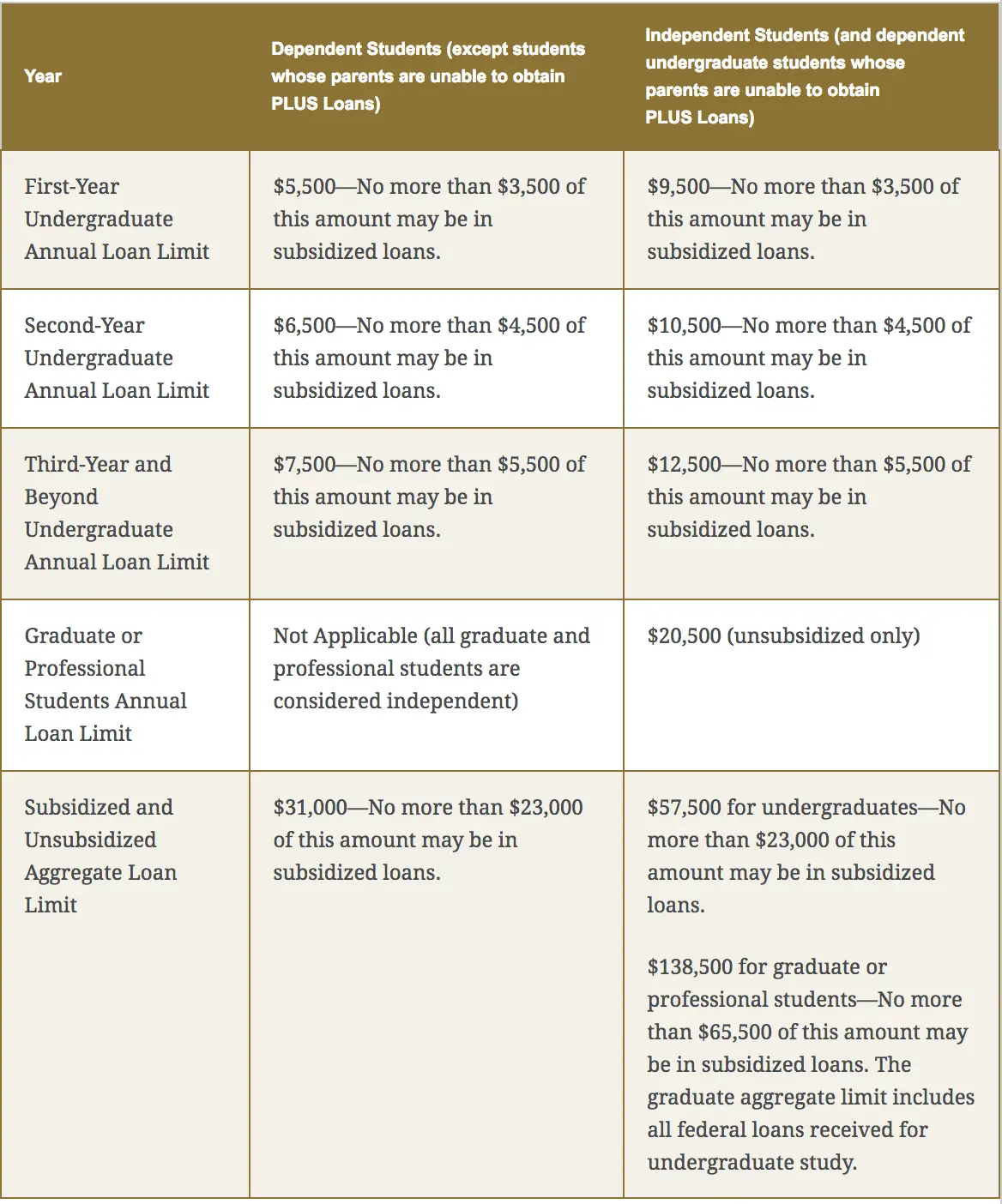

Unsubsidized Stafford Loan Limits

The total amount that you can borrow in Unsubsidized Stafford Loans will depend on a number of factors, including whether you are an undergraduate student or an undergraduate student, as well as the specific year of your education for which you are borrowing.

