What Are The Eligibility Requirements For A Parent To Get A Direct Plus Loan

- You must be the biological or adoptive parent of the student for whom you are borrowing.

- Your child must be a dependent undergraduate student who is enrolled at least half-time at a school that participates in the Direct Loan Program. Generally, your child is considered dependent if he or she is under 24 years of age, has no dependents, and is not married, a veteran, a graduate or professional degree student, or a ward of the court.

- You cannot have an adverse credit history .

- In addition, you and your child must be U.S. citizens or eligible non-citizens , not be in default on any federal education loans, not owe an overpayment on a federal education grant, and meet other general eligibility requirements for the federal student aid programs.

When Do I Begin Repaying My Plus Loan

Repayment of a Direct PLUS Loan begins 60 days after the full amount youve borrowed for an academic year has been disbursed. This means you would generally begin repayment while the student is still in school. If the Direct PLUS Loans had a first disbursement date on or after July 1, 2008, you may request that repayment be delayed until six months after the student graduates or is no longer enrolled at least half-time

For more information about postponing payments, visit the website of the office of Federal Student Aid.

Refinance With A Private Lender

âParent PLUS Loans often have interest rates 1-3% more than other federal student loans. Refinancing parent loans with a private lender could allow you to get a lower interest rate, which will help you get a lower monthly payment and pay the loans off faster.

To qualify, youâll need a good credit score and enough income to cover your monthly bills and other payments for education loans. Since there is an income requirement, explore refinancing Parent PLUS Loans before you retire and your income decreases.

Note: If you refinance with a private lender, youâll lose access to federal benefits like deferment, forbearance, and student loan forgiveness programs

You May Like: Fha Loan Limits Texas

Who Is Eligible To Apply For A Parent Plus Loan

The parent is the borrower for the Parent PLUS Loan, and the loan will not transfer to the student. Only parents of undergraduate students considereddependent for federal aid purposes can apply for this loan. The application is subject to a credit check.

Students must also be meetingsatisfactory academic progress standards for financial aid eligibility to receive the loan.

The application usually becomes available in late March or early April for the upcoming academic year.

Recommended Reading: Usaa Auto Loan Credit Score Requirements

I Was Awarded A Parent Plus Loan Should I Take It

Several different types of financial aid are available for students enrolling in college, including scholarships, grants and loans. While scholarships and grants require no repayment, borrowers must eventually repay the full balance of their student loans plus interest.

As the parent of a student in college, you may be offered a unique type of financing known as a Parent Loan for Undergraduate Students, or PLUS loan. Before you decide whether to accept a PLUS loan, it helps to learn a little about how these loans work.

