Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

VA loan guidelines allow for 100 percent LTV, which means that no down payment is required for a VA loan.

The catch is, VA mortgages are only available to certain home buyers, including:

- Activeduty military service persons

- Veterans

- Members of the Selected Reserve or National Guard

- Cadets at the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman at the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.

The Mortgage Relief Refinance

Over the years, there have been a number of mortgage relief refinance programs designed to help homeowners who are underwater on their loans.

Being underwater means you owe more on the home than it is currently worth. As a result, your LTV is over 100%.

For example, imagine you have a mortgage out for $150,000 on a home thats also worth $150,000. But your home loses value, and is now worth only $125,000. Your new loan to value ratio is 120%.

Having an LTV above 100% would normally disqualify you from refinancing. But with a special mortgage relief program, you can refinance an underwater home into a lower rate to make your mortgage more manageable.

You can read about current mortgage relief refinance programs here.

What Is Loan To Value Ratio

Loan to value ratio or LTV denotes the percentage of a propertyâs actual price that can be obtained as a loan. It denotes the maximum amount of financing you are entitled to receive against the pledged property. The LTV ratio ranges between 40% and 75% for a loan against property. This ratio can vary depending on whether the pledged property is residential or commercial, and self-occupied, rented, or vacant.

LTV ratio calculation is strictly based on the propertyâs recent valuation report, which shall not be more than 3 months old. Otherwise, the property must be valued a new to that end. You can obtain an amount lower than what the loan to value ratio tells. Use a loan against property EMI calculator to determine the amount and tenure you are comfortable with to make an informed decision. Besides the highest loan amount eligibility, the LTV ratio is a measure of the perceived risk of lending.’

Read Also: Usaa Used Car Loans

Find Out If You Qualify For A Mortgage

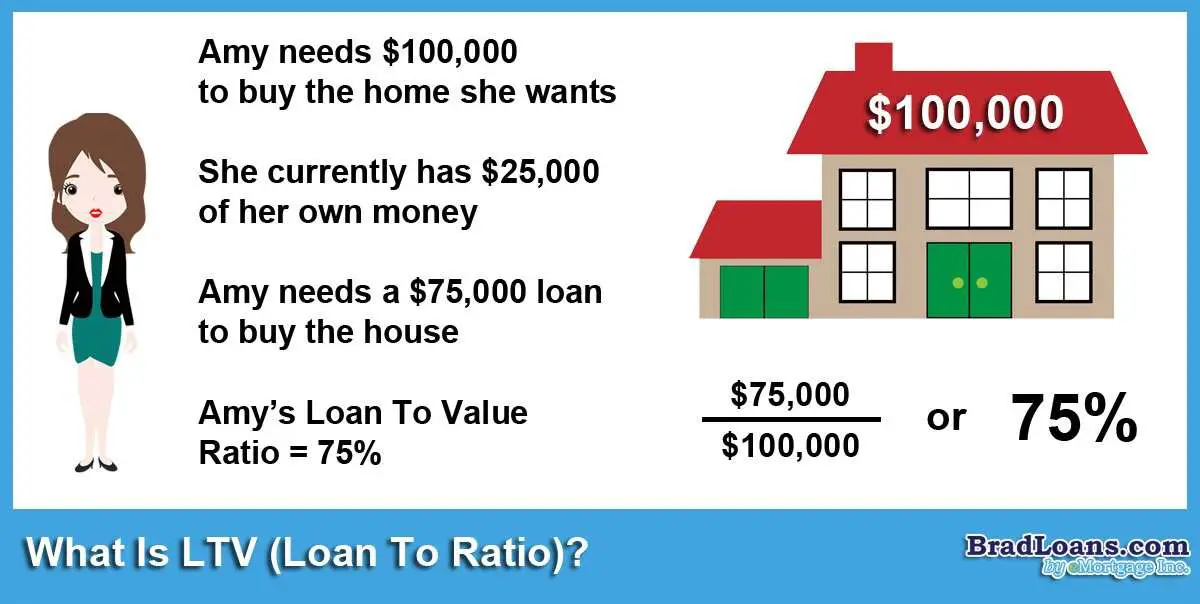

Loantovalue is the ratio of how much youre borrowing compared to your homes worth. Its a simple formula, but its the basis for most mortgage lending.

