What Impacts Your Borrowing Rates

Owning and operating a personal vehicle is a privilege and a convenience, one that we often take for granted in this consumer society of instant gratification. We’ve somehow come to believe that we’re entitled to certain things, such as a high-paying job, a house, and a car, just for example. But these are things that we earn – they’re not handed out like candy. And you need to plan ahead, save money, and get your credit in order if you want the opportunity to borrow the funds needed to put you behind the wheel of a decent mode of transportation.

In case you didn’t know, there are dozens of factors that could have an impact on the interest you’re charged when you seek an advance of funds from a lender. Borrowing money isn’t easy at the best of times, so if you’re in dire straits with your bills and your driving record is a shambles of moving violations and parking tickets, you could be in for a big surprise when you try to borrow money to buy a car. However, when you understand some of the major factors that can affect interest rates, you can do a lot to further your cause and save some money. Here are some considerations to keep in mind before you try to buy the car of your dreams.

Tips For When Youre Shopping Rates

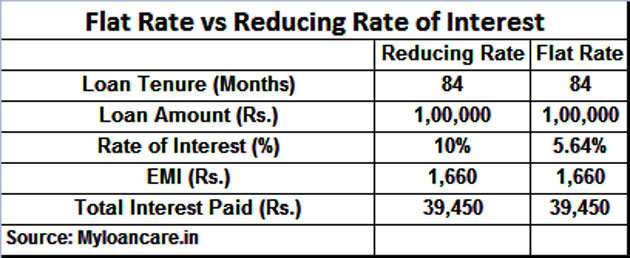

Pay close attention to loan terms, which can vary greatly, depending on the lender. The longer the loan term, the lower the monthly payments will be, but that means more interest will be paid over the life of the loan. Conversely, a shorter loan term may mean higher monthly payments, but then less is paid in interest over the life of the loan.

Shop Around All At Once Or Not At All

If you take your sweet time in comparison shopping for loans, your credit will suffer. Every time a potential lender checks your credit, your credit will momentarily dip making it harder to get a different loan if you decide to do so. This is because shopping around for multiple loans is a signal to lenders that you are desperate for money, even if that is not at all the case.

Also Check: How To Compare Student Loan Rates

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

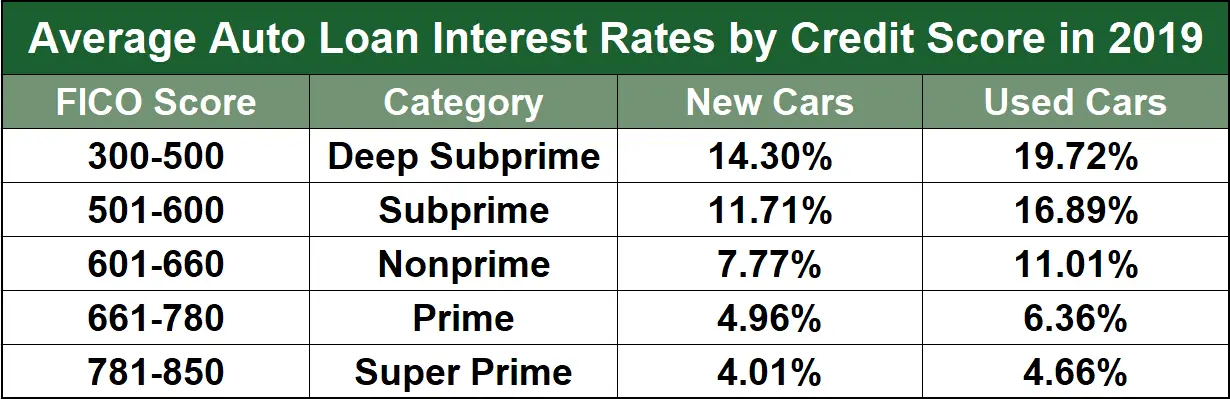

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Read Also: What Is The Maximum Fha Loan Amount In Texas

Simple Steps To Comparing Multiple Loans

When you are ready to buy that new car, house, or business, the first thing you have to consider is how to pay for it. Options for financing are plentiful, but that doesn’t mean the process is easy. In fact, because there are so many options, terms, and fine print, shopping for a loan is a daunting task that requires thorough research.