You May Like: How Long Does Sba Approval Take

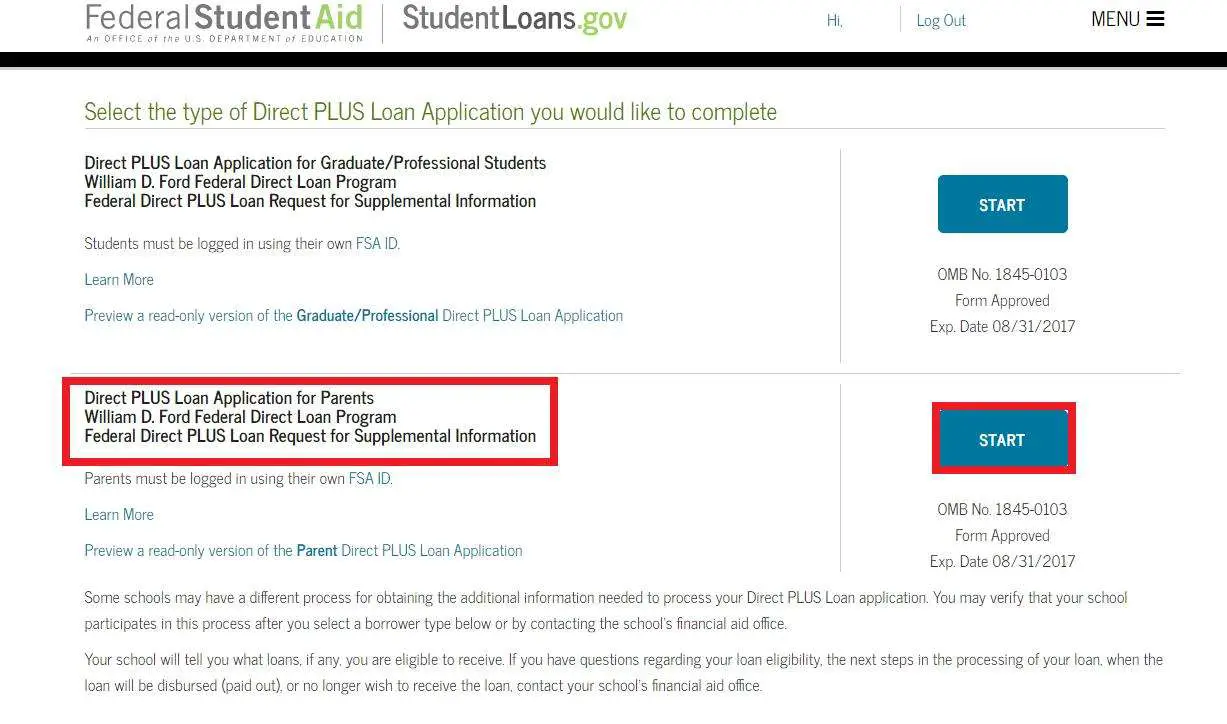

How Do I Request A Direct Plus Loan

The parent applying for the Direct PLUS loan must log in and apply online at www.studentaid.gov. Once you log on follow the steps below:

The Office of Financial Aid will receive electronic notification of your approval and the students award will be updated within 7 days.

What Percentage Of Us Families Are Single Parent

In 2020 nearly 19 million children, amounting to 25 percent of all children in the U.S., were living in single-parent families. That percentage is nearly three times the level in 1960 of 9 percent. Americas proportion of children living with a single parent is more than three times the worldwide level of 7 percent.

Don’t Miss: Fha Limits Texas

Bankruptcy Could Be A Problem

Even after your child has obtained everything he or she can with student loans and grants, you may still need to bridge the gap. This is best done with a federal Parent PLUS loan. Unfortunately, these are credit based, and as suchmay be beyond your reach.

You cannot have an âadverse credit history.â This means that you are more than 90 days delinquent on any debt , or in the past 5 years defaulted on a debt, obtained a bankruptcy discharge, foreclosure, repossession, tax lien,wage garnishment, or write-off of a federal student loan.

Donât Miss: What Is Epiq Bankruptcy Solutions Llc

My Credit Was Not Accepted What Are My Options

- The borrower can re-apply for a PLUS loan with an endorser who does not have an adverse credit history. An endorser is someone who agrees to repay the Parent PLUS Loan if the parent does not repay the loan. The PLUS Loan endorser cannot be the student. The endorser will be required to obtain a FSA ID. The endorser will then need to use a unique PLUS Endorser Code and URL provided by the borrower to complete the Endorser Addendum for the Parent PLUS Loan at www.studentaid.gov.

- The borrower may appeal the adverse credit decision if they believe extenuating circumstances may exist. for more information.

- Federal Direct Unsubsidized Federal Loan. Students whose parents are denied a PLUS loan may qualify to receive additional Unsubsidized Federal Loan. Freshmen and Sophomores can receive an additional $4,000., and Juniors and Seniors can receive an additional $5,000.

Please note that if are approved through an appeal or through an endorser, you must also complete the PLUS Credit Counseling. Go back to the Home Page click on Complete PLUS Credit Counseling.

Also Check: Auto Loan Rates Credit Score 600

What If I Am Denied For A Direct Plus Loan

Dependent undergraduate students, if your parent is unable to secure a PLUS loan, you may be eligible for additional unsubsidized loans to help pay for your education. You would need to provide the PLUS Loan Application and the denial letter from the Department of Education. The additional Unsubsidized Loan your are eligible for would be offered on your Student Center after processing.

Can My Loan Ever Be Canceled Discharged Or Forgiven

You must repay your Direct PLUS Loan even if your child doesnt complete or cant find a job related to his or her program of study, or if you or your child are unhappy with the education you paid for with your loan. However, we will discharge your loan if:

- you become totally and permanently disabled

- your loan is discharged in bankruptcy after you have proven to the bankruptcy court that repaying the loan would cause undue hardship or

- you die, or the child for whom you borrowed dies.

In certain cases, we may also discharge all or a portion of your loan if:

- the school closed before your child completed the program

- the school falsely certified your eligibility for the loan

- your loan was falsely certified through identity theft or

- your child withdrew from school but the school didnt pay a refund of your loan money that it was required to pay under federal regulations.

