Low Down Payment: Fha Loans

The FHA mortgage is a bit of a misnomer because the Federal Housing Administration doesnt actually lend money.

Rather, the FHA sets basic lending requirements and insures these loans once theyre made. The loans themselves are offered by nearly all private mortgage lenders.

FHA mortgage guidelines are famous for their liberal approach to credit scores and down payments.

The FHA will typically insure home loans for borrowers with low credit scores, so long as theres a reasonable explanation for the low FICO.

FHA also allows a down payment of just 3.5% in all U.S. markets, with the exception of a few FHA approved condos.

Other benefits of an FHA loan are:

- Your down payment may come entirely from gift funds or down payment assistance

- The minimum credit score is 500 with a 10% down payment, or 580 with a 3.5% down payment

- Upfront mortgage insurance premiums can be included in the loan amount

Furthermore, the FHA can sometimes help homeowners who have experienced recent short sales, foreclosures, or bankruptcies.

The FHA insures loan sizes up to $ in designated high-cost areas nationwide. High-cost areas include places like Orange County, California the Washington D.C. metro area and, New York Citys 5 boroughs.

Note that if you want to use an FHA loan, the home being purchased must be your primary residence. This program isnt intended for vacation homes or investment properties.

Can I Buy A House With No Down Payment And No Closing Costs

All mortgage loans charge closing costs even no-down-payment mortgages. Closing costs help pay for your mortgage lenders operating fees and third-party services, like the home appraisal and title report. These expenses are necessary when setting up a mortgage and buyers almost always have to pay them.

If you qualify for down payment assistance, the money can often be used for your closing costs as well as your down payment. However, its unlikely the loan or grant you receive will be large enough to cover the full cost of both items. So you should expect to pay something out of pocket even when using DPA.

You can learn more about closing costs and strategies to reduce them here.

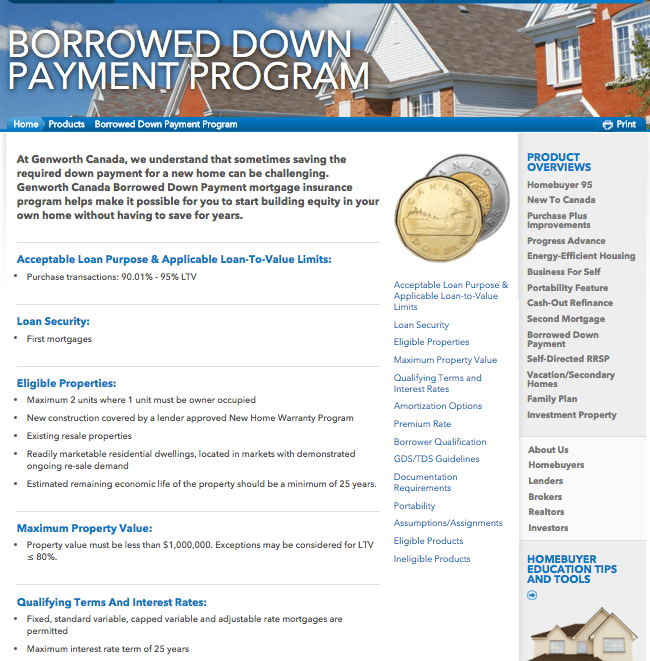

Borrow From Another Source

You can borrow the amount for a down payment from another source. This includes a line of credit, personal loan, or even your own credit card. Although you could borrow most of your down payment this way, we often find it is best to save this option for last push. A final bump should be just enough to push you over the 5% threshold.

However, there is a massive caveat to go along with this: you can dig yourself into a financial pit by borrowing your down payment. We dont recommend doing this without talking to a professional.

Your mileage may vary on any one of these points. Aside from accumulated savings, we rarely encounter anyone who has raised their entire down payment from any one of these sources, but all of the above can make a world of difference when it comes to finally buy your home.

