Loan Calculator: Estimate Your Monthly Payment

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you borrow money from a lender, whether its a personal friend or a bank, youll need to know the total cost of paying back the loan. A loan calculator uses basic information to estimate your installment payments and give you an idea of how much interest youd pay over the life of the loan.

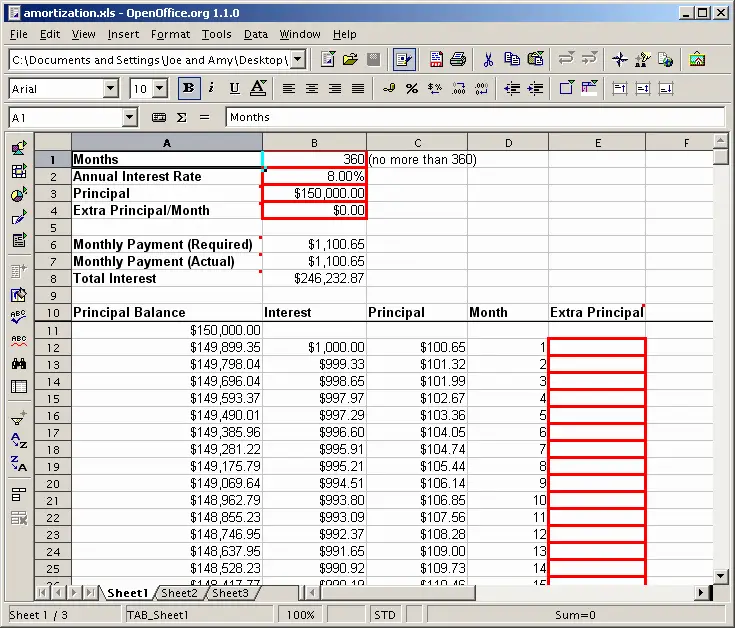

Use this loan calculator to determine your monthly payment for any loan. You can also see how your loan amortizes, or how much is paid down, over the payoff period.

Use the loan calculator if you know the amount you expect to borrow.

Lets say you want to borrow $10,000 to update part of your home. The lender has offered 5.99% APR on a three-year loan. With those terms, youd need to pay back a little more than $300 per month. In the end, youd pay $950 in interest.

How Does This Loan Repayment Calculator Work

The easy-to-use loan calculator above works based on some pretty mundane math. Don’t worry, this isn’t going to turn into an algebra lesson. Just know that we’ve coded all the appropriate formulas to do the math for you.

So, all you have to do is enter three pieces of information: the amount of the loan, the loan term, and the interest rate.

- Loan amount. This is how much you’re intending to borrow. Remember that this includes the total amount you’re borrowing. Depending on the situation, the lender may include fees and or other expenses in that amount.

- Loan term. This is how long you will take to pay back the loan. For the purpose of this calculator, you need to enter the terms in months. So, if you’re borrowing money for 6 months, you would enter 6. If you’re borrowing for 2 years, you would enter 24. To convert terms of years into months, multiply the number of years by 12.

- Interest rate. Enter a hypothetical interest rate. This is how much the lender is going to charge for letting you borrow the money. The higher this rate, the higher the cost of the loan and the more you may have to pay back each month. Don’t include a percent sign when entering this number.

Once you enter all three pieces of information, click “Calculate” and the tool will return an estimated monthly payment. If you borrowed exactly the amount entered at the terms and interest you entered, that would be your monthly payment for the loan.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: Rate For Home Equity Loan

What Is A Pre

Pre-approval is often spoken about in terms of mortgages and personal loans. Most often, you might receive a letter advising that you have been pre-approved for a loan or credit card while many of these mailshots tend to end up in the recycling, you may be able to consider the offer. But just what is a pre-approved loan?

Essentially pre-approved does not mean that your loan application will be automatically accepted although many people wrongly believe that it does. In fact, this means that the lender is offering a loan pending full approval. In other words, even though you are pre-approved, there is no guarantee that your loan application will be successful.

So, whats the point of being told you are pre-approved? Well, its important to remember that being pre-approved means that the lender may be able to approve your application once you have made a full application. A lender may well have carried out a limited check and identified you as being potentially eligible for a loan or credit card.

