Repayment Assistance Plan Stages

The plan has two stages: interest relief and debt reduction.

1. Interest relief

The interest relief stage is available for up to 60 months, or until you are out of school for 10 years, whichever comes first.

During the interest relief stage

- your monthly affordable payment will first go toward paying down your loan principal

- if your payment is large enough, the remainder will go toward monthly interest

- the governments of Canada and Ontario cover all monthly interest that is not covered by your payment

If you are not required to make any payments at all during this stage, the governments of Canada and Ontario will cover your entire monthly interest charges and your loan principal would stay frozen.

Visit the National Student Loans Service Centre website to get more information.

2. Debt reduction

The debt reduction stage occurs after the interest relief stage, which is after you have received interest relief for a minimum of 60 months or you have been out of school for 10 years, whichever comes first.

During the debt reduction stage:

- you will make either no payments or a monthly affordable payment, depending on your income and family size

- your monthly affordable payment, if any, will go first toward paying down your loan principal

- if your payment is large enough, the remainder will go toward paying monthly interest

Visit the National Student Loans Service Centre website to get more information.

Federal Student Loan Holders

- To learn more about your student loans, including how much you owe, your interest rate, loan repayment status, and the name of your loan servicer, follow these steps:

- Visit studentaid.ed.gov to create your Federal Student Aid ID if you do not already have one. Note: The FSA ID is the same username and password you used when you filed your Free Application for Federal Student Aid .

- With your FSA ID, log in to the National Student Loan Data System at NSLDS.ed.gov.

- Using NSLDS, you can find out how much you owe and who services your loans. A loan servicer manages your loans and will be your primary point of contact in repaying your loans, picking a payment plan, consolidating your loans, or answering your questions.

Why Does My Student Loan Balance Never Go Down

Its no secret that student loan debt is a major issue in the United States. According to , the average graduate has over $37,000 in student loan debt. And while its great that more people are getting education and advancing their careers, its frustrating when your student loan balance never seems to go down. So whats the deal? Why does your student loan balance never seem to go down, even though youre making payments every month? Keep reading for some tips on how to make your student loan balance go down.

Why is my student loan balance not decreasing?

Your monthly payment may not be enough to cover the interest charges. Your payments may only cover the interest and not the principal balance. Depending on your loan, your payments may be allocated mostly to the interest and not the principle. This makes it seem like your student loan balance is constantly increasing. You should make extra payments if your income is more than your repayment capacity. The more you pay on your student loans, the less they will cost.

There are many reasons that your student loan balance can increase, but the most common reason is that you missed a payment. The monthly payment you make each month pays for your fees and accumulated interest. The extra payments you make will go only towards the principal. When you see that the balance is increasing, you may want to consider reducing your monthly payments and trying to pay off the principal as much as possible.

Recommended Reading: Fha Vs Conventional 97

Federal Student Loan Holders Seeking An Income

- Income-driven repayment plan options set your monthly loan payment at an amount that is based on your income and family size. Depending on your income, your payments could be as low as $0 a month. If you do not qualify for these options, you may qualify for a graduated repayment plan that allows you to make smaller initial payments that increase over time. This graduated repayment plan could extend your repayment period and increase the total amount you pay in loan interest.To see the various payment plans and your options, visit StudentLoans.gov and log in to the Repayment Estimator tool using your FSA ID.Important: You must contact your loan servicer to choose and enroll in a plan.

- You may be able to consolidate your Perkins and Federal Family Education Loan loans to qualify for an income-driven repayment plan such as Pay As You Earn or Revised Pay As You Earn .Important: Be careful which loans you include in consolidation and avoid consolidating Parent PLUS loans with student loans you took out for your own education because you could lose access to favorable repayment plans.

If you are considering refinancing your federal student loan into a private student loan:

- Understand that you will lose access to the forbearance, deferment, income-driven repayment, rehabilitation, and consolidation options described in this sheet, as well as the forgiveness and discharge options available for federal student loans only.

Start Your Loan Repayment

Six months after you leave school, youll start repaying your loans. Your monthly payment is automatically calculated. Your repayment schedule depends on:

|

Repayment term for Alberta loans |

Repayment term for Canada loans |

|

$0 – $3000 |

Learn more about adjusting repayment details.

Recommended Reading: Using Va Home Loan For Investment Property

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

You don’t need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your six-month grace period.

You will be charged interest on the Ontario portion of your loan during your six-month grace period. This interest will be added to your loan principal .

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

Repaying student loans is an excellent way to establish and improve your credit score. You can make additional payments on your loan at any time if you want to repay it faster.

Get repayment assistance:

If you’re having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you can’t attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9½up to 14½ years. Log in to your National Student Loans Service Centre account.

You May Like: Car Loan Amortization Formula

Federal Student Loan Holders Who Are In Default

Learning How Much You Owe In Student Loans

What you originally borrowed to pay for school is likely not what you owe now. Unfortunately, you probably owe more.

Unless you have federal subsidized loans or made in-school payments, your balances grew over the years due to interest. Depending on your rate, you could end up owing hundreds or even thousands of dollars more after graduation than what you originally borrowed.

To find out what you owe with the accrued interest, try out some of the following tools for tracking your federal and private student loans.

Also Check: What Is The Maximum Fha Loan Amount In Texas

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Who Is My Federal Student Loan Servicer

A loan servicer is a company that handles the billing and other services for your federal student loans. To find out who your loan servicer is, you may login to the Student Aid website. Here you may view information about all of the federal student loans that you have received and find contact information for the servicer of your loans. You will need your Federal Student Aid ID to access this information.

