Installment Loans Vs Revolving Credit: Whats The Difference

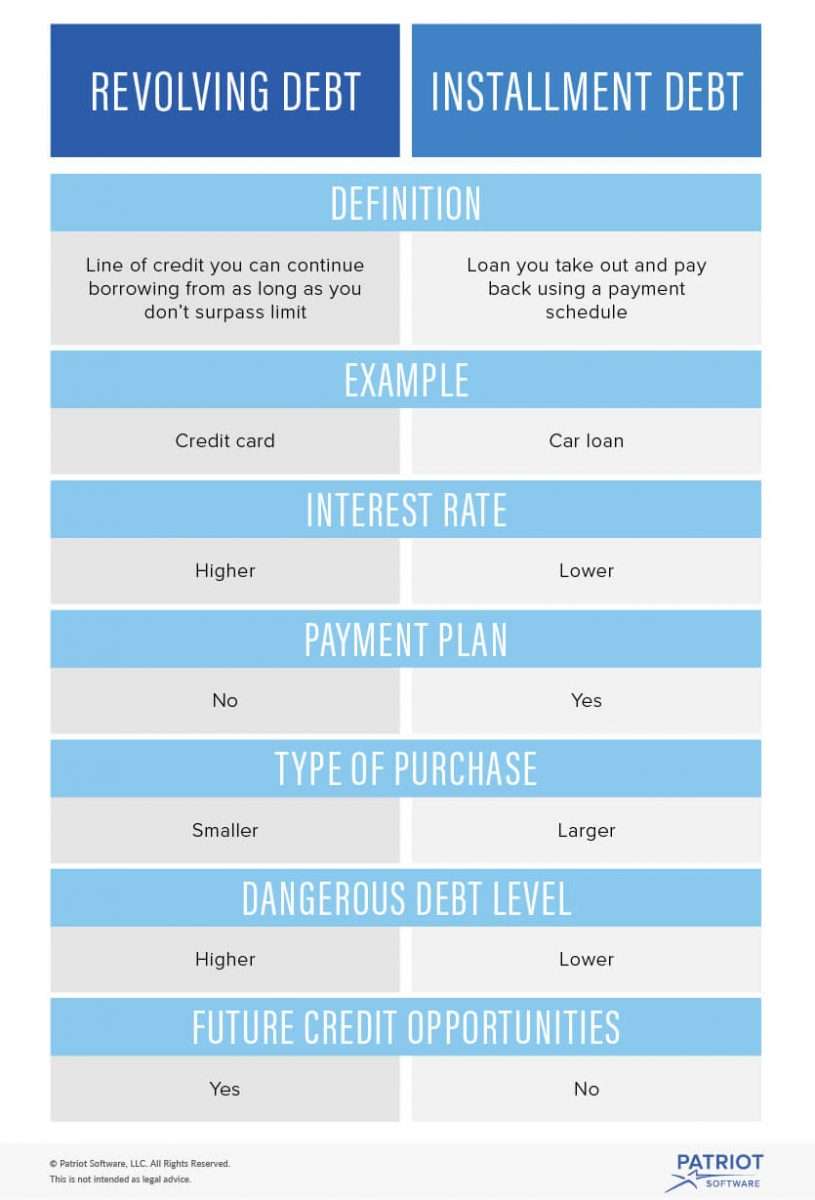

With an installment loan, borrowers will receive the entire loan amount as a lump sum, which theyll be required to make regular payments toward on a fixed schedule until the loan is paid off. Revolving credit gives a borrower a maximum credit limit to borrow from, repay and borrow from again as needed if they havent maxed out their line of credit.

Installment loans tend to be used for larger purchases like a home, where you only need to borrow money once. Revolving credit can be for smaller purchases, and for borrowers who want access to credit whenever they want.

With both types of loans, you may qualify for a variable or fixed interest rate, and the loan amount or credit limit youll be approved for will depend on factors such as your credit score and income.

Business Installment Loans Vs Business Credit Cards

An installment loan, also known as a business term loan is repaid over time with a set number of scheduled payments. When you need funds for

Discover small business financing solutions including small buisness loans, lines of What is a business installment loan and why would I need one?

