What About Online Car Title Lenders

You will mostly find car title lenders operating from storefronts or online. Online lenders will typically give you a list of title loan stores operating closest to you. To finalize the application process, you must physically present your car, a clear title, proof of insurance, and a photo ID or drivers license. Many lenders will also ask for a duplicate set of your car keys.

To be on the safe side, wherever you go for a car title loan, you need to do two things:

- Carefully review the loan terms before getting one to avoid any unpleasant surprises.

- Be wary of add-ons such as vehicle roadside service plans, which may inflate the cost of your loan.

When a car title loan is approved, the borrower receives the money in their checking account, and the lender keeps the car title. You can only get your title back once you fully pay off the outstanding debt.

Remember that these loans come with more cons than pros. If you cannot repay the loan, the lender can repossess your vehicle, affecting your credit score. If possible, its very important to set up autopay for these loans so that you dont miss payments and lose your vehicle.

What Is The Minimum Credit Score For A $10k Personal Loan

Minimum credit score requirements can vary depending on the lenders. They can also vary depending on the loan amount and terms you are requesting. Most lenders look for at least a credit score of 610. However, with stable income, no recent mispayments, and other positive factors, you may qualify for a $10,000 personal loan with a credit score below 610, but its still not likely. While we can speculate about requirements, every borrower will be evaluated based on their own credit and financial situation. You dont want to waste your time applying but oftentimes, checking offers is one of the only ways to know if you qualify and what you qualify for. You will want to use your judgement to decide if applying for a loan is a waste of time or not.

On the flipside, some lenders may want you to have a score higher than 610. Again, it depends. Some lenders state their minimum credit score requirement online or are willing to share it if you ask. Sometimes if you have a high income or a very low debt-to-income ratio, they will be willing to give you loans even with a bad credit score.

Can I Get A Small Personal Loan With Bad Credit Online

Yes, not only can you get a personal loan with bad credit online, but it may be the quickest and cheapest option available to you. Many online lenders can have you approved and have the funds in your personal account in as little as 24 hours, although funding times can vary. Online lenders usually have less strict requirements than traditional banks. Ultimately though, if you have bad credit, you should seriously consider improving your credit score before applying for a loan. Doing so can increase your chance of approval and should help you qualify for a lower interest rate and maybe even higher loan amount.

ONE HOME, ENDLESS POSSIBILITIES

Your home is a work in progress. Whether you wish to redo, repair or redecorate your home, we can make it all happen with the most effortless financing options.

- HOME IMPROVEMENT FINANCING

- HOME REMODEL FINANCING

- BUILDING FINANCING

Recommended Reading: How To Report Ppp Loan Forgiveness On Tax Return

Can I Apply Personal Loan For Bad Credit With A Co

Applying for a personal loan for bad credit makes you qualify for a lower interest rate. Along with a co-borrower, there are increased chances of approval.

With bad credit, a co-borrower with a good credit history is an add-on to your loan application process.

The applicant can be from your families, such as your spouse or parents. In some cases, your siblings are also considered as co-borrower.

Find Your Personal Loan Despitebad Credit At Fastenloans

We help you compare the best available personal loans and ultimately get the lowest personal loan rates from leading lenders.

We work with lenders that offer 100% transparency and have a long track record of successful lending and satisfied customers. Using our loan comparison tool, you can find the right personal loan and eliminate the hassle and guesswork involved in your borrowing.

| Parameters |

|---|

Also Check: How Many Years Of Service To Qualify For Va Loan

How Soon Can I Receive My Funds

Customers can receive an instant decision when they submit a form and depending on the product, they can sometimes receive funds within 1 hour or the next business day. For products that require extra information like secured loans, you can receive money into your bank account within 1 week of submitting a form.

What Are Poor Credit Loans

Poor credit loans are loans made available to those with low credit scores or a limited credit history due to not having previously taken out loans or other similar factors.

NHCash.com does not have a minimum credit score requirement. As such, no credit score is too low to receive an approval for an NHCash revolving line of credit.

You May Like: How To Figure Interest Rate On Auto Loan

Viva Payday Loans: Best Overall For Bad Credit Loans Up To $5000

Quick Ratings

- Acceptance Rate: 7/10

- Customer Support: 8/10

Unlike other bad credit loans, those via Viva Payday Loans arent limited to a measly few hundred dollars. Instead, borrowers looking to purchase luxury items or eliminate costly repair bills can apply for loans of $100 up to $5000. In addition, bad credit loans have easy repayment options from 3 months up to 2 years which helps spread the cost and allows for better budgeting. Furthermore, you wont endure eyewatering interest rates as these range from 5.99% to 35.99%, meaning higher value bad credit loans wont cost the proverbial earth.

