What Happens When I Refinance A Car Loan

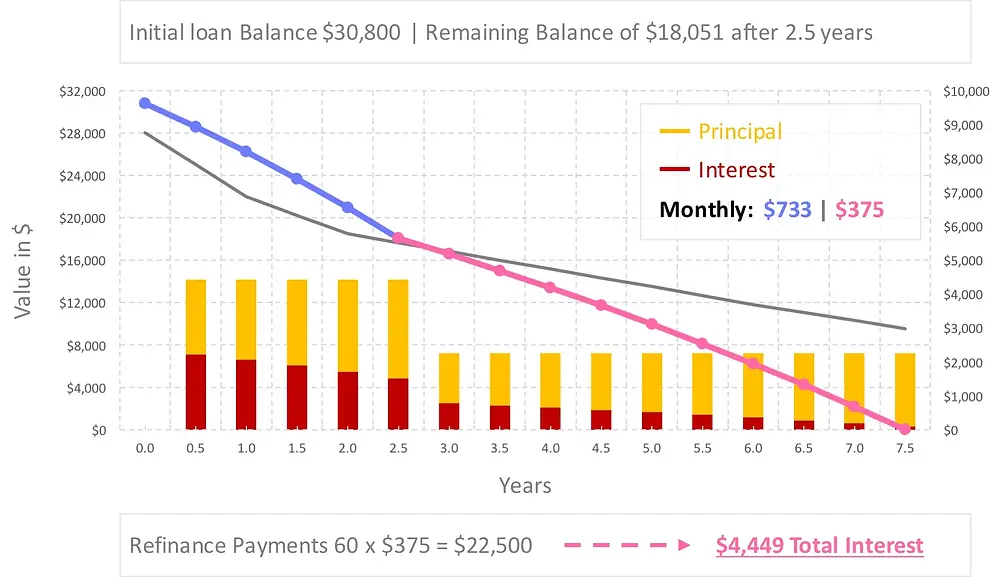

When you refinance a car loan, you essentially apply for a new auto loan, which pays off your current loan. This results in a completely new loan agreement, with a new interest rate and new loan term .

Once your original loan is paid off, youll resume making monthly paymentsthis time on your new loan. Make sure to verify the old loan was paid off youll need to contact your previous lender and make sure that its been paid in full.

Best Car Loan Rates: Conclusion

You can find the best auto loan rates for you through banks, credit unions, online lenders, and dealers. There are also a variety of factors that affect your interest rates and many methods for you to get the lowest rates possible. We encourage you to look around and compare your options to find the best auto loan for you.

How To Use Average Car Loan Interest Rates

Once you know your credit score and the average car loan interest rate you might qualify for, you can use our car payment calculator to estimate the monthly payment for various loan terms.

You wont know your actual rate until you apply for a car loan and receive lender offers, but you’ll have a general idea of the rate. You can expect to pay higher interest rates for longer-term loans than short ones. To ensure you get the best deal possible, get rates from multiple lenders and compare.

If youve already financed a car and your rate is higher than the average rate listed for your credit score, you may be able to refinance for a lower rate and a lower payment. Apply to refinance your auto loan with several lenders to see the rates you’re offered.

About the author:Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Recommended Reading: Who Do I Talk To About An Fha Loan

How Do Auto Loans Work

Auto loans are typically secured loans that charge simple interest, interest calculated on your loan balance, over two to seven years. Your auto loan interest rate is determined by your , loan term and amount, along with the value of the car itself.

While many buyers shop for a car loan at the same time theyre shopping for a car, a better way is to compare annual percentage rates across multiple lenders to make sure youre getting a competitive rate.

If the dealer can beat it, youll know youre getting a fair offer.

Why you should compare auto loan ratesComparing loan rates before you buy a new or used car puts you in a stronger negotiating position at the dealership. This is true whether you have strong credit or need a car loan for bad credit. The lenders above are a good place to start your search.

