Ways To Obtain Mobile Home Financing

Once you decide on your mobile homes features and where youre going to put it, its time to figure out how to pay for it. There are a few options to consider when financing a mobile home.

For example, its possible to get a loan from the same sources as traditional mortgages, such as FHA and VA loans, as well as specialized manufactured home loans through Fannie Mae and Freddie Mac.

These mobile home financing options tend to give you longer repayment terms. Depending on your situation, you may opt for a nontraditional path with a shorter term. This could include chattel or personal loans.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

What Is The Fha Waiting Period For Borrowers With Previous Bankruptcy

Bankruptcy does not automatically disqualify a borrower from obtaining an FHA loan. Minimum 2 years since discharge of chapter 7 bankruptcy. Borrower with less than 2 years discharge may qualify for financing so long as they meet the extenuating circumstances as defined by FHA/HUD. Same rule applies for borrower with chapter 13 bankruptcy.

However, borrower with chapter 13 bankruptcy may still qualify if the bankruptcy has been discharged less than 2 years if the lender is willing to do a manual underwrite with satisfactory payment history under the chapter 13 plan.

Read Also: How Long Does Sba Approval Take

Wisconsin Fha Loans Low Money Down Wi Fha Financing

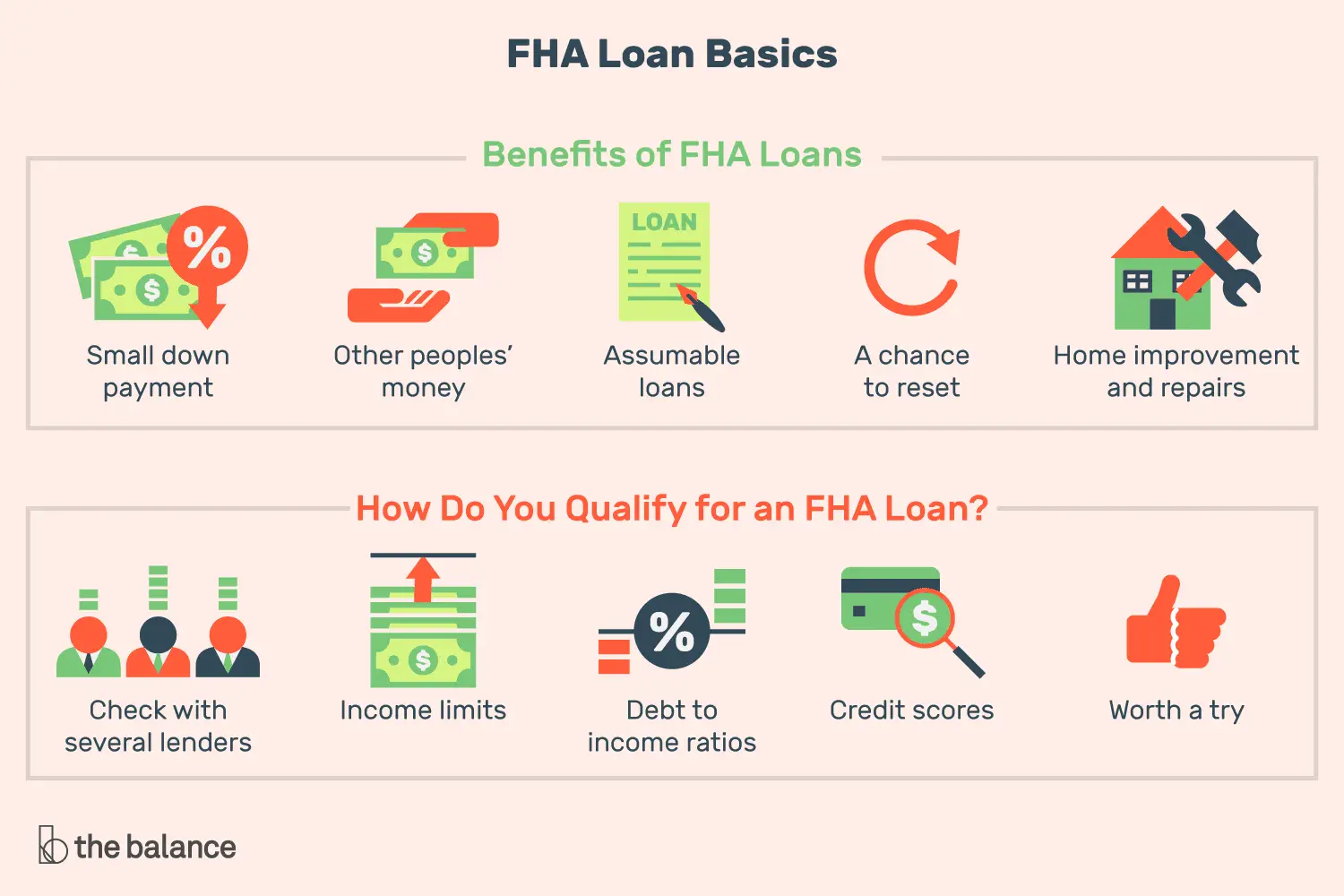

Backed by the Federal Housing Administration, FHA loans are popular among first time home buyers and others interested in low down payment loan options. With an FHA loan, buyers can put as little as 3.5% down on a home purchase or borrow up to 97.75% with an FHA refinance.

Thinking about doing some home repairs? We also offer FHA loans that make the purchase and renovation of a home affordable and easy through one mortgage loan or refinance. Whether youre searching for a low down payment loan for a house just outside Madison or you want to refinance the existing mortgage on your Green Bay condo to something more affordable, a Wisconsin FHA loan could be the solution.

What Is The Minimum Credit Score Required For Fha Loans And First Time Home Buyers

A tri-merged credit report score of 640 is preferred. Depending on overall credit, sometimes borrowers may qualify with middle scores as low as 580.

In some instances, where a co-borrower does not have any credit scores, FHA will consider approval so long as the primary borrower meets the minimum credit score requirements and has more than 50% of the qualifying income with a minimum of 3 tradelines active for last 24 months.

Regardless of credit scores, FHA still evaluates overall credit history to determine if borrower gets approved eligible findings that meet FHA approval guidelines.

Also Check: Usaa Rv Financing

Fha Mobile Home Loans

FHA mortgages can be used to purchase or build a variety of properties and one of those property types is the mobile home.