Cons Of Refinancing An Auto Loan

Potential downsides of refinancing an auto loan include:

-

Lowering your credit score: A lender will pull a hard credit check before making an official refinancing offer, and the hard credit check affects your credit score whether or not you choose to refinance.

-

Paying more in the long run: While monthly payments may be more budget-friendly in the short term, they may entail a longer loan term. As a result, lower monthly payments can result in paying more in interest over the life of the loan.

-

Risking your vehicle: If you used your car as collateral for a personal loan, as described above, falling behind or stopping payments could result in the lender repossessing your vehicle.

Don’t Miss: What Kind Of Loan For Rental Property

Shopping For A Car Start With Us

Buying the vehicle that compliments your lifestyle is important.

Whether its a high-powered sports car for your fast-paced personality,

or the family-friendly minivan you need for your growing family.

Bank of America can help you feel more in control on the road to buying and financing your next vehicle.

You probably spend plenty of time researching what vehicle you really want using our online auto shopping tool or other resources, but researching your auto financing is just as important.

There are many factors that can impact how much your monthly payment will be.

The auto financing process begins with being informed about the whole experience, and were here to make it as stress free as possible to help you get the auto financing you are looking for.

There will be three main stages to the process.

First, the Getting Started stage, when you can research vehicles and financing options, then apply for auto financing online, in-person, or over the phone.

Then, in the Loan Approval stage, you may work with a Loan Specialist to discuss the best terms for your financing, submit any additional documents needed, and if approved, close your purchase or refinance.

And finally, in the Servicing stage, when your financing is complete, youll receive your welcome package and first statement, and begin repaying your loan.

If youre not sure yet which vehicle might be a good fit for you and your budget, Bank of America can help with that too!

What Is An Auto Loan And How Does It Work

An auto loan is a type of debt instrument that consumers use to purchase motor vehicles. Typically, these loans are structured to be paid back in periodic installments and are secured by the value of the underlying vehicle that they are used to purchase. In other words, the vehicle being bought serves as collateral for the loan that can be seized if the borrower fails to pay the scheduled principal/interest.

In terms of the actual structure of the car loan, it is similar to most other consumer loans offered by lending institutions and consists of the principal and the interest. The principal is correlated with the value of the vehicle being bought and/or the amount of down-payment required. Depending on the vehicle or the lending institution, a down-payment may not be required at all however, in the case that it is, the larger the down-payment, the lower the principal amount, which translates to reduced costs for the borrower and lower risk for the lender. One example of this is a car worth $5,000 for which the lender stipulates down-payment to be 10% i.e. $500. Once the borrower pays this $750 up front, the lender provides the remaining $4,500 to finance the purchase of the vehicle.

Transunion published a report noting that the average Canadian consumer held $21,216 in auto loan debt at the end of 2019, an increase of 2% from the same period of 2018.

Read Also: How Much Can We Borrow Home Loan

Who Are The Best Auto Loan Refinancing Lenders

Getting your vehicle refinanced can be tricky. Many lesser-known lenders might send you inquiries about refinancing from time to time.

Some companies are actually scams while others may be trustworthy. In any case, the best auto refinance companies are typically larger lenders with strong financial ratings.

These companies include an assortment of banks, credit unions, and even auto insurance companies. The best lender to refinance with will vary based on your vehicle, personal information, and where you live.

This means that, in some cases, an auto insurance company might be the best lender while in other cases your credit union could be the better option. This is why its important to compare offers from multiple lenders.

Some popular lenders include:

- Consumers Credit Union

- AutoPay

The above list includes a handful of name-brand options with some others that arent as well-known. In addition, many auto insurance companies can offer competitive refinance rates.

Car Loan Versus Car Lease

Financing and leasing are two methods through which people can get a new car. In both cases, the car owner/lessee would have to make monthly payments. The bank/leasing company would have a stake in the vehicle as well.

There are several differences between car leasing and car purchase through a loan. Listed below are some of the differences:

- People who like to change cars every 3-4 years may find it more advantageous to lease a car as opposed to financing it. This way, the hassle of maintenance is also taken care of by the lessor.