Also Check: Capital One Auto Loans Rates

Plus Master Promissory Note For Parents

The PLUS Master Promissory Note is a legal document in which the parent promises to repay their loan and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of the loan. In most cases, the parent may receive more than one loan under an MPN over a period of up to 10 years to pay for their childs educational costs. After completing the PLUS application, parents can complete the MPN at StudentAid.Gov.

A parent who wants to borrow a PLUS Loan for more than one dependent student must complete a separate MPN for each student. In addition, if each parent wants to borrow a PLUS Loan for the same student, they must individually complete a separate application and MPN.

If the parent has an adverse credit history and has obtained an endorser for a PLUS Loan, the MPN that the parent completes becomes a “single-loan” promissory note. No further PLUS Loans may be made under that MPN. The endorser is liable only for the specific loan that he or she has agreed to endorse.

Other Options To Consider

Sometimes, the additional direct unsubsidized loan the student receives from the PLUS denial processing is still not enough to cover the remaining cost of attending WSU. In these circumstances, a student and/or parent may want to consider the following alternatives:

Loan amounts & limits

Parent PLUS loan amounts will vary widely. You parent can borrow as much as they like as long as they are not exceeding your total cost of attendance.

To figure out how much to borrow, follow this equation:Total annual cost of attendance Other aid awarded =$ parent is allowed to borrow

Should you get a Parent PLUS loan? Use these resources from studentaid.gov to make an informed decision.

You May Like: Capital One Preapproved Auto Financing

If Your Plus Loan Request Is Denied

There are three possible courses of action:

Note: the maximum amount of additional unsubsidized loans is up to $4,000 per year for students with fewer than 90 earned credit hours, and up to $5,000 per year for students with 90 or more earned credit hours.

Discharge Options For Parent Plus Loans

The terms forgiveness and discharge have the same essential meaning, but theyre used to refer to different conditions for loan cancellation.

When your loans are erased because you work in a certain type of job, the government refers to that as forgiveness, while the situations below are considered circumstances for discharge. In both cases, youre no longer required to make loan payments and your repayment is considered complete. Here are the cases when parent PLUS loans are eligible for discharge.

- Discharge due to death. If the parent PLUS borrower or the child for whom they took out a loan dies, the loan is forgiven. To receive the discharge, documentation verifying the death must be provided to the student loan servicer.

- Total and permanent disability discharge. If the parent borrower becomes totally and permanently disabled, their loans may be discharged. The government reaches out to eligible Social Security recipients with student loans to let them know TPD is available to them, but others can apply proactively through the federal website DisabilityDischarge.com.

- Closed school discharge. Parents may also be eligible for discharge if their childs school closed before the child could complete their degree program. Contact your student loan servicer to identify whether youre a candidate.

Read Also: Does Upstart Allow Co Signers

What Are Parent Plus Loans

Parent PLUS loans are offered by the Department of Education. They are loans that are taken out by a parent to help pay for their childs education. Only the biological or adoptive parents of a student can take out a PLUS loan for them. PLUS loans are taken out in the parents name, therefore the parent is responsible for repayment of the debt.

Parents can take out a PLUS loan for up to the schools cost of attendance.

Recommended Reading: Stilt Loan Calculator

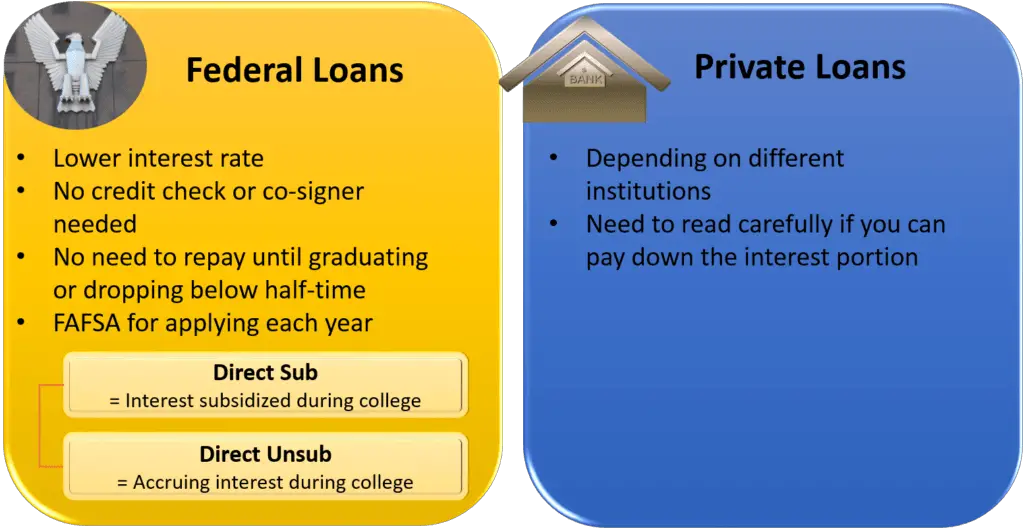

Types Of Loans For Undergraduate Students

Amount

The annual loan limits are $3,500 for freshmen, $4,500 for sophomores and $5,500 for juniors and seniors.

