Limitations On Loan Amount Allowed

You can take out a mortgage for an expensive house if a lender deems you creditworthy. However, if you decide to apply for an FHA loan, be aware that there are limitations on how much money you can borrow on FHA loans. Loan limitations do vary a little from county to county based on the cost of living. Loan limitations also go up regularly to keep up with the cost of living. In 2019, the loan limit ceiling is $726,525 in high-cost areas, while the floor is $317,827.

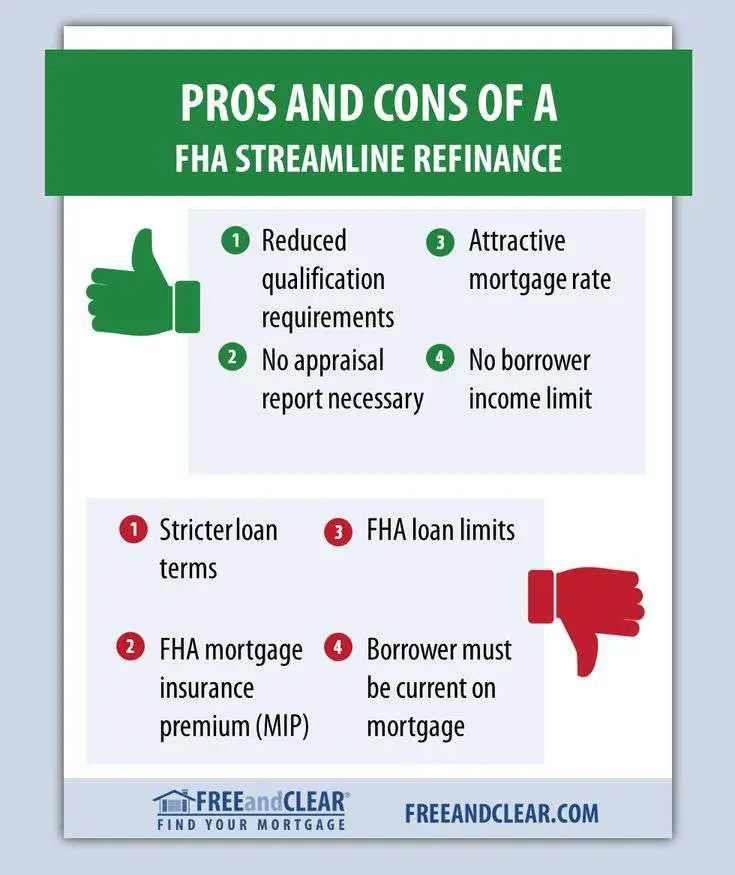

The Cons Of Fha Loans

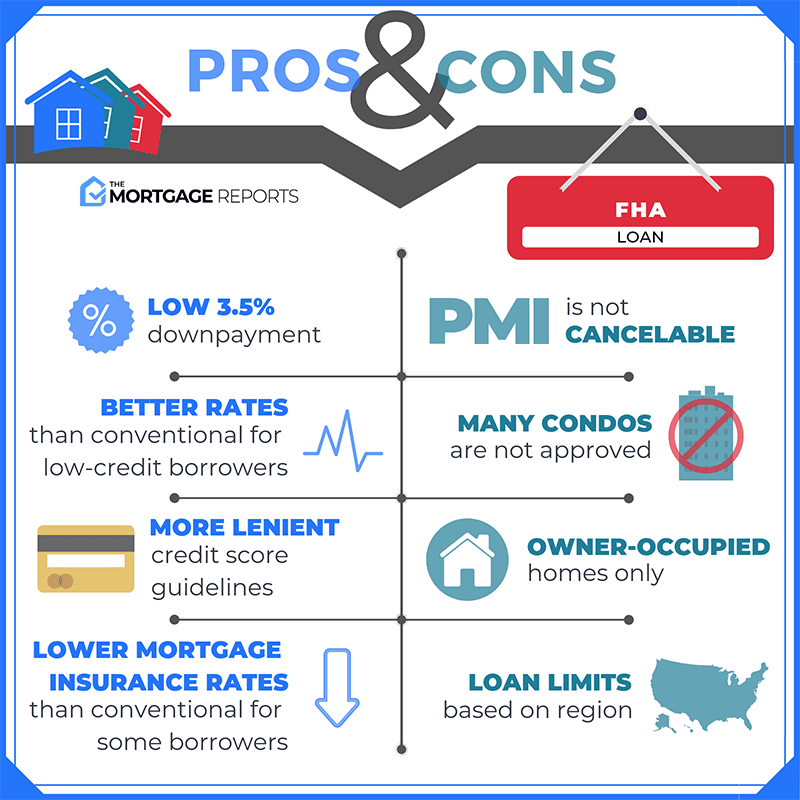

- Mortgage insurance. No, you don’t have to pay PMI. But FHA loans do come with a different type of mortgage insurance premium that comes to 1.75% of your loan at closing. Then you’ll pay an annual premium of 0.45% to 1.05% of your mortgage. If you’re on the fence between choosing a conventional mortgage or FHA loan, do the math to see whether PMI or FHA mortgage insurance will be more affordable.

