Remedies For Properties Below Minimum Standards

There are options for homebuyers who have fallen in love with a property that has one of these potentially deal-killing problems.

The first step should be to ask the seller to make the needed repairs. If the seller can’t afford to make any repairs, perhaps the purchase price can be increased so that the sellers will get their money back at closing. Usually, the situation works the other way aroundâif a property has significant problems, the buyer will request a lower price to compensate. However, if the property is already priced below the market or if the buyer wants it badly enough, raising the price to ensure the repairs are completed could be an option.

If the seller is a bank, it may not be willing to make any repairs. In this case, the deal is dead. The property will have to go to a cash buyer or a non-FHA buyer whose lender will allow them to buy the property in the present condition.

Many homebuyers will simply have to keep looking until they find a better property that will meet FHA standards. This reality can be frustrating, especially for buyers with limited funds and limited properties in their price range.

Fha Minimum Credit Score: 500

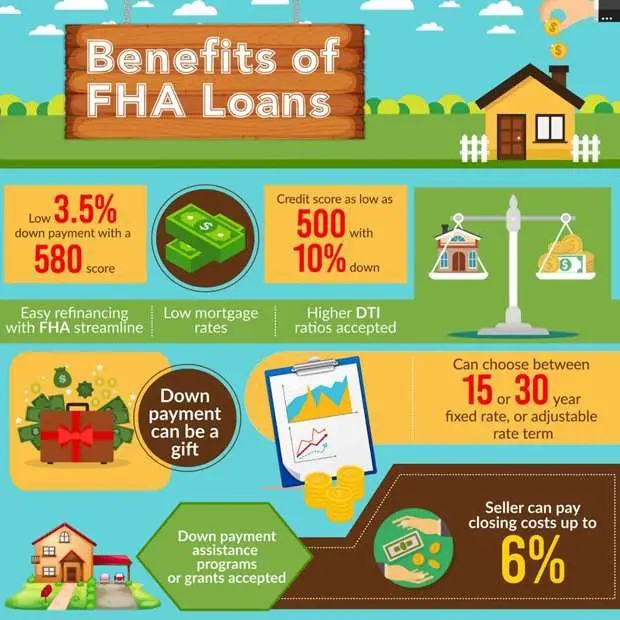

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Bottom Line: Are Fha Loans Good

An FHA loan is a good idea for homebuyers who have a low to moderate income and may not have funds available for a large down payment. Homebuyers with good credit only have to put down 3.5% with an FHA loan. Conventional loans often require a much larger down payment.

This type of loan is also a good idea for homebuyers with less-than-perfect credit because FHA loans have lenient credit score requirements. If you are looking to move into your home fast, an FHA loan is a good option.

If you prefer the benefits of a conventional loan but dont quite qualify for one yet, we recommend you work on improving your credit score and getting out of debt. Even waiting a year or two can make all the difference in your credit score and other qualifying criteria.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

- US. Department of Housing and Urban Development . FHA Mortgage Limits,. Accessed January 28, 2021.

- US. Department of Housing and Urban Development . Local Homebuying Programs,. Accessed January 28, 2021.

- US. Department of Housing and Urban Development . Lenders Guide to the Single Family Mortgage Insurance Process,. Accessed January 28, 2021.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Gifts As Down Payments

You must show proof of the gifted down payment by asking the donor to provide a letter with a statement that the money is a gift without expected repayment. The donor will also need to provide proof of the account from which he withdrew the funds. You cannot receive the gift in cash. Cashier’s check and money order are the preferred method, with a copy of both sides of the check and the bank statements showing where the money was taken from and deposited to.

You must document the source of any large sums of money deposited to your account recently, other than your regular paycheck. What the lender considers a large sum might be as little as $500.

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

You May Like: Can I Refinance My Sofi Personal Loan

How Much Does An Fha Inspection Cost

An FHA inspection will likely cost you anywhere from $300 $600 depending upon the location and size of the home. Although there is no set national price for an FHA inspection, you should budget on the high. The cost for the inspection may be included in the loan.

Read our article on FHA closing costs for a full understanding on how that is handled.

What Are The Limits Of An Fha Loan

The Federal Housing Administration sets limits on how much can be borrowed with an FHA loan. These limits are based on the location of the property, as well as the number of units that it contains.

The FHA sets both a floor and a ceiling for loan amounts. The floor is the limit that applies in low-cost areas, and it equals 65% of the national conforming limit. The ceiling applies in high-cost areas and is 150% of the national conforming limit. There are exceptions to these limits for loans outside of the continental U.S.

For 2021, the national conforming limit is $548,250, which makes the low-cost limit $356,362 and the high-cost limit $822,375 for a single-family home.

Don’t Miss: Loans Without Proof Of Income

Fha Minimum Property Requirements In 2018

In order to use an FHA loan to buy a house, the property must meet the Department of Housing and Urban Developments minimum property criteria.

HUD is primarily concerned with the health and safety of the home buyer / future occupant. In fact, you will encounter the phrase health and safety several times within the new Single-Family Housing Policy Handbook.

To be eligible for FHA-insured mortgage financing, living units within the property must have the following criteria:

- A continuing and sufficient supply of safe and potable water under adequate pressure and of appropriate quality for all household uses.

- Sanitary facilities and a safe method for disposing of sewage waste. Every living unit must have at least one bathroom, which must include, at a minimum, a water closet, lavatory, and a bathtub or shower.

- Living units must have adequate space for healthful and comfortable living conditions.

- They must also have heating adequate for healthful and comfortable living conditions, along with domestic hot water.

- The property should have adequate electricity for lighting, cooking, and for mechanical equipment used in the living unit.

