Do You Want A Loan Or Line Of Credit

Let us walk you through each step in the calculator with helpful tips and definitions.

1 Displayed rate does not represent the actual rate you may receive.

* The calculation is based on the information you provide and is for illustrative and general information purposes only and should not be relied upon as specific financial or other advice. Actual results and loan or line of credit payment amounts and repayment schedules may vary. Calculator assumes a constant rate of interest.

** Creditor Insurance for CIBC Personal Lines of Credit, underwritten by The Canada Life Assurance Company , can help pay off or reduce your balance in the event of death or cover payments in the event of a disability. Choose insurance that meets your needs for your CIBC Personal Lines of Credit to help financially protect against disability or death.

Consider Alternatives Before Signing Your Name

There are alternatives to commercial personal loans that are worth considering before taking on this kind of debt. If possible, borrow money from a friend or relative who is willing to issue a short-term loan at zero or low interest. Alternatively, if you have high-interest credit card debt that you want to eliminate you may be able to perform a.

What’s a balance transfer, you ask? Some on new purchases and on your old, transferred balance for a year. If you can get one of these deals and manage to pay off your balance while you have the introductory interest rate you may be better off opting for a balance transfer than for a personal loan. It’s important to pay off your balance before your APR jumps from the introductory rate to a new, higher rate.

