Personal Loans For Poor Credit

You can be approved for a personal loan or installment loan even if you have a very low credit score, but youll pay a high interest rate.

These rates can be quite expensive over time, so be aware of the total cost of your loan before signing. Generally, we recommend avoiding any loans with APRs above 36%.

Two Lenders Offering Personal Loans for Poor Credit

| Minimum Credit Score |

To compare other options, you can check out our guide to the best bad credit loans.

Business Loans For Low Credit Scores

Small businesses frequently find themselves needing additional working capital to pay bills or take advantage of immediate opportunities. These three lenders look beyond your business credit score to find a way to get you the loan you want on terms you can afford.

You can qualify if your business performance meets the lenders requirements for credit score, company age, revenues, and/or other criteria.

Best Personal Loans For Bad Credit

On This Page

There are various reasons why a person may want to get a personal loan. Typically, individuals take out personal loans to recover from a financial crisis, consolidate debts, finance a large purchase or cover emergency expenses. Depending on the terms, youll have to pay back the total amount borrowed plus interest.

Before getting a loan, there are various factors you need to consider. One of these is your credit score. Lenders typically check a borrowers credit report to determine creditworthiness. MoneyGeek evaluated lenders to determine the best options for personal loans for borrowers with bad credit.

You May Like: How To Ask For Student Loan Forgiveness

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Providing Proof Of Income

Most lenders need you to prove your income. Acceptable documentation includes:

- Bank or credit union statements

- Social Security benefit letters

- Offer letter from a new employer, accompanied by your acceptance letter

Normally, lenders want to verify two years of income. They are as much interested in the reliability of earnings as the amount.

You May Like: What Size Is Jumbo Loan

Merchant Cash Advance Criteria For Borrowers:

- An operating history involving credit and debit card payments

- Specific minimum monthly card sale volumes

- Particular minimum annual revenue

Despite being a form of debt, an MCA isnt technically a loan since the merchant cash advance company is purchasing your future debit and credit card sales. Therefore, an MCA doesnt follow the same regulatory standards as typically business loans. The absence of regulation makes the merchant cash advance one of the most expensive loans.

Fortunately, legitimate MCAs are regulated by the Uniform Commercial Code established by each US state, rather than such federal banking laws as the Truth in Lending Act.

Best Credit Union For Personal Loans: Pentagon Federal Credit Union

- Term: 1 to 5 years

- Funding Time: 1 – 2 business days after verification

Pentagon Federal Credit Union is best for existing members with fair to average credit as its personal loan rates are capped at 18%. Credit unions, in general, are a good option for borrowers as they are willing to work with average or below average credit history. Generally, borrowers with credit scores under 650 may have a difficult time being approved for loans from banks and online lenders, especially for the rates that are as low as the ones PenFed offers.

PenFed offers borrowers personal loan amounts up to $50,000 , which is low compared to most online lenders. However, if you have bad credit, taking out a loan from a credit union may be your best option, considering that personal loan rates can go up to 35% or more. PenFed also accepts co-signers, which can drastically improve your chances of getting approved and help you qualify for a lower rate. Keep in mind that you will have to be a member of the credit union for approval. If you aren’t already a member of a credit union, most aren’t difficult to join.

You May Like: How Long Does It Take To Get Private Student Loan

Best Networks For Credit Card Debt Consolidation Loans

The following five loan networks can help you arrange a personal loan of up to $10,000 or more. They arent direct lenders but rather online services that prequalify borrowers and match them to one or more loan providers. These loan finders charge you nothing for their service, and youre under no obligation to accept any loan offers that come your way.

SmartAdvances.com is an intelligent alternative that can rapidly hook you up with one or more direct lenders. You must collect at least $1,000 a month to prequalify for a personal loan.

You can use the websites personal loan calculator to determine the best repayment schedule. As a member of the Online Lenders Alliance , SmartAdvances.com is committed to a fair credit policy that complies with federal law.

Check Your Credit Score And Credit Reports

Before you apply for a personal loan, take a close look at your credit report and credit score, says Bruce McClary, spokesman for the National Foundation for Credit Counseling.

Federal law entitles you to a free copy of your credit report every 12 months from the major credit-reporting bureaus: Equifax, Experian and TransUnion. Visit AnnualCreditReport.com to request your free credit reports. They wont display your credit scores, but you can visit each credit reporting agencys websites to view them for free or for a nominal fee .

With your report in hand, youll know exactly what your credit score is, and youll be able to identify any negative marks on your record. If you find errors or old debt on your report, you can try to correct them before applying for a personal loan.

