Do I Become Responsible For Paying The Interest That Accrues On My Direct Subsidized Loans Because

I am no longer eligible for Direct Subsidized Loans and I stay enrolled in my current program? Yes

I am no longer eligible for Direct Subsidized Loans, did not graduate from my prior program, and am enrolled in an undergraduate program that is the same length or shorter than my prior program? Yes

I transferred into the shorter program and lost eligibility for Direct Subsidized Loans because I have received Direct Subsidized loans for a period that equals or exceeds my new, lower maximum eligibility period, which is based on the length of the new program? Yes

I was no longer eligible for Direct Subsidized Loans, did not graduate from my prior program, and am enrolled in an undergraduate program that is longer than my prior program? No

I lose eligibility for Direct Subsidized Loans and immediately withdraw from my program?No

I graduated from my prior program prior to or upon meeting the 150% limit, and enroll in an undergraduate program that is the same length or shorter than my prior program? No

I enroll in a graduate or professional program? No

I enroll in preparatory coursework that I am required to complete to enroll in a graduate or professional program? No

I enroll in a teacher certification program ? No

How Do You Apply For Unsubsidized Student Loans

To apply for an unsubsidized student loan, you may need to fill out a Free Application for Federal Student Aid. Once its submitted, schools use the information from the FAFSA to make any financial aid package that they send you. To be eligible to fill out the FAFSA, you must be a U.S. citizen or eligible non citizen with a valid Social Security number. You also must meet other requirements:

- Registered with the Selective Service if youre a male student

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program

- For Direct Loan Program funds, be enrolled at least half time

- Maintain satisfactory academic progress

Dollar Loan Center Locations

1. address 1386 E Flamingo Road, Las Vegas, NV 89119 This is Dollar Loan Center your Community Short-Term Loan provider with 56 locations throughout Nevada and Utah. Established in 1998, were the key provider location information. address 7345 S Durango Dr, Las Vegas, NV 89113. phone 251-1800. emails Dollar

Also Check: Ida Auto Finance

Payments And Interest Accrual

Unsubsidized loans start to accrue interest on the first day of your college career. Students can pay the interest while they are in school. Otherwise, the accumulated interest will be added to the full loan amount, which is not due until after graduation. With a subsidized loan, the government pays the interest until the recipient graduates. In fact, when students get their degree, they have a six-month grace period before the first subsidized loan payment becomes due. Unsubsidized loans also have the same grace period. However, the student must pay the initial interest rate at one point or another. The government doesnt cover these payments while an unsubsidized loan recipient is in college.

Interest Rates For Direct Loans First Disbursed Between July 1 2022 And June 30 2023

Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2013 have fixed interest rates that are determined in accordance with formulas specified in sections 455 through of the Higher Education Act of 1965, as amended .

The interest rate is determined annually for all loans first disbursed during any 12-month period beginning on July 1 and ending on June 30, and is equal to the high yield of the 10-year Treasury notes auctioned at the final auction held before June 1 of that 12-month period, plus a statutory add-on percentage that varies depending on the loan type and, for Direct Unsubsidized Loans, whether the loan was made to an undergraduate or graduate student. Loans first disbursed during different 12-month periods may have different interest rates, but the rate determined for any loan is a fixed interest rate for the life of the loan.

For each loan type, the calculated interest rate may not exceed a maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