Highlights of Bad Credit Loans Up to $5000 From Viva Payday Loans

- 2-year repayment terms offered

Eligibility Requirements of Bad Credit Loans up to $5000

- Income: $250 weekly/ $1000 monthly

- Minimum age: > 18 yrs

- Supporting evidence

Fees and Interest on Bad Credit Loans Up to $5000

- 5.99% 35.99% APR

- Missed payments attract penalties.

What Is The Easiest Type Of Loan To Get With Bad Credit

The easiest types of loans to get with bad credit are typically no-credit-check loans, including payday, title and pawnshop loans. However, these debts come with excessive fees, and we recommend avoiding them. Instead, lean into personal loans for bad credit, like those on this list. Some lenders make loans available to applicants with credit scores as low as 550.

Don’t Miss: Best Lenders For Home Loans

Lending Networks For Bad Credit Personal Loans

The following three companies can find you a personal loan from a direct lender that is matched to your request and qualifying criteria. There is no credit check involved to see your loan offers. These networks specialize in helping bad credit borrowers and charge no finders fees.

| 3 to 72 Months |

See representative example |

PersonalLoans.com is a large network dedicated to helping consumers of all credit types, not just those who have bad credit. As such, only borrowers with good credit will qualify for the top loan amount available, but people with poor credit are welcome to apply and see what they may qualify for with no credit check.

How To Complete The Tower Loan Application Process

When we tell new customers that they can apply for our loans online in as little as 10 minutes, were often met with a skeptical look. But its true.

At Tower Loan, we pride ourselves on keeping our application process as straightforward as possible.

To apply for a loan online, simply follow these three easy steps:

Before beginning your online application, however, we encourage you to review our requirements below. These are mandatory prerequisites that we require from all applicants.

Application Requirements

- Applicants must be at least 18 years of age

- Must reside in one of the areas Tower Loan services

- Must be employed or have a regular source of income

- Must have a valid email address and a savings/checking account

Don’t Miss: Do I Have An Fha Loan

How Long Will It Take To Pay Off A $10000 Personal Loan

How long it will take to pay off a $10,000 personal loan can depend on how much you can afford per month. Most lenders offer 3 to 5-year terms for smaller loans but some lenders may offer up to 12 years. Finding the lowest interest rate possible can help you pay the loan off faster. So how will you know you have a fair interest rate? What is the average interest rate on a personal loan? Depending on your location, the average interest rate can vary. In California, the average is around 10.26%. In Hawaii, the average interest rate is around 6.76%, which is one of the lowest averages. In most places, the average is somewhere between 9% to 11%.

How Do You Fix Bad Credit To Get A Better Loan

If you know you have bad credit and are preparing to apply for a loan, take time to improve your credit score. Some common ways to do that include paying off your existing debts, reducing your overall credit usage, disputing any errors on your credit report and reducing the number of new credit applications made in a short period of time.

Don’t Miss: What Is Refinance Auto Loan

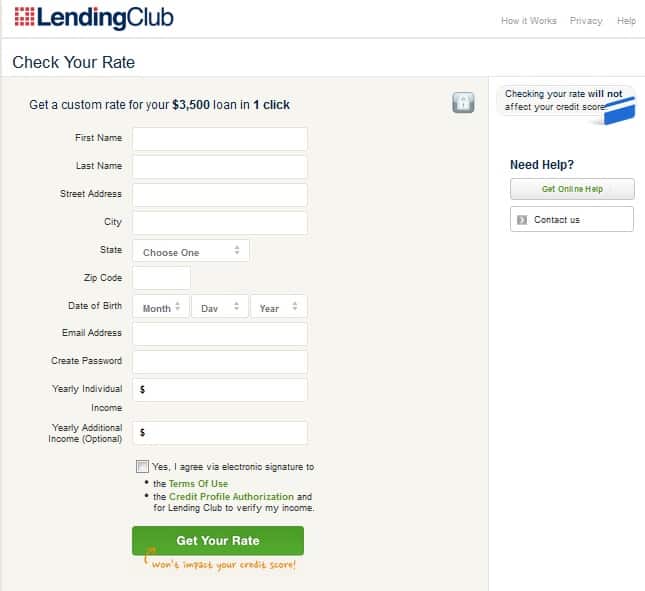

Compare Offers To Find The Best Loan

As you begin to search for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. This comparison tool asks you 16 questions, including your annual income, date of birth and Social Security number in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your credit score.

This tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial and it may use this information in accordance with its own privacy policies and terms of service. By submitting your information, you agree to receive emails from Even. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

What Is A Bad Credit Online Loan

The credit industry has made significant strides in providing loans to consumers with poor credit. You can now apply online for a wide array of loans even if your credit score is less than good . A low score results from problems youve experienced paying your bills and/or having too much debt.

If you wonder where your credit score comes from, the answer is the three major credit bureaus . Each bureau collects data from creditors, lenders, and other data furnishers to compile the information into a monthly credit report on which your credit score is based.

The information providers are mainly creditors that track your loan activity, including new accounts, debt amounts, and payment history. The two most important things you can do to improve bad credit are make timely payments and reduce your overall use of credit.

FICO, the predominant credit scoring model, bases 35% of your score on your payment history. You should see your score slowly rise if you consistently pay on time.

But missed and late payments can rapidly send your credit score plunging. The credit bureaus track payments that are 30 or more days late and record them in your credit report, where they remain for seven years.

Missed payments can forewarn more severe problems that may result in the lender writing off your account. These unfortunate events can remain on your credit reports for up to 10 years, hampering your access to new credit.

Read Also: Can You Use Fha Loan For Investment Property

Lending Process Of Bad Credit Personal Loans

Unlike loans from the bank or mainstream lenders, one can apply online for bad credit personal loans. Our partner lenders usually provide quick approval. An individual will not be judged based on their credit score in order to qualify for a bad credit loan. Instead, their income or job status becomes the major factor of consideration. Once the individual has passed the loan application approval stage, cash will be deposited into their account. The person also agrees to the loan terms as part of the approval.

Bad Credit Loans From Slick Cash Loan

It happens to everyone: you need urgent cash to handle emergencies that arise suddenly. For example, an emergency could be in the form of an unexpected medical bill or roof repair. On the other hand, you may need some money to fix your car. Whatever the reason, bad credit loans from Slick Cash Loan can help you get the cash you need to respond to an emergency.

Folks with bad credit have very limited options when it comes to access to quick cash. Most American households have under $1,000 in savings at any given time. And with minimal savings, paying for unplanned bills or living expenses is quite challenging. And this is where personal loans for people with bad credit come in handy.

Don’t Miss: Usda Loan Forgiveness Update 2022

Final Thoughts On Bad Credit Loans

If you’ve stuck with us to the end, then we hope that our review of the best bad credit loans gave you some valuable information. However, when it comes right down to it, the final decision is yours to make. If you don’t find yourself amenable to the terms of your loan offer, then don’t accept it.

Remember, personal loans may provide a short-term solution, but don’t kid yourself: You’re still taking on more debt. So no matter what kind of financial emergency you find yourself in, spend the time conducting quality research and rate comparisons, then consider every available option.

*This article is provided by an advertiser and not necessarily written by a financial advisor. Investors should do their own research on products and services and contact a financial advisor before opening accounts or moving money. Individual results will vary. Foreign companies and investment opportunities may not provide the same safeguards as U.S. companies. Before engaging with a company, research the laws and the regulations around that service, and make certain the company is in compliance. For comprehensive guidance on U.S. investments and financial regulations, visit the Securities and Exchange Commission âs Investor.gov.

Monthly Installments And Term

- The monthly installment is the amount of money you pay to the lender every month. Monthly installments are calculated by adding the principal amount and the total interest. Then, divide the sum by the total amount of months you will take to repay your loan fully.

- The term is the total number of months you will take to repay the loan. Before you apply for any personal loan for bad credit, you need to check at least the term and the interest rate to determine if you will be comfortable repaying the loan. With Slick Cash Loan, you will get a highly customized term to ensure that you repay your loan effectively.

Read Also: What Is Difference Between Secured Loan And Unsecured Loan

Can I Get A Same Day Loan With Bad Credit

Online loans for bad credit same day applications are typically processed the day the application is submitted. Once the application form is completed online and the submit button is pressed, the borrower can expect feedback in about 2 minutes. From there, the chosen lender will review and process the loan application, and in most cases, disbursement is made within 24 to 48 hours or as soon as reasonably possible.

Factors To Consider Before Choosing Loans For Bad Credit With Instant Approval

There are a few factors to consider before choosing loans for bad credit with instant approval decisions.

Don’t Miss: What Are The Qualifications For Rural Development Loan

What Documents Do I Need To Apply For A Personal Loan

When you apply for a personal loan, the lender will likely ask you to submit some documentation. The specific documents requested will depend on the lender but could include:

-

Personal identification, such as a government-issued ID

-

Social Security card, to verify your identity

-

Income verification, such as tax returns or pay stubs

-

Bank statements, to further demonstrate your income

Be sure to read any documentation requests from the lender carefully this way, you can make sure you submit the most accurate information possible.