Starting A Business With A Family Loan

Most lenders arent willing to work with businesses that havent yet opened their doors. A popular alternative for startups are family loans.

Using a family loan to fund a startup works a lot like any other family loan. However, given new businesses are risky, you might want to draw up a business plan before you meet, which tells your family what your business is and where you see it going in the future.

You might also want to consider asking for an equity investment, instead of a loan. While you wont own 100% of your new business, you also wont have to repay the funds you borrow.

What To Think About

The person looking to borrow money should consider the following issues before they ask a family member or friend for a loan:

It’s more likely a request to borrow from family or friends will be successful if it’s for a specific purpose.

So, a family member is more likely to loan money to purchase a new washing machine because the old one has broken rather than for a non-essential purchase like a games console or a holiday.

It’s also important to provide a clear plan for repaying the loan, whether this is getting another job, more hours or cutting back in other areas to repay the debt over a specific period.

For the potential lender, there are some different things to consider:

If making a loan to a family member or friend will put the lender at risk of financial difficulty themselves, it’s important to find a way to say no.

Equally, if a person doesn’t want to make a loan because they don’t think they will be repaid or just don’t want to enter into such an arrangement, that’s within their right and they should not feel compelled to lend money in those circumstances.

If the problem is that the situation seems too informal, there is another option: make it more formal.

Limiting Loans To What You Can Afford

Making a large loan to help someone out is a bad idea if it puts the squeeze on your own finances. When deciding how much to lend to someone, a good way to frame it is to think of the money as a gift. In other words, how much money could you lose without it hurting you financially?

That doesnt mean youre assuming you wont be repaid. Instead, it helps you set some realistic boundaries for lending money to friends and family, so you dont end up in the position of needing a loan yourself later.

Read Also: Is Myeddebt Ed Gov Legit

Benefits And Drawbacks Of Borrowing From Family

Not sure if borrowing from your family is the right choice? Weigh the pros and cons of getting a family loan first.

Benefits

- No credit check. Even if your family wants to know your credit score before you apply, they arent able to pull a hard inquiry that can cause your score to drop a few points. But they might want you to check your credit to see how youve been doing financially.

- Low or no interest. Depending on your personal situation, family members are likely to agree to a lower interest rate than youd find at your bank if they charge interest at all.

- Room to negotiate. Unlike with other types of loans, you have more of a say in the rate and terms you end up with than you might with a traditional lender. But be understanding. Its still a loan, and you should treat negotiation professionally.

Drawbacks

S You May Take To Protect Your Security

As a lender, you may wish to protect your security interest from third parties. To do so, you must ensure the security agreement meets three conditions:

-

it includes specific descriptions of the collateral

-

the borrower has signed it

-

the agreement is registered with a government registry

These steps perfect your security interest. A perfected security interest has priority over claims by other parties to the collateral. If two parties have a security interest in the same collateral, and one interest is perfected and the other isnt, the perfected security interest takes priority. If both security interests are perfected, the first one to have perfected their interest has priority.

If the borrower physically gives you the collateral, that also perfects your security interest. It has the same effect as a security agreement. It shows the borrowers intention to give you an interest in the property.

Check for prior security interests

If youre asking for a security interest in the borrowers property, its best to check the government registry to see if there are already security interests in the property.

Don’t Miss: Myeddebt Ed Gov Legit

Lending Money To Friends And Family Requires Careful Planning

Lending money to family and friends can be a gesture of goodwill when someone you know is in a tight spot financially, but it can be problematic if your efforts to help lead to disagreements or you experience financial issues as a result. In a 2019 LendingTree survey, 24% of people who lent money to someone they knew said they regretted doing so. If youre approached by a friend or family member for a loan, keep these dos and donts in mind.

Figure Out How Much You Can Afford To Lend

Before you agree to help someone out financially, ask yourself:

-

How much can I comfortably lend them without sinking my own finances?

-

Will I be okay financially if they dont pay me back?

-

How will this affect my relationship with other family members?

Prepare yourself for the possibility that you wont get the money back. That way if you do, it will feel like a bonus.

Don’t Miss: Car Loan Through Usaa

Dont Assume Anything About A Family Loan

There have been several well-reported cases of parents and children who had different ideas about a sum of money which changed hands in order to purchase a property or pay for education and often one party is left feeling angry or misled.