How Does A Personal Hire Contract Work

To get a personal hire contract youll need to pass a credit check and then pay several months repayments upfront.

With a personal contract hire agreement, there may be a limit on how many miles you can drive on an annual basis. If you go over the limit, youll be charged a fee. However, you wont need to pay for servicing or car tax during the length of the agreement.

At the end of the agreement, you can hand the car back without paying a penny more towards its price, unless it’s damaged.

Read Also: How Does Pre Approval For Car Loan Work

When Should I Not Refinance My Car Loan

While refinancing a car loan can be a smart opportunity to save money, there are some situations in which refinancing is not financially sound:

Interest Rate On Auto Loans

Source:Statistics Canada

A car loan allows you to finance the cost of purchasing a car in Canada. Instead of a large, up-front payment, you can pay a monthly fee plus interest. You can use the loan to buy new or even used cars. Additionally, you can use car loans to purchase RVs, commercial vehicles, and more. In most cases, theloan will be securedby your vehicle. If you fail to make payments, the lender can seize your car to pay off your debt.

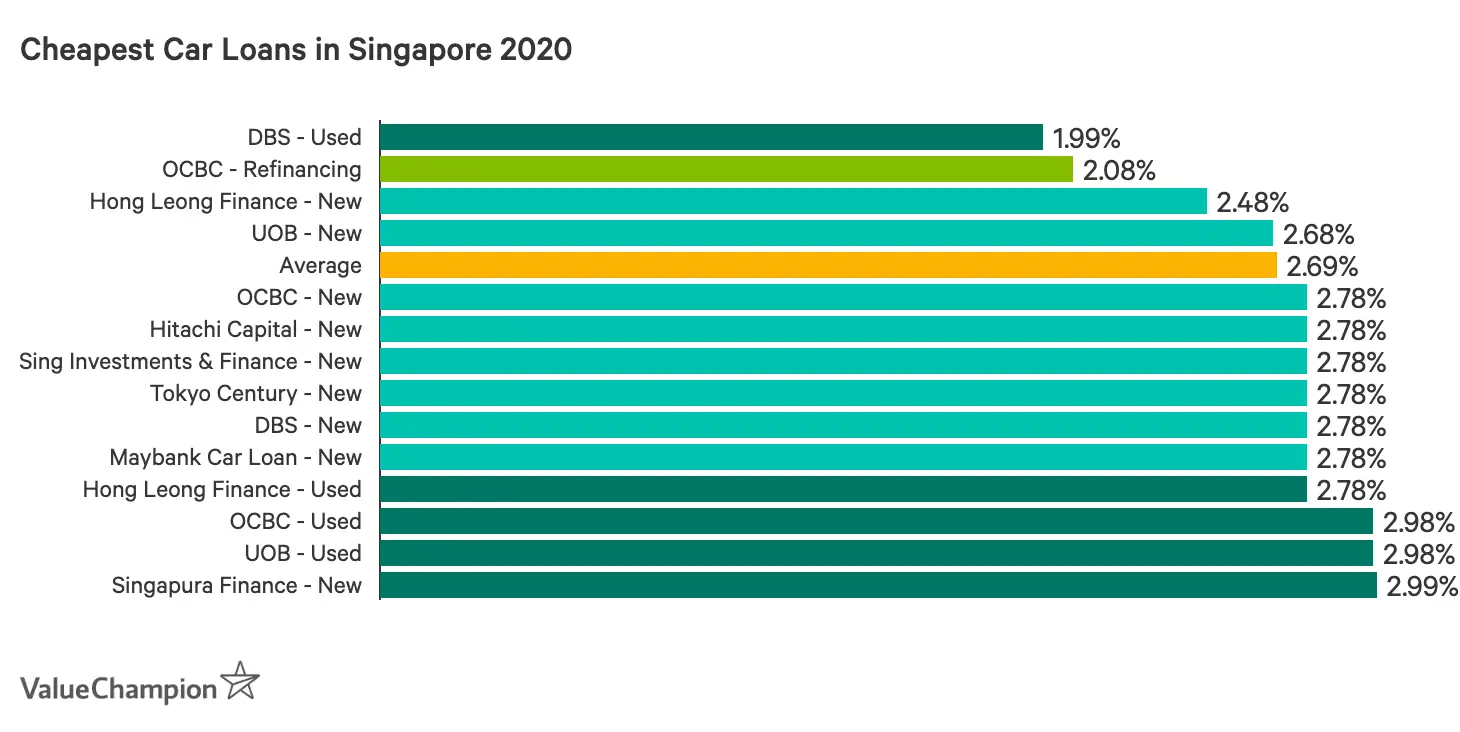

While car loans are available from various sources, including banks,, and auto dealerships, it’s important to compare interest rates before committing to a loan. The average car loan interest rate in Canada for new loans is 5.23%. However, rates can vary widely depending on the lender, your financial situation, and the type of car. Continue reading to compare auto loan rates and learn how to get the best deal.

You May Like: What Does Cash To New Loan Mean

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

- 2.99% to 24.99%

- Minimum loan amount: $4,000

Using a soft pull on your credit, LendingClub allows borrowers to compare refinancing options instantly.

-

Easily compare refinance rates online

-

Pre-qualify with a soft credit check

-

No origination fees or prepayment penalties

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto-loan refinancing. If you’re looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy, and you won’t pay an origination fee for your loan. Sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

Which Bank Offers The Best Car Loans

The criteria for choosing an appropriate car loan for you is not the best bank, but the cost and the type of car you are wanting to buy. The car loans and their eligibility vary according to the price and the category of the car you want to buy. It also depends on the key USP the borrower is looking for in the lender.

Don’t Miss: Best Place For Car Loan

Compare Auto Loan Rates In August 2022