- Minimum 3.5% down payment. This is still a relatively low minimum down payment. But if you’re struggling to come up with 3.5%, consider looking into a USDA or VA loan. These are two other government-backed loans, and if you qualify, you might not need a down payment at all.

- Borrowing limits. FHA loans restrict you to borrowing under a certain amount, which could keep you from buying a home you like.

- Minimum property standards. You won’t be approved for an FHA loan if your home has significant structural or safety issues, or if it’s in a loud area. These restrictions could prevent you from buying a major fixer-upper or a home in a certain area.

You may think you don’t qualify to buy a home, but an FHA mortgage makes it possible even if your finances aren’t as strong as you’d like.

How Do Fha Loans Differ From Conventional Loans

Before we explore the pros and cons of FHA loans, its helpful to take a look at the most popular loan type: conventional loans.

Unlike FHA loans, conventional loans are not backed by the government, so theyre a bit more difficult to qualify for.

Private mortgage lenders, such as banks or other financial institutions, offer conventional loans to borrowers with good credit and low debt levels.

The stricter lending requirements can make them more difficult for first-time buyers or buyers with not-so-great credit.

Generally, conventional loans require a minimum credit score of at least 620, but this varies by lender.

Read Also: Fair Credit Loans Guaranteed Approval

The Cons Of Getting A Federal Housing Administration Loan

Despite its numerous benefits, there are some downsides to using an FHA loan to purchase a home.

FHA Mortgage Insurance

Securing an FHA loan is less stringent than a standard conventional loan. As a result, FHA borrowers are required to pay upfront and annual mortgage insurance premiums . A borrowers MIP is used to cover the Federal Housing Administrations risk of providing home mortgages with lower financial requirements.

The MIP for an FHA loan is 1.75% of the borrowers loan amount for the upfront MIP cost and between 0.45% to 1% annually for the life of the FHA loan. In addition, unless a borrower provides a 10 percent down payment, the MIP for an FHA loan does not expire.

FHA Property Approval

To purchase a home with an FHA loan, a home must meet FHA standards for build and safety quality. Prospective homes for an FHA loan cannot have major build issues that the FHA considers unlivable. These standards are often higher than those required by a conventional loan and may cost you to lose out on your dream home.

Home Borrowing Limits

The FHA has a limit on maximum mortgage amounts that borrowers are allowed to secure. However, this limit is adjusted by location. If you live in an area with a high average home cost, the FHA mortgage limit will be higher than in places with low average home costs.