Recommended Reading: Reverse Mortgage On Condo

Recommended Reading: How Much Interest Am I Paying On My Home Loan

What To Consider When Using A Smaller Down Payment

Because your mortgage payment will be higher with no money down, you may feel like youre saving money on the purchase but its key to keep in mind that each monthly payment will be impacted by this decision. Almost all major online real estate websites have a mortgage calculator of some sort, so use those while shopping for homes to get an idea of what that monthly note is going to look like. Be sure that the calculator youre using is also capable of factoring in PMI so youll be able to compare and contrast sizable down payments versus home purchases with no money down.

Recommended Reading: Reverse Mortgage Manufactured Home

What Is A No Down Payment Mortgage

Zero-down or no-money-down mortgages were readily available prior to the subprime mortgage meltdown of 2008, when home values were rapidly rising and credit guidelines were more lax. Today, unfortunately, no-down-payment mortgages from commercial lenders are extremely rare, and those that exist are only available to select individuals who can document an adequate incomeoften, along with minimum credit scores in the mid 600 range many private lenders require even higher credit scores.

Thankfully, there are several no-down-payment public programs that some aspiring homeowners may qualify for. This article lists some of these lesser-known loan optionsand some alternatives if you aren’t eligible for any of them.

Don’t Miss: Best Personal Loan Bad Credit

What About Credit Scores

Your credit score is likely going to be the first thing any lender looks at when determining loan conditions. Every time a lender pulls your credit rating, your overall score might decrease by five to 10 points. Your credit score can be completely independent of your ability to put down a big down payment, but it will still affect the conditions of your loan.

A low credit score’s impact on your loan conditions decreases as you put more money down. Lenders are always going to be hesitant to lend to someone with a low credit score, so a larger down payment can help make them feel as if you’re less risky.

Is Private Mortgage Insurance Bad

Mortgage insurance isnt good or bad. Lenders may require PMI to protect their investment in case a borrower cant continue to make payments. And this protection is what allows lenders to offer so many low down payment mortgage options.

Some loan types require PMI, and its also required for borrowers who make a down payment less than 20 percent of the homes sale price. Some policies exist for the life of your loan, while others can be canceled once homeowners reach 20 percent equity.

Homeowners pay PMI up-front, with an additional monthly payment, or a combination of the two.

Consider this: Home prices are generally increasing. The additional monthly PMI payment may be more cost-effective than waiting until you have a larger down payment.

Consider what loan types youre eligible for and their mortgage insurance requirements. Anticipate additional expenses and budget accordingly.

Low and no down payment mortgages make homeownership accessible for first-time buyers. Know which loans youre eligible for when youre thinking about how to buy a house with no money. Then, get pre-approved for the mortgage of your choice once youre ready to start house hunting.

Happy homebuying.

Dan Green

Receive real estate and mortgage news by email weekly. Personalized for you & your specific homebuying goals.

Homebuyer is powered by Novus Home Mortgage, a division of Ixonia Bank, NMLS #423065. Member FDIC. Equal Housing Lender

You May Like: How To Check If Loan Is Fannie Or Freddie

How To Buy A Home With A Low Or No Down Payment

After a record-breaking surge in U.S. home values last year, saving enough cash for a down payment that traditionally is 10% or 20% of the purchase price is tougher than ever for Americans hoping to buy a home.

Home prices jumped 17% in 2021 and probably will gain an additional 8.4% this year, even as mortgage rates increase, according to the National Association of Realtors.

First-time homebuyers can purchase property by making a low or no down payment through various federal and state assistance programs, depending on their financial situation.

How To Apply For An Investment Property Loan

It may take time to fill out your application, so gather any required information and paperwork ahead of time. You may need to provide tax returns and financial statements as well as information about your business.

Once youre approved, youll be given a loan agreement that lists loan terms, including your mortgage rate. If you approve, sign the documents and the funds should be deposited into your bank account.

