Grad Plus Loan Specifics

Grad PLUS Loans do not have a need-based requirement, but you must be enrolled at least half-time at an eligible school in an eligible program. The loan has a fixed interest rate, and for loans disbursed between July 1, 2020, and July 1, 2021, the interest rate is 4.30%.

In addition to interest on the loan, there is also a loan fee that is proportionately deducted from each disbursement . For loans disbursed between Oct. 1, 2018, and Oct. 1, 2019, the fee is 4.248%. For loans disbursed between Oct. 1, 2019, and Oct. 1, 2020, the fee is 4.236%.

The amount you can borrow with the Grad PLUS Loan varies by person and school. Your school will calculate its cost of attendance. The amount you can borrow is determined by subtracting any other financial assistance you have from the cost of attending your chosen school. If you discover that the loan is actually too much, you can always adjust the amount that you borrow.

First-time PLUS Loan recipients have to complete entrance counseling and sign a Master Promissory Note .

Before applying for a Grad PLUS Loan, however, you will need to fill out the FAFSA.

Look For Other Funding Sources

If you have poor credit, taking out private student loans probably isnt an option. Youre unlikely to be approved without a creditworthy cosigner. Even if youre approved, you might get much higher interest rates than you would with federal loans.

Instead, another way to support your child is by helping them find and apply for grants and scholarships. Your child can combine multiple scholarships and grants to reduce their college costs and limit their need for student loans.

Use our guide to state financial aid grants to find money for your childs education.

Your child can also use the tips in our all-inclusive guide to college scholarships for high school seniors to find financial aid.

Check Your Credit Score

First off, you need to know exactly what your credit score is. College students might not know what their credit score is, or whether its good enough to get a private student loan on their own.

Fortunately, there are a few options to check your credit score for free, such as this free credit tool from LendingTree.

Read Also: How Much Can I Qualify For A Car Loan

What Credit Score Do You Need For Sallie Mae

4.8/5Sallie MaehaveSallie MaeSallie MaeFICO score

Herein, what credit score do you need to get a student loan?

Most private lenders require you to have a of at least 670 or higher on a 300-850 scale used by FICO, the most widely known . If you‘ve maxed out federal student loans and you need a private student loan,you‘ll need a history to qualify.

Beside above, does Sallie Mae report to credit? The length of time afforded before reporting to a is different for private loans and for each lender for example, Sallie Mae usually reports delinquent private loans after 45 days. Usually if you are not 45 days late, you won’t incur a bad mark on your at least, not yet.

In this regard, does everyone get approved for student loans?

Almost everyone qualifies for student loans, though students with the greatest financial need can generally borrow under the best terms. The first step in applying for a student loan is figuring out whether you will be considered an independent student or one who is dependent on your parents.

Can I get student loans with bad credit?

Having bad credit won’t disqualify you from getting a student loan. You can borrow federal student loans, which don’t factor in history. But, if federal student loans and other aid isn’t enough to pay for college, you may need a private student loan.

What Credit Score Do You Need To Get A Parent Plus Loan

The parent PLUS loan credit check doesn’t include a credit score check, so there’s no minimum credit score requirement. However, the borrower can’t have an adverse credit history, which is defined as:

- Having over $2,085 in combined debt on your credit report that’s 90 or more days past due, or that was sent to collections or charged off within the past two years.

- Having experienced one or more of the following in the past five years: Debts discharged through filing bankruptcy, foreclosure, repossession, tax lien, wage garnishment or had a federal student loan go into default or be written-off.

If you have an adverse credit history and your loan request is denied, you can appeal the decision if there were extenuating circumstances that led to the adverse credit. For example, you’ve paid off accounts that were previously in collections.

Alternatively, you may be able to qualify for a parent PLUS loan with an endorser who doesn’t have an adverse credit history, as long as it’s not the child using the money for school. In either situation, you’ll also need to complete a credit counseling course to take out the loan.

If you applied and can’t qualify for a parent PLUS loan, your child may be eligible for additional unsubsidized federal student loans. In some cases, this may be preferred as the undergraduate loans have a lower interest rate and origination fee than parent PLUS loans. But it also means your child will be responsible for the entire loan amount.

