Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5/1 ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

What Is A Loan Estimate

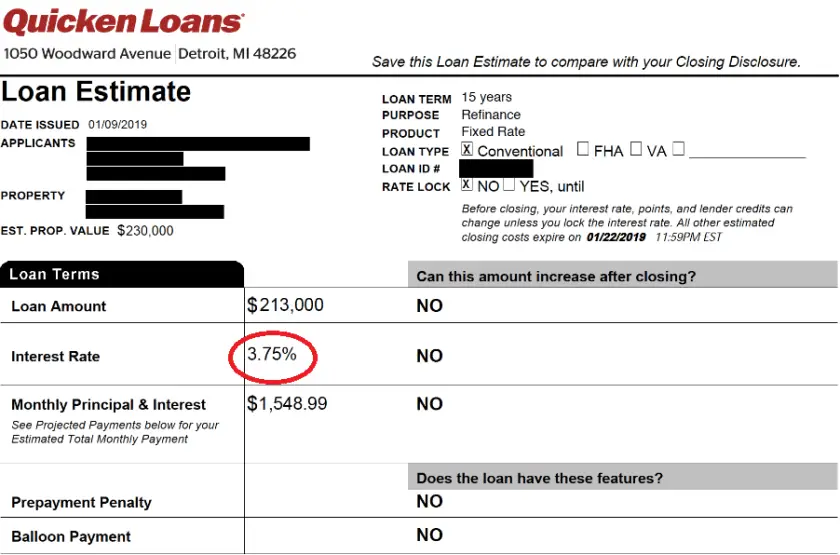

A Loan Estimate is a three-page form that you receive after applying for a mortgage.

The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

The Loan Estimate is a form that took effect on Oct. 3, 2015.

The form provides you with important information, including the estimated interest rate, monthly payment, and total closing costs for the loan. The Loan Estimate also gives you information about the estimated costs of taxes and insurance, and how the interest rate and payments may change in the future. In addition, the form indicates if the loan has special features that you will want to be aware of, like penalties for paying off the loan early or increases to the mortgage loan balance even if payments are made on time . If your loan has a negative amortization feature, it appears in the description of the loan product.

The form uses clear language and design to help you better understand the terms of the mortgage loan you’ve applied for. All lenders are required to use the same standard Loan Estimate form. This makes it easier for you to compare mortgage loans so that you can choose the one that is right for you.

Closing Services For Which You Can Shop

- Youll pay a pest inspection fee to a professional who comes out and examines the home you want to buy for evidence of wood-destroying insects such as termites and carpenter ants. Any significant damage will need to be repaired before closing.

- The survey fee verifies the propertys boundaries.

- The four title fees go toward making sure you can take ownership of the property free and clear of claims by any third party, such as a previous owners relative or a tax authority. Youll also have to buy a title insurance policy that protects the lender against claims that might arise later that werent uncovered during the title search. The title company is also often the company that handles your loan closing, so theres a fee for that too. This fee might be listed as an escrow agent or settlement agent.

It doesnt matter whether the cost of these closing services differs from one lender to the next when youre deciding on a lender. Theyre just estimates, and youll be able to shop around for these providers and decide how much to pay.

Recommended Reading: Usaa Refinance Car

The Purpose And Timing Of Your Loan Estimate

Your Loan Estimate shows the costs associated with closing on your mortgage as well as over the lifetime of the loan. If these fees from the lender change too much from the initial estimate say, because your loan length changes the lender is required to issue you a new Loan Estimate.

Youll receive this Loan Estimate within three business days of completing your mortgage application. For the purposes of these regulations, youre considered to have submitted a complete application when your lender receives each of the following items:

- Your name

- The property address of the home you want to purchase/refinance

- The propertys value estimate or purchase price

- Your loan amount

Keys To Comparing Lenders With Loan Estimates

All the most important things for a borrower to look at are on the first two pages of the Loan Estimate, Beeston says: the loan type, rate lock information, rate, and fees.

For example, the , which includes the interest rate plus fees, is a better measure of the overall cost of a mortgage than the interest rate. But it does include some costs such as prepaid taxes that can adjust between the Loan Estimate and closing. So the APR on the Loan Estimate might change, thats why its important to focus on comparing lenders fees and the interest rate.

You May Like: Can Other Than Honorable Discharge Get Va Loan

Lenders Shouldn’t Be Asking You To Pay Any Substantial Upfront Fees At This Point

- If a lender asks you to pay for anything other than a credit report fee in order to get a Loan Estimate, this is against the law. You might choose to work with another lender. You can also submit a complaint to the CFPB.

- Lenders must wait to charge you additional fees until you choose a loan offer and tell the lender that you are ready to move forward with your application. Once you tell a lender that you are ready to proceed, the lender you choose may charge you additional fees, such as an application or appraisal fee.

