Which Is Right For You

With the risk of having your property seized if you don’t repay the loan, you might wonder why anyone would choose a secured loan. People sometimes choose secured loans because their credit history will not allow them to get approved for an unsecured loan.

With some loans, such as a mortgage or auto loan, the lender won’t approve your application unless they have permission to take possession of the property if you default. Some loans are secured by design, including title loans and pawn loans.

What Is An Unsecured Personal Loan

An unsecured personal loan is typically based on your ability to repay, your creditworthiness, and information provided on your application. Unsecured personal loans are not backed by collateral. Even though unsecured personal loans can be obtained without collateral, borrowers who default on their loan could still face consequences of not paying their debt. Borrowers risk hurting their credit score and their chances of obtaining another unsecured loan.

There are numerous types of unsecured personal loans available for those who qualify.

- The most widely-held form of unsecured personal loans are credit cards. Each time you swipe your card, youre essentially borrowing funds when and where you need them, up to your credit limit.re typically based on creditworthiness, income and are subject to verification. Personal loans are a great option for quick funds with no collateral.

You may use an unsecured loan, like a Best Egg personal loan, for a variety of purposes. From consolidating credit card debt to paying for a wedding, the possibilities are endless:

How To Improve Your Chances Of Getting A Loan

Now that you have a good idea about the differences between secured loans vs unsecured loans, as well as whats important in order to get approved for a loan, youre ready for the next step. That is, making sure youre in the best possible position, should you decide to apply for a loan. Improving your business credit and maintaining a good credit score is important to improve your chances of getting approved for a loan.

Here are some ways to help build your business credit score:

You May Like: What Credit Score Is Needed For Usaa Auto Loan

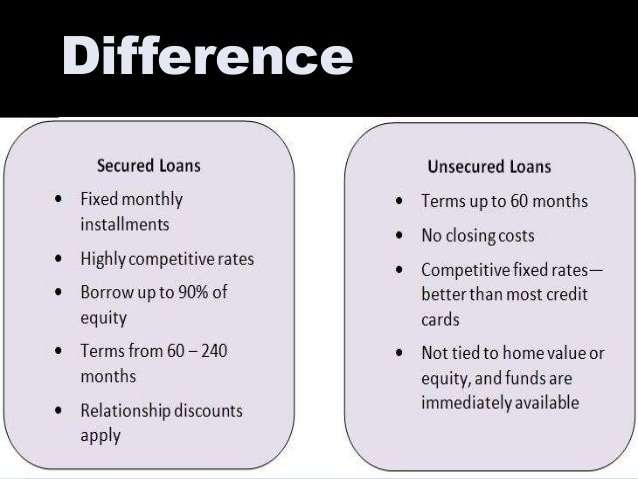

Whats The Difference Between Secured And Unsecured Loans

The main difference between a secured loan and an unsecured loan is whether the lender requires security.

A secured loan requires security. This may be property, inventory, accounts receivables or other assets. If the loan canât be met, the lender may rely upon these assets to clear the outstanding balance, interest or fees.

An unsecured loan doesnât require physical assets as security. Instead, your lender will often look at the strength and cash flow of your business as security.

Know Before You Borrow

Both loan types have strengths and weaknesses, which can vary per borrower and lender. If you plan to apply for a loan, make sure you have a clear understanding of the interest rate, monthly payment amount and repayment period before moving forward. A personal loan calculator can help to see what you might pay each month. By researching and comparing your options, you can find the best loan option for you.

*This article has been updated from its original posting in January, 2014.

The information in this article is provided for general education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness or fitness for any particular purpose. It is not intended to be and does not constitute financial, legal, tax or any other advice specific to you the user or anyone else. The companies and individuals referred to in this message are not sponsors of, do not endorse, and are not otherwise affiliated with OneMain Financial.

You May Like: Does Va Loan Work For Manufactured Homes

What Is The Difference Between A Secured And An Unsecured Loan

Find more articles like this in our Info Hub A secured loan means that you borrow a sum of money and put up something of value as security usually your home.