Read Also: Fha Mortgages Refinance

Problem #: Strict Parent Plus Loan Eligibility Requirements

Parent PLUS loan eligibility requirements are strict, and students may be forced to seek private loans when their parents are denied.

To meet Parent PLUS loan eligibility requirements, a borrower must be the parent of a dependent undergraduate student who is enrolled at least half-time at a qualifying school, and the borrower must pass a credit check without being deemed to have adverse credit. Read here for the full definition of adverse credit along with more information about Parent PLUS Loan eligibility.

Do Lenders View Graduate Students Differently

If youre pursuing an advanced degree, you might have an easier time securing private student loans for grad school. Thats because, per the Consumer Financial Protection Bureau, as a graduate or professional student, you might be more certain of your job prospects and earning potential.

Graduate students also are more likely to have an employment history of high salaries, especially if they spent a few years working after completing their undergraduate degree. They tend to have longer credit histories as well, allowing lenders to get accurate insights into the applicants financial management.

Additionally, several lenders offer private student loans specifically to graduate students that carry different requirements. CommonBond, for instance, requires cosigners for both its general undergraduate and graduate student loans. However, it has no such requirement for its MBA student loans.

Many lenders offer student loans specifically for students in MBA, medical, dental, law or other graduate programs that can lead to high-paying careers.

Don’t Miss: Usaa Auto Loan Rates Today

Bottom Line: Good Credit Is Needed For Private Student Loans

Its a smart idea to utilize federal student loans first, as they dont have a credit requirement. But private student loans can be an important tool to fill in gaps in college costs. You or a cosigner must have a good credit score to get student loans from a private lender.

If you need student loans now, enlisting a cosigner is the way to go. But its never too early to start building credit and improve your chances of qualifying for student loans in the future.

Rebecca Safier contributed to this article.

Parents Not Students Take Out The Loan

One of the most important things for parents to remember about taking out a Parent PLUS loan is that you not your child will be legally responsible for repaying the debt. The student cant cosign the loan, and you cant transfer the loan directly to your child.

You might be able to transfer the responsibility at a later date if your child refinances the debt with a private student loan lender. The student may need a low debt-to-income ratio and strong credit to qualify, and the new private student loan wont qualify for federal repayment plans or forgiveness programs you could take advantage of with the Parent PLUS loan.

Some families create an informal agreement where the child pays the parent, who then makes the loan payments.

In other words, your agreement with your kid may not hold up with the reality of the situation.

Well discuss some options below if youre having trouble repaying the loan, but first, heres a little more about how Parent PLUS loans work.

Also Check: Usaa Rv Loan Calculator

Student Loans Are One Optionbut Not Your Only Choice

While loans are helpful for many students, other funding opportunities should be maxed out first. Parents can help their children get all the free money they can by submitting the Free Application for Federal Student Aid as early as possible and applying for individual grants and scholarships.

Once that funding has been exhausted, consider federal student loans to cover additional costs. If you still need more money after that, consider private student loans as a final option.

Cosigning As A Borrowing Option For Parents

While a parent loan gives full responsibility for repaying the loan to the parent, cosigning gives equal obligation to the cosigner and the borrower. The loan will appear on both credit reports and payment history good and bad will affect both people on the loan. Most undergraduate students dont have the credit history to qualify for private student loans on their own and are likely to need a cosigner.

Don’t Miss: Does Carmax Pre Approval Affect Credit Score

Options For Parent Plus Denial

The parent will be notified of a credit denial by the Department of Education. The parent can choose to obtain an endorser or appeal the credit decision by calling 1-800-557-7394. Please notify UNM if the parent decides to obtain an endorser or appeal the credit decision. UNM must make additional steps to ensure a loan in this situation disburses properly. If the parent does not wish to pursue those options, UNM will award the student additional unsubsidized loans as long as the student fills out the Student section on the bottom of the PLUS application.

To become eligible, you may take one of the following actions:

- An endorser is someone who does not have an adverse credit history and agrees to repay the loan if you do not repay it.