If You Havent Already Find Out More About The Lenders Rate

If your rate is not yet locked, ask:

- When in the process do you typically lock interest rates? Could I lock earlier or later, if I wanted to?

- What do I need to do to lock my rate? Are there any additional fees to lock my rate?

- How many days would I have to close before my rate lock expires?

- Are there other rate-lock periods available? How would the pricing on my Loan Estimate change if I wanted a different length of rate lock?

Regardless of whether your rate is already locked, ask:

- What happens if I am unable to close in the specified amount of time?

- For example, would there be a fee to extend the rate-lock?

- How much would that fee be? Is there a chance that the lender would refuse to extend the rate-lock?

Don’t Miss: Can You Use A Va Loan For A Manufactured Home

How To Read A Loan Estimate: Page 3

Page three of the Loan Estimate has a few more key numbers to help you compare offers from different mortgage lenders.

- In 5 years Shows how much you will have paid altogether, and how much you will have paid off toward the loan balance alone, in 5 years. This number is especially helpful if you dont plan to stay in the house a long time, as it helps you understand the weight of upfront costs vs. interest rate in the short-term

- Another way to compare two lenders rates and fees combined. The APR represents your total loan costs over the life of the loan, including interest and upfront costs, expressed as an annual percentage

See where you can find these items below.

Your Loan Hasnt Been Approved Or Denied Yet

When you receive a Loan Estimate, the lender has not yet approved or denied your loan. This is true even if your rate is already locked. The Loan Estimate shows you the terms the lender expects to offer you if you decide to move forward with your loan application. You have not committed to this lender. In fact, you are not committed to any lender before you have signed final closing documents.

You May Like: What Bank Has The Lowest Home Equity Loan Rates

Whats Included On A Loan Estimate

First, to get a Loan Estimate, youll need six pieces of information: your name, income, social security number, desired loan amount, desired property address, and its listing price. After you provide these six pieces of information, a lender is legally required to share a Loan Estimate within 3 days. Some aspects of the Loan Estimate, such as points and credits, can fluctuate until the loan is locked.

Other numbers, such as taxes, will change throughout the process as documentation is received and loan estimates are updated. When the loan is locked, the terms of that documentation are binding and valid for a period of 10 days. At Better Mortgage, we provide a Loan Estimate as soon as you create an account, so you can instantly review and decide next steps. Once you receive your Loan Estimate, you should review the terms and evaluate the costs outlined in each section.