- Auto Loan Rates

- Wide range of repayment options

Cons

- Good to excellent credit required

- No prequalification offered

Who this lender is best for: Lightstream is best for those looking to finance their vehicle as soon as possible and prefer a fully online experience.

Impact on financial wellness: You will undergo a hard credit check following application submission you cannot prequalify to check your rates ahead of applying.

Time to receive funds: Funds become available as soon as the day you apply.

Fees: Lightstream has no fees.

Additional requirements: While credit requirements are not disclosed, the most competitive rates will only be offered to those with excellent credit.

Special features: Repayment terms ranging from 36 to 84 months and the ability to borrow as much as $100,000.

| LENDER |

|---|

- Discount for members only

- High minimum loan amount

Who this lender is best for: Best if you intend to finance your vehicle via a dealership rather than fully alone. To receive the most competitive rates, it is also best for those that hold an account with Bank of America.

Impact on financial wellness: Following the application, you can expect a hard credit check.

Time to receive funds: Funds will become available as soon as the same business day.

Fees: You can expect to pay title and state fees in some states

Additional requirements: Bank of America requires that the car you’re financing be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000.

How To Get Your Car Loan Approved Faster

A critical factor in getting a loan approved fast is determining how much EMI you are comfortable paying. Use our Car Loan EMI calculator to estimate how much you will need to set aside. These will enable you to plan and prepare for the Car Loan application process.

To make sure your Car Loan is approved faster the key is to provide all the necessary documents and complete your Know your Customer formalities.

Recommended Reading: How Much Income Needed For Fha Loan

Here’s How To Pay A Car Payment With A Credit Card:

- Mobile payment services: One way to pay your car loan or lease with a credit card is to use a mobile payment app such as Venmo or PayPal as a middleman. These applications allow you to transfer money from user to user, and you can fund them with a credit card.

So, for example, you could use your credit card to pay a friend or family member through the app, and they can then make your car payment for you or give you the money to do it yourself. Just make sure you really trust the person, and be careful because payments may count as purchases or cash advances, depending on the service and the credit card issuer. But either way, there are fees involved. Venmo, for example, charges 3% of the transaction amount.