You can use an FHA mortgage to purchase mobile homes, manufactured homes, modular housing and similar types. FHA loan rules in HUD 4000.1 group these types of mortgages together under the manufactured housing description.

Not all manufactured housing or mobile homes are eligible for an FHA mortgage. HUD 4000.1 has certain criteria that must be met for the loan to be approved.

Those requirements include, but are not limited to being a single-family dwelling with at least 400 square feet of floor area the property must have a HUD Certification Label.

Alternately, instead of the label, there must be a letter of label verification issued on behalf of HUD, evidencing the house was constructed on or after June 15, 1976, in compliance with the Federal Manufactured Home Construction and Safety Standards according to HUD 4000.1.

But those rules arent the only onesyour mobile home or manufactured house must be classified as real estate, it must be built on a permanent chassis, and it must be affixed to a permanent foundation that meets HUD requirements.

The home must be taken directly from the manufacturer or dealership to the site where it will become attached to the foundation.

A recreational vehicle is exactly thata vehicle that cannot be classified as real estate for any reason as it pertains to FHA home loan approval.

What Are The Fha Guidelines For Borrower With Previous Foreclosure And Deed

Foreclosure waiting period is measured from the date of title transfer. Three years must have elapsed from the time title transferred. If the foreclosed loan was an FHA loan, the 3-year waiting period is based on the date the FHA claim was paid .

Borrowers with foreclosure/DIL within 3 years of case number assignment that was due to documented extenuating circumstances may be eligible if the borrower has re-established good credit since the foreclosure. A downgrade to manual underwriting is required. If the foreclosure was included in the bankruptcy, the foreclosure waiting period still applies. HUD treats the foreclosure and BK independently, not as a single event.

Don’t Miss: Mlo Endorsement To A License Is A Requirement Of

Is A Mobile Home Right For You

Only you can decide if the pros outweigh the cons with a mobile home. It could be a great way for many people to break into homeownership at a lower cost. And for those who plan to live in the home for a long time, depreciation may not be that big of a drawback.

If you have more questions about manufactured homes or FHA loans, complete our contact form and well be in touch.

Tim Lucas

Editor

Figure Out The Specifics Of The Home That You Want To Purchase

The type of home youre looking for will affect the loans you may be eligible to receive. For example, if you want to buy a double-wide manufactured home that costs $100,000 or more, you wont be eligible for an FHA loan. In addition, older mobile homes may not qualify for financing at all.

