Paypal Small Business Loan

PayPal also offers a more traditional small business loan, available for customers who dont use PayPal. This might also work out better if you dont want the confusion of ever-changing payments and prefer to have the same payment every week, with a known pay-off date.

Unlike the PayPal Working Capital loan, the LoanBuilder loan is credit-based. When you apply youll be presented with a range of loan options . This isnt unique to PayPal though most lenders offer you a few choices when you apply.

The LoanBuilder loans also work differently from traditional loans. Instead of being charged interest, youll pay one fixed fee thats tacked onto the loan. You can pay off the loan early, but since the fee has already been charged to your account, you wont save any money like when you pay off a normal loan early. Its not quite a penalty fee per se, but you dont really get any benefit of paying it off sooner besides wiping the debt from your business.

Sba 7 Loan Interest Rate Ranges

The Small Business Administration guarantees SBA loans, which are offered by banks it partners with to help serve small businesses. These loans are among the most in-demand on the market because of the long terms and relatively low interest rates offered to borrowers. In particular, the SBA 7 loan is a versatile one, and helps cover a range of business financing needs, like purchasing equipment or working capital. These loans can be awarded for up to $5 million with terms as long as 25 years.

The exact interest rate borrowers pay will depend on several factors, including the amount of the loan and whether youve opted for variable or fixed interest rates, as shown in the tables below. In addition, the partner bank working with the SBA will likely have fees that can vary slightly from lender to lender.

Heres a rundown of the interest rates you could expect:

| SBA 7 variable loan interest rates |

|---|

| Loan amount |

| Prime + 5.0% | 8.25% |

In addition to the more general 7 loans, the SBA offers other business loans that are more specific. For example, the SBAs 504 CDC loan is specifically for businesses looking for financing to purchase fixed assets like land, machinery or real estate. These loans require at least 10% down for borrowers. Up to 40% of the loan is offered by a certified development company and the remaining percentage is offered by a bank. The benefit is that these loans have fixed rates that are fairly low, but they are dependent on the loan amount.

Upgrading To A Paypal Business Account

If you prefer, you can have multiple PayPal accounts: a personal and a business account, but you have to use unique emails for each account.

If youd like to use your PayPal personal account email to upgrade to a PayPal business account, follow these steps:

Also Check: How Much To Spend On Car Based On Income

Setting Up A Paypal Business Account

Just so you know

Did you know you can use Jotform to collect PayPal payments for your business? Create your online payment form for free today!

Youll also be asked to agree to an E-communication Delivery Policy, a User Agreement, and a Privacy Statement. Once youve read through these documents and are ready to continue, check the box and click Agree and Create Account.

This card has no annual fee once youve received at least $250 in payments. You can use the card balance anywhere that has the Mastercard logo and get 1 percent cash back each month on select purchases.

