Student Loan Debt Collector Salaries

The problem in getting rehabilitation through the system is that bill collectors process the rehabilitation application. They are paid 16% of anything they collect and they are often paid well over $100,000 per year in commissions and bonuses by re-writing loans and collecting payments. The IBR loan is granted if you make 9 of 10 on-time payments. It is worth noting that if you are on social security and can only pay five dollars per month the whopping commission check from doing three hours of work is only about $.80 for hours of the debt collectors work.

However, the commission from a doctor with a $3,000 per month payment is $480 for the same two to three hours of work. Thats why rehabilitation applications for minorities and the poor end up in the trash. However, if you file a Chapter 13 and ask for a hardship discharge due to poverty, you suddenly receive approval for IBR loans and processing through rehabilitation rushes through.

These government student loan debt collectors also receive payment for every letter and phone call. They receive payments for wage garnishments and tax seizures. Interestingly, social security check garnishments tripled from about 2009 to 2014 and rapidly increased again from 2014 to 2020 for the very poor which should never happen. Instead, senior citizens on social security should have zero dollar repayments in an IBR for their government loans. However, unfortunately, servicers are unlikely to process their documents.

Claiming Undue Hardship In A Student Loan Bankruptcy Case

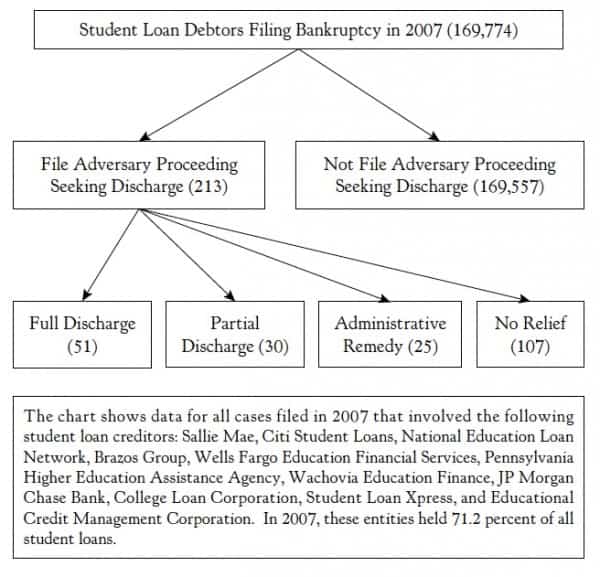

A Chapter 7 bankruptcy alone will not wipe away your student loan debt. In order to stop collections altogether, you will have to file a petition for a determination of undue hardship. Claiming undue hardship means that repaying your loan is too difficult and too expensive like a weight that moves the scale from struggling to suffering. This determination will take place in an adversary proceeding in bankruptcy court.

There are three criteria you must meet to successfully claim undue hardship in a student loan bankruptcy case:

This three-step measurement is also known as the Brunner Test, and if all requirements are met, your lender will no longer be able to collect loan payments from you.

If the determination of undue hardship is unsuccessful, you can still apply for Chapter 13 bankruptcy, which allows the court, rather than the lender, to determine the monthly size of repayments. These payments will often be smaller and allow for more flexibility for several years until repayments return back to normal or the borrower petitions once again for undue hardship.

Five: Indicating Expenses On The Attestation Form

On Attestation Form Line 14, the debtor checks yes or no for various expense categories as to whether the debtors expenses are below dollar amounts set out on the form for the debtors family size. The dollar amounts are based on IRS National Standards for food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous.

If each expense item is below the standard, the AUSA will need no further inquiry and the listed dollar amounts are allowed. If the debtors actual expenses for a category exceed the expense standard, the AUSA, in consultation with ED, should consider whether the debtor has a reasonable explanation for the additional expense and may allow it. The debtor reports excess expenses on Line 14 and should include an explanation of why the expense is necessary. For example, the debtor in the Sample Scenario states that she must pay an additional $150 for inhalers and medication, not covered by insurance, for her daughter who has asthma.