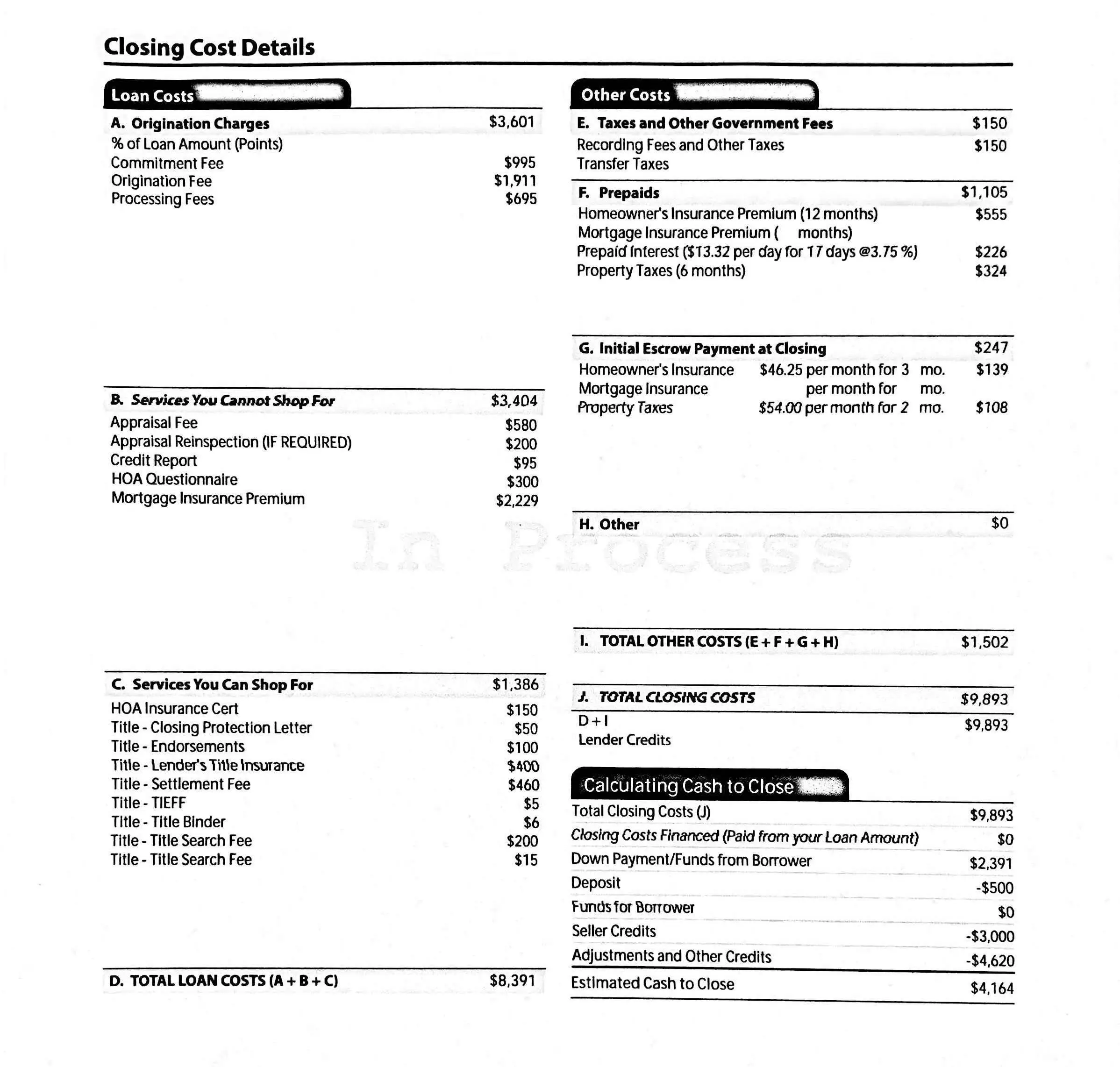

Section A: Origination charges

This is where youll see points if youve opted to purchase a lower rate. You may also see underwriting, processing, or origination fees.

Section B: Services you cannot shop for

Services you cannot shop for are set by the lender and must be paid by the borrower. The big ticket item here is your appraisal, which makes sure your home is worth what the seller claims its worth. The appraisal must be conducted by a licensed third party, and the one-time fee for that process will be reflected here. Other lenders may also charge condo fees or subordination fees.

What Can Cause A 3

Any substantial revision to the loans terms triggers a new three-day review. However, a change in the amount of a real estate agents commission, modifications to the escrow, or adjustments to prorated payments for taxes, utilities and the like dont qualify. Only three things can reset the 72-hour clock:

The APR increases by more than one-eighth of a percentage point for fixed-rate loans or more than one-quarter of a percentage point for adjustable-rate mortgages.

A prepayment penalty is added to the loan terms.

The loan product changes, such as moving from a fixed-rate to an adjustable-rate loan or to an interest-only mortgage.

Don’t Miss: Usaa Used Car Loan Rate

When Is A Loan Estimate Binding

Technically, a loan estimate is only binding on the date its issued. Like stock prices, interest rates change daily, so if you dont lock your mortgage rate in with the lender the same day you receive your loan estimate, the interest rate, terms and closing costs could change. Once your loan is locked, there are some scenarios that could result in a difference between your initial and final loan estimates. The CFPB provides common examples of situations where you might be subject to a change of circumstance adjustment to the terms of your home loan:

- You decide to change loan programs

- You decide to make a lower down payment

- Your credit score drops on a credit report pulled before closing

- You disclosed income that couldnt be documented or used by the lender to qualify

THINGS TO KNOW

Current regulations restrict how much certain fees on your loan estimate are allowed to change after theyve been disclosed. There are three tolerance levels lenders must follow:

Can I Get Multiple Loan Estimates

Yes — in fact, its very important to get multiple loan estimates. The value of this document is the way it allows you to compare one mortgage to another and determine which one is right for you. The more effort you put into shopping for a mortgage, the better your odds of finding one that suits your needs and saves you money.

Your loan estimate will be based, in part, on your . In order to offer you an accurate estimate, lenders pull a copy of your credit report. This inquiry drops your credit score by a small amount but is a necessary step when purchasing a home. Fortunately, home buyers are expected to rate shop, and credit reports pulled by multiple mortgage lenders within a 45-day window are recorded as a single inquiry. When you are requesting loan estimates, make sure you request all estimates within a short period of time to minimize the impact to your credit score.

You May Like: Is Bayview Loan Servicing Legitimate

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Additional Information About This Loan

If you want to quickly compare borrowing costs, this section provides the details you need to shop for an affordable lender. This includes:

- In five years: What will happen to your loan over time.

- Annual Percentage Rate : This takes interest and fees into account to calculate your total annual borrowing costs.