Also Check: How Much Do You Need For Fha Loan

How To Get A Bad Credit Loan

Its possible to get a personal loan with bad or no credit. However, if you take the time to work on your credit, you could save a lot of money by benefiting from a lower interest rate. If you need a personal loan now, however, consider these tips to finding the best personal loan for bad credit for you:

What Is Prequalification

Prequalification is offered by many lenders to allow potential applicants to view their payment plan, interest rates and monthly payment prior to actually submitting an application for the loan. Prequalification requires a soft credit pull, through which lenders view a limited portion of your credit history. Notably, a soft credit pull will not have any impact upon your credit score.

Also Check: Easy Approval Bad Credit Loans

Choose The Right Lender

It almost goes without saying if you do not place your trust in the most reliable, reputed money lending sites out there, you may be setting yourself up by walking straight into a scam.Unfortunately, it is not always easy to spot such scams, so it is always best to only look through lenders that are popular and have been around for a while.One of the most telling signs of dealing with a potential scam is that such sites require you to pay fees before you even get a loan approved. Additionally, you will also need to check whether the loan provider you are opting for is allowed to operate in your state.

Secured Vs Unsecured Bad Credit Loans

If your credit score draws red flags, the best chance to get money you need could be through a secured loan, one in which you borrow against an asset you own, such as a home, car, boat, property, savings or even stocks. The lender will hold the asset as collateral against you defaulting on the loan. If you dont repay the loan, you lose the asset. Secured loans offer lower interest rates, better terms and access to larger amounts of money than unsecured loans.

An unsecured loan has nothing more than a promise that you will repay behind it and could be very difficult to get from most banks. Banks are willing to make unsecured loans to their best customers people who have the income and credit history to prove they will repay the loan but are very cautious about lending money otherwise.

An unsecured loan is no risk for the borrower, but high risk for the bank so you can expect considerably higher interest rate charges and little flexibility on qualifying or terms of the loans.

Read Also: Will Multiple Loan Applications Hurt My Credit Score

How Do I Choose The Best Bad Credit Personal Loan For Me

To get the best bad credit personal loan, consider what is most important to you. Many borrowers prioritize the lowest interest rate, but also consider any fees, the minimum credit score needed, and the accessibility of the lender’s customer service. You’ll also want to make sure you’re able to select a term length that works for you and that your loan’s purpose is allowed by the lender you choose.

For bad credit loans specifically, you’ll want to understand if you qualify for a loan or if you may need to add a cosigner to boost your chances of being eligible.

Guides like this one will help you weigh multiple lenders to compare their pros and cons. Make sure to also read individual reviews of any lenders you’re considering.

How Do You Apply For Personal Loans

When youve shopped around among lenders and found the right one, youre usually able to apply online and can often get a decision within minutes. However, some small local banks or credit unions may require you to visit a branch to apply for a loan.

When you apply for a personal loan, youll need to submit personal information, including your Social Security number and other relevant info. Lenders check your credit and either approve or deny your loan. Theyll also let you know the specific loan terms youve qualified for. Pay attention not only to the monthly payments, but also any fees youll have to pay and how long youll have to pay off the loan.

You May Like: Where To Take Personal Loan

Should You Use A Personal Loan To Pay Down Credit Card Debt

There are benefits to paying off credit card debt with a personal loan if the situation is right for you. In addition to a higher credit score, a personal loan can help streamline your finances. The right loan can allow you to consolidate multiple loans into one payment, shortening your to-do list and simplifying your life.

The biggest motive, however, should be to eliminate debt so you want to make sure you can pay off the loan timely.

Eliminating that debt can be nothing short of life-changing, Schulz says. It can free you up to build an emergency fund, save more for retirement, work toward buying a home or paying for your kids college. Its a big, big deal.

How To Get The Best Car

The best rates go to those with good credit, but there are still ways to save money if your credit has room for improvement

If youve ever financed the purchase of anythingwhether it was a car or a refrigeratoryou know your credit score is key to getting a favorable interest rate. The best deals are reserved for those with the best credit, but that doesnt mean you have to accept the worst terms if your credit isnt so good.

A good credit score usually means you can get a lower interest rate, while a poor credit scoreor having no credit because youve never financed anythingcan push you into the subprime category. To the lender, a low credit score means youre a higher riskor, according to their statistical calculations, less likely to pay back the loan. So you end up having to pay a higher interest rate, which adds significant finance costs on top of the purchase price of the car youre buying.