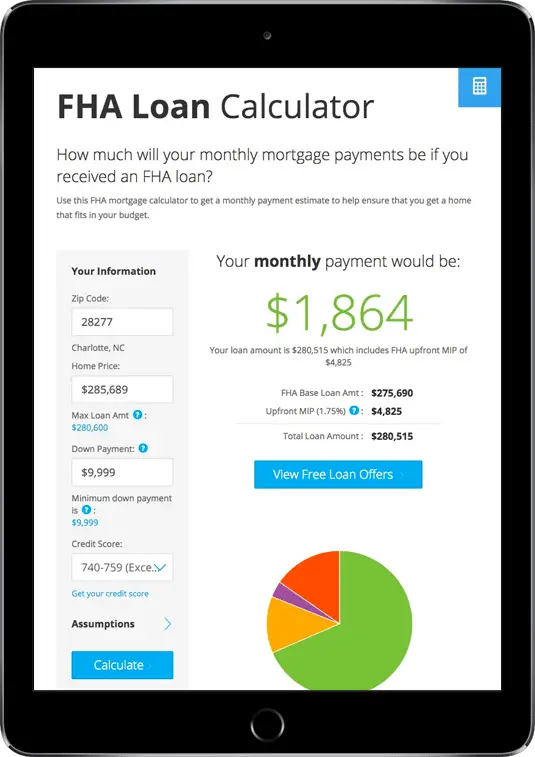

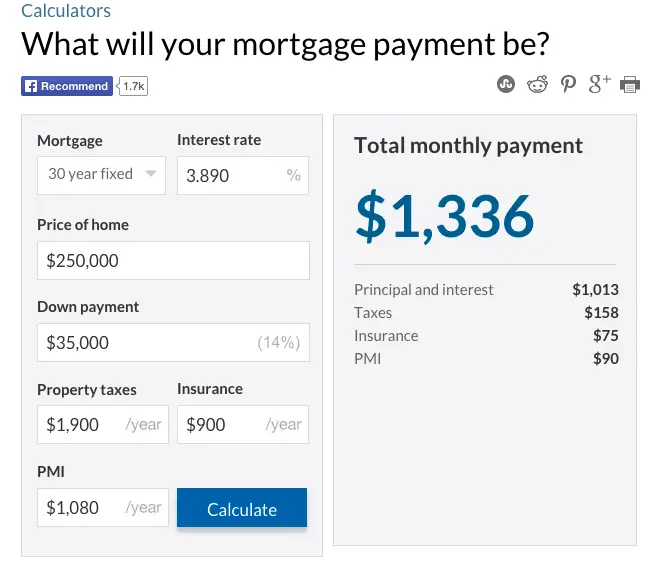

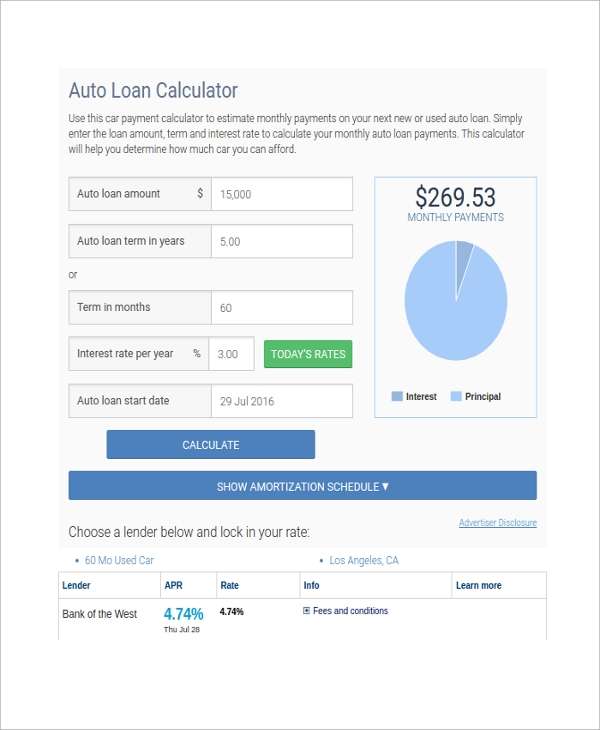

Loan calculators can help you figure out whether a personal loan is the best fit for your needs. For example, a calculator can help you figure out whether you’re better off with a lower-interest rate over a lengthy term or a higher interest rate over a shorter term. You should be able to see your monthly payments with different loan interest rates, amounts and terms. Then, you can decide on a monthly payment size that fits into your budget.

How To Calculate Your Loan Cost

As a borrower, your loan cost primarily comes down to the loan amount you are seeking with determined interest. There are several other factors that should also be solidified to discover your overall loan cost. Payments toward the balance can be estimated using the Capital Farm Credit farm land loan calculator.

Follow these instructions to determine an estimated payment schedule and to understand the breakdown of how your payments are credited towards your loan:

- Insert your desired loan amount.

- Select the estimated interest rate percentage.

- Input your loan term .

- Determine your payment frequency .

- Select the amortization type for your loan or Fixed Principal

Interest may be the largest variable in your estimation, as rates fluctuate up and down, depending on market conditions, inflation, and a variety of other factors. You can select an estimation based on current rates to get a rough idea of how much total interest will be accrued over your payment cycles. This can help you determine the best plan for making actual payments.

*Note: The loan rate calculator is to be used for estimation purposes only and will never provide complete accuracy. Loans are subject to approval, terms of credit may vary, and the calculator is not to be used for any unintended purpose such as providing legal or investment advice.

Read Also: Arvest Construction Loan

Which Factors Influence How Much Interest You Pay

As you can see from the maths above, the balance of your principal influences your interest, as does the annual rate youre charged. Some home loans have whats called a variable interest rate, which means that percentage can change based on factors such as the Reserve Banks cash rate. Other mortgages have one fixed rate for the life of the loan, while some people split their home loan to include both variable and fixed interest payments.The length of your mortgage will also influence the total amount of interest youll pay since interest is charged each year.The length of your loan affects how much youll pay in interest.One of the ways you can reduce the overall cost of the loan is by increasing your monthly payments above the minimum required. This can shorten the duration of the loan, meaning you will pay fewer years interest, and lower the interest faster by getting the balance down more rapidly.By plugging in different payment amounts on a home loan calculator, you can see the impact that adjusting your monthly instalments can have on your total interest costs. Some calculators also allow you to assess the effect of offsets, lump sum payments, extra repayments and different interest rates all of which can affect the interest youll pay over the life of the mortgage. You could use this information to help you develop strategies to better manage your loan repayments and plan for mortgage refinancing if you choose to pursue this option.

What Is Considered A High Interest Rate

Every loan type has its own average amount of interest. The rate is calculated based on a number of factors, including:

- The principal amount

- The borrowers credit-worthiness

Because no two loans are alike, it can be hard to determine what a good interest rate is. Your credit cards, auto loans, personal loans and mortgages all have unique factors that are used to determine your interest rate.

Don’t Miss: Auto Loan With 650 Credit Score

Is It A Good Idea To Get A Personal Loan

Whether or not a loan is a good idea for you will depend on your personal circumstances and why you are looking to borrow several thousand pounds. If youre not sure you can afford to make the same repayment every month and you only need a thousand pounds, you could consider a instead.

For sudden costs that youll be able to pay off after a month or two, a credit card or even an arranged overdraft on your bank account may be more suitable than a personal loan, as it generally doesnt matter when you pay these debts off, as long as you make a minimum monthly repayment. At the other end of the spectrum, large amounts of money may require a secured loan also known as a homeowner loan.

An unsecured loan really shines in the middle ground. Its for an amount that is not too little but also not too large. Youll be tied to it for several years, but youll also be sure that you clear your debt by the end of the term, provided you keep up with your repayments.

Loans have the added advantage of not tempting you to spend more, with a credit card typically allowing you to keep using it until you hit your credit limit. A loan will therefore make it hard for you to get into any additional debt, as long as you put all your debt on it and cut up and cancel all your cards.

How Much Will My Loan Payments Be

The loan amount, the interest rate, and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

220 Donald Lynch Boulevard

Also Check: Auto Loan Rates Credit Score 600

Home Equity Line Of Credit

A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as: Should you borrow from home equity? If so, how much could you borrow? Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan?

How Much I’ll Pay In Loan Interest

If you borrow $20,000 at 5.00% for 5 years, your monthly payment will be $377.42. Your total interest will be $2,645.48 over the term of the loan.

Note: In most cases, your monthly loan payments won’t change over time. With , the proportion of interest paid vs. principal repaid changes each month. As the loan continues to amortize, the amount of monthly interest paid will decrease .