Life Insurance is coverage that pays a benefit when the insured person dies. Loan means the revolving or instalment lending agreement/small business loan and

Why A $500 Credit Limit Has Bigger Impact On Your Credit Score

Having both an auto loan and a credit card in your name will impact your credit score, but the revolving credit account will play a bigger factor in your score’s calculation. Here’s why:

- Reason 1: Revolving credit is highly influential when calculating your credit utilization rate, or the percentage of your total credit that you’re using. Your credit utilization is the second biggest factor that makes up your credit score. As you keep paying off your revolving balance on your credit card, your credit score will go up and you’ll free up more of your available credit. Whereas with an installment loan, the amount you owe each month on the loan is the same, and the total balance isn’t calculated into your credit utilization.

- Reason 2: Revolving credit has more of an impact on your credit score because it also offers more “financial clues” into your behavior than installment credit does, Droske says. With a $20,000 auto loan, the borrower can only behave in so many ways: Either they make the monthly payment on time over the term of the loan or they don’t. On the other hand, borrowers can make lots of decisions when using a credit card charge a little and pay the minimum, max it out and pay it off entirely, don’t use it at all. How you manage your variable debt tells lenders a lot about how you’ll manage future debt you don’t have yet.

Recommended Reading: How To Add Apr To Car Loan

Pay Down And Pay Off Outstanding Debt

My original article emphasized the importance of getting out of student loan debt. I mentioned suggestions for managing that debt, like lowering student loan bills through better repayment or refinancing plans and making loan payments on time. Hopefully, doing these things would make it easier for millennial business owners to financially plan to start a business.

However, according to Bank of Americas Better Money Habits Millennial Report, student loans now only account for 25% of millennials debt. The Winter 2020 report examines the precarious balancing act that millennials have with outstanding debt. And this debt is no longer limited to student loans.

The reason? Millennials are no longer twentysomethings. Millennials began turning 40 in 2021. The report shares the various types of debt that millennials carry in middle age, including auto loans , credit card debt and mortgages . Each makes up a higher percentage of debt than student loans.

Further, the report addresses the worries that millennials have surrounding their debt. Those surveyed say that having debt keeps them from reaching professional and personal milestones. Millennials today feel like they cant or cant yet fulfill the following goals:

- Buy a first or nicer home .

- Save for the future .

- Welcome children or grow their family .

- Get married .

- Start their own business .

Despite these grim percentages, millennials are not giving up.

Relationship With A Bank Lender

Many banks provide ongoing support for their lending customers, such as business credit score tracking or a dedicated relationship manager to work with your business. Most banks also offer other types of financial products, such as business checking accounts, business credit cards and merchant services, if you prefer to use one institution for your financial needs.

Although some alternative lenders offer additional support and services, the Federal Reserves 2021 Small Business Credit Survey reports that businesses that receive financing are more satisfied with their experience with small banks and large banks compared with online lenders .

You May Like: How To Calculate Mortgage Loan Payoff

Observe The Money Moves Of Gen Z

Millennials and Gen Z allegedly dont like one another very much. Something about a TikTok dance? I digress. Millennials can learn from individuals at all stages of entrepreneurship, including the class of creators that makes up Gen Z.

How exactly does watching the entrepreneurial moves of Gen Z translate to financial advice?

Gen Z came up in a world where many cheaper tools are at their disposal. They are natural social natives that utilize digital platforms to build their brand.

Watch which tools they use to build their business and how they save money through using them. A good example is observing the platforms they use, like Square to accept payments and Etsy for creating an ecommerce presence. These tools are cost-effective and allow Gen Z to focus on their business. Take a few notes if you havent started already, millennials.

Tips For Using Revolving Credit

This type of credit can be a very useful tool. Still, you need to know how to use your revolving accounts so that you keep a good credit score.

Recommended Reading: How Much To Loan Officers Make

Banks And Credit Unions

Banks and credit unions typically offer the most competitive business loans, and some such as Union Bank and Native American Bank offer lending programs dedicated to minority-owned businesses. But traditionally, minority business owners have faced difficulties in getting approved for small-business bank loans. If you can qualify for a business loan from a bank, however, this will likely be your most affordable option.