- Money transfer services: Companies like MoneyGram and Western Union allow you to directly pay a collection of participating billers, and you can fund the transaction with a credit card. However, this may be treated as a cash advance, which would mean expensive fees and interest charges would apply, in addition to the fees charged by the service. You can learn more about how this works from our explanation of how to transfer money from a credit card to a bank account.

The bottom line is that these options are far from ideal and should only be considered if you’re in a real bind, or if you do the math and somehow find an opportunity to save. That could be the case if you’re able to transfer part of an auto loan to a 0% balance transfer credit card, for example.

What Should You Consider Before Getting Car Finance

Lease terms

Car finance contracts come with terms you must stick to.

For example, if you want to make any physical changes to your car, youll need to get it approved from the car finance company. Even though it may make the car more valuable, make sure you check in with them first. You may also have to check with your car insurer before making modifications, as they may alter your insurance policy.

You’re also required to pay for any repairs the car needs when you return the car.

Lease limits

Youll have to pay extra if you go over the agreed mileage limit. Car finance companies charge around 10p a mile for this. It may be cheaper for you to choose a car finance deal with higher mileage limits than go over.

Gap insurance

Gap insurance covers the gap between how much you have paid for your car and how much an insurance company would pay out if it was stolen or damaged beyond repair.

Car salesmen will try hard to sell you gap insurance. But you’re likely to get a better deal on gap insurance from third party providers. Find out more about how gap insurance works.

Don’t Miss: What Is Loan To Value Mean

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

What Extra Charges Come With Personal Contract Purchase

Personal contract purchase agreements can be more expensive than other car finance deals.

Make sure the car you are handing back doesn’t have extensive damage or the car dealer may ask you to pay extra charges.

Where you’ve paid at least half the price of the car/car loan, you may be able to return the car early, without paying an extra fee, which is the difference between how much you have already paid and the price of half the car.

Personal contract hire

A personal contract hire is similar to personal contract purchase. The only difference is that you don’t have the option to buy the car at the end of the agreement.

Don’t Miss: What’s Better Home Equity Loan Or Line Of Credit

Consumers Credit Union: Most Flexible Terms

Starting APR: 3.49% for 2020 or newer vehicles, 3.74% for 2016 to 2019 vehiclesLoan amounts:$250 to $100,000Loan terms: Up to 84 monthsAvailability:50 statesMinimum credit score:640

Consumers Credit Union is an Illinois-based credit union that is now open to national membership. While the lender features average rates for the industry, it offers a wide range of terms and loan amounts, which is why our team awarded it Most Flexible Terms.

The credit union has a lot of loan options. Its best auto loan rates start at 3.49% APR for members. As long as you qualify, you can borrow any amount from $250 to $100,000 with term lengths up to 84 months.

It is important to note, however, that these rates are only for cars that were made in 2019 or later. The company has higher rates for older cars, with rates starting at 3.74% APR.

While Consumers Credit Union is a membership-based organization and not a bank, anyone can become a member. All you need to do is provide a Social Security number or a tax identification number and pay a $5 nonrefundable fee to the Consumers Cooperative Association.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Also Check: What Is Interest Rate For Commercial Loan

Take Steps To Improve Your Credit Score

Your credit report will inform you of the different ways you can improve your credit, but here are some best practices that can help you decide what to do:

- Pay all of your bills on time and get caught up on past-due payments.

- Pay off any collection accounts you may have.

- Work to pay down your credit card debt to reduce your .

- Limit applications for other credit accounts.

- Review your credit report and file a dispute with the credit bureaus if you find errors or fraudulent activity.

Note that there are some credit report items you may not be able to fix. For example, missed payments remain on your credit report for seven years, and if they’re legitimate, you can’t remove them.

If you have some past items that you can’t address, focus on what you can control before you apply. As your credit improves over time, you can refinance the auto loan at a later date.