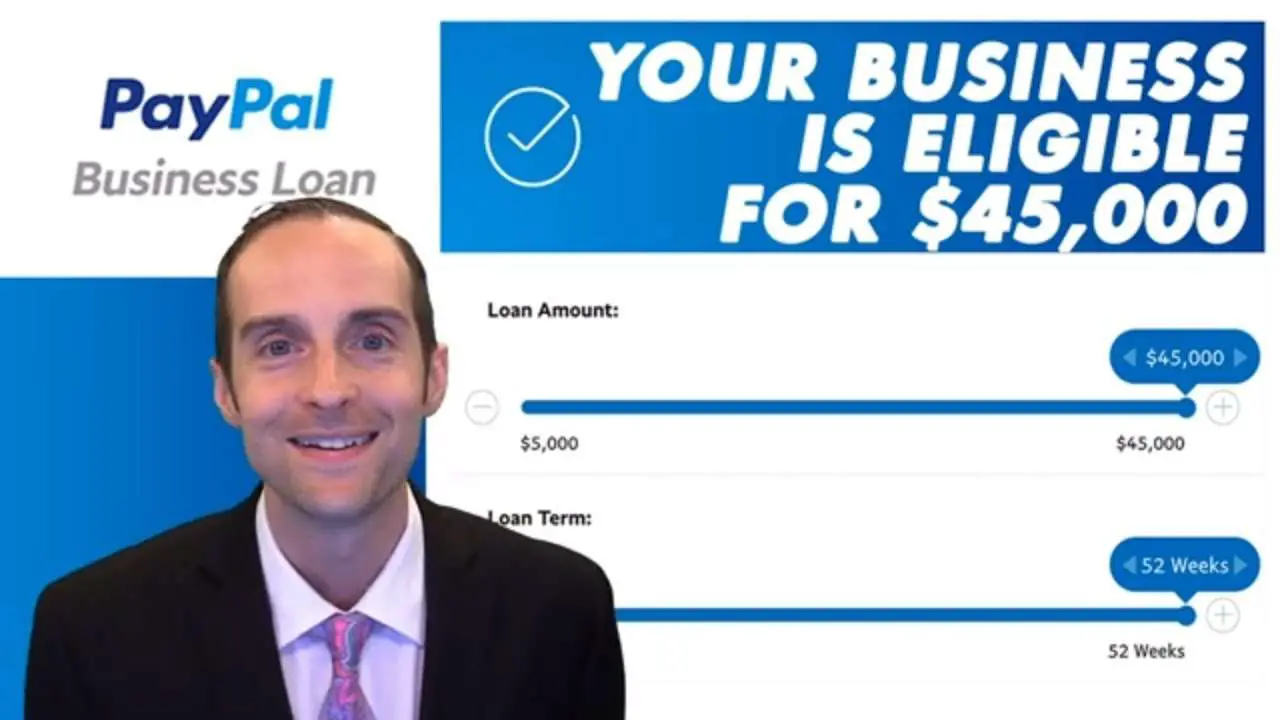

Paypal Working Capital Loan Options

Assuming you still like the sound of a Paypal loan, what can you expect to actually get?

PayPal Working Capital offers only one loan product. The loan amounts, fees, repayment terms, and retrieval rates can vary, of coursebut you wont get to choose between a term loan and a line of credit, for example.

Unfortunately, PayPal prefers to leave a lot to the imagination. It doesnt provide many specifics about its loans.

Recommended Reading: Refinance Auto Loan With Usaa

Paypal: A Good Option For Small Businesses

Before we analyze each of the PayPal benefits individually, lets check some numbers that speak for themselves: around the world 17 million merchants and almost 250 million people use PayPal. Today PayPal moves more than $150 billion in payment transactions every year.

It is the worlds largest payment system.

Whats the reason behind PayPals success? Why is it the leader not only in online payments but also in mobile payments?

First, simplicity. It makes it easy for small businesses to accept payments and for consumers to pay with just a couple of clicks.

Second, variety. It provides a variety of solutions for accepting credit and debit card payments, Apple Pay, Google Pay, eCheck, and more. Besides payment solutions, it brings smalls business owners other banking and POS tools.

Third, affordability. PayPal is free for consumers, and retailers are charged competitive rates for processing transactions.

Paypal Business Account Fees

If you want to start using PayPal for your business, its important to understand the PayPal business account fees associated with standard transactions and accepted payments online and in store.

Most important, there are no initial costs to get started or monthly costs attached to a standard PayPal business account. There are no termination fees either. Using a standard PayPal business account is best for businesses that want to save on fees and enjoy some flexibility.

If you want to offer a more robust customized and integrated shopping cart and checkout experience for your customers online, you may want to consider upgrading to a PayPal Payments Pro account. It costs $30 per month, along with the standard transaction fees.

PayPal business account transaction fees are only applied when you sell products or services and accept payments online or in store. Your business pays a standard transaction fee based on the percentage of the total transaction amount and the fixed fee of the currency for the respective country. Below is a breakdown of the percentages and fixed fees for online and in-store transactions in the U.S.

| Transaction types |

| 4.2% | no fee |

*International sales made online incur an additional 3-percent currency conversion charge and a 1.5 percent charge for receiving a payment from a different country.