Installment Loan Vs Revolving Credit Which Is Right For You

- You need a lump sum upfront, to get a good deal on a major purchase, for instance.

- Your small business has a relatively steady income so you can budget for regular payments.

- Your small business is well-established and you and/or it have good credit, meaning you may be more likely to get good loan terms.

- You want to be prepared for future financial needs but dont require a lump sum right away.

- You may need access to relatively small amounts quickly to take advantage of business opportunities or pay for shortfalls.

- Your business has a need for perks offered by a business credit cards. If you have to travel frequently for your company, for instance, a card that offers miles could help defray those costs

Also Check: How To Reduce Your Student Loan Debt

What Is A Small Business Term Loan

A term loan is a type of installment loan. When you take out an installment loan, youll receive the entire loan amount upfront and then repay the loan over a predetermined period. Generally, youll make monthly payments. And, if you have a fixed-rate loan, each payment will be for the same amount.

Banks, credit unions, and online lenders offer small business term loans with varying requirements, loan amounts, fees, and terms. Small Business Administration loans may be installment loans, but you can find faster and easier ways to get a loan as well.

Sometimes, you may take out a term loan with a specific purpose, such as an equipment financing loan to buy a new piece of machinery. Other terms loans allow you to use the money for almost anything.

When Comparing Term Loans Vs A Line Of Credit Term Loans Are Best When:

- You need a lot of funding: You may be able to borrow a lot of money with a term loan. Business owners may take out term loans when they want to expand their business, buy a competitor, or ramp up for a surge in orders.

- You want a long repayment period: Cash flow is often an issue for small businesses. Applying for a term loan with a more extended repayment period can lead to lower monthly payments and minimize the impact on your cash flow. With a fixed-rate term loan, you also dont have to worry about rising interest rates like you may have to with a variable-rate line of credit.

- Youre paying down high-rate debt: While taking out a term loan to fund a new project might be the most compelling reason, a term loan can also serve a purely financial purpose. If youre struggling with high-rate debt, such as business credit card balances, you may be able to use a term loan to consolidate the debts and decrease your interest rate.

- You have a profitable plan: Borrowing money without a thought-out plan can jeopardize your business. While business owners customarily take risks, make sure you can put the money you borrow into action and get a positive return on investment.

Read Also: How To Pay Off Car Loan In Full

How To Obtain A Loan With Donotpay

If you want to apply for a small business loan successfully, be ready to go through a complicated process that will require a lot of time and effort.

To prove that you qualify for the loan, you will need to submit various documents, including a business plan, budget sheets, , and financial statements. You will also need to provide many details about your company.

If you want to avoid getting denied because of an incomplete application, you can rely on DoNotPay to guide you through the process. Our app will make sure you submit all the necessary paperwork and include every detail the lender asks for.

All you need to do is and:

If you are not sure which lender you should choose, you can use our integrated Find Online Business Loan Lender product and let DoNotPay narrow down the options for you.

Large Loan Amounts And Competitive Repayment Terms

Bank loans are often available in amounts up to $1 million or more. Many online lenders, on the other hand, only offer financing in smaller amounts. Popular online lenders OnDeck and BlueVine, for example, both have maximum loan limits of $250,000.

Business loans from banks also tend to have long terms, up to 25 years in some cases. These loans usually have monthly repayment schedules, as opposed to daily or weekly repayments.

In comparison, online business loans typically have shorter repayment terms, ranging from a few months to a few years. Many of these loans require daily or weekly repayments.

Don’t Miss: How Much Is The Average Home Loan

Which One Is Better For You Installment Loan Vs Revolving Credit

Therere significant points to consider when determining which one of these two options is suitable for your small business.

First, determine how much you need for a particular purpose youre borrowing and if youll need it at once. You might be able to get more if you go for an installment loan than revolving credit.

Be sure if you need cash or credit. You may need a loan or line of credit if youre purchasing vehicles for your business. But, if you want a resource to help you buy supplies from a vendor, go for a business credit card or tradeline.

What Is A Business Line Of Credit

A business line of credit is a type of revolving credit line. With a line of credit, the lender approves you for a total credit limit, but you dont need to take out a loan right away.

