Interest Capitalization On Student Loans

Whether you have a fixed or variable interest rate, interest generally starts to accrue as soon as the money is disbursed to you or to the school. Subsidized federal loans may offer the only exception, because the federal government covers the interest while you’re still in school. For unsubsidized loans, this accrued interest will not be covered.

Thats why, if at all possible, you should make payments while youre in school even if the lender allows you to defer payments until after you graduate.Deferment does not mean that your loans aren’t accruing interest.

Interest that accrues without payment can capitalize. That means the unpaid interest gets added to your principal. Once its added to your principal, you can be charged interest on it.

Lets use the same numbers from our daily compounding example above.

If you accrue $41.10 in interest during the first month of your loan and dont make a payment, your principal can increase from $10,000 to $10,041.10. Then, after that, the daily compounding rate would be applied to the new principal, meaning that youre being charged interest on interest.

If you defer interest payments until youre out of school, you could potentially wind up adding thousands of dollars to your principal.

On the flip side, making interest-only or interest-plus-principal payments while youre still in school can save you thousands of dollars over the life of your loan.

Additional Factors To Consider When Calculating Student Loan Interest

When calculating your student loan interest, keep in mind that there are a few other key factors at play:

- Fixed vs. variable rates. Unlike federal student loans, which offer only fixed interest rates, some private lenders offer fixed or variable student loan interest rates. A fixed rate wont change during your loan term, but variable rates can decrease or increase based on market conditions.

- Term length. How short or long your student loan term is dramatically changes how much total interest youll pay. In addition to calculating your total interest paid, the student loan calculator above shows you how much of your monthly payment goes toward interest to see this view, click on show amortization schedule.

- Private student loans require a credit check. The stronger your credit, the more likely youll be offered competitive, low interest rates. Borrowers with bad credit might be approved at a higher interest rate, which means more money spent on interest charges overall.

How Payments Are Applied

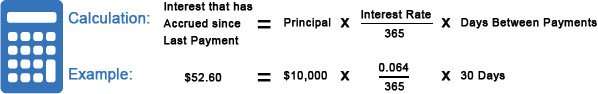

Each month, your loan payment is prorated based on the amount due. Your payment is first used to pay any interest that has built up since your last payment. Then, the rest is used to pay down your principal. If your payment is late, the funds will be applied to the most past due loan group first.

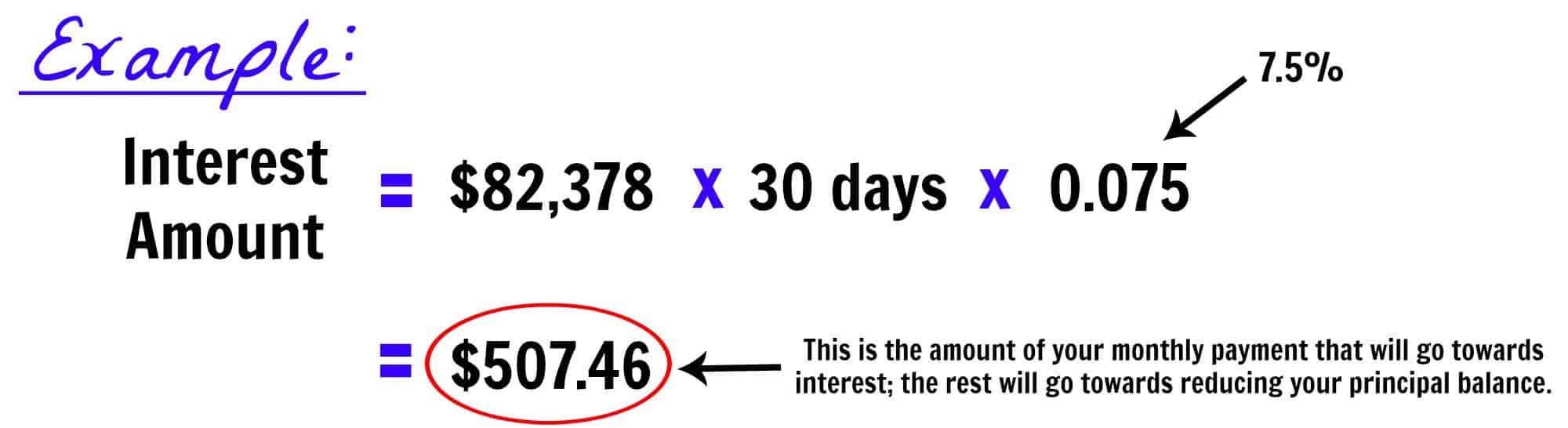

To estimate how much loan interest has built up since your last payment, use this calculation:

Read Also: Usaa Bad Credit Auto Loans

How To Choose A Student Loan And Repayment Plan

If youre trying to choose between student loan providers, there are few things you should consider, including:

- Interest rates

- Loan eligibility requirements for you or your cosigner

- Repayment terms, such as number of years, options for paying while in school, penalties for early repayment, and grace periods after youre no longer in school

- Options for forbearance if you cant pay for some reason

- The lenders reputation

If youre looking for a private student loan, its important to make sure that youre working with a lender that doesnt issue predatory loans, that is, loans with terms that are likely to put the borrower deep into student loan debt and maybe even into default.

Your student loan repayment plan should be reasonable and aligned with what you can reasonably handle upon graduation. Your loan amount should align with your financial need try not to take out more than you reasonably need for your education.

Also Check: Usaa Auto Pre Approval

Will I Pay More Student Loan Interest On An Income

In most cases, yes, youll pay more student loan interest by joining an IDR plan. The reason for this is that IDR plans extend a borrowers repayment schedule by 10 or more years compared to the standard repayment plan. More years of repayment also means more years of interest accrual.

One exception to this rule is if the borrower joins the Public Service Loan Forgiveness program and is able to receive forgiveness after 10 years. In this case, both interest and overall cost on an IDR plan would be lower than the borrower would pay on the standard plan.

You May Like: Capitol One Car Loans

Save By Lowering Your Interest Rate

The other main way to save on student loan interest is to reduce your interest rate. There is no way to change the interest rate on federal student loans through the Department of Education. But you may be able to lower your rate by refinancing your federal loans with a private lender.

Going back to our sample loan described above, what if you could refinance that 6.5% loan to a 3.5% interest rate. In that case, only $77 of your first payment would be going toward interest. And youd only pay $7,800 in interest overall a savings of over $10,000!

And notice that youd net these savings even while making the exact same monthly payment of $570. So, in this example, youd actually save more money by refinancing and keeping your payments the same, instead of keeping your interest rate the same and increasing your monthly payment to $700.

How Do Interest Rates Work

Depending on your credit worthiness and the type of loan you get, you can expect to pay somewhere between 1.25% and 12% interest for the money you borrow as part of a college loan.

