What Is The Difference Between Apr And Interest Rate

- Main

-

Your interest rate is the direct charge for borrowing money.The APR, however, reflects the entire cost of your mortgage as a yearly rate and includes the interest rate, origination charge, discount points, and other costs such as lender fees, processing costs, documentation fees, prepaid mortgage interest and upfront and monthly mortgage insurance premium. When comparing loans across different lenders, it is best to use the quoted APRs for the same type and term of loan.

What Is A Cash

With cash-out refinancing, you refinance your mortgage with a mortgage that is larger than the amount you still owe on the original mortgage and then you keep the difference. Cash-out refinancing differs from home equity loans in that you are actually taking out a new mortgage and not simply taking a loan off the equity youve built up on your property.

One thing to keep in mind with cash-out refinancing is that you will still need to collect all the documentation you would for a mortgage, including proof that you can keep up with the payments.

Why You Need A Mortgage Calculator

Buying a home is one of the biggest decisions you will ever make. Not only are you choosing a home for you and your family to live in for years to come, but you are also entering into a major financial commitment, and its important to know what you are getting into. Using a home loan calculator to calculate your estimated mortgage payments is a very important step on your journey to your new home. This way, you can calculate your expected mortgage payments and determine just how much house you can afford, and also avoid falling in love with a house that is outside your realistic price range.

Using a home loan calculator will also help you set your budget upfront, so you can narrow down your search when the time comes for you to choose your dream house.

Our mortgage calculator can help you do just that. Simply put in your loan amount and expected loan term, and our loan interest calculator will direct you only to the most relevant results.

Read Also: Loans You Don’t Have To Pay Back

How Do Home Equity Loans Differ From Mortgages

Both home equity loans and cash-out refinance loans use your home as collateral. But there are some major differences to keep in mind:

- Terms: A cash-out refinance loan is a type of mortgage. Like conventional mortgages, they usually have terms of 15 or 30 years.

- Closing costs: Although home equity loans tend to be more expensive than mortgages, they usually have lower closing costs.

- Home equity loans usually have fixed interest rates. Cash-out refinance loans, like other mortgages, can be fixed- or adjustable-rate mortgages.

How Does A Cash

With a cash-out refinance , you can borrow over 100% of the equity on your house. For instance, lets say you owe $150,000 on a $300,000 house. This means you have $150,000 of equity in your home. With a cash-out refinance you could borrow $200,000, replace your mortgage with the cash-out refinance, and have $50,000 left over to use as you see fit.

Also Check: What Kind Of House Loan Can I Get

Pros And Cons Of Helocs

HELOCs offer a combination of relatively low interest rates and the flexibility to borrow what you need when you need it. If you need money over a staggered period, a line of credit is ideal. However, there are always risks when you take out a loan, especially one that’s secured by your home. Here are some of the key considerations for getting a HELOC.

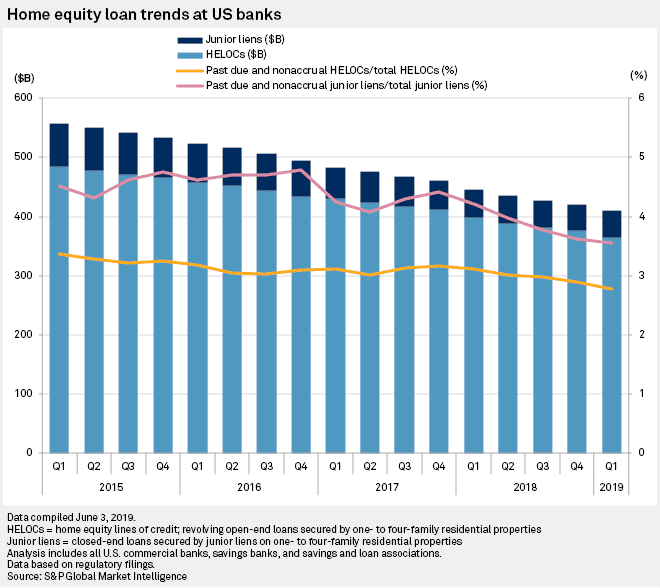

Average Home Equity Rates Over Time

While average home equity rates are significantly lower than they were 10 years ago, theyre trending upward. Take a look at how rates on home equity financing have changed over the last decade.

| Year | |

|---|---|

| 2010 | 6.75% |

Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80% for a 15-year home equity loan.