Don’t Miss: Fha Loan To Buy Land And Build Home

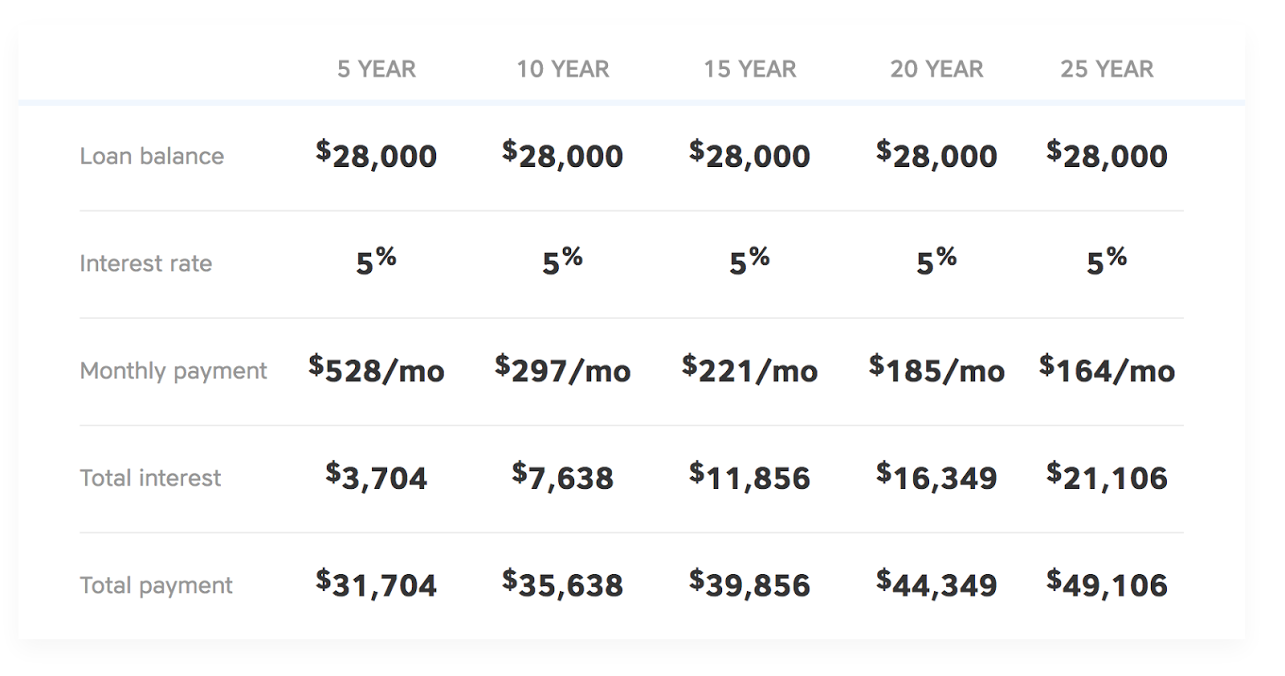

Loan Payment Walkthrough Example

For example, lets assume a borrower has a $10,000 loan balance at the beginning of repayment with an interest rate of 5% and a 10-year level repayment schedule.

They would make payments of $106.07 per month and pay $2,727.70 in total interest over the life of the loan. For the first month, the payment would be applied as follows:

$41.67 to interest

$64.40 to principal

But, if the borrower sends in $188.71 the first month, a greater proportion of the payment would be applied to reduce the loan balance:

$41.67 to interest

$147.04 to principal

If the borrower continues making monthly payments of $188.71, the loan will be paid off in only five years with a total interest of $1,322.76.

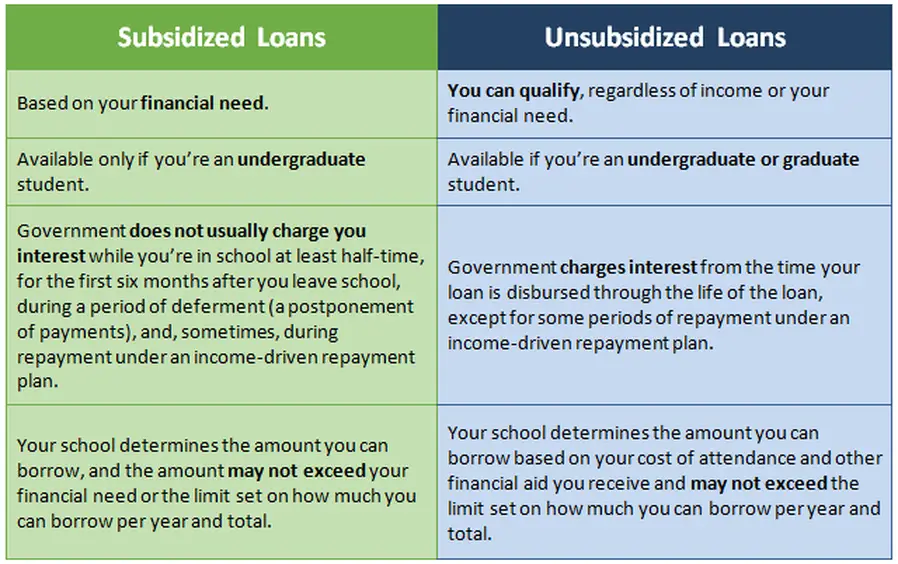

What Are Subsidized Loans

Subsidized loans are undergraduate loans for students who demonstrate financial need. The loan doesnt accrue interest while you are in school and on deferment periods. The U.S. government pays off the interest, so technically, you pay no interest until six months after graduation. The loan factors in parents contributions and other financial aids such as grants. Once you start paying off the interest and the principal, the government stops paying the interest. Federal direct subsidized loans are sometimes called Stafford loans.