Therefore, an unsecured loan is unattached to any asset that you own.

When you get a loan from a bank or a loan from a credit union they are typically unsecured loans in the same way that credit cards, catalogues and bank overdrafts are also unsecured lending types.

Two other types of unsecured loan types are payday loans and guarantor loans, both of which have come under heavy criticism in recent years for mis-spelling.

Lastly, another unsecured loan is a student loan The student loan repayment arrangement varies due to the particular payment plan you are on.

A secured loan against a car is usually refered to as a logbook loan and some rent-to-own lenders exist such as Brighthouse, allowing an individual to purchase goods on a secured loan basis.

With a secured loan, if you do not keep up the payments, the lender can sell the item used as security, even if that means leaving you homeless.

With an unsecured loan debt, if you dont keep up the payments, the lender can take action in the courts to get the money back. More commonly, and before it gets to that stage they will serve a default notice against you as per the terms of Consumer Credit Act of 1974.

If it does end up in court, you will usually be ordered to pay off the loan in regular instalments set at an amount the court decides you can afford.

What Is The Difference Between A Secured Loan And An Unsecured Loan

Throughout life, many people will need to take out a loan of some kind. From home and auto loans to personal loans to business loans, lending is an age-old way of getting through hard times, making major purchases or getting a business up and running. Since the concept of lending has been around for such a long time, it has created a wide variety of loans with a dizzying array of variables ranging from interest rates to terms of the loan. Here is a brief overview of two types of loans: secured and unsecured.

Read Also: What Type Of Loan Do I Need To Buy Land

Whats The Difference Between Secured Vs Unsecured Loans

The main difference between secured and unsecured loans is how they use collateral. Collateral is when something of economic value is used as security for a debt, in the event that the debt is not repaid. Usually collateral comes in the form of material property, such as a car, house, or other real estate. If the debt is not repaid, the collateral is seized and sold to repay all or a portion of the debt.

Key Difference: A secured loan requires collateral, while an unsecured loan doesnt require collateral.

Does Having Collateral Improve My Chances Of Getting A Loan

Having collateral will typically improve your chances of getting a loan, especially if your credit score is poor.

But just because a secured loan is the best option for you, doesnt mean that option will always be available. Certain types of loans are more likely than others to offer a secured option. Home equity loans and HELOCs are by their very nature secured loans. Secured credit cards are relatively common, with most of the big issuers offering at least one secured option. But most personal loans tend to be unsecured. Though you can still find secured personal loans, it might require more searching and you may be limited in your selection of lenders.

While choosing a secured loan instead of an unsecured loan may make it easier to qualify for a loan at reasonable interest rates, Nayar cautions borrowers from overleveraging themselves: Ask yourself if you are taking on more debt than youre able to repay, he says. Otherwise, your home, vehicle, or other asset could be in jeopardy.

Recommended Reading: Which Bank Is Best For Construction Loan

Which Type Of Loan Is Right For You

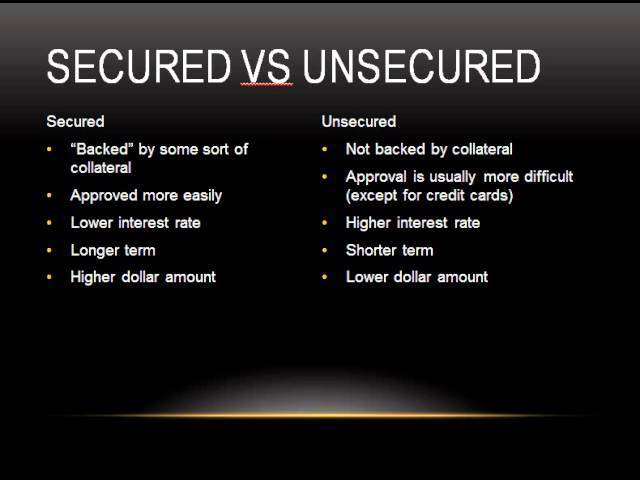

As a rule, secured loans will allow you to borrow more money at lower rates, but they put your property at risk if you fail to pay. Unsecured loans don’t put your property at risk, but they can be more difficult to get and you’ll generally pay more interest.