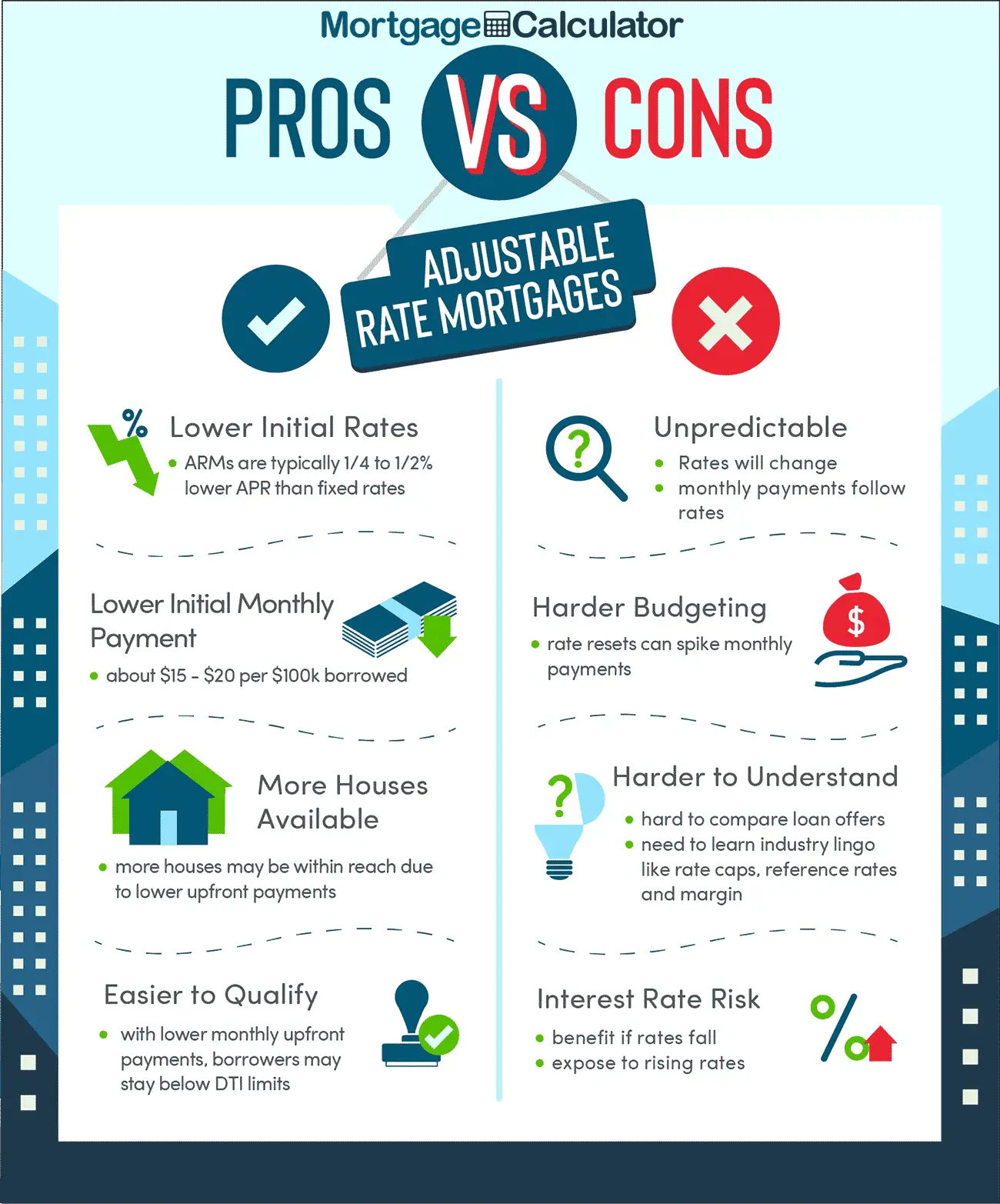

You May Have To Pay Higher Interest Rates

There is a misconception that all FHA loans have lower interest rates compared to conventional loans, however, this is not always the case. The loan type that you get, whether FHA or conventional, does not dictate the interest rate of your mortgage. Rather, it will still be your credit score that will influence the best rate that you can get.

Those who have low credit scores might find that FHA loans could offer better mortgage rates. On the other hand, if your credit score is very good or excellent , it is possible to find a better rate with a conventional loan.

You May Like: How To Check If Loan Is Fannie Or Freddie

Pros And Cons Of Fha Loans: 17 Myths Busted

Learning the pros and cons of FHA loans will help you figure out if this 3.5% down mortgage is right for you.

Est. Read Time:Homeownership Insights Podcast

If you want to fast-track your path to homeownership, an FHA loan is worth a look. These government-backed loans help homebuyers become homeowners with credit scores as low as 580 and just 3.5% down.

Unfortunately, these low down payment loans have been stigmatized as only being for folks with bad credit. Theyâve also gotten a bad rap because of the minimum property requirements set by the FHA.

Hereâs the thing: No loan program is perfect for everyone. An FHA loan has pros and cons, just like a conventional or USDA loan.

But FHA loans make sense for a lot of borrowers, and not just those with low credit.

In fact, some borrowers who qualify for both FHA and conventional loans could save thousands of dollars over the life of their loans by going FHA if their credit scores fall below 680.

Thatâs why weâre going to give you the Fairway version of MythBusters and dispel 17 common misconceptions about FHA loans.

Can I Acquire An Fha Loan With Student Debt

In short, yes, you can still qualify for an FHA mortgage even if you have outstanding student debt, though it may present some challenges. If youre making monthly payments toward your student loans, this will limit how much money you can borrow by affecting your DTI.

Since your debt-to-income ratio is calculated using your total monthly debts, lenders will have to take your student loan payments into consideration, and depending on your debt, you may have to apply for a smaller mortgage.