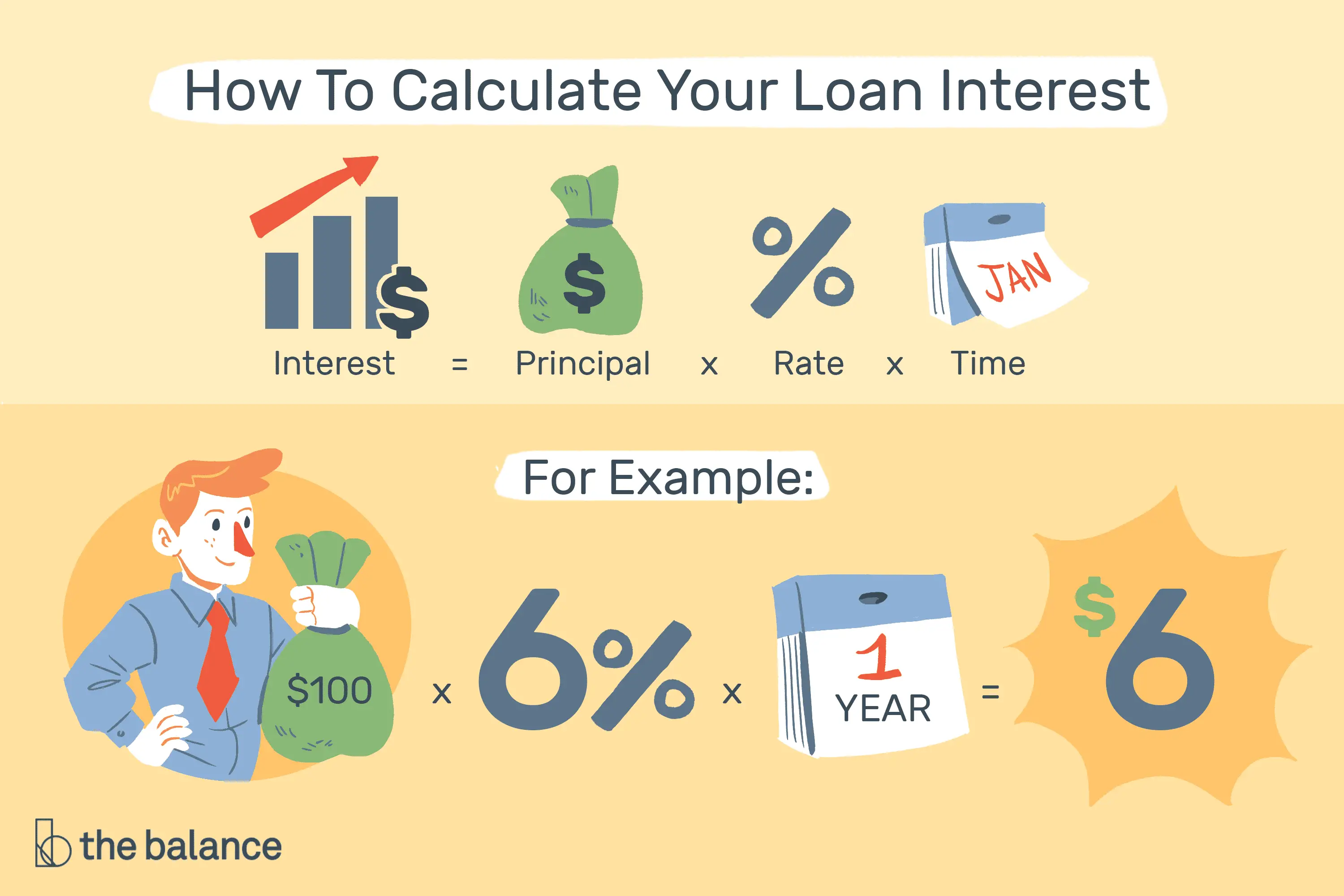

Interest rate is expressed as an , or annual percentage rate. The APR refers to the amount of interest that is charged over one year.

Lets use some round numbers to make this easy. If you have a 10,000 loan at 5% APR, youd expect to pay around $500 in interest during the first year of the loan.

The simple equation is:

$10,000 principal x 0.05 APR = $500 in interest

However, the amount you actually pay depends on how the interest rate is applied. Yes, this is where that fine print comes in, but remember, we promised to make it easy so stick with us.

Don’t Miss: Usaa New Auto Loan Rates

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

Why Does The Amount Fluctuate Each Month

Between my student loan and my wifes student loan we paid $277 in interest for January 2010. In December of 2009 we paid only $261 in interest and in November of 2009 it was $288. Our principal decreases every month, so whats up with the large fluctuations and how could we have paid more in November of 2009 than in January of 2010 if the principal is less? Great question.

The answer lies in 2 conditional variables that effect the number of days since last payment from month to month:

The number of days since the last payment will obviously differ from month to month based on these two variables.

If the month has 28 days the interest calculated will be less than in a month that has 31 days because 3 extra days were figured into that months calculation. Also, if the last day of the month falls on a weekend or holiday, the calculation will not be performed until the next business day thus increasing that months number of days since last payment.

Thus regardless of the fluctuation in monthly amounts we will never be charged anymore than 365.25 days worth of interest on our student loans in a given year.

You May Like: Sofi Vs Drb

The Basics What Is Debt & Interest

Lets start with the basics of what is debt and interest. Debt is money that you are borrowing from someone else because you may not have enough money. Unless you are borrowing from your kind parents, there is no incentive to let someone borrow your money without a cost. In fact, there is a risk of lending money because the borrower might default or never pay back your money.

Thats why interest exists! Interest justifies the inconvenience of lending out money and risks of being unable to re-collect your money. .

Is It Possible To Lower The Interest Rate On Federal Student Loans

Federal student loans come with fixed interest rates. In one sense, thats a good thing because borrowers can know that their interest rate wont go up over time. However, theres also no way to reduce the interest rate on a federal student loan, even if the national average has dropped since you took out your loans. Borrowers can refinance federal student loans with a private lender to secure a lower rate, but the refinanced loans no longer qualify for federal benefits.