Acceptable forms of payment include Venmo, PayPal Credit, PayPal payments, and all major credit and debit cards with PayPal Checkout and PayPal Payments Standard.

Read Also: Refinancing Fha Loan Calculator

How To Send Money Through Paypal Using Your Account

1. Start the payment. If you have an invoice or a money request, all you need is to click on the Pay now button. If you are looking to start a payment yourself, first you should log in to PayPal and then tap the Send button.

2. Choose the type of payment. There are two options: you can make a personal or a business payment. Youll also have to choose whether its a Friends and Family payment or you are paying for goods and services, either in the US or internationally. The fees are different for each transaction type, so make sure all the information is correct.

3. Fill in the recipient details. Its simple add a telephone number or an email address of the recipient.

4. Confirm the amount of money & currency. PayPal allows transactions in many different currencies, just pick yours.

5. Choose how you want to pay. Usually, there are several funding sources: PayPal balance, a credit, or a debit card, a bank account.

6. Find the receipt in your mailbox. You might have to press the Confirm button a couple more times and you are done. Check your mailbox, youll find a receipt there that confirms that the transaction was processed.

Paypal Working Capital And Business Loans Review 2020

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

With small-business financing through PayPal, entrepreneur Lisa Brooks has grown her catering and meal-delivery business, Heart & Soul Personal Chef Service, from a one-woman operation to a budding business with 10 employees.

Brooks uses PayPals working capital loan, which offers loan amounts based on PayPal sales. As her sales have increased, Brooks has taken additional loans at higher amounts. The loan is repaid automatically with a percentage of each PayPal sale.

It doesnt feel like a loan to me, Brooks says.

Since 2013, PayPal has provided more than $10 billion in business financing. In addition to the working capital loan, PayPal also offers a more traditional small-business loan.

With the business loan, you dont need to process payments on PayPal to qualify, says Joseph Gallo, senior communications manager at PayPal.

Heres what you need to know about PayPal loans and how they compare with other small-business loans.

Recommended Reading: How Long Does The Sba Loan Take

Reputation And Customer Reviews

Customer satisfaction is a helpful way to evaluate a potential business lender. Look for consistent, positive customer reviews, a high rating from the Better Business Bureau, and industry awards and recognition. It’s a good idea to seek out a business lender that has an easy-to-find phone number and contact information. It should also have a visible ‘About Us’ section on its website with company news and frequently asked questions.

De Facto National Standards

Soon, merchant cash advance companies as well as prominent fintech lenders like PayPal Inc. and Lending Club Corp. could be required by state authorities to provide far more transparency to small business borrowers.

Regulators in California and New York have proposed requirements for online lenders to disclose the cost of the financing small business borrowers apply for, such as interest rates and fees. Lawmakers in Connecticut, New Jersey, and North Carolina have introduced similar legislation.

Once in place, potentially as soon as Jan. 1, 2022 in New York, the state rules could create de facto national standards that small business borrowers have been without due to a gap in federal law.

Better disclosures and more transparency would help entrepreneurs avoid the financing that comes with the sort of aggressive, high-cost repayment Bush experienced as soon as he took the advance.

It probably will save a good number of small businesses, he said.

Read Also: How To Get Approved For Capital One Auto Loan

Paypal’s Working Capital Fees Explained

PayPal only charges a single fee on top of the principal balance that needs to be repaid. Borrowers choose the amount they’d like to loan out as well as the single interest fixed fee they pay. The higher the fee you choose to pay, the lower the total repaid. On a sample $8,000 loan for a business that processes $100,000 in annual PayPal sales, there is a $655 reduction in loan fees if the business chooses to pay 30% of its daily sales rather than 10%.

A Paypal Business Loan Through Loanbuilder

You can get a PayPal Business loan for varying amounts, from $5,000 to $500,000. Your business should have been operational for at least 9 months and have annual revenue should be $42,000 or more.