In many instances, an invitation for a pre-approved loan means you have already cleared the first hurdle and the lender would welcome an application from you. However, any loan will still be dependent on a full application and you passing more stringent financial checks.

How To Calculate Personal Loan Payments

Start by entering how much you want to borrow in the field marked Loan Info. Then use the personal loan calculator to:

- Simulate your payback period in years or months.

- Calculate the ideal interest rate on your loan.

- See how much you would pay in principal and interest.

You can select “show ” to see a timetable of how your monthly payments of principal and interest will reduce your balance until your loan is repaid. Use the “add extra payments” feature to find out how paying more toward your principal speeds up your amortization schedule.

Also Check: How To Get Out Of Motorcycle Loan

How Much Home Can You Afford

Buying too much house can quickly turn your home into a liability instead of an asset. Thats why its important to know what you can afford before you ever start looking at homes with your real estate agent.

We recommend keeping your mortgage payment to 25% or less of your monthly take-home pay. For example, if you bring home $5,000 a month, your monthly mortgage payment should be no more than $1,250. Using our easy mortgage calculator, youll find that means you can afford a $211,000 home on a 15-year fixed-rate loan at a 4% interest rate with a 20% down payment.

What Is A Loan Rate Calculator

Capital Farm Credit provides a land payment calculator that maps out your payments and loan amount, indicating your total payment and showing what amount of interest you pay in relation to your principal and your overall equity toward the remaining balance.

For those looking to secure a Texas land mortgage, our land loan calculator can be used as the first step toward understanding your financial requirements before you talk with one of our expert loan officers and determine a detailed payment plan, based on your requirements.

Don’t Miss: Loans Like Sky Trail Cash

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

Average Interest Rates For Car Loans

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

Also Check: What Is Difference Between Secured Loan And Unsecured Loan

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

You May Like: Which Bank Has The Lowest Auto Loan Rates

How To Use Credit Karmas Simple Loan Calculator

Whether youre thinking of taking out a personal loan for debt consolidation or a student loan for college costs, you probably want a sense of how much your loan will cost over time.

Our loan calculator can help you understand the costs of borrowing money and how loan payments may fit into your budget. It takes into account your desired loan amount, repayment term and potential interest rate. Youll be able to view an estimated monthly payment, as well as the amortization schedule, which provides a breakdown of the principal and interest you may pay each month.

Keep in mind that this loan payment calculator only gives you an estimate, based on the information you provide. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. This loan payment calculator also doesnt account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your monthly mortgage payment.

Here are more details on the information youll need to estimate your monthly loan payment.

An Introduction To Personal Loans

A personal loan, also known as an unsecured loan, allows you to borrow a certain amount of money in exchange for paying a certain amount of interest, which will be charged as long as it takes you to pay off the loan. Once youve taken out such a loan, you will need to make a set repayment every month for a period of time that is previously agreed upon with your lender.

The representative is the rate that at least 51% of borrowers will be charged the actual rate your lender offers you could be quite a bit higher, depending on your credit score. This means that the monthly repayment and total amount repayable listed alongside any personal loan example should only be used as an indication of the minimum you will be asked to pay back.

You can use a personal loan for any number of things to help pay for a car or other large purchase, to consolidate debts, or for some necessary home renovations.

Unsecured loans also tend to come with lower interest rates than credit cards and allow you to borrow more than on cards. Most loans will furthermore offer a fixed APR and will set the repayments in advance, which means that you can be sure of how much you need to pay back each month, and plan accordingly.

In the same vein, many unsecured loans will charge a penalty not just for missing a payment , but also if you want to pay off the loan early. This early repayment charge is a maximum of two months interest so it is something to consider but not a deterrent to early repayment.

Don’t Miss: Does Usaa Do Home Loans

Which Home Mortgage Option Is Right For You

With so many mortgage options out there, it can be hard to know how each would impact you in the long run. Here are the most common mortgage loan types:

- Adjustable-Rate Mortgage

- Federal Housing Administration Loan

- Department of Vertans Affairs Loan

- Fixed-Rate Conventional Loan

We recommend choosing a 15-year fixed-rate conventional loan. Why not a 30-year mortgage? Because youll pay thousands more in interest if you go with a 30-year mortgage. For a $250,000 loan, that could mean a difference of more than $100,000!