- If you are a parent borrower, the endorser may not be the student on whose behalf you are requesting the Direct PLUS Loan.

- The information causing the adverse credit decision is incorrect OR

- There are extenuating circumstances relating to the adverse credit history.

Should You Consider Bankruptcy For Parent Plus Loans

Filing Parent PLUS Loan bankruptcy requires an additional proceeding called an adversary proceeding, and success is neither guaranteed nor typical. In most courts, youâll have to prove that repaying your student loan debt is causing you an undue hardship, and youâve made a good-faith effort to repay your loans. Since the government offers income-based repayment plans and extended repayment terms, itâs hard for many borrowers to provide sufficient proof.

Don’t Miss: Is Usaa Good For Auto Loans

The Basics Of Plus Loans

To be eligible for a Parent PLUS loan, your child must be enrolled at a qualifying school and take at least a half-time course load. You and your child must also meet the basic eligibility criteria, such as demonstrating financial need and being a U.S. citizen or eligible noncitizen.

Youll also have to fill out and submit the Free Application for Federal Student Aid, or FAFSA, which you can now fill out and submit as early as October 1.

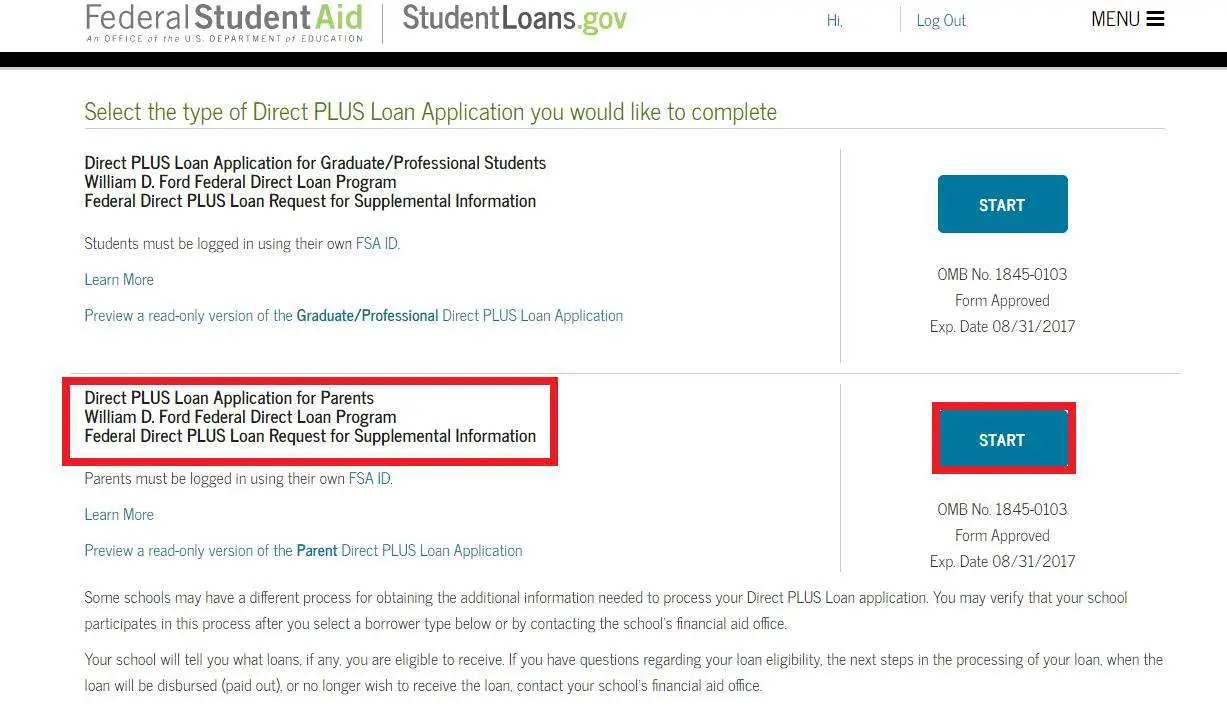

Schools have different application processes for Parent PLUS loans. Youll either be able to request the loan from StudentLoans.gov, or you may have to check with the schools financial aid office for information on their process.