Sometimes the choice between a secured and an unsecured loan is not really yours to make. Mortgages and car loans are always secured, for example. If you don’t yet have the credit history and score to get approved for an unsecured credit card, starting with a secured credit card can help you build credit.

But what if you’re planning a minor bathroom remodel or another small project? Choosing in this case can be a bit more complicated. Should you use a home equity line of credit to pay for it or finance it using an unsecured personal loan? The best way to decide is to do the math: Compare interest rates, fees and repayment requirements. Keep in mind that while the HELOC is riskier, it also gives you the opportunity to borrow only what you need, unlike a personal loan where you take out a specific amount and have to pay back that amount regardless of whether you needed the whole thing for your remodel. That said, if savings are nominal, or you don’t want to put up your house as collateral, a personal loan may be best.

How To Prioritize Debt Repayment

Smart borrowers clearly consider whether a debt will be secured or unsecured before borrowing. But presence or absence of collateral also figures when deciding how to repay existing debts.

One recommended approach is to pay off the debt with the highest interest rate first. This is sometimes referred to as the debt avalanche method. Generally speaking, this often means concentrating on paying off unsecured debts before paying off secured debts.

The debt snowball method takes a different approach. With this method, you generally focus on paying off the smallest amount of debt first in a short period of time while still making payments on your other debts, to help generate momentum toward repayment.

Sometimes its better to prioritize needs. For instance, if you lose your job and have to choose between paying the mortgage and making extra payments on a credit card to reduce the high-interest balance, it may make more sense to pay the mortgage first. In the case of an either-or decision, ensuring you have shelter takes precedence.

Similarly, if you need your car to get to work, you may elect to make sure the car payment is made before the personal loan payment, even if the personal loan carries a higher interest rate.

If you find you need help with managing your secured or unsecured debts, debt relief can take different forms, and one may work better than another for your financial situation. Make sure to explore all of your options before deciding on a method.

Also Check: Usaa Car Loan Refinance

Best Unsecured Business Loans In 2022

Sometimes you just need to get yourself out of a sticky situation or cover a large expense. Unsecured loans come in handy when you do not have much to put up as collateral. Whether as a student or business owner, unsecured loans give you the financial capacity to meet your demands.

Heres a look into what unsecured loans are.

Which Loan Type Is Best For You

After considering the advantages and disadvantages of both loan types, its helpful to know which one is the best for certain circumstances. Here are some common contexts in which one may be better than the other.

- A secured loan may be best if youre trying to make a large property purchase or dont have the best credit. The piece of property that you are purchasing can be used as collateral if you dont already own other property. Additionally, this loan is more accessible for you if you have low creditworthiness and may be more advantageous with lower interest rates.

- An unsecured loan may be best if you have high creditworthiness and a steady income. High creditworthiness helps you meet strict qualification criteria and can also help you obtain better interest rates .

Overall, secured and unsecured loans are each useful in different situations. Remember that the key difference is that unsecured loans dont need collateral, while secured loans do. Secured loans are less risky for the lender and may allow for some advantageous repayment conditions. On the other hand, unsecured loans are risky for the lender, and they often come with stricter conditions that try to lessen that risk.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Interest Rates: Secured Vs Unsecured Personal Loans

Unsecured personal loans typically have higher interest rates than secured loans. Thats because lenders often view unsecured loans as riskier. Without collateral, the lender may worry youre less likely to repay the loan as agreed. Higher risk for your lender generally means a higher rate for you.

Personal loans are generally unsecured. As of August 2020, the average APR, or annual percentage rate, for a 24-month personal loan was 9.34%, according to Federal Reserve data.