Read Also: How Much Is Va Loan Interest Rate

Bottom Line: Is It A Good Idea To Get An Fha Loan

Whether an FHA loan is right for you will depend on your specific situation. According to the Consumer Financial Protection Bureau, for borrowers with fair or poor credit scores or less money for a down payment, FHA loans are normally less expensive than conventional loans.

On the other hand, if you have good credit and at least 10% for a down payment, an FHA loan may be more expensive than a conventional loan. If you are considering an FHA loan, make sure you check offers from multiple lenders. Remember that the FHA sets minimum eligibility standards, but each lender has its own specific approval requirements, rates and fees.

What Are The Downsides Of Fha Loans

FHA loans may have great benefits for borrowers but there are downsides to this option too. It is always smart to know both the pros and the cons before you make your final decision.

- There Are Loan Limits There will be limits on how much you can borrow for a mortgage with an FHA loan. The amount varies depending on where in the country you want to buy. Limits are generally quite high but it is a good idea to know ahead of time how much house you can afford.

- Mortgage Insurance is Required FHA mortgage insurance is built into every loan granted. The premium is charged monthly and is sometimes twice the amount you would pay with a traditional loan. With a down payment of less than 10 percent, you will have to continue to pay the mortgage insurance for the life of the loan.

- Minimum Property Requirements The home you are buying must meet certain requirements after a mandatory appraisal by the FHA. This is separate from the usual home inspection process and determines standards of livability and basic safety.

Also Check: Guaranteed Loans No Credit Check

What Is An Fha 203 Loan

The FHA 203 is a mortgage loan that helps borrowers with low credit scores achieve homeownership or a home refinance. The loan originates from an FHA-approved lender and is guaranteed by the Federal Housing Administration. To qualify, those with scores between 500 and 579 must put 10% down, while borrowers with scores of 580 and above can make the minimum 3.5% down payment.

Your Credit Report Options

Lenders check the credit reports of borrowers to determine how financially responsible and how financially capable they are of making loan payments on time and in full. One of the most important elements of the credit report is the credit score, which provides lenders with an overall view of how creditworthy a borrower is. For conventional home loans, most lenders require borrowers to have a credit score of at least 640. Credit score requirements are much less restrictive when it comes to FHA loans. Borrowers who have a credit score of 500 or above will still qualify for an FHA loanand those with a credit score of at least 580 will be able to access maximum financing.

Another thing lenders look for when pursuing your credit report is your debt-to-income ratio. This shows them how much money you make versus how much debt you have. If the debt-to-income ratio is too large, theyll determine that you will not be able to take on more debt via a home loan. The highest debt-to-income ratio typically accepted by lenders on a conventional loan is 43 percent, although they do take into account certain additional factors when looking at a borrowers debt-to-income ratio as well, such as any cash reserves they might have as well as high credit scores. With FHA loans, the maximum debt-to-income ratio accepted is 50 percent .

Also Check: Bank Of America Rv Loans

Fha Home Loans Allow Lower Credit Scores

Unlike many mortgage products, buyers with less than perfect credit scores are able to obtain an FHA loan. Ideally, FHA is looking for buyers with credit scores greater than 620, however, there are circumstances that allow buyers with a 580 credit score or greater to obtain a home loan.

One of the most important steps to buying a house is to understand your credit score and history before shopping for a mortgage. Credit scores do have an impact on a buyers ability to get a mortgage and also the interest rate theyre offered.

Bottom line, another benefit to FHA home loans is that they to still give the buyers the opportunity to obtain financing to purchase a home even with a lower credit score.

Benefits Of Fha Loans

An FHA loan is a government-backed mortgage option that gets its namesake by being insured by the Federal Housing Administration . Since FHA loans are insured by the government, lenders feel more comfortable taking on riskier borrowers, which can grant you, the borrower, more leniency when it comes to meeting certain loan qualifications, like credit score and debt-to-income ratio . Simply put, you may still qualify for an FHA loan without having to be the perfect financial candidate.

For some, this added flexibility on loan qualifications may be just enough to help finally become a homeowner, but for others, a conventional loan could serve their needs perfectly well. Lets break down exactly what FHA loans can offer their borrowers and further explore in which cases an FHA loan might be right for you.

Read Also: Which Car Loan Companies Use Transunion

Health And Safety Guidelines

While other loan plans only consider home values, FHA loans have quite ambiguous regulations. The homes must go through several checks to ensure they are not faulty in any way. Inspections are done to uncover any irregularity in the house, including decay and leaks. Without these defections being rectified, the FHA loan approval can be difficult. Health and safety guidelines should be attained.