Once you know your LTV, you can figure out which mortgages youre likely to qualify for and which lender offers the best rates for your situation.

How Does Ltv Change My Mortgage Options

First and foremost, LTV will put a maximum on how much you can borrow for a particular mortgage deal. Lenders will typically arrange their mortgage offers into LTV tiers to reflect how risky they feel each customer is. The lower the LTV, the better the rate the lender will offer as they view you as having less chance of falling into payment arrears and should that happen, they have more chance of recovering all of their money through a repossession.

Also Check: How Does Pmi Work On Fha Loan

Lenders Set Maximum Lvr Limits

Lenders each have their own limits on the maximum loan to value ratio a home buyer can have.

Some have a maximum LVR of 90%. This means you need at least a 10% deposit to be eligible for a home loan.

Others have a maximum loan to value ratio of 95%, meaning you could secure a home loan with as little as a 5% deposit.

What Does Ltv Mean

Your loan to value ratio compares the size of your mortgage loan to the value of the home.

For example: If your home is worth $200,000, and you have a mortgage for $180,000, your loan to value ratio is 90% because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment.

If you put 20% down, that means youre borrowing 80% of the homes value. So your loan to value ratio is 80%.

LTV is one of the main numbers a lender looks at when deciding to approve you for a home purchase or refinance.

You May Like: Usaa Car Loans Review

What Is A Loan

The loan-to-value ratio, commonly referred to as LTV, is a comparison of your cars value to how much you owe on the loan.

An LTV over 100% means you owe more on the loan than your vehicle is worth. This is considered negative equity. Its also often referred to as being upside down or underwater on your loan. The higher your LTV, the harder it may be to qualify for a car refinance loan.

An LTV under 100% means that you owe less on the loan than your vehicle is worth. This is considered positive equity and is more desirable by lenders.

How To Calculate Ltv For Mortgage Loan

The LTV ratio for a mortgage loan is calculated by dividing the available loan quantum by the pledged propertyâs current value and then multiplying it by 100. It is expressed in percentage mostly. If the eligible loan amount is Rs.1 crore and the mortgaged propertyâs value is Rs.2 crore, the loan to value ratio is 50%. One may use a loan to value ratio calculator to compute the same.

This online calculator requires three inputs primarily to that end, namely, employment type, property type and its current market value. Select whether you are salaried or self-employed, if the property is commercial or residential, and then enter its latest value to check the loan amount for which you are eligible. Divide that sum by your propertyâs value and multiply it by 100 to calculate the loan to value ratio for a mortgage loan.

The sum differs based on whether the mortgaged property is a house or a commercial property. Depending on whether itâs self-occupied, rented, or vacant, a house fetches a high loan to value ratio compared to a commercial asset. The LTV ratio for a mortgage loan on a self-occupied property is significantly higher than one that is vacant or rented.

Recommended Reading: One Main Financial Approval Odds

Is It Better To Have A Higher Or Lower Ltv

With a lower LTV, you’ll appear less risky to lenders than with a higher LTV, which could help you qualify for a lower interest rate. And if your LTV is 80% or lower, you can avoid paying for mortgage insurance.

About the author:Barbara Marquand writes about mortgages, homebuying and homeownership.Read more

Factors That Affect Ltv Calculation:

Certain factors affect the LTV ratio and vary from person to person. LTV is higher or lower based on:

NOTE: This page only talks about LTV calculation and the factors that affect it. The calculator shows the maximum loan amount one may be eligible for based on LTV as well as net monthly disposable income. However, please note that eligibility of the applicant in terms of employment history, income, current monthly income credit score, etc. are also taken into account while determining the maximum loan amount that can be given.

Don’t Miss: Usaa Refinance Student Loans

Possible Effects On Insurance

If you pay private mortgage insurance on your mortgage, keep an eye on your LTV ratio. Your lender is required by federal law to cancel PMI when a homeâs LTV ratio is 78% or lower than the homeâs original appraised value . This cancellation is generally preplanned for when your loan balance reaches that percentage. However, if your LTV ratio drops below 80% because of extra payments you made, you have the right to request your lender cancel your PMI.

What Does My Loan

LTV is used by mortgage lenders to assess risk when deciding whether or not to extend credit to you. A high LTV ratio would be riskier for a mortgage lender, while a low LTV ratio would be safer. This can have impacts on your mortgage approval and your mortgage interest rate.