Interest rates

For loans first disbursed on or after 7/1/20 and before 7/1/21 the interest rate is fixed at 2.75 percent.

Repayment

Interest charges and repayment of principal begin six months after you leave school or drop below half-time enrollment. The government pays the interest on the subsidized loans while you are enrolled at least half time.

Qualifications

Subsidized Stafford Loans are given to undergraduate students based on financial need. First-time borrowers must complete online entrance counseling prior to loan approval.

Application

To be eligible for a Stafford Loan, you must complete the steps listed under “Applying for a Stafford Loan” at the top of this page.

Review our Direct Stafford Loan for more information about how to review and accept your award.

You May Like: Average Motorcycle Apr

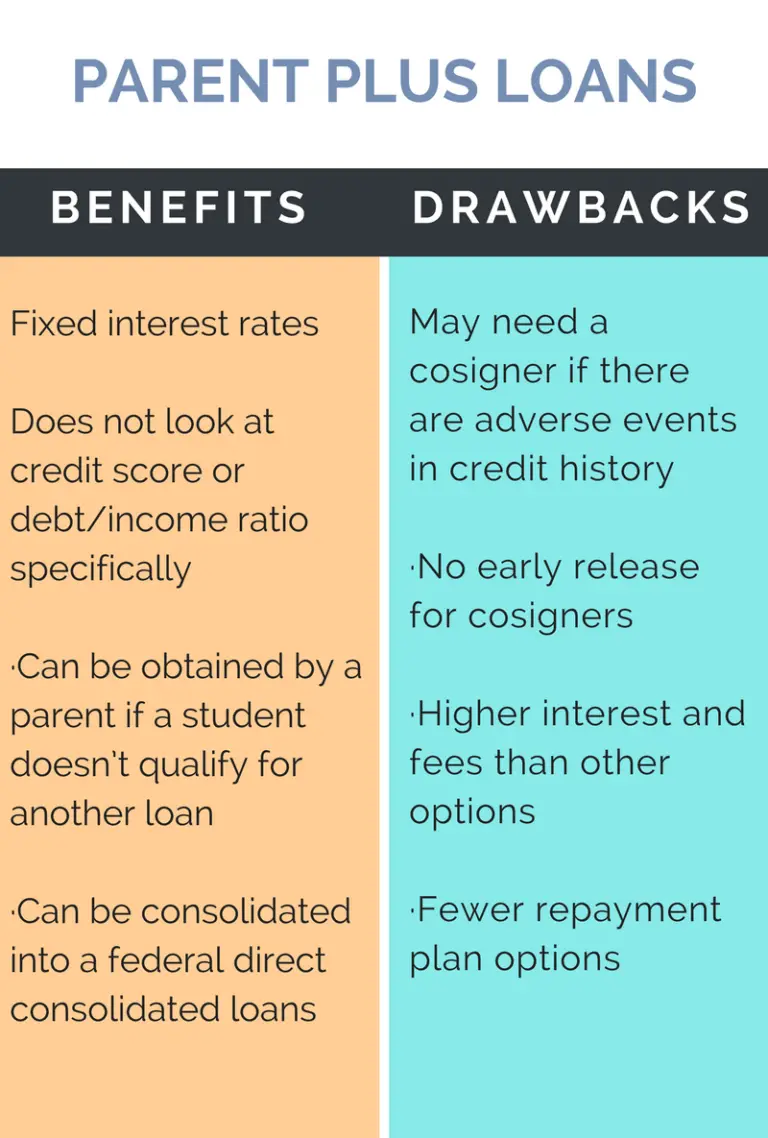

Are Parent Plus Loans Worth It

Parent PLUS loans can be useful if your child has maxed out their student aid and has no other alternative to lower the cost of their education . However, parent PLUS loans can derail your own life goals, like saving for retirement, paying off your mortgage or living the lifestyle youve always imagined for yourself. Before taking out a loan, understand the extra cost youll pay in interest and make a plan for repayment so youre not taken by surprise.