The Pros Of Fha Loans

- More lenient borrowing requirements. FHA loans’ requirements surrounding credit scores, debt-to-income ratios, and down payments are more lax than conventional loans’ stipulations. This means you can own a home even if your finances aren’t in perfect shape.

- No income limits. Government-sponsored mortgage companies Fannie Mae and Freddie Mac offer conventional mortgages with just 3% down. These can be great loans, but you don’t qualify if your income is high compared to the median income in your area. But you can be eligible for an FHA loan regardless of your income level.

- No private mortgage insurance.Conventional mortgages require you to get PMI if you have less than 20% for a down payment. PMI typically costs between 0.2% and 2% of your mortgage amount, according to insurance-comparison website Policygenius. But you dont need PMI with FHA loans.

You May Like: What Is Federal Loan Forgiveness

Myth : Fha Loans Allow The Lowest Down Payment

FHA loans offer a pretty good deal with the 3.5% down payment option. But theyâre actually not the lowest down payment option out there.

VA loans and USDA loans both allow eligible borrowers to buy homes with 0% down â and it doesnât get much better than that. Some conventional loan programs allow you to buy a home with just 3% down.

Fortunately, the FHA allows borrowers to use gift funds and closing cost assistance to cover all of their upfront costs, including the down payment and closing costs. So you could get an FHA loan with no money down if you have family, friend, or employer gifts or you qualify for down payment assistance.**

Con: Less Attractive Offer

In a hot market, when homeowners are receiving many offers on their property, a FHA loan may actually keep your offer from being accepted. This is because FHA loans have stricter requirements for the seller, including multiple home inspections. Some sellers simply view the FHA loan as a hassle they don’t want to deal with.

Read Also: How To Calculate Home Loan Amount

What Is A Community Bank

Community banks are commonly defined as individual banks that have less than $1 billion in assets, while community banking organizations generally are those with under $10 billion in assets. There were 4,750 community banks in the U.S. with more than 29,000 branches in 2019, according to the latest FDIC data.

Since community banks are often privately owned, they tend to focus on their communities interests rather than capital market demands, according to the FDIC.

What Are The Downsides Of An Fha Loan

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the life of the loan if you make the minimum 3.5% down payment. FHA county loan limits also curtail your buying power, since theyre set at 35% below conforming conventional loan limits in most counties across the U.S.

Recommended Reading: How To Calculate Dti For Home Loan

Myth 1: You Cant Get An Fha Loan If Youve Had A Foreclosure

Borrowers can apply for an FHA loan if theyâve owned a property that has gone through foreclosure. However, youâll likely have to wait three years to qualify, unless you can prove that:

- The foreclosure was caused by circumstances beyond your control

- The foreclosure was caused by the serious illness or death of a wage earner

- The foreclosure occurred because your ex-spouse got the house in the divorce and the house went into foreclosure after that point

Generally speaking, however, divorce is not considered a valid reason for waiving the waiting period. If the property went into foreclosure because you couldnât sell it while relocating for personal or professional reasons, the FHA does not consider that an extenuating circumstance either.

Who Qualifies For An Fha Loan

The FHA regulates and insures FHA loans, but you get an FHA loan from a private, FHA-approved lender. Lenders can differ slightly in some of their requirements.

Lenders consider several factors when determining your interest rate.

- An FHA loan requires a minimum credit score of at least 500.

- Down payment: A down payment of at least 3.5% is required for borrowers with credit scores over 580. For borrowers with scores between 500 and 579, there is a 10% down payment requirement.

- Debt-to-income ratio: This type of loan usually requires a debt-to-income ratio of 50% or less.

- Borrowing limits: Loan limits vary by location. In low-cost areas, the limit is $356,362. The limit can reach $822,375 in high-cost areas.

Theres no income requirement for an FHA loan, but the lender will require you to show proof of stable employment. The property you are seeking a loan for must meet FHA property standards, and you must plan for the home to be your primary residence.

Recommended Reading: How Much Auto Loan Will I Qualify For

Fha Loans With Total Mortgage

There are many FHA advantages and disadvantages to consider, but the choice you make depends on your financial situation. If you dont have the best credit history or you dont have much cash to put down, then an FHA mortgage loan may be an option worth considering.

Total Mortgage currently offers 15, 20, 25, or 30-year fixed-rate FHA mortgages. FHA adjustable-rate mortgages are also available.

Apply today for an FHA loan with Total Mortgage and well close your new purchase in 21 days or less.