The debtor can provide an explanation, probably on Line 15, as to why the additional $118 is needed to operate the auto, such as the need to travel a long distance to get to work and the increased cost of gas. The AUSA, in consultation with ED, should carefully consider and accept the debtors reasonable explanation and allow the additional expense.

Don’t Miss: What Credit Score Do I Need For Home Equity Loan

Understanding Restricted Exception To This Rule And Just How Courts Take A Look At Excessive Adversity

With respect to the Us Password Part 523 out-of Term eleven, student loans commonly dischargeable unless the individuals money enforce and you will excessive difficulty with the loaner. not, it is critical to remember that bankruptcy process of law usually fool around with other examination to determine even if a borrower features knowledgeable excessive adversity. One of the most popular s the Brunner take to, hence examines about three secrets.

- Normally the fresh new debtor care for a decreased total well being if youre paying the funds?

- Perform the latest borrower stay in impoverishment for the duration of the installment several months?

- Provides the borrower generated a good-faith work to repay its education loan debt?

For individuals who pass which try, there can be a go that you may have your education loan totally or partially discharged inside the case of bankruptcy. Yet not, just like the unnecessary difficulty isnt defined within bankruptcy legislation, that it decision might be made within discretion of the courtroom. Hence, it is crucial that folks given such an alternative keep up with the help of an experienced attorney. Incapacity to do so can result in a reduced opportunity at the getting a good result. Demand a totally free consultation on Education loan Attorney within the business to learn more.

The Bapcpa Bankruptcy Code Reform Act

Bankruptcy is a Federal legal process. It is not a function of Michigan state law. It functions pursuant to the rules outlined in a Federal statute called the US Bankruptcy Code .

The Code in its current form was enacted by Congress in 1978. It has been amended on a number of occasions. The most recent large-scale amendment was the so-called BAPCPA Bankruptcy Reform Act enacted in 2005.

In the original, 1978 version of the Code, student loans were just as dischargeable in bankruptcy as any other commercial debt.

BAPCPA and the prior couple of Code amendments greatly altered the dischargeability of student loans in bankruptcy.

A debt of any sort is non-dischargeable in bankruptcy only if the Code says that this is so. Michigan state law doesnt have anything to do with it. It is entirely preempted by Federal law in this way.

Neither does your promissory note, loan application, rental lease, mortgage agreement, or any other paper containing terms and conditions of your promise to repay money loaned to you.

So what does the Code say about student loan debt discharge?

You May Like: Where To Get Student Loans

Complaints That Discharge Orders Are Being Violated

Consumer complaints raise serious questions about whether student loan companies are violating discharge ordersmeaning theyre unlawfully collecting on loans even after a borrower has been through bankruptcy.

One consumer shared:

I have argued numerous times that loan was discharged as part of my chapter 7 bankruptcy . They have collected monthly payments since then as part of the charge off, they have been reporting my account as late each month since then to the various credit agencies even though Ive been paying their agreed upon monthly payments. As per a number of recent cases, it has been determined that in fact the loans were dischargeable.

Another consumer wrote:

Another consumer wrote:

Student loan companies cannot collect debts that a consumer no longer owes. As noted above, certain types of education loans are dischargeable in bankruptcy without the higher standard and without the filing of an adversary proceeding. Collecting on debts that have been discharged through bankruptcy might not only violate the Consumer Financial Protection Acts prohibition on unfair, deceptive, and abusive practicesit could also violate the order of a United States bankruptcy judge.

These complaints raise serious concerns about the practices of private student loan owners, lenders, servicers, and collectors and their handling of bankruptcy discharges.

Has Your Loan Been Discharged?

How Can I Get Rid Of Student Loans Without Paying

Getting rid of your student loans without paying isnt easy. Youre responsible for repaying the debt, unless you qualify for student loan forgiveness, cancellation or discharge that covers all or a portion of your student debt. Contact your loan servicer or lender to learn about your repayment options.