There are a number of important factors both the borrower and the lender should consider and while informal family loans may seem straightforward at the start, over time feelings and financial needs change. Lending money to family should rarely be treated lightly and if open communication about the terms of a loan is established, it could save a lot of heartache and financial stress in the future.

Discuss An Interest Rate Thats Reasonable

This can be a touchy subject but its definitely one that needs to be discussed and taken seriously. Since its you thats putting up the money and taking on a certain amount of risk its completely reasonable to ask for interest. But dont be surprised if your friend or family member objects, they might not have even thought about interest and therefore might not have budgeted for it. If this is the case have a conversation about it and explain your side of the situation, theyll probably understand.

When it comes to setting the rate, be fair and reasonable. Youll probably want the rate to be lower than one from a bank but still high enough that youre making more money than if you left the cash in your bank account. Dont forget about taxes as you might run into some complications surrounding gift taxes.

Recommended Reading: Usaa Car Refinance Rates

Be Careful With Cosigning

Some family members offer to help loved ones qualify for a loan or credit card by cosigning, rather than lending money themselves. They think theyre protecting themselves and their money.

Theyre not.

Not only are you still on the hook for repaying the debt, you also risk your credit score. Worse, you no longer have control over the amount of the debt. Your family member could rack up $10,000 in credit card debt without your permission, whereas you might have lent them only $1,000 as a direct loan.

If someone asks you to open a credit card in your name for their personal use or requests that you cosign for a loan, agree only if you trust them implicitly. You can control cash, and lending it wont directly affect your credit score. When you cosign for a third-party loan or line of credit, youre on the hook for the balance.

Is Lending To Friends Or Family A Good Idea

There are a few things to consider before you lend money to a friend or family member.

If you do lend them money, will it cause problems with your friendship? Will it make it hard to see them if they dont pay you back, and what would you do if theyre not able to repay the loan?

No matter what the reason for them coming to you, its important to carefully look at all of your options to make sure youre doing the right thing.

For example, they may want to borrow money from you to pay off a high-interest loan or to tide them over between jobs.

But you have to put your financial well-being first. If things went wrong, you could end up losing your money and your friendship.

The first thing to ask yourself is if you can afford the money. It shouldn’t be money that you rely on, or money you need for yourself to pay household bills or childcare costs, for example.

Then you need to think of the potential scenarios that might occur. What if your friend then loses their job and takes longer to repay you, maybe they take out another loan that they decide to pay off first. Would you be comfortable if your friend didnt pay you back on time and it took them a little longer?

While some of these things are impossible to know, there are safeguards you can put in place.

These will work for both of you because they dont want to wreck their relationship with you on top of their financial problems.

Read Also: Can I Use A Va Loan For An Investment Property

Legal Considerations Of The Bank Of Mum And Dad And Other Family Loans

More and more first-time home buyers are now relying on family members to help them get onto the property ladder and loans from family members are becoming the norm. This if reflected by the fact that the bank of mum and dad is now said to be one of the 10th largest lenders in the UK.

Increasing house prices, difficulties with saving and bad credit ratings are just a few reasons why, for some, loans from family members are the only realistic option when it comes to buying their first home.