As with private student loans, Parent PLUS loans require a credit check. Your application might be denied if you have an adverse credit history as defined by the Department of Education. For example, you cant have charged-off accounts, accounts in collections or a 90-plus-day delinquent account with a combined balance of $2,085 or more.

You may be able to appeal the denial if your negative credit history is based on extenuating circumstances and you complete PLUS .

You could also get approved if you have an endorser who doesnt have an adverse credit history and youve completed PLUS credit counseling. The endorser takes a similar role to that of a cosigner and will be responsible for repaying the loan if the borrower doesnt.

How To Find Out If You Qualify For A Private Student Loan

Your credit score is a central factor that determines whether a lender will approve or deny your request for a private student loan. But these three digits arent the only factor that matters to lenders.

Heres what you need to do if you have a good credit score for student loans and meet other requirements:

You May Like: Usaa Car Loan Pre Approval

Transfer Parent Plus Loans Into Your Childs Name

If your child has good credit â a score thatâs at least in the 600âs â and enough income to cover their expenses and debt payments, you may be able to transfer Parent PLUS Loans into their name with a private student loan refinance. Not all lenders allow this switch, but several do.

The benefit to you is obvious: you get free from the student debt, your child takes over the student loan payments, and you can start putting more money into retirement plans.

The tradeoff in refinancing is that the loans will lose protections like payment suspension during the pandemic, income-based repayment plans, and cancellation at death or disability.

Note: Refinancing may be an option even if your child doesnât have good credit and a low debt-to-income ratio. The lender may ask you to be a cosigner. Before you agree, know your cosigner rights.

Answers To Pressing Questions About The Parent Plus Loan

Parent: My son has been accepted to an expensive private college for the fall, and we have been awarded a pretty generous financial aid package from the school . This leaves us with about $20,000 per year to finance. I make $50,000 per year and will be applying for the Parent PLUS loan and have several questions. Im in the process of refinancing my home and know that my credit score is 748. My biggest fear is that when it comes time to apply, I will not be approved. I believe that my credit score shouldnt be a problem, but my income is not very high. Over the course of four years and approximately $20,000 in loans each year, would this be a problem in getting approved, due to the high debt to income ratio? Also, can the loan be deferred until after my son graduates? Can I be put on a repayment plan that is income based? I know we will be repaying this loan for a long time but was hoping there is some leniency in the way the loan is repaid. Thank you! Robert B.

Also Check: Texas Fha Loan Limits 2020

Other Factors Lenders Consider

While your credit score is undeniably an important factor that lenders use when determining if you qualify for a private student loan, it is not the only factor. Lenders also look at other things including:

- Your debt-to-income ratio: This is the ratio of debt payments vs monthly income.

- Your employment history: A stable history of employment for at least 6 months to a year is preferred.

- Your income: More income is better than less.

- The mix of credit you have: Its good to show a responsible payment history with different kinds of debt, including revolving credit and installment loans .

- The degree youre pursuing: This is especially important for grad students.

- Future earning potential: As with the degree youre pursuing, this serves as an indicator of your ability to repay loans in the future.

> > Read more: How Do Student Loans Affect Your Credit Score?

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Also Check: Usaa Auto Loan Payment Calculator

Parent Loans For College

You raised the student we raised the bar on parent student loans to help pay for school. With your strong credit, private parent loans for college tuition can help pay for your childs education and prepare them for a bright future. Like our other loans, we never charge origination fees and provide repayment flexibility built for parents. Even better, we give you the option to get up to $2,500 of the loan1 delivered straight to you so you control the spending on extra education expenses like books, electronics, or dorm supplies. Ready to get started? Our application takes just three minutes and youll get an instant credit decision.

How Do Parent Student Loans Work

The rising cost of a higher education and growing concern over student loan debt have prompted many parents to explore the possibility of taking out loans to help their children pay for college. Their two main options are parent PLUS loans issued by the federal government and private student loans issued by banks and credit unions. Here’s an overview of how parent student loans work and the pros and cons of each.

Don’t Miss: Capital One Auto Loan Application Status