You May Like: Can I Pay Off My Child’s Student Loan

How Do I Apply For A Heloc

You have to be approved for a HELOC by a bank or lender just like with your mortgage. You will need to provide financial documents like pay stubs and information about your home’s value, like your loan-to-value ratio. Lenders will also run a credit check before approving you.

In some cases, you may need to have your home appraised to confirm its current market value. It’s important to interview multiple lenders to compare rates and fees in order to find one who will give you the best rates. Some experts recommend starting with the bank or lender that already holds your mortgage, but shopping around can help you compare offers.

Low Competitive Home Equity Rates Plus:

No application fees, no closing costs and no annual fee

There’s no fee to apply, no closing costs and no annual fee. There’s also no fee to convert your variable-rate balance to a Fixed-Rate Loan Option.

Online application

Submitting your application takes about 15 minutes. When you’re done, we’ll show you how to check your application status and securely upload documents.

Convenient access to funds

You have the flexibility to decide when and how much to use through Online Banking, by phone, at our financial centers or with no-access-fee checks.

Mobile & Online Banking

Manage your account, make payments and transfer funds using our top-rated Mobile Banking app and Online Banking.

Also Check: Are Va Loan Interest Rates Lower

Loan Closing And Disbursement Of Funds

At closing we will require all applicants to provide two forms of identification one must be a valid photo ID. After reviewing the terms and conditions of your line of credit, you will be asked to acknowledge and accept those terms and conditions by signing loan documents.

When using a primary residence as collateral, a three business day right to cancel period is required by law to allow applicants the opportunity to cancel their home equity line of credit application.

Once your right to cancel period has expired, the funds from your home equity line of credit will be available.