As you pay off your mortgage, your LTV ratio will decrease. Your LTV ratio can also decrease if your property value increases.Torontos housing markethas performed well, and only 13% of mortgages within Toronto were high-ratio mortgages in 2016. Similarly, only 10% of mortgages within Vancouver were high-ratio. In comparison, Calgary had 36% and Halifax had 45% of mortgages being high-ratio in 2016.

Likewise, your LTV ratio can increase if your property value decreases. Having a LTV ratio above 100% means that you owe more on your mortgage than what your property is worth, and is also known as negative equity or being underwater on your loan. Borrowers with underwater mortgages are more likely to default.

Also Check: Usaa Auto Loan Calculator

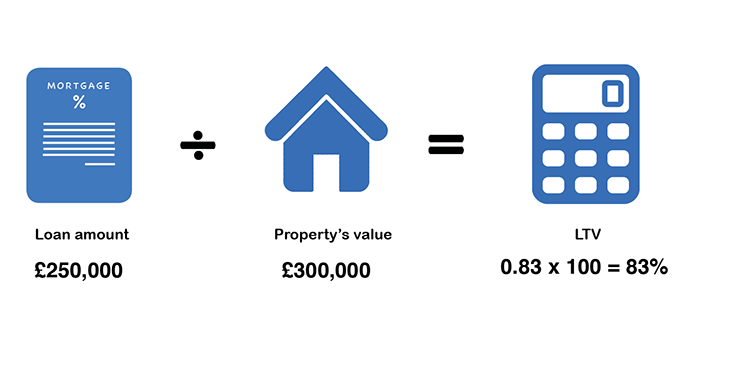

Loan To Value Example

Mr John wants to buy a new house and has applied for a mortgage at a bank. The bank needs to perform its risk analysis by determining the loan to value of the loan. An appraiser of the new house shows that the house is worth $300,000 and Mr John has agreed to make a down payment of $50,000 for the new house. What is the loan to value ratio?

- Loan amount: $300,000 $50,000 = $250,000

- Value of asset: $300,000

Using our formula we can substitute the values for the variables in the equation:

$$LTV = \dfrac000}000} = 0.83333$$

For this example, the loan to value amount is 0.83333. However, you would express the ratio in percentage by multiplying by 100. So the loan to value amount would be 83.33%. The loan to value ratio is above 80%, so analysts would consider it high.

Consider another scenario where the owner of the new house Mr John wants to buy is willing to sell the house at a price lower than the appraised value, say $280,000. This means that if Mr John still makes his down payment of $50,000, he will need only $230,000 to purchase the house. So his mortgage loan will now be $230,000.

Let us calculate the loan to value of the new loan application.

- Loan amount = $230,000

- Value of house = $300,000

$$LTV = \dfrac000}000} = 0.7667$$

What Is Loan To Value Or Ltv

A loan is taken by people when in need of funds. To obtain a loan is easy when you have property or assets to place as collateral security with the lender. The amount granted as the loan is not the entire value of the property but a certain percentage of its value, which is determined based on factors such as the type of property, the age of the property, your monthly income, current financial obligations, and other parameters including the organizations policy at the time of loan application. This ratio or percentage of the amount of loan that would be forwarded against the appraised value of the property is known as the Loan to Value Ratio or LTV.

``

Max Loan Amount

As per your property value and monthly income & obligations, you may be eligible for a loan of upto INR0.

Monthly EMI

Your monthly EMI will be around INR0for the interest rate and tenure selected

Total Interest payable

Disclaimer : Please note that this calculator is for demonstrative purposes, and only takes into account the n…Read More

Don’t Miss: Usaa Auto Interest Rates

How To Use The Loan To Value Ratio Calculator

The loan to value calculator comprises five fields. These are â

- Employment type

Follow the steps below to use a loan to value ratio calculator:

Step 1. Select whether you are a self-employed or a salaried individual.

Step 2. Choose between a residential or commercial property type.

Step 3. Enter propertyâs current market value.

You can view the eligible loan amount instantly after inputting these variables. To view the EMI amount, interest payable, and total payable amount, you need to enter a suitable tenure in the mortgage LTV calculator. You can also tune the term as per your convenience to determine an EMI you are comfortable bearing every month.