Don’t Miss: Bank Loan With Bad Credit

Freddie Macs Home Possible Mortgage

Home Possible is Freddie Macs mortgage product for low-income borrowers. Unlike Fannies option, you dont have to make a downpayment. If the mortgage is for a single-unit property, including a manufactured home, borrowers without credit scores may finance up to 95% of the home purchase. To qualify, you must:

- Earn less than 80% of the median income for your area

- Use the house as a primary residence

- Have a minimum credit score of 660 if your lender doesnt use its automated Loan Product Advisor tool

Can I Buy A House With No Down Payment

If youre looking for a no-down-payment mortgage, there are a few options to explore.

Government-backed VA and USDA loans allow no down payment but have special eligibility requirements. If you dont qualify for one of those, you could apply for a low-down-payment mortgage and use an assistance program to cover your out-of-pocket cost. And some private lenders offer their own no-down-payment mortgages which might come with additional perks like no PMI.

Ready to get started?

In this article

Read Also: Which Student Loan Servicer Is Best

Home Buyers Dont Need To Put 20% Down

Its a common misconception that 20 percent down is required to buy a home. And, while that may have true at some point in history, it hasnt been so since the advent of the FHA loan in 1934.

In todays real estate market, home buyers dont need to make a 20% down payment. Many believe that they do, however despite the obvious risks.

The likely reason buyers believe 20% down is required is because, without 20 percent, youll have to pay for mortgage insurance. But thats not necessarily a bad thing.

First Home Loan Program

Program Summary

MaineHousings First Home Loan Program makes it easier and more affordable to buy a home of your own by providing low fixed interest rate mortgages. There are options with little or no down payment required, and if you still need help with the cash for closing costs, we also offer a down payment and closing cost assistance option called Advantage. You must apply for a MaineHousing loan at one of our approved lenders. MaineHousing mortgage options include:

Eligibility

Am I eligible?

- Am I a first-time homebuyer? If you have not held an ownership interest in your principal home within the past 3 years, you qualify as a first-time homebuyer. That means even if you have owned a home before you may still be eligible.

- Am I a Veteran, retired military or on qualified active duty? If so, the first-time homebuyer requirement is waived and MaineHousing provides an interest rate reduction. Salute ME Summary

What kind of home can I buy?

- New and existing single family homes.

- Owner-occupied, 2- to 4-unit apartment buildings.

You May Like: Navy Federal Home Loan Credit Score

Types Of Loans You Can Use As A Down Payment

There are a few different ways you can get a down payment without having to save for it:

- Line of credit. You can opt for a line of credit for your down payment. But it cannot be from the same bank youre getting your mortgage from.

- Personal Loan. This could potentially be a good option for someone who is in great financial standing but doesnt want to wait any longer to purchase a house.

- . This is probably the worst option as charging at least 5% of the purchase price of your home could put you into for years.

- Borrowing from a family member. If you have a generous family member then you could potentially borrow your down payment from them.

- Government programs. Depending on what province you live in there are special government programs that can provide lower-income families with down payment assistance.

Government Programs

No Down Payment Credit Score Requirements

Most lenders require a minimum credit score of 580 for a no-down-payment VA loan or 640 for a zero-down USDA loan. FHA loans are also available with a FICO score of 580, though youll need a 3.5% down payment to qualify. If you want to use a conventional loan with just 3% down, youll need a credit score of 620 or higher.

You can see a full list of credit score requirements to buy a house here.

Recommended Reading: What’s The Smallest Car Loan You Can Get

Do No Down Payment Mortgages Really Exist

Purchasing a home with no down payment saved doesnt mean that you dont have to make a down payment it simply means that youre not using your own hard-earned and saved cash to pay for the down payment. It means youre going to borrow your down payment , which in return means youre taking on even more debt. This is why its important that youre in good financial standing before you take on even more debt than is technically necessary.