Recommended Reading: Usaa Car Financing

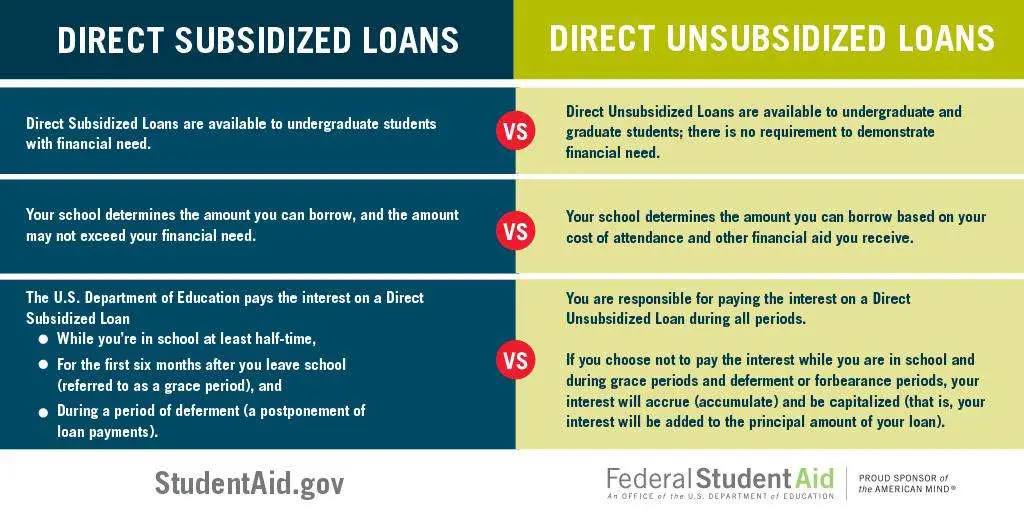

What Is The Difference Between A Subsidized And Unsubsidized Loan

Blog> Financing Your Education> What is the Difference Between a Subsidized and Unsubsidized Loan?

The culinary college search process is exciting! With so many different opportunities out there, youll be sure to find a program that lines up with your passions and career goals.

Financial planning for school on the other hand can be a bit overwhelming. It may be hard to know where to start. But dont be discouragedthere are many resources available to you.

And, financial aid is not just for 4-year colleges! There are many options available for 2-year programs such as culinary school, too.

The Biden Presidency’s Affect On Student Loans

While the president has no say in student loan interest rates, Biden has been seeking other ways to make college more affordable for students and reduce the need for student loans altogether. Most recently, he has suggested offering two years of free community college for all students, as well as two years of subsidized tuition for low-income students attending historically Black colleges and universities, tribal colleges and universities and minority-serving institutions.

He has also been exploring avenues of forgiving existing student loan debt. However, any student loan forgiveness measures would likely apply only to federal student loans.

Read Also: Interest Rate For Car Loan With 650 Credit Score

Which To Borrow: Subsidized Vs Unsubsidized Student Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read more on federal student loans

-

Government loan rates:Current student loan interest rates

When choosing a federal student loan to pay for college, the type of loan you take out either subsidized or unsubsidized will affect how much you owe after graduation. If you qualify, youll save more money in interest with subsidized loans.

|

What you need to qualify |

Must demonstrate financial need |

Don’t have to demonstrate financial need |

|

How much you can borrow |

Lower loan limits compared with unsubsidized loans |

Higher loan limits compared with subsidized loans |

|

How interest works while you’re enrolled in college |

Education Department pays interest |

|

|

Undergraduate and graduate or professional degree students |

Federal Direct Parent Plus Loan

Available to parents of dependent undergraduate students and parents of eligible non-degree students

- May be borrowed for up to the full cost of attendance, less other financial aid

- Each time the loan is borrowed, the parent must Apply for a PLUS Loan

- If you have adverse credit history, you may still have options to obtain the loan. PLUS Credit Counseling is required in these situations.

A Reminder About Interest Rates and Loans

Please note that interest rates are subject to change from year to year based on federal regulations. These loans are disbursed directly to the school to be applied to the students account. The actual amount of the loan disbursed to the school is the amount accepted, less the origination fee.

You May Like: Upstart Early Payoff Penalty

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan anytime. Still, most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the grace period when the government continues to pay the interest due on the loans.

When your loan enters its repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicers website in most cases.