You May Like: Fha Refinance Fees

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

What Happens If You Miss A Loan Payment

If you miss a payment, you might be penalised.

If you have an unsecured loan and you miss a payment, it’s likely that you’ll have to pay a fee for late payment to your loan provider. Using our personal loan repayment calculator before taking a loan out would hopefully help you to avoid this situation.

If you have a secured loan, which is secured against your home or vehicle and you miss a payment, you’ll likely have to pay a late payment fee. Most lenders don’t consider repossession until you’ve missed at least three payments. Lender’s seek repossession only as a last resort. Thats why you need to think very carefully before taking out a secured loan.

Don’t Miss: Can You Use A Va Loan For Investment Property

Retiring A Mortgage With Extra Payments

Many homeowners invest in home security systems to protect their property and personal assets. However, a security system will not protect the homeowner against financial disaster or bankruptcy. Making additional mortgage payments will shrink the total amount of interest paid over the life of the loan, and the borrower will pay off the debt more quickly. In addition, the home equity will grow at a faster pace when extra payments are applied to the loan. This provides for a margin of protection by lowering the interest costs. This method gives the property owner a home free and clear of debt. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

What Is Cash Call Mortgage

Category: Loans 1. Advertised Rates CashCall Mortgage CashCall Mortgage consistently provides the lowest cost loans for home mortgages. Lower your rate for the last time! Call 1-866-708-5626 or apply online CashCall Mortgage consistently provides the lowest cost loans for home mortgages. Lower your rate for the last time! Call

Read Also: Sss Loan Application

How Moneyfacts Works

-

BALANCED. Moneyfacts.co.uk is entirely independent and authorised by the Financial Conduct Authority for mortgage, credit and insurance products.

-

FREE. There is no cost to you. Our service is entirely free and you don’t need to share any personal data to access our comparison tables.

-

TRANSPARENT. We only receive payment from product providers and intermediaries for quick/direct links and adverts through to their websites.

-

COMPREHENSIVE. We research the whole market and scour the small print so you can find the best products for your needs.

What Is A Loan Term

A loan’s term is the time duration during which it should be fully repaid with interest, if repayments commence on schedule. Generally loans for larger amounts of money come with longer terms, e.g. a personal loan for $5,000 may have a one year term whereas a mortgage would typically have a term between five years and thirty years. A longer term loan typically results in a greater amount of interest to be paid in total, but the pay backs come in smaller installments. Whether a longer term loan is preferable to a shorter term one is a personal calculation as it depends on the personal financial situation and preferences of the borrower.

Don’t Miss: Transferring Car Loan To Another Person

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

Recommended Reading: Fha Loan Limits Fort Bend County

Benefits Of Paying Off Loan Early

The moral of the story is that paying off a loan or any kind of debt early is always a great way of saving the amount of money paid in interest as well as decreasing the overall loan term. This extra money can be used to meet other imminent or long-term needs. There are many benefits of paying off loans early. The most beneficial of them is less risk and less stress.

What Is A Pre

Pre-approval is often spoken about in terms of mortgages and personal loans. Most often, you might receive a letter advising that you have been pre-approved for a loan or credit card while many of these mailshots tend to end up in the recycling, you may be able to consider the offer. But just what is a pre-approved loan?

Essentially pre-approved does not mean that your loan application will be automatically accepted although many people wrongly believe that it does. In fact, this means that the lender is offering a loan pending full approval. In other words, even though you are pre-approved, there is no guarantee that your loan application will be successful.

So, whats the point of being told you are pre-approved? Well, its important to remember that being pre-approved means that the lender may be able to approve your application once you have made a full application. A lender may well have carried out a limited check and identified you as being potentially eligible for a loan or credit card.

In many instances, an invitation for a pre-approved loan means you have already cleared the first hurdle and the lender would welcome an application from you. However, any loan will still be dependent on a full application and you passing more stringent financial checks.

Recommended Reading: Loan License In California

How To Pay Off A Loan Faster

The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest. Paying off the principal is key to shortening a loan. Our Loan Payoff Calculator shows you how much you might save if you increased your monthly payments by 20%.

How Long Will It Take To Pay Off My Loan

When you repay a loan, you pay back the principal or capital as well as interest . Interest growing over time is the really important part: the faster you pay back the principal, the lower the interest amount will be.

E.g. You borrow $40,000 with an interest rate of 4%. The loan is for 15 years. Your monthly payment would be $295.88, meaning that your total interest comes to $13,258.40. But paying an extra $100 a month could mean you repay your loan a whole five years earlier, and only pay $8,855.67 interest. Thats a saving of $4,402!

Play around with our Loan Payoff Calculator, above, to see how overpayments can shorten the length of your loan.

The following guide focuses particularly on student loans, but the tips and advice can apply to all types of loans. So read on to learn how to shorten and shrink your loan.

Read Also: Does Carmax Pre Approval Affect Credit Score