Why its important: All lenders have specific lending criteria based on the type and value of your home.

Read Also: Usaa Vehicle Loan Calculator

Determine Your Down Payment

It helps to know how much you can provide as down payment before you start looking for a home. The size of your down payment may have an impact on the amount you get pre-approved for. Plus, down payments of less than 20% of the purchase price of a home require mortgage default insurance, whereas down payments that are 20% or above may not.

Manufactured Homes Financing Requirements And Guidelines

Manufactured home financing guidelines require that the land must be owned by the homeowner. The manufactured home needs to be permanently built on a concrete foundation.

- The floor area of the manufactured home needs to be a minimum of 400 square feet

- There are overlays with regards to credit for manufactured home financing borrowers

- Minimum credit scores for manufactured home financing is 620 by most lenders

- However, depending on the manufactured home financing mortgage lender, higher credit scores may be required

The reason why manufactured home lenders require higher credit scores is that they classify it as higher risk investments.

Don’t Miss: Usaa Used Cars

Who Can Get A Manufactured Home Loan

Getting a loan for a manufactured home is different than getting a traditional home loan.

There are a few basics you should know before diving into mobile home financing options:

- Not all manufactured homes are considered real estate

- If the home is on wheels or you pay fees to the DMV, the home is considered a vehicle

- There are strict rules about property condition and age

To qualify for traditional home financing or refinancing options, a home must be classified as real estate. But not all manufactured housing is considered real estate.

Ifyour mobile home is at least 400 square feet, on an approved permanent foundation, andtaxed as real property, you can apply for conventional or government-backedmortgages.

If you pay annual fees to the DMV, or the building is still on wheels, then the property is a vehicle, not a house. In this case, it will not qualify for a mortgage loan. Mobile homes often fall into this category.

You may be able to get a mobile home loan for personal property instead of real estate if you have at least 5 percent down and the home is reasonably new.

Also know that many manufactured home loan programs have strict guidelines about the propertys condition and age. Thats because manufactured housing tends to depreciate in value, while traditional home values tend to increase over time.

Related

How Do I Apply For An Fha Loan

An FHA mortgage is a great way to buy a house without needing a big down payment or perfect credit score.

While theyre backed by the federal government, FHA mortgages are available from just about any private lender. So its easy to apply and shop around for low rates.

You can start your application online and even close online in some cases. Or you can work oneonone with a loan officer for extra guidance. You get to choose your lender and how you want to apply.

Don’t Miss: Should I Choose Fixed Or Variable Student Loan

What Is A Manufactured Home

Manufactured homes are a type of prefabricated housing thats constructed in factories and then transported to a lot for a permanent residence. Fewer banks are willing to lend mortgages to cover manufactured housing, but there are some options available.

One such option is an FHA loan, a type of loan that has helped countless people get onto the housing market.

Mobile Manufactured Or Modular

Mobile homes are factory-built homes made before June 15, 1976. They might be very nice homes, but they were built before regulators required certain safety standards. Mostalthough not alllenders are reluctant to lend on these properties.

Manufactured homes are factory-built homes constructed after June 15, 1976. They’re subject to the National Manufactured Housing Construction and Safety Standards Act of 1974, and they’re required to meet safety standards set by the U.S. Department of Housing and Urban Development . These rules are often referred to as the “HUD Code.” Manufactured homes are built on a permanent metal chassis and can be moved after installation, but doing so can interfere with financing.

Modular homes are factory-built homes that are assembled on site and are required to meet all the same local building codes as site-built homes rather than those required by the HUD Code. They’re usually permanently installed on a concrete foundation. Like site-built homes, modular homes tend to hold value and appreciate more than manufactured or mobile homes, so its easier to get loans for these homes.

What you call a mobile home is probably a manufactured home, even though the home isor once wasmobile. Either term works, but most lenders avoid lending on properties that are categorized as mobile homes.

Don’t Miss: Usaa Graduate Student Loans

How Long Can You Get A Mobile Home For

Chattel loans typically only have terms of 15 or 20 years, but you can get some government loans for longer. The FHA Title II loan, for instance, can have a term of up to 30 years, but it’s closer to a standard real estate loan, since it also includes land, not just the mobile home. Loans like this are more limited in availability for mobile and manufactured homes.

Foundation And Land For The Home

You may decide or local laws may require you to put the home on a foundation. Those costs can escalate quickly, depending on the type of foundation you choose.