Depending on your unique situation, you might be able to request student loan discharged due to undue hardship through a bankruptcy court however, this process is more difficult and requires a separate trial.

Read Also: Are Student Loan Forgiveness Calls Legit

Loan Discharge Because Of Disability

If you are disabled, you may be able to get your loans discharged without having to go through bankruptcy proceedings.

With certain federal loans, Total and Permanent Disability Discharge is available to those who are totally and permanently disabled. If youre eligible, the loan servicer can forgive the total remaining balance of your loans. For more information and how to apply, visit DisabilityDischarge.com.

Although not all private loan lenders offer discharges in the case of disability, some do. For example, College Ave will forgive the remaining balance if the borrower becomes permanently disabled.

If you have a disability and want to apply for a loan discharge, contact your lender directly via the customer service department. Explain your situation and what has changed since you took out the loans, and ask if the lender offers loan discharges in the case of disability.

What Is A Private Student Loan

Private student loans are issued by private lenders like banks or other financial institutions. Navient and Sallie Mae are two common private student loan lenders. To be considered a qualified education loan â instead of a personal loan â the loan must be used solely for âqualified higher education expenses.â This includes the cost of attendance at any eligible educational institution.

Letâs break this down:

-

Cost of attendance includes tuition, fees, room and board, books, necessary equipment and materials, supplies, and transportation.

-

Eligible education institutions include most accredited public and private post-secondary institutions, including those that are for-profit. Put simply, most colleges and vocational institutions are eligible, accredited institutions.

If you default on a private student loan, the lender is out of luck. By contrast, federal student loans are issued by the U.S. Department of Education and guaranteed by the federal government. That means that if you default on these loans, the federal government pays for the loan.

Students often take out a mix of federal student loans and private student loans to cover their full college expenses.

Also Check: Can I Get An Fha Loan After Bankruptcy

Government Programs In Which You Manage Or Discharge The Loans

Fortunately, the government has many programs that allow you to discharge or get a government loan out of default. Getting out of a government student loan default normally requires consolidation or rehabilitation. Always check to confirm if the debt is government or private by signing into the National Student Loan Data System and creating an account. Then, you will know if the loan is a government loan or not. Some government loans made in the 1970s might not show in the NSLDS database. Knowing if the loan is Government or private gives you the advantage of knowing who governs the loan.

If the loan has an adjustable or high-interest rate it is probably a private student loan. Some of the private loan rates are at credit card levels. Government loans have administrative powers that allow garnishments by merely sending a notice. Additionally, the requirement is only to send the notice. It is not a requirement that you receive notice to garnish wages or bank accounts. Look at the Salt companion student loan book for 60 different programs to manage or discharge your student loans.

Will Bankruptcy Help With Private Student Loans

Bankruptcy is a legal process that allows individuals and businesses to restructure their debts and get a fresh start financially. Its a way to get help when you cant pay your debts anymore and need assistance in reorganizing them.

Private student loans are a type of education loan issued by a private lender rather than the government. They can be used to pay for college or other higher education expenses, such as tuition, fees, and books. Private student loans usually have different terms and conditions than federal student loans and may have higher interest rates and fees.

This blog post will explore how bankruptcy can help with private student loans. Well discuss the eligibility requirements for bankruptcy and private student loans, the bankruptcy process for private student loans, and the different types of bankruptcy that might be relevant for dealing with private student loans. Well also consider some important considerations for filing for bankruptcy, including the impact on credit scores, the costs and fees associated with bankruptcy, and alternative options for dealing with private student loans.

Read Also: Easy Approval Bad Credit Loans

Have You Considered Other Repayment And Forgiveness Options

Can you file bankruptcy on student loans? Maybe. Should you? That depends on your personal situation.

Filing bankruptcy on student loans is a complicated, intrusive and extensive process. In fact, Fuller advised not doing it at all if you can. It should be a last resort, he said.

There are many alternative solutions to filing bankruptcy on student loans. For example, federal loans come with options such as income-driven repayment plans and deferment or forbearance. These programs could provide relief without the extreme step of bankruptcy.