Read Also: How Much Of A Car Loan Can I Qualify For

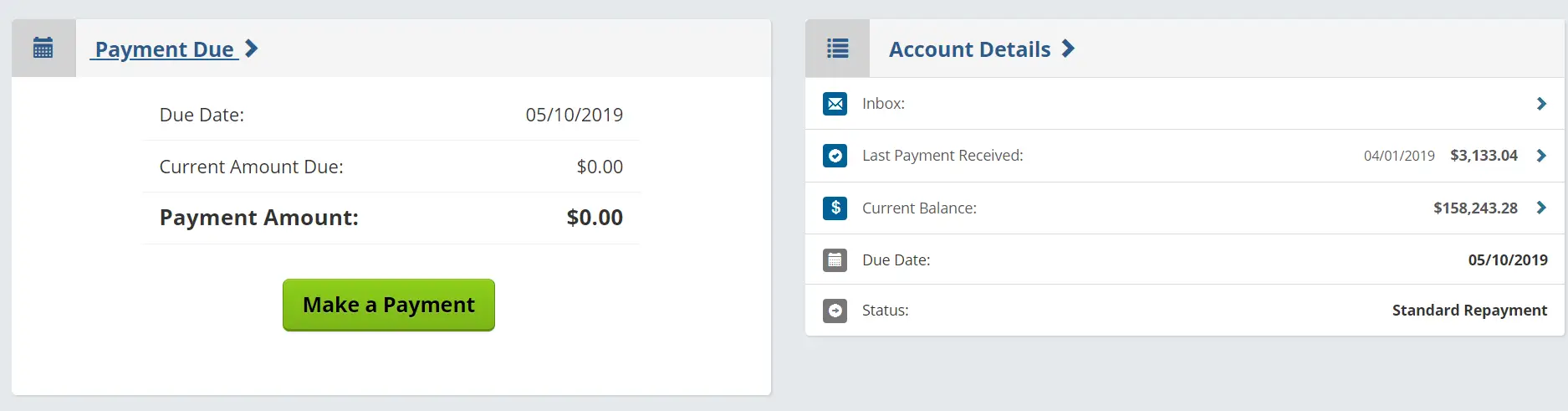

How To Check Your Student Loan Balance

By: Sean LaPointe | 14th June 2021

Did you take out a student loan at university to help with tuition fees and living costs? Keeping track of how much you owe can help you budget and manage your money better. It can also help you keep your debt under control. Here is a useful guide to checking your student loan balance.

Lowering Your Monthly Payments

Typically, when you enter the repayment period for your loan, you have up to 91/2 years to repay it.

If you need more time to repay your loan, you can extend the repayment period to 141/2 years. This will lower your monthly payments, but it will increase the total amount you repay because more interest will accumulate over a longer period of time.

Example:

| $167 |

Recommended Reading: Refinance Fha Loan Calculator

If You Don’t Repay Your Loans

If you don’t make your loan payments, you will be in default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further OSAP until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and HST rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

How To Find The Balance On Your Private Student Loans

Retrieving balances on private loans is a little trickier than finding information on federal loans. Theres no national website for private student loans like there is for federal loans. Also, the financial institution that originally issued the loan might outsource the loan servicing elsewhere or sell your loans to a different entity.

However, there are other ways to find your private loan balances:

- Ask your original lender : Your original lender is always the best place to begin this search. Hopefully, youve kept your original loan documents with the lenders contact information. One phone call should help you find your student loan balance and current servicer.

- Ask your school for help: If youre having trouble tracking down your loans, talk to your universitys financial aid office. They can help you identify who currently manages your debt.

- Check your credit report: Credit reports list all of your current and past credit obligations, including student loans. It will list the amount you borrowed and the loan servicer, which you can then contact to find the status of your account or to make payments. You can get a free credit report from the three main credit reporting agencies Experian, TransUnion and Equifax by visiting AnnualCreditReport.com.

Recommended Reading: How Much Car Can I Afford Based On Income Calculator

Use The National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System , a database run by the Department of Education.

When you enroll into a college or university, the schools administration will send your loan information to the NSLDS. The database also pulls information from loan servicers and government agencies, so its a comprehensive outline of all federal student aid youve received.

To find your federal student loan balance on NSLDS:

While the NSLDS is useful, there are some limitations:

- Not always up to date: Information on the NSLDS can be as much as 120 days old, so it may not be the most up to date view of your loans.

- Not all loans are listed: The NSLDS only contains information about Title-IV eligible loans and grants, so if you took out other federal loans such as loans for medical or nursing school programs they wont show up on the NSLDS. Private student loans also wont be listed.

Managing Your Student Loans

While it may sound complex, learning how to answer How much do I have in student loans? is an important first step in managing your debt. Once you know how much you owe and who your loan servicers are, you can come up with a repayment plan that works for you.

Tip:

If youre wondering how long itll take to pay off your student loans, enter your current loan information into the calculator below to find out. Use the slider to see how increasing your payments can change the payoff date.

Enter loan information

Read Also: Does Upstart Require Collateral

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Who Is My Loan Servicer

A loan servicer acts as a third party, or middle-man, between you and your lender. The servicer manages your loan, and any payments you make go through the servicer first. You have a loan servicer whether your loan is federal or private.

Its useful to know who your loan servicer is and how to contact them, as this is who youll need to contact if you want to change payment plans or apply deferment or forbearance.

Also Check: Www Upstart Com Myoffer

Registering Your Fsa Id

To sign up and log into the NSLDS, youll need to enter your Federal Student Aid ID. If you havent registered an FSA ID yet, youll need a valid email address and your social security number. You will have to set up challenge questions with answers and go through a few other profile setup steps before you can access your information.

The NSLDS does not list:

- Private loan balances.

- Older loans , even those that are still in repayment.

- Medical or nursing school loans.

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

You May Like: How Long Does The Sba Process Take