Don’t Miss: How Does Capital One Auto Loan Work

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

Rates For Federal Student Loans

- Direct loans to undergraduate students: 3.73%

- Direct loans to graduate or professional students: 5.28%

- Direct PLUS loans: 6.28%

While federal loans are usually a better option than private loans, you do have the option to go rate shopping with private loans. For private loans, the better your credit, the lower your rate. If you can’t qualify or are looking to get an improved rate, enlist a cosigner with great credit.

Also Check: Do Loan Originators Make Commission

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

Dont Miss: Does Collateral Have To Equal Loan Amount

Use This Calculator To See How Much Of Your Monthly Student Loan Payment Goes Toward Interest

Loan interest adds up and can impact the amount youre able to pay on your student loan principal. This calculator shows how much interest youre being charged on your student loan since your last payment.

You can also use it to estimate how much of your monthly loan payment goes to pay interest . Any remaining payment amount goes toward your loan principal. The sooner you pay down the principal, the less interest you pay in total, and the faster your loan is paid off**.

**Whenever you can, pay extra on your loan principal even a little can make a difference. Be sure to notify your lender that you want the extra contribution to apply to the principal balance. If you dont, they may apply it to future interest payments while continuing to charge interest on the remaining principal.

301 Sundance Parkway

Also Check: Is Prosper Legitimate

When Do I Start Accruing Interest

Student loan interest typically accrues daily, starting as soon as your loan is disbursed. In other words, student loans generally accrue interest while youre in school.

Subsidized federal loans are the exception the government pays the interest that accrues while the borrower is in school, so borrowers generally dont have to start paying interest on subsidized loans until after the six-month grace period.

How Do You Calculate Monthly Amortization In The Philippines

How to Calculate Monthly Payment on a Loan?

How can I pay off a 30-year mortgage in 20 years? Five ways to pay off your mortgage early

How do I pay off a 30-year mortgage in 15 years?

Options to pay off your mortgage faster include:

How can I pay off a 20 year mortgage in 10 years? Expert Tips to Pay Down Your Mortgage in 10 Years or Less

Also Check: Do Private Student Loans Accrue Interest While In School

When Does Student Loan Interest Begin Accruing

Generally, interest starts to accrue as soon as your loan funds are disbursed for private student loans and for most federal student loans. The exception is direct subsidized loans, which are interest-free until your repayment period begins.

However, many borrowers may not know that you can pay off the interest while in school and during your six-month grace period to prevent it from capitalizing at the end of that time. Capitalized interest is unpaid interest added onto your loan balance after periods of nonpayment. This will increase your overall loan balance, and you’ll later pay interest on that higher amount, increasing the total cost of your loan.

“You could pay the interest while you’re in school,” says Marguerita Cheng, a certified financial planner and CEO of Blue Ocean Wealth. “But I’m here to say every situation is unique. What I mean is if you’re an engineering student and your coursework is really hard, maybe it’s okay to not pay the interest and focus on doing well in school. I know sometimes people like absolute advice, and if you can pay the interest, pay it. But every situation is truly unique.”

Simple Vs Compound Interest

The calculation above shows how to figure out interest payments based on whats known as a simple daily interest formula this is the way the U.S. Department of Education does it on federal student loans. With this method, you pay interest as a percentage of the principal balance only.

However, some private loans use compound interest, which means that the daily interest isnt being multiplied by the principal amount at the beginning of the billing cycleits being multiplied by the outstanding principal plus any unpaid interest that’s accrued.

So on Day 2 of the billing cycle, youre not applying the daily interest rate0.000137, in our caseto the $10,000 of principal with which you started the month. Youre multiplying the daily rate by the principal and the amount of interest that accrued the previous day: $1.37. It works out well for the banks because, as you can imagine, theyre collecting more interest when they compound it this way.

The above calculator also assumes a fixed interest over the life of the loan, which youd have with a federal loan. However, some private loans come with variable rates, which can go up or down based on market conditions. To determine your monthly interest payment for a given month, youd have to use the current rate youre being charged on the loan.

Also Check: Bayview Mortgage Reviews

How Compound Interest Works

Compound interest is charged based on the overall loan balance, including both principal and accrued but unpaid interest .

So, compound interest involves charging interest on interest. If the interest isnt paid as it accrues, it can be capitalized, or added to the balance of the loan.

For example, if the loan balance starts at $10,000 and the interest due after one year is capitalized, the new loan balance becomes $10,500 and the interest accrued in year two is $525 .

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan.

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Read Also: Refinance Options For Fha Loans