A secured loan typically would have a lower rate. For example, you may be able to qualify for a secured Wells Fargo personal loan with a possible APR of under 6%, depending on the term length, amount borrowed and your credit history.

Debt Help For Unsecured Debt

Getting out of unsecured loan debt can be complicated. Often a debtor has defaulted on several credit cards and owes more than his or her income is capable of repaying. If that is the case, borrowers should contact the debt holder, usually the credit card company or a collection agency, to discuss debt settlement options.

First, try to organize your finances to pay down your credit card balances. Focus on the cards with the highest interest rates first while making minimum payments on the rest. In order to reach your payment goals, go on a personal austerity program brown bag lunches instead of eating out cut the cord on cable TV, find a cheaper cellphone plan, cancel vacation plans and look for ways to trim your electric bills.

If that doesnt work, the next-best solution could be a debt management program through a nonprofit credit counseling agency. The agency will work with credit card companies to reduce interest rates on your cards and design an affordable monthly payment. This process eliminates the debt over time usually 3-5 years and requires discipline and commitment.

Bankruptcy can discharge many personal debts, but not all. Student loans and child support are prime examples of non-dischargeable debt, meaning you are still obligated to pay them even after your other debts have been removed through bankruptcy.

You May Like: How To Transfer Car Loan To Another Person

What Is A Secured Personal Loan

A secured personal loan is a loan that is backed by collateral. Valuable items typically used as collateral for secured personal loans can range from vehicles to homes.If a secured personal loan is, in fact, the route a borrower wants to take, its vital that they fully understand how important repayment on the loan is, and what may happen to their collateral if their loan payments arent being made. In some cases, if the borrower defaults on the loan, the lender can take certain actions to mitigate their losses. Some lenders may even collect and sell the collateral.

Examples Of Unsecured Loans

- Personal Loans

- Payday Loans

With credit cards, you can buy things today as long as you repay the card issuer when you get a bill. If you dont repay the full balance when the bill is due, high interest rates kick in and it becomes very costly for the card owner. Student loans that go into default become a negative mark on a consumers credit report, until the consumer resumes regular payments.

Read Also: Usaa Auto Loans Bad Credit

Rules For Collateral On Secured Vs Unsecured Loans

With an unsecured loan, you do not need to have any collateral. This means you don’t need to put any assets at risk to guarantee the loan. Your property can’t directly be taken by the lender in the event you don’t pay the loan.

With a secured loan, you do need collateral. In most cases, this means you put some money into a special savings account controlled by the personal loan lender, or you give a lender an ownership interest in a savings or investment account. However, other assets can also be used as collateral, such as a vehicle, your home, or certificates of deposit . If you don’t have assets to use as collateral, you can’t qualify for a secured loan.

The amount of collateral required varies depending on the lender’s policies. In some cases, you need collateral valued at 100% of the loan amount or close to it. In other circumstances, especially if you have better credit, you can put up some collateral to guarantee the loan, but can borrow more than the collateral is worth.

Typically, when you use investment accounts or a savings account as collateral, letting the value of the account drop below a certain level violates the terms of the loan agreement. This could trigger an immediate obligation to repay your loan if you don’t bring the account value up — your loan terms specify exactly what occurs if this happens.

Secured Loan Vs Unsecured Loan: Which Is Right For You

There are a couple factors that go into deciding on a secured vs. unsecured loan. A secured loan is normally easier to get, as theres less risk to the lender. If you have a poor credit history or youre rebuilding credit, for example, lenders will be more likely to consider you for a secured loan vs. an unsecured loan.

A secured loan will tend to also have lower interest rates. That means a secured loan, if you can qualify for one, is usually a smarter money management decision vs. an unsecured loan. And a secured loan will tend to offer higher borrowing limits, enabling you to gain access to more money.

You May Like: What Credit Score Is Needed For Usaa Auto Loan