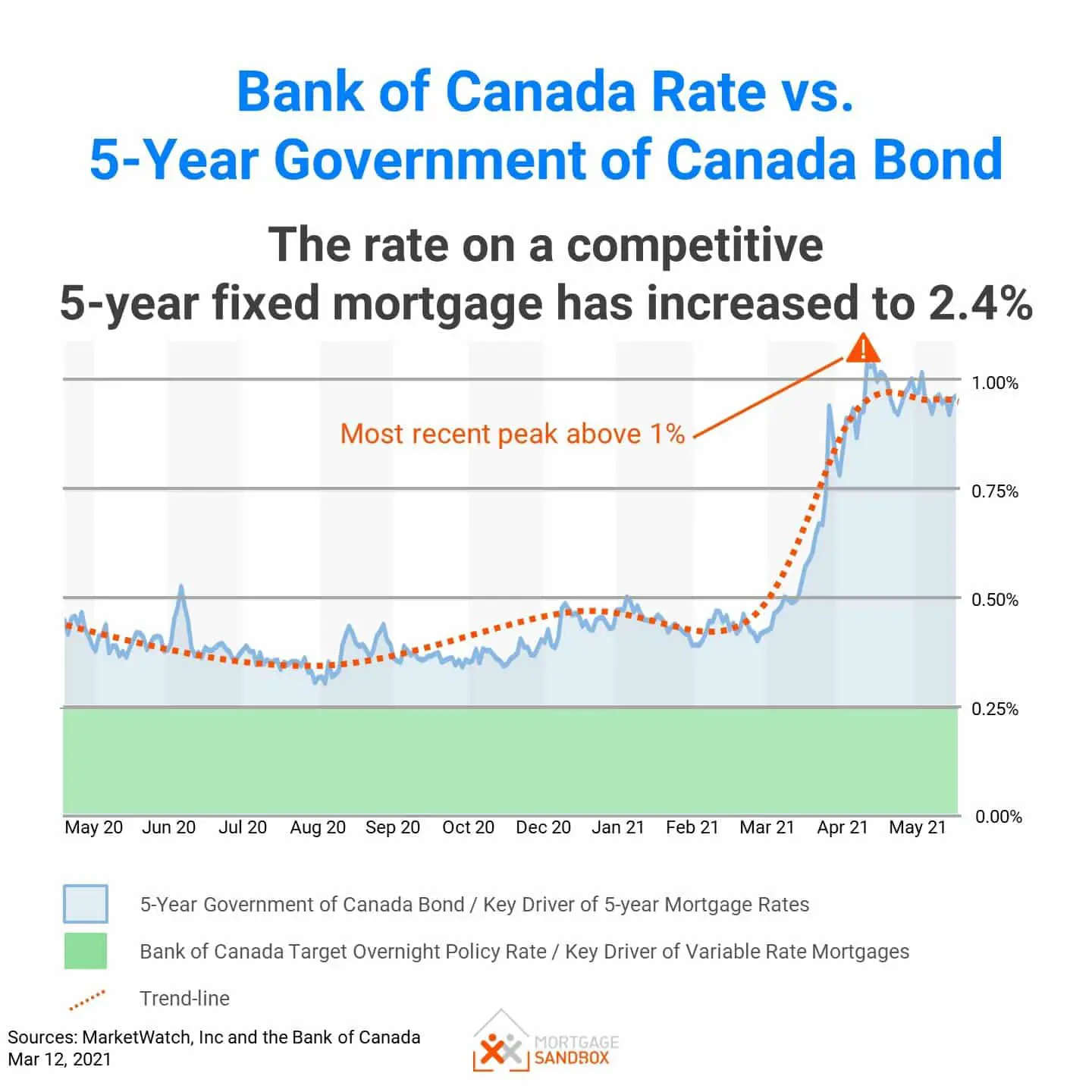

Today’s Current Mortgage Interest Rates

While mortgage lenders requirements have grown significantly stricter in recent years, the COVID-19 pandemic has led to extremely low-interest rates on mortgages. Even a fraction of a percentage point can lead to thousands or tens of thousands of dollars in savings over the term of a mortgage.

Mortgage rates can vary widely depending on various criteria, such as your credit history and the value of your new home, along with market conditions.

Also Check: How To Obtain Student Loan Account Number

How To Get Home Equity Financing

Have a good grip on your financial situation before you apply for a home equity loan or HELOC. Ensuring you have a plan for how youre going to pay it back is crucial to protecting your most valuable asset: your home.

Choose a lender you can trust, says Cook. Youll want to shop around with a few different lenders to see who offers the best rates.

From there, youll fill out an application through your chosen lender and complete the verification process. It may take a few weeks for you to have access to your loan or line of credit.

A Home Equity Loan Is Better If:

- You want a fixed-rate payment: Your monthly payment will never change even if interest rates rise.

- You want one lump sum of money: You receive the entire loan upfront with a home equity loan.

- You know the exact amount of money you need: If you know the amount you need and don’t expect it to change, a home equity loan likely makes more sense than a HELOC.

You May Like: How Do I Know How Much Loan I Qualify For

How To Use Home Equity

Home equity loans and HELOCs can be used for multiple purposes. The most common uses are for home improvements which can boost the value of your home over time and debt consolidation. Using home equity to consolidate debt can be risky if you dont address the behavior that got you into debt. You dont want to run into the same problem down the road.

Be thoughtful about how you tap into your home equity. Do your homework before you make the big decision, Cook says.

Make sure you ask questions upfront to understand what rates and fees are associated with your loan options, Cook says. What you really want is a true apples-to-apples comparison. Sometimes theres so much fixation on the rate that people forget about some of the fees associated with these products.

Is A Heloc Tax Deductible

Interest paid on a HELOC is tax deductible as long as its used to buy, build or substantially improve the taxpayers home that secures the loan, according to the IRS. Interest is capped at $750,000 on home loans . So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed.

If you are using a HELOC for any purpose other than home improvement , you cannot deduct interest under the tax law.

Don’t Miss: How Much Deposit For Fha Loan

How To Apply For A Heloc

With most HELOC lenders, you can generally get the application process started in just a few minutes online. Youll simply enter some personal and financial information, such as your name, address, salary, desired loan amount and estimated credit score.

To apply for a HELOC, start with these steps:

Getting A Home Equity Loan With Bad Credit

If you have poor credit, you may have a harder time getting approved for a loan, but it is still possible. If you’re interested in applying for a bad-credit home equity loan, the first step is to shop around with a few lenders. Since each lender has its own requirements, it’s possible one lender will be more accepting of a poorer credit score and offer better rates than a similar lender.

Generally, you’ll have to meet the following criteria to qualify for a home equity loan:

- At least 15 percent to 20 percent equity in your home

- A minimum credit score of 620

- On-time bill payment history

- Stable employment or income history

If you don’t meet the requirements, you may want to consider getting a co-signer to increase your chances of approval.

Don’t Miss: What Are Current Auto Loan Rates

Home Equity Loans: A Complete Guide

Home equity loans are a useful way to tap into the equity of your home to obtain funds when your assets are tied up in your property. Theyre generally offered at lower interest rates than other forms of consumer loans because they are secured by your home, just like your primary mortgage.