Also Check: Does Fha Loan On Manufactured Homes

Recommended Reading: Is Carmax Pre Approval A Hard Inquiry

Example Of Subsidized Loan Eligibility

Lets say you are a dependent student and in your 3rd year of college. Your total cost of attending college is $10,000, which includes: tuition, fees, books, supplies, transportation, lunch, and personal expenses. Your expected family contribution determined from your FAFSA is $3000 and your total financial aid from grants and scholarships totals $2,000. You have expenses not met of $5000 . You could get a subsidized loan for the portion of expenses that were not met which is $5000. If you still need additional money to cover costs, you could receive a maximum of $500 in an unsubsidized loan. You could not exceed $2,500 in an unsubsidized loan since the maximum a 3rd year student could borrow in federal direct loans is $7,500.

$10,000 Cost of Attendance $3,000 Expected Family Contribution $2,000 Financial Aid

How Does Student Loan Interest Work

When you borrow money from a bank or other financial institution, youre using their money to fund something you want. For the privilege of using their funds, lenders will then charge you interest.

Student loan interest is no different. While interest rates are commonly lower on student loans than on credit cards or other unsecured debt, they are rarely 0%. That means if you borrow $10,000 for school, unless youre able to pay it back in full the same day, you will end up paying back more than $10,000.

This is worth exploring further, so lets dive into some of the details, such as:

Read Also: Apply For A Capital One Auto Loan

What Are The Eligibility Criteria For These Loans

Although unsubsidized Stafford loans are easy to get, there are specific requirements you still need to fulfill to get these loans. If you meet the requirements listed below, the Federal Student Aid office will disburse your loan amount to your school after completing the application.

- You are either a US citizen or a Permanent Resident.

- Be enrolled at least half-time at a school that participates in the Direct Student Loan Program.

- You are an undergraduate, graduate, or professional student.

- To continue getting these loans, you must maintain satisfactory academic progress as defined by your school.

How Interest Is Calculated On Private Student Loans

Unlike federal loans, private student loan rates arent set by the government. Instead, these rates are determined by individual lenders based on current market rates.

Your credit score will also affect the kind of rates you get approved for in general, the better your credit, the lower your rate.

If youd like to qualify for a lower interest rate, here are a couple of options to consider:

- Build your credit: If you can wait to take out a private student loan, you could consider working to improve your credit before you apply to get a better interest rate in the future. There are several ways to potentially boost your credit, such as making on-time payments on all of your bills or becoming an authorized user on a credit card account owned by someone you trust.

- Apply with a cosigner: Having a creditworthy cosigner can improve your chances of getting approved for a private student loan if you have bad credit. Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

You May Like: Www.lowermycarloan.com

How To Pay Interest On Unsubsidized Loans

Most students don’t start making payments until they leave school, but did you know you can start paying them before while you’re still at PCC? In fact, it is a really good idea to pay the interest on your loans while you are still taking classes. A small payment each month can keep that interest from stacking up and save you a lot of money.

For example: for a $5,000 loan, your monthly interest payments would be $28. If you paid this interest while in school, you would save $940!

Choose a loan by selecting a numbered box

Find contact info

How To Apply For An Unsubsidized Student Loan

First, make sure you meet the following criteria to qualify for an unsubsidized student loan. You must:

- Be a U.S. citizen or national, or a permanent resident

- Be enrolled on at a least half-time basis at an accredited institution

- Have no loan defaults or owe a refund to any previous student loan or aid

- Stay in good academic standing

Here’s how to apply:

Also Check: How Long To Refinance Fha Loan

Private Student Loan Interest Rates

If youre looking for the best student loans to finance your college education, we always recommend that you start by looking at federal student loans first. Federal loan types offer the same fixed interest rate for every borrower and provide multiple repayment plans, which arent typically offered by private lenders. However, if youve already taken out federal student loans but are still falling short of affording your dream college, then it may make sense to look at private student loan lenders to supplement your federal loans.

With that in mind, interest rates on private student loans can vary widely from lender to lender and also fluctuate based on several other factors, such as your credit score. We looked at five different private lenders to give you an idea of what your average student loan interest rate range may be on a private loan. Unlike federal student loans that have fixed rates, private loan interest rates are set by the lender and can vary based on a number of factors, including if you have a cosigner and the amount borrowed.

A Guide To Subsidized And Unsubsidized Loans

As you explore funding options for higher education, youll come across many different ways to pay for school. You can try your hand at scholarships and grants, but you may also need to secure federal student loans. Depending on your financial situation, you may qualify for a subsidized loan or an unsubsidized loan. Heres the breakdown of subsidized and unsubsidized loans, along with how to get each of them.

Don’t Miss: Fha Title 1 Loan Rates