Anywhere from a fifth to a quarter of all car loans fall in the subprime category, according to analysts at TrueCar, a major online automotive marketplace that is partnered with Consumer Reports. Thats more than 5 million car loans per year.

But your credit rating may not be the only factor driving up the rate on your car loan. If you finance through the car dealer, using a lending option that they broker rather than a bank or credit union, the rate is often higher because the dealership takes a cut for acting as the middleman.

You May Like: Is An Auto Loan Secured Or Unsecured

How To Apply For A Loan With A Low Credit Score

There are a few steps you can take to help your approval prospects when you apply for a loan and you have a low credit score:

The lenders in this review all offer loans to consumers with low credit scores. If none of these work, you may be able to turn to your family and friends for short-term help. Just be aware that this can put your personal relationships in jeopardy.

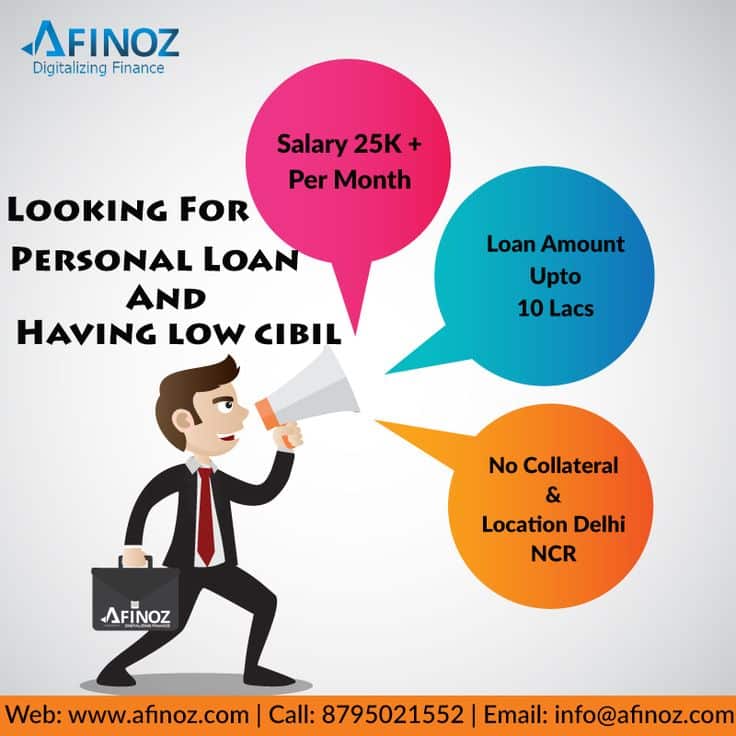

How To Apply For An Instant Personal Loan For Low Cibil Score

Check Eligibility

Provide the required details and find out if youre eligible for a loan in just 2 minutes.

Select Loan Tenure

Choose the loan amount and repayment term of your choice based on the options provided.

Upload Documents

Youll have to upload all the relevant documents after which they will be verified

Amount Disbursed

Post verification and submission of loan agreement, the loan amount will be credited to your account within 24 hours

Read Also: How Many Personal Loan Can I Get

Bad Credit Loans: Top Online Direct Lenders For No Or Poor Credit Scores

Bad Credit Loans is known to help those who are grappling with bad credit ratings to obtain loans online. This free service allows lenders to connect with borrowers and approve loans to them without taking into account their credit ratings.We say this because it is not uncommon for customers to receive funds from lenders on this site without the demand for a credit check.This company does not exercise any control over the lenders listed on the site. But, it does offer you any relevant information you may require, helping you decide whether you would like to trust a certain lending partner.

Features

The following are the main features ofBad Credit Loans:

- A platform that helps connect borrowers to lenders and offers both parties adequate information on the other

- The site has advanced encryption technology that keeps your private information safe

- Using this service is completely free

- Borrowers only need to complete an online form for lenders to decide whether they would like to engage with them

Pros

- Very easy for borrowers to find lenders

- You can borrow amounts of anything between $500 and $5,000

- Allows you to assess and compare interest rates from different lenders

Cons

- Customers with poor credit ratings receive lower loan amounts

Customer Experience

Whats The Easiest Loan To Get With Poor Credit

In general, secured loans are easier to get than unsecured loans because theyre less risky for the lender. Secured loans also tend to come with lower interest rates than unsecured loans, even if you have poor credit. Secured loans are riskier for the borrower, however, because you could lose your collateral if you dont make payments.

One type of loan you should avoid is payday loans, which may have low credit score requirements at the cost of high fees and APRs that could dig you deeper into debt.

Also Check: How To Cut Your Mortgage Loan In Half