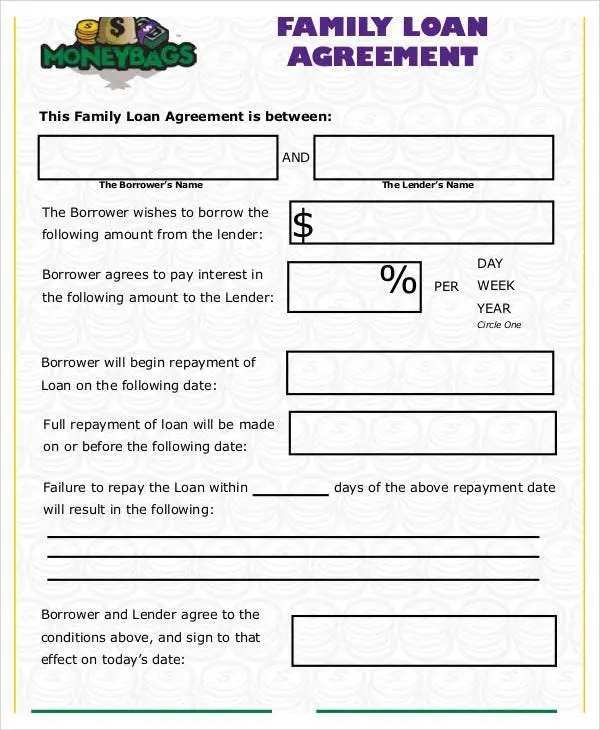

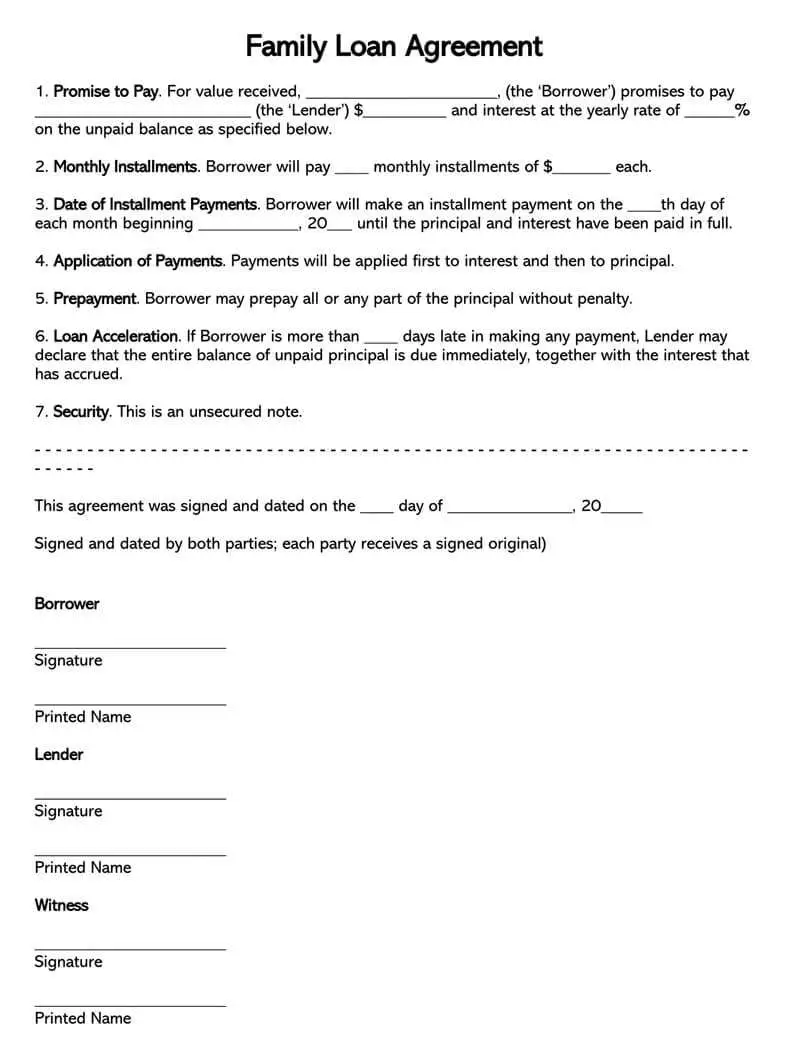

Late Fees And Collateral

The family loan agreement must also state any consequences lenders can impose on their borrowers if they stop making their repayment. This includes whether the borrower will be charged for late fees or if the lender will take any collateral. Stating this ensures the lender has proof that the borrower was well informed of the consequences attached to late fee payment.

You May Like: Refinance Auto Loan With Usaa

Lending Money Only To People You Trust

If youre lending money with the expectation that youll get it back, then its important to be selective about to whom you offer a loan. Limiting loans to friends or family members you trust to pay back what they owe can help you avoid financial and emotional headaches later. In the Lending Tree survey, for example, nearly a third of borrowers and lenders reported negative consequences, including resentment and hurt feelings.

If you dont feel comfortable lending money to someone, then its OK to say so. You may get some pushback, but its important that youre only lending money when youre confident that it wont cause the relationship to go south.

Consider asking the person to whom youre lending money for some type of collateral equivalent to the loan amount that you can hold as security until the loan is repaid.

Know That Your Relationship Will Change

Money is often a divisive and awkward topic, especially in personal relationships.