You can borrow against the credit linesometimes called taking a drawas long as your balance doesnt exceed your credit limit. As a revolving account, you can pay down your balance and take out more draws without reapplying for a new loan. Its similar to a credit card, but often with a higher credit limit.

With a business line of credit, you only pay interest on the money you borrow. However, you may have a variable interest rate, and your interest rate may arise after you take out a draw.

In comparing a term loan vs. line of credit, depending on the terms of the credit line, it can be similar to a term loan in that you may have to repay each draw over a specific period. Or, you may be able to make minimum payments during an initial draw phase, such as a three- or five-year period. If your line of credit has a draw phase, you may be able to apply to keep the credit line open at the end. Otherwise, your account enters a repayment phase, you wont be able to take out any additional draws and youll have to pay off the outstanding debt over a specific term.

Don’t Miss: How To Accept Parent Plus Loan

The Typical Terms On An Installment Loan

Installment loans are almost always secured loans , but most installment loans are linked to the purchase of an asset, which is the security. Before an installment loan is granted, the asset or assets linked to the purchase must be valued, and its fair market value determined. Interest rates on installment loans vary, depending on whether the loan secured and on the credit rating of the borrower.

Secured loans are loans backed by an asset . Secured loans usually have lower interest rates than unsecured loans.

Pros Of Revolving Credit

1. Flexible: business is allowed to borrow what they need and pay it back at the end of the billing cycle

2. Easy application process unlike installment loans

3. Collateral might be optional

4. limited interest: interest is based on what you borrow

5. Continuous access to funds: you can withdraw and repay the account balance repeatedly

6. Cash backs and travel rewards on different offers

Don’t Miss: How Do You Find Out Your Student Loan Account Number

Cons Of Revolving Credit

- You can easily go into debt: If you use revolving credit to the spending limit, you could develop dangerous spending habits. For example, if you fail to pay off the balance at the end of the month, this will result in higher interest charges. These rates can even exceed 29%, which can make your credit card debt too difficult to pay off.

- You may harm your credit score: Even though responsible use of credit cards and loans generally helps improve your credit score, missed payments can easily put your accounts into default and thus harm your credit score. Keep in mind that a low credit score will most likely lead to high interest rates in the future. This will cripple you in situations when you have to borrow money again, so you may end up without getting a loan or a credit line.

- It may come with withdrawal requirements: Some revolving credit accounts come with pre-set withdrawal requirements. This means you as a borrower will need to withdraw a set amount of money before a particular date.

- There are various types of fees: The lender can charge an inactivity fee if you dont use your credit for a defined amount of time.

How Lines Of Credit Differ From Traditional Loans

Both revolving credit and lines of credit are different from traditional loans. Most installment loansmortgages, auto loans, or student loanshave specific purchasing purposes in mind. You must tell the lender what you are going to use the money for ahead of time and, unlike with a line of credit or revolving credit, you may not deviate from that.

Line of credit payments tend to be more irregular. Unlike with a loan, you are not being lent a lump sum of money and charged interest right away. A line of credit allows you to borrow funds in the future up to a certain amount. This means you are not charged interest until you actually start tapping into the line for funds.

Also Check: What Is The Best Online Loan

When Can You Access Borrowed Funds On Revolving Debt Vs Installment Loans

When you take out an installment loan, you get the entire amount youre borrowing in one lump sum when you close on the loan. If you took out a $10,000 personal loan, youd have $10,000 deposited into your bank account, or would get a $10,000 check. If you decide you need to borrow more money, youd be out of luck even if you paid off almost your entire $10,000 balance. You would need to apply for a new loan to borrow more.

With revolving debt, you get to choose when you borrow funds. You could borrow right after opening a credit card, wait six months, or wait years to borrow, depending on what you want . As long as you havent used your full line of credit, you also have the option to borrow again and again, especially as you pay down what youve already borrowed.

Installment loans tend to be best when you want to borrow to cover a fixed cost, such as that of a car or another big purchase. If you know youll need to borrow but its hard to predict when youll need the money or how much youll need, then revolving debt may make more sense.