For undergraduate students who are dependent on their parents, you can borrow a total of $31,000 in Unsubsidized Stafford Loans. The amount varies by year:

- During your first year you can borrow $5,500 in subsidized loans

- During your second year you can borrow $6,500 in subsidized loans

- During your third year you can borrow $7,500 in subsidized loans

For undergraduate students who are independent of their parents, you can borrow a total of $57,500 in Unsubsidized Stafford Loans. The amount varies by year:

- During your first year you can borrow $9,500 in subsidized loans

- During your second year you can borrow $10,500 in subsidized loans

- During your third year you can borrow $12,500 in subsidized loans

For graduate and professional students, you can borrow a total of $138,500 in Unsubsidized Stafford Loans. This aggregate includes loans for your undergraduate career. You can borrow a total of $20,500 each year.

Typically, your school will determine exactly how much you can borrow each year and notify you of this amount in your financial aid package.

Tips For Student Loan Borrowers

- If youre not sure of the best strategy for securing student loans, consider working with a financial advisor. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Interest rates for private student loans are often higher than those for federal loans. If you or your child is struggling to pay private student loans, consider student loan refinance rates available now.

Stafford Loan Vs Federal Direct Loan

In researching Stafford Loans and other student loans, you might find some confusion between the terms Stafford Loan and Direct Loan. Thats because, in 2018, these two terms usually refer to the same thing. In fact, theyve meant the same thing since July 1, 2010.

Before July 1, 2010, students could take out Stafford Loans through the FFEL program. The FFEL program allowed private lenders to give out Stafford Loans with government backing against default.

Since July 1, 2010, all Stafford Loans have been distributed by the federal government directly. Thats why they are now often referred to as Direct Loans or Federal Direct Loans.

Before 2010, Stafford Loans and Federal Direct Loans were often two different things. Since July 1, 2010, Stafford Loans and Federal Direct Loans are one and the same.

Recommended Reading: What Credit Score Does Usaa Use For Auto Loans

Do I Become Responsible For Paying The Interest That Accrues On My Direct Subsidized Loans Because

I am no longer eligible for Direct Subsidized Loans and I stay enrolled in my current program? Yes

I am no longer eligible for Direct Subsidized Loans, did not graduate from my prior program, and am enrolled in an undergraduate program that is the same length or shorter than my prior program? Yes

I transferred into the shorter program and lost eligibility for Direct Subsidized Loans because I have received Direct Subsidized loans for a period that equals or exceeds my new, lower maximum eligibility period, which is based on the length of the new program? Yes

I was no longer eligible for Direct Subsidized Loans, did not graduate from my prior program, and am enrolled in an undergraduate program that is longer than my prior program? No

I lose eligibility for Direct Subsidized Loans and immediately withdraw from my program?No

I graduated from my prior program prior to or upon meeting the 150% limit, and enroll in an undergraduate program that is the same length or shorter than my prior program? No

I enroll in a graduate or professional program? No

I enroll in preparatory coursework that I am required to complete to enroll in a graduate or professional program? No

I enroll in a teacher certification program ? No

Complete A Federal Direct Loan Request Form

All student loan borrowers are required to complete an AIMS Education Direct Loan Request Form each year. Students are asked to indicate the loan amount to borrow for the academic year or term. The AIMS Education Direct Loan Request Form may be obtained at the Financial Aid Office on campus.

After completion of the above procedures and submission of all required documents to the Financial Aid Office, students will typically be notified of their Financial Aid Awards within two to three weeks.

Also Check: Current Usaa Car Loan Rates

Some Steps On How To Successfully Apply For Stafford Loans

Below are some steps on how to successfully apply for Stafford Loans:

1. Know the Eligibility Requirements

The way on how to successfully apply for Stafford Loans is to know the requirements. Below are some of the eligibility requirements:1. You must be working toward a degree or approved certificate at UMBC.2. Also, you must be meeting Satisfactory Academic Progress standards.3. Furthermore, you must be enrolled for at least six credits each semester.4. Additionally, the current year FAFSA is required. Its important you pay attention here. If they selected the FAFSA for verification, you must submit all required documents.Also, these documents must be reviewed before the loan can be processed.

Can I Get More Direct Subsidized Loan Funds

Direct Subsidized Loans have annual and aggregate limits that cannot be increased. However, if you received less than the maximum Subsidized Loan award for your academic level and your financial situation has changed significantly since you filed your FAFSA, you should talk to the financial aid administrator at your school to find out if the subsidized loan award can be increased.

Don’t Miss: Usaa Home Loans Credit Score

A Beginner’s Guide To Getting The Loans You Need To Graduate

Unless their parents have somehow saved enough moneyor earn massive salariesmost students need to borrow to pay for college today. Working your way through college is largely a thing of the past, as well. Few students can make enough to pay for college while they’re also taking classes. For that reason, student loans have become increasingly common. Here’s what you need to know about applying.