Features of the loan:

- Sign loan agreement and get the funds transferred to your PayPal business account

Don’t Miss: What Do Loan Officers Look For In Bank Statements

Is Paypal Asking For Ssn Details When You Should Comply

Why is PayPal asking for my social security number? You should disregard any effort made by PayPal asking for SSN or EIN info if you are a casual buyer on PayPal. Simply do not enter the number. However, it is helpful to add your tax number when you need to collect payments online from PayPal customers or process business transactions.

So why does PayPal need my Social Security Number ?

When using PayPal for invoicing or business transactions, the addition of a tax ID number can be used for tax reporting purposes. This is good information to know, especially if you are starting a business. It also assists PayPal in identifying your identity.

Why Is Paypal Asking For Ssn Information

If youre a U.S. citizen and you have an SSN, you can get your EIN for free on IRSs website here.

HOWEVER, if youre NOT a U.S. citizen and you do NOT have an SSN, the process of getting your EIN is more complicated and requires more paperwork.

We offer a QUICK and EASY service for non-U.S. citizens who do NOT have an SSN get their EIN here.

Whenever you open a PayPal account, you need to provide the site with certain personal details. PayPal, itself, is an online financial service that permits users to pay for items using a secured account online. In some cases, you may ask, Why Does PayPal Need My SSN?

You May Like: Loan Originator License California

A Simple Application Process

Online lenders typically have a streamlined loan application process. Often, an online lender will require fewer documents than traditional bank loans. For larger business loan amounts, more paperwork may be required, but most business lenders start with your recent business bank statements or sales history to determine how much your business might be eligible for. By simplifying the application process, these business lenders can get you an answer faster while often reducing the number of hoops your business is required to jump through.

Paypal Working Capital Loan

Best for: Businesses that process sales through PayPal and need working capital for things like covering payroll or seasonal dips in revenue.

PayPal Working Capital provides financing of up to 35% of your annual PayPal sales, with a maximum borrowing amount of $125,000 on your first two loans, and up to $200,000 thereafter.

PayPal charges a single fixed fee based on your sales volume, account history, the amount of your loan and the percentage of sales you choose to direct toward repayment.

You choose the repayment percentage of your sales when you apply for a loan, with payments automatically deducted from your PayPal account until the loan is repaid in full.

Approved loans are funded within minutes, with repayments beginning 72 hours after the loan is received. PayPal requires you to repay at least 5% or 10% of your total loan amount every 90 days to keep your loan in good standing.

Heres what youll need to qualify:

-

A PayPal Premier or Business account for at least three months, as PayPal uses these accounts to determine whether or not you qualify.

-

At least $20,000 in PayPal sales in the past year with a PayPal Premier account, or at least $15,000 in annual PayPal sales if you have a Business account.

-

If you have an existing PayPal working capital loan, you’ll need to pay it off in full before applying for another round of financing.

Approval and funding take only a few minutes since the company already has your information and account history on file, Gallo says.

You May Like: Usaa New Car Loan Rates

Business Loans You Can Get Without A Credit Check

Get Matched to the Right Loan For Your Business

Let our experts match you to lenders based on your unique business metrics.

Maybe you need a loan to start your business or launch a new product or division, or perhaps you are dealing with the unexpected, like a dip in revenue, costly repairs and renovations, or staffing needs. Regardless of why you need the extra capital, theres one thing that will likely govern how easy or difficult it is to secure it: your business credit.

Unfortunately, for some business owners, a credit check could be out of the question. Some simply dont want a hard inquiry to show up and subsequently damaging their existing credit score, and others are intimately familiar with their credit score and know that, in some cases, it can immediately disqualify them. Whatever the reason is, identifying a financing option to fit your needs can be difficult, but its not impossible. There are a variety of options, including working capital loans through your payment process, merchant cash advances, invoice factoring, and crowdfunding.

See What Bad Credit Loans You Qualify For

Get personalized loan matches, after you sign up for a free Nav account. It wont hurt your credit score.