Special Instructions For Parent Plus Loans

Parent PLUS loans are offered to the Parents of Dependent Students. If a parent would like to decline the loan that is being offered because they do not plan on borrowing the Parent PLUS loan, the PLUS Decline Form needs to be completed. Requests will be processed within 2-3 business days of receipt.

If you have already applied for A Parent PLUS loan and would like to Decline an Accepted Parent PLUS loan, please complete the Parent PLUS Loan Request Form.

Parent FAQ

When does the Parent PLUS loan go into repayment?

Parent borrowers begin repayment after the loan is fully disbursed, and standard repayment lasts ten years. Parents can request that their Parent PLUS loan is deferred while the student is enrolled in school.

Who is eligible to borrow a Parent PLUS loan?

- Parents of dependent undergraduate students. Parent includes biological or adoptive parent, step-parent if the biological or adoptive parent is remarried at the time the FAFSA was filed. Parents do not include legal guardian or grandparent.

- Have a valid Social Security Number

- Be a U.S. Citizen / Eligible non-Citizen

- Registered with the Selective Service

- Not be in default

- Not in Title IV grant / loan over-payment

Are there any exceptions to a parent applying for the Parent PLUS loan?

- If the parent is incarcerated

- Parents whereabouts are unknown

- The parents income is limited to public assistance or disability benefits

- The parent of dependent student is not a U.S. citizen or permanent resident

Read Also: Does A Loan Processor Have To Be Licensed In California

Additional Unsubsidized Direct Student Loan

If a Parent PLUS loan application is unsuccessful, a student may request to borrow additional funds through the Federal Direct Unsubsidized Loan program.You, the student, may only apply for the additional Direct Unsubsidized Loan if your parent have been denied. If the Parent PLUS Loan is later approved, the student will no longer be eligible for the additional Direct Unsubsidized Loan.

The PLUS Loan denial must be on file with our office before an increase to your additional unsubsidized student loan can be processed. To make a request to borrow the additional funds through the Federal Direct Unsubsidized Loan Program, you will need to complete WSUs Parent PLUS loan decline form.

Once WSU is advised that you are not pursuing the PLUS loan, and youd like the unsubsidized Loan funding offered to you, the PLUS loan will be cancelled and a supplemental direct unsubsidized loan will be offered to you.

The maximum additional amount you may request is $4,000 per year for freshmen and sophomores, and $5,000 per year for juniors and seniors. You will then need to accept the additional loan in myWSU.

Comparing Federal Student Loans

PLUS loans differ from other federal student loans considerably. Some of the primary differences include:

- Higher interest rates Although all types of federal student loans come with interest, the interest rates associated with PLUS loans are often higher than with other federal student loans. These loans typically involve origination fees as well, thus increasing the cost of the loan even more.

- Harder to borrow Other types of student loans are available to students regardless of their credit scores or lack of credit history. However, PLUS loans will be available only to parents with a good credit history.

- Fewer repayment options Whereas other types of student loans are eligible for a variety of repayment options, including income-based plans, PLUS loans are not. Instead, they must be repaid within 10 years to 25 years, depending on the parents preference.

Don’t Miss: Do Private Student Loans Accrue Interest While In School

How To Apply For A Parent Plus Loan

Are you still thinking about applying for one of these monsters? Hopefully not. But maybe you enjoy horror stories . . . or rubbernecking fender-benders! If so, lets go over the steps to apply for a Parent PLUS Loan.

Step 1. Have your student complete a FAFSA. If you dont know, thats the Free Application for Federal Student Aid. Its found on the Federal Student Aid website. This is a good thing to do even if you and your child arent applying for any loans, because its necessary for receiving any form of financial aid, including scholarships and grants.

Step 2. Complete the Application. The exact title is the Direct PLUS Loan Application for Parents. Thats also found on the Federal Student Aid site. This is also where you decide how much you want to borrowwhich is obviously zero. If you were going to pull the trigger here , you would need to authorize a credit check.

At that point, the Department of Education will be in touch if you have adverse credit. Thats because they really want you to get this loan! Theyll tell you how you can appeal an adverse credit finding, or go find a cosigner. But we know youre too smart for that.

Step 3. Sign the Master Promissory Note. Thats the terms and conditions for paying back your loan. Youll see it there on the same government website as the application. We really hope you havent reached this step because once you sign, you will be locked in for at least 10 years of loan payments, and who knows how much in interest.