What Is A Plus Loan

Parent PLUS and Graduate PLUS loans are applied for in the same way as Stafford loans. Unlike the Stafford Loan, however, the Graduate and Parent PLUS loans are subject to an adverse credit history check.

Parent PLUS loans are federal loans taken out by a parent on behalf of a student and are only available to students under age 24 who are studying at undergraduate level. If the parents are denied on their application for a Parent PLUS loan, their child is eligible to be considered independent for Stafford loan purposes. Please alert us as soon as possible if your PLUS loan is denied and provide us with the relevant supporting paperwork so we can adjust the Stafford loan amounts accordingly.

While Parent PLUS loans generally go into repayment immediately, a parent borrower can request to defer repayment during the students studies and/or for an additional 6 months after the student graduates. Parents must request to have their loan deferred directly through the lender.

Graduate PLUS loans are available to postgraduate/professional students and are borrowed by the student. Graduate PLUS loan borrowers must apply for the maximum Stafford loan available to them before being allowed a Grad PLUS. This loan, like the Parent PLUS, can also be deferred during your studies but you must request this yourself, with the lender, otherwise the loan will go into repayment immediately.

Read Also: Credit Score For Usaa Personal Loan

Subsidized And Unsubsidized Stafford Loans

Another set of terms you need to know when youre applying for financial aid regards subsidization. Federal loan subsidization is the process by which the government pays the interest on your loan.

There are two different types of Stafford Loanssubsidized and unsubsidizedand its important that you know which type of loan youre qualified to receive:

Federal Student Loan Requirements

- If you have defaulted on a previous loan, you will not be eligible.

- Submit any additional documents that may be requested via your NEST account. For example, verification documents such as taxes or citizenship requirements.

- You are under no obligation to accept funds simply because they have been included in your aid notification.

Stafford Loan LimitsStafford Loan Interest Rates

You May Like: Transfer Car Loan To Another Bank

Eligibility Requirements For Schools

For you to qualify for the Stafford student loan forgiveness, the school you enroll in should also meet specific criteria before you can fully enjoy the forgiveness benefits. Here are the eligibility qualifications you need to meet:

If the school you enroll in qualifies for one of the above requirements during which you had your one year service but didnt qualify for the following years, you can count those years as part of your service required.

What Is The Stafford Loan Interest Rate & How Do Stafford Loans Work

The main difference between the types of Federal Stafford Loans is how interest is handled.

The interest on a subsidized Stafford loan will be paid by the government while students are in school or while loans are in deferment.

Meanwhile, the interest on an unsubsidized Stafford loan will be paid by the student and is added to the loan balance.

Federal student loan interest rates reset for new loans on July 1 each year.

As an example, undergraduate students who took out loans for the 2019-2020 school year received a 4.53% interest rate. Graduate students received a 6.08% interest rate. These are fixed interest rates that don’t change for the life of the loan.

Stafford Loans are daily interest loans. This means interest accumulates each day.

For more information about interest capitalization for Stafford Loans, visit studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

Don’t Miss: Usaa Auto Loan Payment Calculator

Student Withdrawal And Return Of Title Iv Funds Policy

If a student who receives Title IV funding withdraws, interrupts for more than 180 days or drops below half time attendance, Trinity Laban Conservatoire of Music and Dance will follow the requirements of returning funds as defined by the US Department of Education and is applied alongside the Colleges Withdrawal and Refund Policy. The Finance Office will use the worksheets provided by the US Department of Education to determine how much of the loan may be retained and how much must be returned. The US Department of Education is the Lender.

Return of Funds by Trinity Laban

A student earns aid on a daily basis and therefore if a student withdraws, any unearned aid for that payment period needs to be returned to the lender. Once the conservatoire has determined the amount of unearned aid, funds will be returned to the lender and the student notified if he or she needs to return any funds to the lender.

Loans are returned in the following order.

Loans must be repaid in accordance with the terms of the borrowers Promissory Note.

There are some Title IV funds that students are scheduled to receive that cannot be earned once a student withdraws because of other eligibility requirements. For example, a new student receiving aid for the first time who withdraws within the first 30 days of a programme will be deemed not to have earned any aid.

Determining the date of Withdrawal

Return of Funds by Student

How To Apply For A Federal Direct Stafford Loan

Step 1. Complete the Free Application for Student Aid . The FAFSA is the Department of Educations online application which is required for anyone requesting federal financial aid. UA Little Rocks school code is 001101. Once you have completed this form, the information will be sent to our office. Your financial aid package will be calculated and awarded to you via BOSS.

