Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

How Much Interest Do You Pay On A $1000000 Home Loan

As your loan size increases so does the total amount of interest youâll pay over your full loan term. You can see here that borrowers with a $1,000,000 loan amount could pay more than $800k in interest if theyâre not always on a competitive rate. That means paying over 80% of the total loan size again to your bank.

| Amount borrowed | Total interest paid over life of loan |

|---|---|

| $1,000,000 | |

| $824,120 |

Loan Interest Calculator Terms & Definitions

- Principal â Denoting an original sum invested or lent.

- Interest â Money paid regularly at a particular rate for the use of money lent, or for delaying the repayment of a debt.

- Interest Rate â The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding.

- Term â The duration of the loan.

- Monthly Payment Amount â The dollar amount due each month to repay the credit agreement.

- Total Years Until Loan Payoff â The number of years until the loan will be paid in full.

- Loan Balance â The total amount that needs to be paid off .

- Lender â An organization or person that lends money, usually to make money through interest.

- Borrower â An organization or person that borrows money, usually having to pay interest.

Also Check: Usaa Refinancing Car Loan

How To Refinance Your Mortgage

There are a number of ways to refinance your mortgage, but the most important step is to get prequalified with a lender. Doing this will not only help you to know whether you meet the basic requirements of the lender but will also give you an idea of your potential interest rates for the refinance. If you have an idea of your rates, you can plug that information into the mortgage refinance calculator and see for yourself how much you stand to save.

Make sure to shop around for lenders, too you may be given different rates by different lenders, which could mean the difference between refinancing at a lower rate and sticking with your current loan. Be sure to check with your current lender, too they have an incentive to keep you as a customer, so its worth seeing whether the current lender will offer you a lower rate than a new lender would.

Once youre prequalified, the refi loan process will follow similar steps as the original loan process did. Youll likely need to get another appraisal and will go through the closing process again, too.

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

You May Like: How To Refinance An Avant Loan

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

Number Of Days In The Month

The number of days in the month can impact your repayment amount. Interest is usually calculated daily, so your interest repayments will typically be slightly higher for a 31-day month compared to a 30-day month.

Other factors, such as whether you make additional repayments or whether you use a mortgage offset account, can also impact the amount of interest payable. Additionally, if you make interest-only repayments for a period of time, this will also generally increase your interest in the long run. This is because you wont be paying down the principal amount during this time.

By budgeting and managing your finances carefully, you may be able to cut expenses from elsewhere and use the money saved to reduce your loan amount , which would reduce the amount of interest you pay. Canstars Budget Planner Calculator may assist you to plan for your expenses generally. Depending on your personal circumstances and the type of loan you are looking for, you may also like to view Canstars Award winners for:

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Are The Standard Interest Rates For Personal Loans

Actual interest rates will vary depending on an applicants credit score, repayment history, income sources and the lenders own standards. Interest rates also vary with market conditions, but for 2019 the interest rates for personal credit ranges from about 6% to 36%.

If we compare the average interest rate of personal loans to other forms of financing, we can see they have rates below that of a credit card, though charge a bit more than most secured forms of financing. The big benefits of personal loans for those who take them is they are unsecured and the approval type is typically faster than other forms of financing.

| Financing Type |

|---|

Lets Evaluate Your Results

After considering upfront costs of 00

Lets break it down:

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Read Also: Does Va Loans Cover Mobile Homes

Use Our Interest Rate Calculators

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

How Does The Cash Rate Affect Commercial Interest Rates

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

You May Like: Usaa 84 Month Auto Loan

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Also Check: What Is The Commitment Fee On Mortgage Loan

How You Can Reduce The Interest You Pay

One way you can reduce the interest you pay over the life of your loan is through an offset account attached to your mortgage. The money held in this account is used to offset the interest charged on your home loan each month. You may pay for the privilege of an offset account, so ensure youre getting the most out of it by keeping money in the account.

Consider depositing your savings, lump sum payments, bonuses and your salary into the account every month to reduce the amount of interest you pay on your loan. Essentially, the more you keep in your offset, the less interest youll pay.

How Is Interest Calculated On A Credit Card

Credit card interest is usually calculated daily based on the outstanding balance on the card. The balance can include any purchases , cash advances , balance transfers, interest from previous months and other fees and charges. Banks generally charge different interest rates for purchases, cash advances and balance transfers.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Calculating Credit Card Interest

With is similar, but it can be more complicated. Your card issuer may use a daily interest method or assess interest monthly based on an average balance, for example. Minimum payments will also vary by the card issuer, depending on the card issuers approach to generating profits. Check the fine print in the credit card agreement to get the details.

How Much Of Your Home Loan Repayments Are Interest

Have you ever stopped to consider what proportion of your home loan repayments cover your principal loan amount, interest rate and fees? In this article we break down what your repayments cover and what you can do to pay less interest over time.

Your home loan is made up of a principal loan amount and the interest you must pay within the loan term. In addition, you may also incur a number of fees over the life of the loan such as: one-off establishment or application fees ongoing fees such as redraw facility or offset account keeping fees break costs should you break your fixed rate mortgage or discharge fees for paying out your mortgage in full.

Most lenders offer several types of home loans including:

Recommended Reading: How To Find My Loan Servicer

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

Calculate Cumulative Loan Interest

=CUMIPMT

To calculate the cumulative principal paid between any two loan payments, you can use the CUMIPMT function. In the example shown, we calculate the total principal paid over the full term of the loan by using the first and last period. The formula in C10 is:

=CUMIPMTFor this example, we want to calculate cumulative interest over the full term of a 5-year loan of $5,000 with an interest rate of 4.5%. To do this, we set up CUMIPMT like this:

rate – The interest rate per period. We divide the value in C6 by 12 since 4.5% represents annual interest:

=C6/12nper – the total number of payment periods for the loan, 60, from cell C8.

pv – The present value, or total value of all payments now, 5000, from cell C5.

start_period – the first period of interest, 1 in this case, since we are calculating principal across the entire loan term.

end_period – the last period of interest, 60 in this case for the full loan term.

With these inputs, the CUMIPMT function returns -592.91, the total interest paid for the loan.

Don’t Miss: How Long For Sba Loan Approval

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

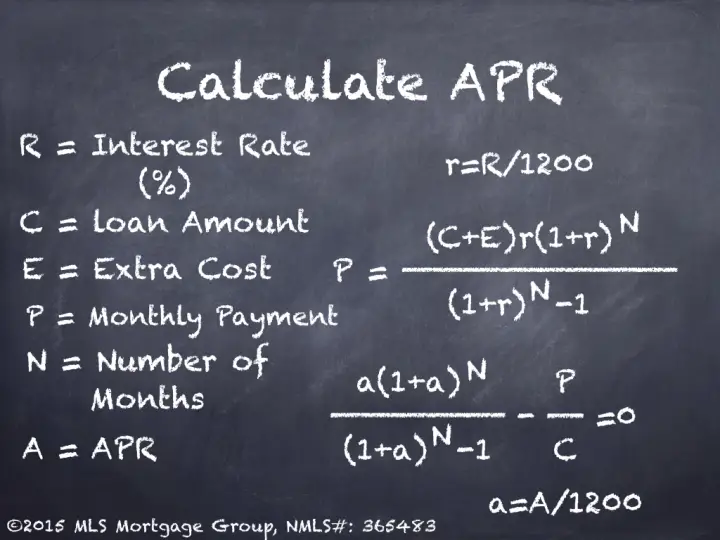

Amortized Loan Payment Formula

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- n: 360

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

Don’t Miss: Does Va Loan Work For Manufactured Homes