You also have the option to apply for forgiveness, either through an income-driven repayment plan or Public Service Loan Forgiveness . PSLF is available to those who work for certain public service organizations, such as government agencies or nonprofits.

And if you have private student loans, talk to your lender. They might have a hardship program for student loans that you didnt know about. Fuller suggested sending to your private loan servicer a letter via certified mail outlining your financial hardships, your income and how much youre able to pay. Your servicer may respond with a repayment plan that provides some relief. After all, you dont lose anything by asking.

Before filing bankruptcy on student loans and trying to fight against a system that makes it difficult to discharge your debt, be sure to research your other debt repayment options for student debt relief.

Andrew Pentis and Alli Romano contributed to this report.

The Bankruptcy Code And Non

Section 528 of the Bankruptcy Code details the specific types of debts that are not dischargeable in bankruptcy.

Until the Code was amended from its original form, student loan debts were not listed in Section 528 at all. The Code was then amended to include government subsidized student loans among the non-dischargeable debts. Then, in BAPCPA, amended again to include all student loans, including private student loans.

Why? Was there really a big problem with rich doctors running straight from medical school to bankruptcy court?

There was not. What there was, however, was a strong lobbying push by Sallie Mae and other student loan debt servicers in Congress. In other words, palms were greased, and a law was passed that made life worse for everybody except student loan servicers.

What Section 528 of the Code now reads is that student loan debt is non-dischargeable unless repayment would impose an undue hardship on the debtor and the debtors dependents.

Did Congress go so far, however, as to also include in the Code a definition of undue hardship?

It did not. It left that definition to the Courts.

Well-heeled, well-paid Federal judges naturally remembered where they came from when figuring it out.

Not.

Also Check: Does Opp Loan Help Credit

Need More Bankruptcy Help

Did you know Nolo has been making the law easy for over fifty years? It’s trueâand we want to make sure you find what you need. Below you’ll find more articles explaining how bankruptcy works. And don’t forget that our bankruptcy homepage is the best place to start if you have other questions!

|

Our Editor’s Picks for You |

|

More Like This |

Qualifying For Student Loan Bankruptcy Discharge

A discharge of your student loans may be possible if you prove you have an undue hardship that prevents you from making student loan payments, orwith private loansif the loans did not provide an educational benefit.

With federal student loans, there is no standard set of guidelines for demonstrating undue hardship. Most courts rely on the Brunner Test, which requires you to prove that:

- You wouldnt be able to maintain a basic living standard if you made loan payments.

- Your financial hardship will last an extended amount of time.

- You made a good faith effort to repay your loans before filing for bankruptcy.

Not only are these circumstances extremely challenging to prove, the Brunner Test is somewhat subjective. Not only every state, but every jurisdiction will have different standards in determining whether the Brunner Test applies, said Leslie Tayne, a financial attorney and the founder and managing director of Tayne Law Group, in an email to The Balance.

Its not the only test that exists, however. The courts of the Eighth Circuit, for example, use the totality of circumstances test, which looks at the borrower’s overall situation. This benchmark is considered less restrictive than the Brunner Test.

Read Also: Home Loan Rates In India

Can You File Bankruptcy On Student Loans In Indiana Yes But You May Need To Pass A Test

Federal bankruptcy law covers student debt that was:

- Made, insured, or guaranteed by a governmental unit, or

- Made through a program funded by a government unit or nonprofit group.

The law states that this debt can be discharged when it will prevent undue hardship on the debtor and his or her dependents. How do you prove there will be undue hardship if you need to pay back these loans? Many courts use a test developed by a federal appeals court in 1987 in the case of Brunner v. N.Y. State Higher Educ. Servs. Corp.

There are three considerations:

- The debtor cant maintain, based on his or her income and expenses, a minimal standard of living for themselves and their dependents if they repay the debt.

- This situation is likely to last for a significant part of the loans repayment period.

- The debtor made good-faith efforts to pay back the debt.