Step 2. Log in to BOSS and accept your loan.

Step 3. If you are a first time Stafford Loan borrower, complete an online Entrance Counseling session. You must complete the Stafford Entrance Counseling. This is an online loan counseling session which will take about 30 minutes to complete.

Step 4. Complete the Federal Direct Loan Application and Master Promissory Note. If you are a first time borrower through the Federal Direct Student Loan Program, you must apply for the Stafford Loan on the Department of Educations website and electronically sign the Master Promissory Note.

Recommended Reading: Bayview Mortgage Modification

Stafford Loan Refinancing And Consolidation

There is no federal student loan refinancing program. In order to refinance your Stafford Loan, you would need to turn to a private lender who would essentially convert your loan into a private loan. While this may bring benefits such as a lower interest rate or lower monthly payments, it also means that you will be losing certain benefits carried by federal loans, such as the ability to place your loans in deferment or forbearance. Therefore, its important to weigh the pros and cons of refinancing before you make a decision.

Student loan consolidation is a process in which you combine multiple federal student loans into a single new loan, called a Direct Consolidation Loan. This new loans balance will be the total of all of its component loans, added up. The interest rate that it carries will be the weighted average of all of the loans that make it up.

Stafford Loans can be consolidated under this program.

Do You Qualify For A Stafford Loan

Stafford Loans are available to both undergraduate and graduate students and are distributed based on financial need. The amount you receive from your Stafford Loan depends on your year of study, and the amount usually increases with each subsequent year. First-year undergraduate students are eligible to borrow up to $5,500. The interest rate on your Stafford Loan also varies based on when the loan is taken out.

To qualify for either type of Stafford Loan , you must meet the following basic criteria:

- Be a U.S. citizen, U.S. national, or U.S. permanent resident

- Be enrolled at least half-time at a college, university, or school that participates in the Direct Loan Program.

- Be enrolled in a program at your school which leads to a degree or certificate.

Read Also: How Does Pmi Work On Fha Loan

What Is The Difference Between A Subsidized And An Unsubsidized Loan

There are two types of Stafford Loans: Subsidized and Unsubsidized. Your unmet financial need, calculated by your cost of attendance minus your estimated family contribution , determines which type of Stafford Loan you qualify for.

For the Federal Direct Stafford Subsidized Student Loan, the federal government pays the interest on your Subsidized Loan while you are in school and during the six-month grace period after you leave school.

Important change to Subsidized loan program: For all new borrowers who receive a loan on or after July 1, 2013 a 150% limitation is in effect. This means a student who is eligible for a subsidized loan will reach their subsidized limit at 150% of your program’s published length. For instance, a student who is in an associate degree program, the 150% limitation is equivalent to 3 years. Once a student has reached their 150% limitation, their interest subsidy Loan limit will end on all outstanding loans that were disbursed after July 1, 2013, and interest will begin to accrue. Students are therefore encouraged to complete their program on a timely basis.

What Are The Differences Between Direct Subsidized And Unsubsidized Loans

Like grants, direct subsidized loans are meant for students with exceptional financial need. The U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate. By contrast, direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

Read Also: Capital One Auto Loan Approval

Becoming Responsible For Paying Interest

A subsidized loan means that the government is responsible for paying the interest accrued on your loan. However, certain scenarios you might face during college, such as transferring to a shorter program, could transfer this responsibility to you. Make sure you know what it will take to maintain your subsidized loan status.

Do I Have To Apply For Stafford Loan Every Year

Yes, you have to apply every year. Federal Stafford loans do not renew automatically. I received notification that I have been approved for an Unsubsidized Loan. Complete your Entrance Counseling and sign your Master Promissory Note online through the Department of Educations Direct Loan Servicing website.

Don’t Miss: Usaa Graduate Student Loans

Do All Teachers Qualify For The Stafford Student Loan Forgiveness

Simple answer, no, as said earlier. Most people think that just because you are a teacher, you automatically qualify for the forgiveness benefits. Its not true. You have to be eligible for the requirements stated by the federal government, and one of them is being a highly qualified teacher. According to the government, to be a highly qualified teacher, you need to teach in a classroom directly or teach in a classroom-like setting, such as the gymnasium, library, etc. If you fail to meet this condition, you will also fail to acquire your student loan forgiveness.

Here is the standard definition provided by the federal government on what it means to be a highly qualified teacher. If you qualify based on the description, then you can receive your forgiveness program.