Also: Usaa Car Loan Bad Credit

Interest Rate Vs Annual Percentage Rate

When you start to research interest rates, youll notice that lenders will give you both an Interest Rate and an Annual Percentage Rate. The difference between these two numbers is a continuing source of confusion among consumers.

· Your Interest Rate is the per year cost to borrow the money from the lender. It doesnt matter if the rate is fixed or adjustable, and it does not include other fees charged to you by the lender.

· The Annual Percentage Rate includes the interest rate, broker fees, points you choose to pay and other items charged to you to get the loan. The APR is almost always higher than the interest rate.

The interest rate and loan balance are what determines your monthly mortgage payment. Because the APR includes loan fees charged by a lender, its often a much better tool for comparison shopping. It gives you a clearer picture of the overall cost of the loan. When you are shopping for lenders, ask what they include in their APR. The Truth in Lending Act was put in place by the Federal Government to protect consumers from unlawful credit practices. It requires lenders to disclose what fees make up their Annual Percentage Rates.

You should also be aware of unsolicited loan offers that sound too good to be true. Veterans are often considered easy pray for predatory lenders that try to lure you in with super-low interest rates that will balloon up after a period. Always be sure to do your homework and beware any offer that sound like easy money.

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

Also Check: Is Prosper Legitimate