A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income.

But the good news is, a 15-year mortgage is actually paid off in 15 years. Why be in debt for 30 years when you can knock out your mortgage in half the time and save six figures in interest? Thats a win-win!

Common Types Of Loans

A loan can be either secured or unsecured. When you take out a secured loan, you put up collateral, such as a home or car. No collateral is needed to get an unsecured loan. Often, interest rates are lower on secured loans since the lender has a piece of property it can claim if a person stops paying the loan. Within those two categories are multiple loan types:

Also Check: How To Apply Government Home Loan

Alternatives To Personal Loans

While you can find funding options from a variety of sources, these are three of the most common alternatives to personal loans.

- Line of credit. Instead of borrowing a lump sum, a line of credit allows you to borrow as much or little as you need, up to your credit limit. You only pay interest on the amount you borrow, and interest rates tend to be lower than many credit cards.

- Credit cards are best for smaller purchases. Many personal loans dont allow you to borrow less than $1,000. This makes credit cards a good option for day-to-day spending provided you dont carry a balance over several months.

- Home equity loan or HELOC. Home equity loans and HELOCs use the equity in your home as security to lower the cost of your loan. While these can be used for almost any expense, theyre typically best for home improvement or repairs and post-secondary education costs.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Who Will Refinance An Upside Down Car Loan

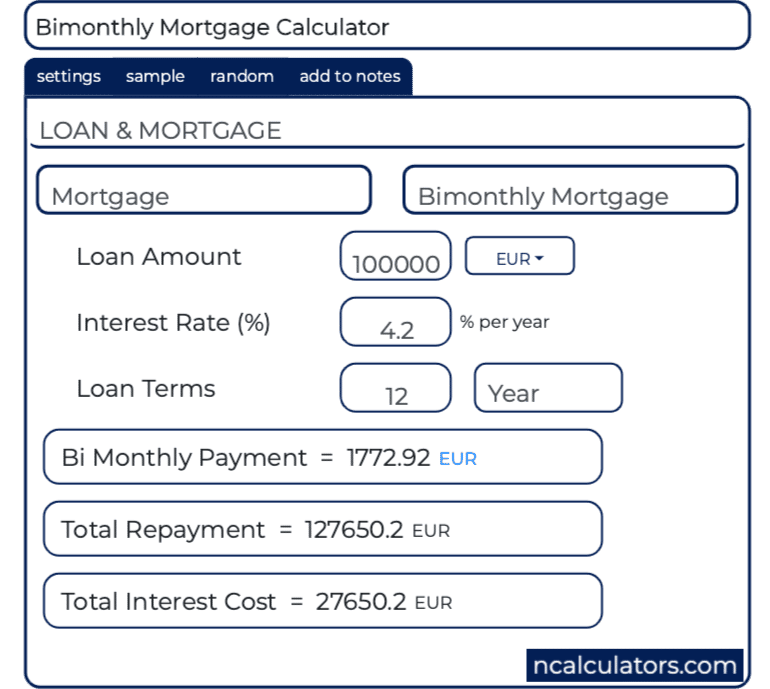

Why Biweekly Is Cheaper But Not The Cheapest

Biweekly is Usually Cheaper

Given the same repayment time-frame and loan interest rate, choosing a bi-weekly loan over other popular loan repayment frequencies will usually result in the lowest interest cost. That’s because the balance that the interest is charged on is declining more often.

To understand why increasing loan repayment frequencies reduces interest costs — all other terms being equal, think of a loan as the lender renting the use of each dollar bill they borrow to you. This means that the sooner you return a dollar bill you are renting, the less rent you will be charged on that dollar.

For example, if you are making annual payments, then you will be renting the same number of dollars during the entire year — giving the lending institutions more time to charge you rent on each dollar.

On the other hand, if you return a portion of the rented dollars periodically throughout the year, the rent you will be charged will be less than the rent charged on the annual payment frequency. And the faster you return the dollars, the lower your annual rental charges will be.

The Best of All Payment Frequencies

What is the cheapest of all payment frequencies? Biweekly? Weekly? Daily? No, it’s actually …

Once!

In other words, if you save up and pay cash for the item you are considering purchasing you will only end up making one payment, and you will end up paying $0.00 in interest charges.