Read on to learn more about home equity loans and other ways to take advantage of your equity to decide if this loan option is right for you.

Home Equity Loan Vs Heloc For Bad Credit

Because home equity loans and HELOCs both use your home as collateral, they are both viable options if you have poor credit it will likely be easier to qualify for a home equity product than, say, an unsecured personal loan.

However, it’s still important to consider which option is right for your financial situation, especially if your poor credit is a result of missed payments. If you know that you would benefit from a structured monthly budget, a home equity loan is the right option. If you would rather focus on keeping your debt low, a HELOC will allow you to take out only as much as you need and pay it back on a more flexible timeline.

If you’ve shopped around at different lenders, have considered getting a co-signer and still aren’t sure if you’ll get approved due to your credit score, you still have options. Consider why you’re interested in taking out a loan. Do you need the funds immediately? Will this help you or hurt you in the long run by racking up more debt?

If you’re having trouble getting approved, take some time to improve your credit score. It’s also important to decide how a loan could impact your credit score in the future because you’ll be taking on more debt with both a home equity loan or a HELOC.

Don’t Miss: Can Loan Companies See Other Loans

How Do I Apply For A Home Equity Loan

Applying for a home equity loan is similar to applying for a mortgage. You need to qualify with a lender or bank who is willing to lend you the money. First, the lender will first want to make sure you have at least 15% to 20% equity in your home. If you do, the lender will take into account your credit score , your income and your current debt-to-income ratio to determine whether you qualify and what your interest rate will be. You should be prepared to have financial documents like pay stubs and W2s in order, as well as proof of ownership and proof of the appraised value of your home. It’s important to interview multiple lenders to determine which lender can offer you the lowest rates and fees.

Conventional Home Equity Loan

This is an excellent option if you are looking for a lump-sum payment. It is a second mortgage that is secured by the equity in your home and provides funds in a lump sum at a fixed rate for a fixed term .

Use the funds to finance a home improvement project, replace the roof on your home, consolidate your debts, pay off a large unexpected expense, and so on. Repay the loan in budget-friendly fixed monthly payments, just like your original mortgage.

Recommended Reading: Usaa Pre Approval Car Loan

What Can I Use A Home Equity Loan For

Home equity loans can be used for anything you choose to spend the money on. Typical life expenses that people usually take out home equity loans to cover are expenditures like home renovations, higher education costs like tuition or to pay off high-interest debt like credit card debt. There’s a bonus for home improvements: If you use a home equity loan for renovations, the interest is tax deductible.

You can also use a home equity loan in an emergency situation or for life events like weddings. But keep in mind that whatever you chose to use a loan for, taking out a large sum of money that accrues interest is an expensive choice you should always carefully consider especially since you’re using your home as collateral to secure the loan. If you can’t pay it back, the lender could seize your home to repay your debt.

How Rising Mortgage Rates Affect Home Equity Loans

The Federal Reserve has raised interest rates in 2022 to combat inflation, and its likely these increases will continue for the time being. This action from the Fed has influenced rising home equity rates. Because home equity loans typically have fixed rates, it might be a good idea to lock in a rate sooner rather than later to avoid higher costs if rates continue to rise.

Also Check: Fha Loan Mobile Home Requirements

Best Home Equity Loan Rates In September 2022

The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Each lender will evaluate your eligibility differently, so shopping around can help you find the best offer. Your rate will depend on your credit score, income, home equity and more, with the lowest rates going to the most creditworthy borrowers.

| LOAN TYPE | |

|---|---|

| Starting at 5.25% | Customer experiences |

How Is My Home Equity Loan Amount Calculated

If youre a numbers person, here are the steps youd take to calculate the home equity loan amount with a maximum 85% LTV ratio on a $400,000 home with a $300,000 mortgage balance.

Read Also: How Much Can I Borrow For Home Improvement Loan

How To Qualify For A Heloc

The basic requirement of a HELOC is that you own your home. At most, lenders permit homeowners to borrow up to a combined loan-to-value ratio of 90% . In other words, a lender will not approve you for a HELOC if it means your home equity drops below 10% of your homes current appraised value. Generally, banks offering HELOC loans will only accept borrowers with owner-occupied properties, although in some cases they may accept rental or investment properties as collateral.

Aside from CLTV, all the other minimum requirements of mortgage or loan eligibility apply. You will need to be a U.S. citizen or resident aged 18 years or more. The lender will run a credit check, which will affect your credit score. And you will need to provide certain financial documentation, although less than for a traditional mortgage application.