However, the instalment amount can vary when you actually apply for a loan against property based on your eligibility and applicable interest rate. The LTV ratio calculation can also differ depending on specific factors.

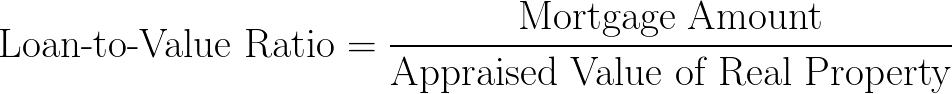

How Is Ltv Calculated

Working out LTV is a simple calculation. Take what you want to borrow and divide by the value of the property.

For example: LTV = £ 225,000 divided by £ 300,000LTV = 75%

There is no need to do the calculation yourself, however. Use our LTV mortgage calculator below, for an instant calculation of LTV.

Don’t Miss: Fha Refinance Rate

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

High Ltv Mortgages 90% & 95% Ltv Mortgages

If you only have a small deposit to put down, such as 5% or 10% of the property value, you will be restricted to 95% or 90% LTV mortgage deals.

The good news is that recent years have seen increasing numbers of lenders launch high LTV deals, although the rates offered will be higher compared to lower LTV mortgages.

Prior to the 2008 financial crisis, some lenders used to offer 100% LTV mortgages, where you didnt need to put down a deposit at all, but these are now considered too high risk. Some even offered 125% LTV deals, where you could borrow more than the propertys value, but again, these are no longer available.

Recommended Reading: Upstart Loan Calculator

Definition And Example Of Loan

A loan-to-value ratio tells you how much of a property you truly own compared to how much you owe on the loan you took out to purchase it. Lenders use LTVs to determine how risky a loan is and whether they’ll approve or deny it. It can also determine whether mortgage insurance will be required.

- Acronym: LTV ratio

For example, if you buy a home that appraises for $200,000 and make a down payment of $20,000, you are borrowing $180,000 from the bank. The loan-to-value ratio on your mortgage would then be 90%.

The ratio is used for several types of loans, including home and auto loans, and for both purchases and refinances.

LTVs are part of a bigger picture that includes:

- Your credit score

- Your income available to make monthly payments

- The condition and quality of the asset youre buying

It’s easier to get higher LTV loans with good credit. In addition to your credit, one of the most important things lenders look at is your debt-to-income ratio, your debt payments divided by your income. This is a quick way for them to figure out how affordable any new loan will be for you. Can you comfortably take on those extra monthly payments, or are you getting in over your head?

Loan To Value Ratio Definition

The Loan to Value Ratio Calculator is a financial calculator that will instantly calculate the loan to value ratio of any property if you enter in the mortgage amount and the property value. The loan to value calculation is an important financial calculation that is done by homeowners and lenders to determine if the homeowners has enough equity in their home to qualify for certain mortgage interest rates when refinancing.

Enter the current appraised value or fair market value of the property in the property value field and then enter in the total mortgage amount on the property in the mortgage amount field to calculate the loan to value ratio. The lower the loan to value ratio then the better for the homeowner because the loan is generally considered less risky. The higher the loan to value ratio then the more risky a loan is considered to be.

Don’t Miss: Usaa Rv Loan Terms

Does Ltv Affect Interest Rates

Lenders use risk based pricing as one factor in determining interest rates. While a higher LTV doesnt necessarily rule out a loan, a higher interest rate may result in order to protect the lender. A borrower with an LTV of 95% may have a loan with a full point higher interest rate than one who has an LTV of 80%. Additionally, borrowers with a higher LTV may be required to carry additional insurance on their loan. Private Mortgage Insurance can further protect lenders on high-risk loans.

How Do You Calculate Loan

Divide the amount of the loan by the appraised value of the asset securing the loan to arrive at the LTV ratio.

As an example, assume you want to buy a home with a fair market value of $100,000. You have $20,000 available for a down payment, so you’ll need to borrow $80,000.

Your LTV ratio would be 80% because the dollar amount of the loan is 80% of the value of the house, and $80,000 divided by $100,000 equals 0.80 or 80%.

You can find LTV ratio calculators online to help you figure out more complicated cases, such as those including more than one mortgage or lien.

Also Check: Loan Officer License California