- When the lease period expires, the lessee can return the car to the leasing company. He/she does not have to go through the process of car valuation and sale, as would be the case if he/she owned the vehicle.

- In the event of leasing a car, there is a restriction on the distance you can drive it for. This kind of restrictions are not there when you are the owner of a financed car.

- Another disadvantage of leasing a car is the fact that you will be unable to customise the vehicle based on your personal preferences.

Read Also: Is Student Loan Refinancing Worth It

Here’s How To Pay A Car Payment With A Credit Card:

- Mobile payment services: One way to pay your car loan or lease with a credit card is to use a mobile payment app such as Venmo or PayPal as a middleman. These applications allow you to transfer money from user to user, and you can fund them with a credit card.

So, for example, you could use your credit card to pay a friend or family member through the app, and they can then make your car payment for you or give you the money to do it yourself. Just make sure you really trust the person, and be careful because payments may count as purchases or cash advances, depending on the service and the credit card issuer. But either way, there are fees involved. Venmo, for example, charges 3% of the transaction amount.

- Money transfer services: Companies like MoneyGram and Western Union allow you to directly pay a collection of participating billers, and you can fund the transaction with a credit card. However, this may be treated as a cash advance, which would mean expensive fees and interest charges would apply, in addition to the fees charged by the service. You can learn more about how this works from our explanation of how to transfer money from a credit card to a bank account.

The bottom line is that these options are far from ideal and should only be considered if you’re in a real bind, or if you do the math and somehow find an opportunity to save. That could be the case if you’re able to transfer part of an auto loan to a 0% balance transfer credit card, for example.

|

Category |

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Also Check: How Much Do We Qualify For Home Loan

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

How Do You Compare Car Loans

One of the best ways to compare car loans is to look at the key components of the loan and choose which option best suits your goals and financial needs.

When it comes to comparing car loans, its important to make sure youre comparing apples with apples. For example, secured car loans must be compared with other secured car loans, and unsecured loans with other unsecured loans.

If you factor the following details into your car loan comparison, youll likely be better equipped to make a fair comparison and work out which car loan best suits your needs.

| Car loan factor |

Recommended Reading: How To Check If Loan Is Fannie Or Freddie

How Does Auto Loan Refinancing Work

Auto loan refinancing is a unique process that depends on a multitude of factors. Why should I refinance? Some of these are listed below:

- Initial loan terms and interest

- Vehicle worth

- State you live in

With so many variables, its hard to make concrete predictions on when youll be able to refinance an auto loan without any context. There are a few situations when youll want to seek refinancing, however.

When should you refinance your loan? Its a good idea to refinance your auto loan if you fall under these circumstances:

- Notable credit score improvement

- Lower monthly payments are available

- Your vehicles value is stable or increasing

- Interest rates have improved with the market

Many lenders will have fluctuating interest rates by month depending on the performance of the market overall. This could mean youll pay a substantial amount more on interest for the same vehicle just because the market isnt thriving.

In other circumstances, you could lower your monthly payments by refinancing to a loan with a longer term. This often depends on the vehicles worth and mileage.

Lenders wont provide a loan for a vehicle that could break down due to old age or high mileage. If they do, you can expect to pay more for interest. The lender has to be sure their money is repaid.

Ask About Early Repayment Penalties

If your fortunes change and you start making more money, you might want to consider paying off your loan early in order to save in interest and stop having the hassle of monthly payments. But if you do so without checking the fine print, you may be hit with penalties that will make it not worth doing so. It is best to check with your lender before agreeing to anything.

You May Like: How To Figure Car Loan Payments

Looking For The Best Car Loan

Its important to shop around to find the best car loan for your circumstances. When comparing car loans, its worth considering both the price and features . To help consumers compare their options, Canstar researches and rates over 200 products from over 70 providers as part of its Car and Personal Loan Star Ratings.

Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan interest rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to loan money to people with average or poor credit, even if they cant get approval from their bank though they may not get the lowest rate available. Online lenders also tend to be the quickest to approve loans and disburse funds.

- Dealerships. Local car dealers are often willing to work with borrowers of all credit ratings. But because many dealerships offer financing through an external lender, dealers may inflate interest rates in order to make a profit.

Also Check: How To Apply Loan In Sss