The list above was adapted from the aforementioned HUD handbook, which covers the minimum property criteria for FHA purchases. As you can see, these are not overly strict property requirements. They are, in fact, quite basic. The primary concern is that the home being purchased does not interfere with the health and safety of the occupant.

Submit Applications And Documents

When you apply for a mortgage, you must fill out a detailed application. Lenders also will ask for documentation to support the information you provide on the application form.

Some of the documents that mortgage applicants can expect to provide include:

- Address or addresses for the past two years.

- Social Security numbers.

- Information on financial accounts.

- Total approximate value of all property.

- If an applicant is self-employed: two years of tax returns, income statements, and balance sheets for their business.

Don’t Miss: Sofi Vs Drb

What Is An Appraisal

Let’s start with a quick definition. An appraisal is an expert assessment of a particular product or asset to determine its value. Within the context of FHA loans, the purpose of the appraisal is to determine the market value of the home that is being purchased.

During this process, the appraiser will look at comparable properties that have sold recently, in the same area as the one being purchased. He will also visit the “subject house” and evaluate it both inside and out. After this review process, the appraiser will write a report to detail his findings. The report will include an estimated value of the home, as well as any required repairs. The report will then be sent to the mortgage lender for review and further action.

How To Find An Fha Lender And Apply For An Fha Loan

FHA borrowers get their home loans from FHA-approved lenders, which can have different rates, costs and underwriting standards even for the same loan. FHA loans are available through many sources, from the biggest banks and credit unions to community banks and independent mortgage lenders.

Applying for an FHA loan requires a few key steps:

- Know your budget. Before you submit an application for an FHA loan, youll want to know how much you can afford to spend on a home. Consider your current income, expenses and savings, and use Bankrates mortgage calculator to estimate your monthly payments based on different home prices and different sizes of down payment.

- Compile your documents. Applying to borrow a large chunk of money means handing over a complete look under the hood of your finances. Before you apply for an FHA loan, have all these documents ready to go: two years of tax returns two recent pay stubs your drivers license and full statements of your assets and any other places where you hold money).

- Compare your offers.Getting preapproved with multiple lenders is helpful so you can compare different rates and terms to make sure youre getting the best deal.

Also Check: How Do I Find Out My Auto Loan Account Number

Fha Loan Eligible Properties

Detached or semi-detached homes, manufactured homes, townhouses, and condos are eligible properties for the FHA program, so long as they are safe, secure, and sound. An appraiser will determine if the property meets FHA conditions.

There are many areas where the FHA does require problems to be remedied in order for the sale to close. Common issues include electrical and heating, roofs, water heaters, and property access .

Fha Loan Guide: Limits And Requirements

Buying a home is the biggest investment most people make in their lives. But few can afford to do so with cash, which is why buyers need a mortgage to cover the cost.

At the same time, getting a mortgage isnt cheap. Many expect theyll need to pay 20% of the purchase price as a down payment a dauntingly large obstacle for most people. Fortunately, there are options.

With Federal Housing Administration loans, borrowers might qualify for mortgages with a down payment as low as 3.5%. FHA loans also are easier to get for borrowers with less-than-perfect credit. But they come with limits, so heres what you need to know about FHA loans:

Read Also: Usaa Auto Loan Rates And Terms

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

The Complete Fha Appraisal Requirements Checklist

When you buy a house, you have several tasks to focus on, from home inspections to mortgage paperwork. If you’re planning to get a mortgage backed by the Federal Housing Administration , the house you want to buy requires an appraisal that meets strict standards. Here’s almost everything you need to know to get started.

Read Also: California Loan Officer License

Minimum Property Requirements For Fha Loans According To Hud

By Brandon Cornett | March 19, 2013 | © HBI,

FHA loans have become increasingly popular over the last few years. In fact, the Federal Housing Administrations share of the mortgage market has increased from 5% to more than 30% since the housing market crashed. Because these loans are more prevalent in the marketplace, its important to understand how they work.

Property requirements are a key aspect of the FHA program. In order to be approved for a government-insured mortgage loan, a house or condo must meet a specific set of requirements. These requirements are outlined in HUD Handbook 4150.2, chapter 3, which is available online.

Florida Fha Mortgage Limits

Every state in the United States has actually specified maximum mortgage limits that are arranged for single parents house, plus 2-4 unit homes. The limitations include put in relation to the common home revenue appreciate in that county. The base FHA loan limit for single families homes in Florida for many counties was $331,760. Utilize this FHA loan maximum search appliance observe exactly what the FHA financing limits are located in your own county.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Fha Property Requirements: Which Homes Qualify For A 35% Down Loan

FHA loans are among the most solid mortgages in the market. Low down payment, low credit score requirement, and relatively low interest rates. Plus, unlike some home loan programs, theres no upper income limit on who can qualify and FHA loans can be used anywhere in the country.

But if youre considering an FHA loan for your home purchase, you need to know all of the criteria particularly the FHA property requirements.

To qualify for this low down payment loan, the house you buy must pass an FHA appraisal. And FHA property standards are a bit stricter than, say, conventional loan programs.

That doesnt mean theyre impossible to meet. In fact, most homes will pass the FHA appraisal just fine. But it helps to understand the FHA property requirements before you start your house search so you can focus on seeing properties that are likely to qualify.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is An Fha Loan

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration. FHA home loans require lower minimum credit scores and down payments than many conventional loans, which makes them especially popular with first-time homebuyers. In fact, according to FHAs 2020 Annual Report, more than 83 percent of all FHA loan originations were for borrowers purchasing their first homes.

While the government insures these loans, they are actually offered by mortgage lenders that have received the FHAs stamp of approval.