According to one manufactured home company, slab or pier and beam foundations are among the most affordable. But if you decide to create a basement foundation to add some living space to the home, you could pay substantially more. Depending on the square footage of your manufactured home, you could pay tens of thousands of dollars to put down a foundation.

Then theres the land itself. If you buy the land, will it need to be cleared and readied for a foundation to be built? Consider the labor and materials costs if so.

There are always costs and trade-offs, and its important to see the full picture before you make a decision.

You can sidestep some of those expenses by purchasing an existing home thats already on a foundation. But if youre buying directly from the factory and need to arrange for a foundation and land clearing, make sure to work those into your budget.

You may also be able to rent land in a manufactured home community or mobile home park, though youll want to look carefully at the terms and costs of that as well. Make sure its affordable, because you may find youre better off purchasing land yourself after all.

Read Also: Car Loan Interest Rates Credit Score 650

Fha Manufactured And Mobile Home Loans

FHA loans help those with a low down payment and less than optimal credit scores to qualify for a mortgage. The FHA guidelines for both mobile homes and manufactured homes have loan limits plus foundation and appraisal rules that must be followed.

FHA eligible manufactured homes must be occupied as a primary residence and must have been built after June 15, 1976 on a permanent foundation. Each home must be classified as real estate and must have a HUD certification label attached.

Common Questions About Fha Mobile Home Loans

FHA home loan options include FHA mortgages for mobile homes. You can buy a mobile home, manufactured home, or modular home using an FHA mortgage and there are many common questions about this type of FHA mortgage option.

What Does the FHA Define As A Manufactured Home?

The FHA official site describes a mobile home as a property built to the Manufactured Home Construction and Safety Standards and displays a red certification label on the exterior of each transportable section.

The FHA official site also states that manufactured homes are built in the controlled environment of a manufacturing plant and are transported in one or more sections on a permanent chassis. FHA loan rules state that any mobile home must be affixed to a HUD-approved permanent foundation as a condition of loan approval.

Manufactured Home Versus Modular Homes?

Is there a difference, for the purpose of FHA loan approval, between a mobile home and a modular home? According to the FHA, manufactured homes are constructed according to a code administered by the U.S. Department of Housing and Urban Development This so-called HUD Code, requires any manufactured home purchased with an FHA mortgage, to be constructed on a permanent chassis.

FHA Home Loan Options For Mobile, Modular, and Manufactured Homes

The HUD official site advises consumers that there are two basic options for mobile/manufactured homes.

Mobile Home Installation Problems

Also Check: My Car Loan Is Not On My Credit Report

How Do I Qualify For Mobile Home Financing

To be eligible for our mobile home loan program, some of the requirements that must be met include the following:

- The home must be a minimum of 400 square feet.

- The home must have been built after June 15, 1976, and in conformance with the Federal Manufactured Home Construction and Safety Standards .

- The home must be on a permanent foundation and cannot be located in a mobile home park.

- The loan must also cover the land that the manufactured home sits on. If it does not, and the mobile home is on land you do not own, we can still help you! Our personal property loans are *powered by MHL. Talk to one of our home loan specialists today!

Looking to refinance instead? Learn more about refinancing a manufactured home or refinancing a mobile home with eLEND!

Manufactured Home Financing Options: Title 1 Loans

According to the HUD website, a Title I loan can be used for the purchase or refinance of a manufactured home, a developed lot to place the home, or a home and lot combination. The home must be the borrowers principal residence to qualify.

FHA approved lenders work with the Title I program to make the loans from their own funds and the Title I program ensures those loans in case the home buyer defaults.

A homeowner does not have to purchase or own land that their manufactured home is going to sit on.

Borrowers may lease a lot in a manufactured home community and still qualify for a loan as long as the lease is for a lease term of at least 3 years. Also, the lease must include a provision that the owner will receive at least 180-day notice if the lease is going to be terminated. This is in place to protect the homeowner in case a community closes.

Don’t Miss: Can I Use A Va Loan For An Investment Property

Applying For An Fha Loan

Home ownership is a goal that can be tough to reach. FHA loans can make it easier. With low down payments, relaxed credit requirements and competitive rates, FHA loans are designed to meet the needs of first-time homebuyers and other buyers whose credit or finances might make it difficult to qualify for a conventional mortgage.

You can submit an application for an FHA loan at most mortgage lenders. Here’s what you should know in order to apply.