“Loaning money to family members is more than just a financial decision it’s also an emotional one,” Moore says. “Loaning money to someone across the Thanksgiving table from you can cause major issues, sometimes without you realizing it.”

“It turns your relationships from sibling to lender, and when there is an issue , it can make you seem like you’re holding the money over them even when you don’t intend to,” he said, advising that it’s imperative not to mention the payments outside of predetermined times. “Even off-hand comments across the room like, ‘Sure hoping to get that first payment soon!’ can ruin a relationship.”

Read Also: Loaning Signing Agent

Alternatives To Loans From Family Member

A 2009 survey by CNN Money reported that 27% of people who lent money to family or friends didnt receive any money back and 43% were not paid in full. In other words, most of the time loans between family and friends dont work and destroy relationships.

However, there are alternative sources of money if you want to avoid the very real possibility that taking or giving a loan to a family member or friend will not result in a good outcome.

Admittedly, it will be difficult to tap some of the sources for mortgage loans, house renovations or car loans, but if youre looking to start a business, the Small Business Administration is a government agency dedicated to serving small businesses. They offer a variety of loan programs, including a General Business Loan that could get you $50,000 to $250,000. The SBA also has a Microloan program that offers up to $50,000 for startups and some non-profit childcare centers.

When you go online, there are peer-to-peer lending sites such Lending Club and Prosper or crowdfunding sites like Kickstarter and Crowdfunder may deliver the loan you dont want to ask Mom and Dad for.

If youre looking for something that will help with a renovation or be a down payment for a home or new car, you could consider borrowing from your 401 retirement fund or doing a home equity loan or home equity line of credit .

8 Minute Read

Why The ‘perfect’ Loan Is Impossible

Michael LeBourdais is the former chief of the Whispering Pines-Clinton Indian Band in Kamloops, B.C., and the chairperson of the Tulo Centre of Indigenous Economics.

He, too, is a rancher, and knows first-hand the problem of trying to obtain a loan.

“It’s very, very disparaging to First Nations just trying to get a credit card, just trying to start a small business, just trying to keep a cow-calf-cattle operation going,” he said.

“We’ve never owned new equipment. All of our equipment is used because we have to pay cash for it.”

LeBourdais explains that for people who don’t have collateral, such as a First Nations rancher on reserve, the bank might require that the loan be backed 100 per cent what’s known as a “perfect” loan.

“You need literally to have bonds, to have stocks, to have gold or something sitting in a safe that the bank feels comfortable that they can snatch up and grab if the loan goes sideways,” LeBourdais said.

At least one bank specifically cited that challenge.

In a statement to Cost of Living, BMO said that “in the case of someone collateral is located on a First Nation, the lender needs to understand the limitations and restrictions of the Indian Act, in particular the challenges centred around Section 89.”

Meanwhile, all five major Canadian banks tout Indigenous banking services on their websites.

You May Like: Mortgage Originator License California

Be Open & Transparent With Other Family Members

Family members get touchy about money. If you lend your responsible daughter money in a bind but turn away your less-than-reliable son when he comes knocking, expect a hissy fit.

But as awkward as that sounds, its far better than trying to keep family loans a secret from other family members.

Secrets within a family have a tendency to get out. When they do, theyre a recipe for hurt feelings. Legitimately so families should operate with transparency.

Dont try to hide loans within the family. If necessary, call a family meeting to discuss it. And if you , always ask their thoughts and approval before lending a cent.

Lend Money To Your Spouse Or Child

Income Tax Act s. 74.5, Income Tax Regulations s. 4301

If one spouse is in a higher tax bracket, it may be beneficial to lend money to the lower-income spouse. Money can also be loaned to a child who is under 18 years of age. The funds can be used to purchase investments, and tax on the investment income will be paid by the lower-income spouse at a lower marginal rate. A promissory note should be written for the loan, with the interest rate and principal amount specified. Interest must be paid on the loan by January 30th of each year. In order for attribution rules to not be applied, the interest rate charged must be greater than or equal to the lesser of:

the prescribed rate set by Canada Revenue Agency at the time the loan is made, or the rate that would, having regard to all the circumstances, have been agreed on, at the time the loan was made, between parties dealing with each other at arms length.

In order for this to work, the investments from borrowed funds should be in a separate investment account in the borrower’s name.

Recommended Reading: Capitol One Car Loans