Loans Canada Lookout

Apply For A Federal Housing Administration Loan

Probably the most well-known type of government-backed mortgage, an FHA loan is one that has been secured by the Federal Housing Administration, reducing the risk faced by the mortgage lender. The added security encourages lenders to lower their credit score and down payment requirements.

To qualify for an FHA-backed mortgage, youll need a credit score of at least 580, though minimum score requirements will vary by lender. On the plus side, youll only need a down payment of 3.5% of the homes purchase price.

Not every bank or lender will offer FHA-backed mortgages, but many of them will. Our experts picked their top two companies below.

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

| N/A | N/A |

Due to the nature of the lending network, you may receive offers from unfamiliar companies or out of state lenders. Be sure to research your chosen lender before making any commitments.

Also Check: What Can I Afford Mortgage Loan Calculator

No Down Payment Loans For The First Time Home Buyer

As a first-time home buyer, you may not have much to put down on a home.

The key is to find the right loan program or combination of programs.

If youre buying outside a major metro area, check into the USDA loan. Its a no down payment program. You dont have to be a first-time home buyer to get one, but this is who usually uses it.

If you have a military background, you could be eligible for a loan from the Department of Veterans Affairs. It requires nothing down and rates are typically lower than for FHA.

If you choose a loan program that requires a down payment, look around for secondary programs. Your city, state, or county may provide grants and down payment assistance to help first-time home buyers break into the housing market. Learn more about down payment assistance programs here.

Protecting Yourself With No

If you must take out a no-money-down loan, you can take a few steps to reduce your chances of going upside down. These tricks can help you put yourself in a better position:

-

Get gap insurance: With gap insurance, you’ll have coverage for the difference between what you owe on your loan and what the car is worth if the car is stolen or totaled, eliminating the need to pay off your negative equity out-of-pocket.

-

Buy low: With a no-money-down loan, it’s best to get a vehicle with a lower overall cost so you’ll have less to pay back. Consider looking for an older vehicle at the base trim level without many add-ons.

-

Refinance: While you’re obligated to pay off your loan terms, you don’t have to stick with the terms you got at purchase. After you build your credit or pay down some of your loan, you can refinance for a better deal that will save you money.

-

Trade in your old car: If you don’t have the money for a down payment but do have an old car to trade in, you can put that money directly into your new car. Use the trade-in as the down payment, and you’re likely to have better loan terms and enjoy some of the benefits of making a large down payment.

Also Check: Are Student Loan Forgiveness Calls Legit

Why Lenders Still Offer 100% Loans

Many new home buyers wonder why most types of loans require a down payment.

After many studies, banks and lending institutions have determined that the higher the down payment on a loan, the lower the chances of the borrower defaulting. In fact, the down payment amount is more important in determining risk than even credit score.

Thats why, years ago, the standard down payment amount became 20%. Anything less than that requires some kind of insurance, such as private mortgage insurance , so the lender would get their money back if the borrower failed to pay the loan back.

Fortunately, there are programs for which the government provides insurance to the lender, even though the down payment on the loan is zero. These government-backed loans offer a zero-down payment alternative to conventional mortgages.

Benefits Of Large Down Payments

When you make a large down payment in proportion to the total value of the vehicle, you can enjoy a wide variety of benefits that wouldn’t otherwise be available. Remember, the 20% or 10% standard is the minimum, so it’s always going to be better for your loan terms to put down more than the minimum. These are some of the most important benefits of a large down payment:

Recommended Reading: Personal Loan For Home Renovation

Choose A Loan With Little Or No Down Payment Requirement

Not all mortgage loans are created equal. The mortgage loan you apply for could determine how sizeable your down payment should be:

- Conventional loans offer down payments as low as 3% depending on factors like your credit score and history.

- FHA loans are backed by the government and require as little as 3.5% down, depending on your credit score.

- USDA loans are available to low- and moderate-income families in qualifying rural and suburban areas. They typically require little to no money down.

- VA loans are available to veterans and their families, as well as active duty service members. They typically require no money down if you qualify.