- Total interest percentage: This is the total interest you’ll pay over time. It’s expressed as a percentage of the amount you borrow. Lower is better. It means borrowing costs are cheaper.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Just Two Closing Documents Among Many

No doubt youll see many other documents during the loan closing. Lots and lots of them.

But these two legally binding and required documents bookend the loan process: The Loan Estimate comes after you submit an application with a lender, and the Closing Disclosure form arrives when youre nearing the get-a-mortgage finish line.

About the author:Hal Bundrick is a personal finance writer and a NerdWallet authority in money matters. He is a certified financial planner and former financial advisor. Read more

Whats In A Loan Estimate

Your loan estimate is three pages long. The first page lists the most important information, like the terms of your loan and closing costs. The second page shows your loan costs and origination charges, such as lender fees, aka application fee or underwriting fee. These are negotiable, so compare them with other lenders when mortgage shopping.

Page three of your estimate lists the percent paid in interest, APR and total cost in five years- . You can see a sample of page three on a loan estimate below.

Read Also: How To Calculate Amortization Schedule For Car Loan

Page 3 Of The Loan Estimate

THINGS YOU SHOULD KNOW

You may notice a big difference in your APR and interest rate if youre taking out a government-backed loan like an FHA loan. Thats primarily due to the higher cost of mortgage insurance, which protects the lender against losses if you default and they have to foreclose. FHA loans require two types of FHA mortgage insurance, while conventional loans typically only require one type of private mortgage insurance .

How To Get A Loan Estimate

Your lender will provide you with a loan estimate once they’ve received six pieces of information about you:

- Name

- Social Security number

- Property address

- Estimated property value

- Desired loan amount

That said, providing additional information, such as your desired loan type and down payment amount, can result in a more accurate loan estimate.

Remember: A loan estimate isn’t a closing disclosure. If you don’t like the terms on offer, take no action. But if you like the terms cited in a particular loan estimate and want to move forward, you must provide your loan officer with what is known as your “intent to proceed,” or your agreement to move forward with the loan application, and quickly. Lenders are only required to honor the terms of a loan estimate for 10 business days. After you express your intent to proceed, your lender will request more information about your finances and will provide a closing disclosure with your finalized loan costs.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Ask Each Lender For The Same Kind Of Loan With The Same Features

You want to be comparing apples to apples when you get your Loan Estimates. At this point in the process, you should already have a pretty good idea of the kind of loan and features you want:

If youre unsure about any of these options, click the links above for specific information, revisit our Explore loan choices phase for a step-by-step overview, or have a more exploratory conversation with lenders.

How A Loan Estimate Works

Borrowers should approach several lenders and do multiple loan payment calculations when shopping for a mortgage loan. Obtaining loan estimates can help you assess the costs of each loan and compare them with other loans so that you can choose the best one for your finances. With an estimated in hand from one lender, you may even be able to negotiate a better estimate with another lender, such as paying points to lower your interest rate.

Within three days of receiving your mortgage application, before they have approved or denied your requested loan, lenders will send loan applicants a loan estimate. Below are the sections and individual items that appear on the form, along with how to interpret them. When comparing several loan estimates, ensure they have similar general features, the same type of interest rate , and, preferably, similar issuance dates. Interest rates can change daily, so getting your estimates a few days apart may impact your quoted costs.

To negotiate a better estimate with a potential lender, multiple loan estimates are your best bargaining tool. You can always return to a lender and ask for a better loan estimate.

Recommended Reading: How Much Car Can I Afford Calculator Salary

What Is The Closing Disclosure

While the Loan Estimate provides an estimation of projected home loan terms, the Closing Disclosure form has your official loan terms.

Now:

This form is nearly identical to the Loan Estimate.

The primary difference is that you receive this form once you are cleared to close. Youll get it within three days of your closing day.

It is important to examine the Closing Disclosure closely. It will have your actual interest rate, actual loan terms, actual monthly payment, and the exact amount you need to bring to closing.

Make sure you compare the details of the original Loan Estimate with the Closing Disclosure.

You should expect some minor variations, but many of the details should remain the same. These include the sale price, the loan amount, the loan term, and the type of loan.

You should also read the document to make sure your name is spelled correctly, and that it has the right property address.

Loan terms that could be different on the Closing Disclosure include:

- Prepaid interest amount

- Escrow amounts

- Third-party fees

- Fees paid to the lender Cash to close

If you notice any major discrepancies between the Loan Estimate and the Closing Disclosure, talk to your lender as soon as possible.

Note: You can cancel the mortgage at any time if youre not comfortable with the loan terms.

Thoroughly reviewing this final document is critical in the home buying process because it eliminates surprises at closing.

This helps alleviate some of the stress that comes with a home purchase.