Backing Out Of A Loan

To avoid serious heartache later on, be sure to look over all the loan documents carefully before signing on the dotted line. You do have some recourse if you realize youve made a mistake, as long as you act quickly. Theres a federally mandated three-day cancellation rule that applies to both home equity loans and HELOCs, but you have to notify the lender in writing. That notice has to be mailed or filed electronically by midnight of the third day , or its void.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Regions provides links to other websites merely and strictly for your convenience. The site is operated or controlled by a third party that is unaffiliated with Regions. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

Recommended Reading: How Much To Loan Officers Make

What Is A Home Equity Loan And A Home Equity Line Of Credit

Even though both are similar, there are some differences. Do keep in mind that both can leave you at risk of foreclosure if you fail to pay back your lender.

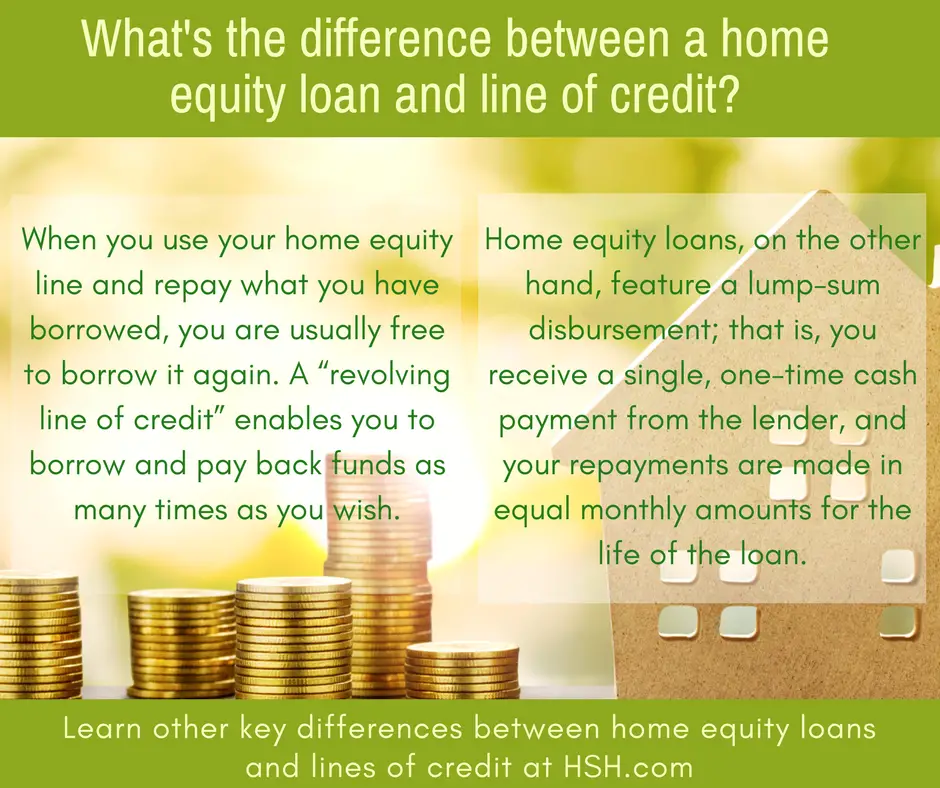

Home equity loans are distributed as a single lump sum that you pay back to the lender with interest in fixed monthly payments. Think of it like a second mortgage on your home. Home equity loans have fixed interest rates, which means the rate doesnt change. They can also be tax-deductible, depending on how you use them.

A HELOC acts like a credit card, so you can tap into the funds whenever needed. As you pay the balance back, the available balance is replenished. There is a draw period where you can withdraw funds, followed by a repayment period where you no longer have access to the funds.

Alternatives To A Home Equity Loan

A home equity loan is not the right choice for every borrower. Depending on what you need the money for, one of these options may be a better fit:

- Home equity line of credit : Like a home equity loan, a HELOC lets you borrow from your home’s equity. However, you’ll borrow from a credit line. Additionally, HELOCs have variable rates.

- Cash-out refinance: If you can qualify for a lower interest rate than what you’re currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that’s more than your current mortgage balance, you can pocket the difference in cash.

- Reverse mortgage: With a reverse mortgage, you receive an advance on your home equity that you don’t have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive.

- Personal loan:Personal loans may have higher interest rates than home equity loans, but they don’t use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum.

Don’t Miss: Aer Loans

How Much Can You Borrow With A Home Equity Loan

A home equity loan generally allows you to borrow around 80% to 85% of your homes value, minus what you owe on your mortgage. You can do some simple math to estimate how much you might be able to borrow.

For example, say your home is worth $350,000, your mortgage balance is $200,000 and your lender will allow you to borrow up to 85% of your homes value. Multiply your home’s value by the percentage you can borrow . That gives you a maximum of $297,500 in value that could be borrowed. Subtract the amount remaining on your mortgage , and you’ll get the approximate sum you can borrow as a home equity loan in this case, $97,500.

Alternately, you can ditch the math and use our home equity loan calculator.

What Is A Home Equity Line Of Credit

Simply put, a home equity line of credit is a line of credit that uses your home as collateral. A TD Home Equity FlexLine, our HELOC, allows you to access up to 80% of the value of your home . Apply just once and, once youre approved, your credit will be available when you need it, subject to the terms of your agreement.

Recommended Reading: Genisys Loan Calculator

Why Take Out A Second Mortgage

Homeowners can use their home equity loan or HELOC for a wide range of purposes. From a financial planning standpoint, one of the best uses of the funds is for renovations and remodeling projects that increase the value of your home. This way, you may increase available equity in your home while making it more livable.

Borrowers should be careful of cross-collateralization because it affects real estate lending terms.

You can also use the money to pay off other high-interest rate debt in an alternative type of debt consolidation. This could be especially helpful for paying off high-rate credit card balances. Youre effectively replacing a high-cost loan with a secured, low-cost form of credit.

Of course, you can also borrow to fund an overseas vacation, a new sports car, or possibly your childs education. Whether its worth eroding your equity is up to you and something to which youll want to give some serious thought.

How To Qualify For A Home Equity Loan

Follow these steps to determine if you’re eligible for a home equity loan:

Recommended Reading: How To Get An Aer Loan

Rate Terms And Repayment Of A Cash

A cash-out refinance loan is a flexible home equity option. With a cash-out refinance loan, you can choose between a fixed or variable rate loan, and the term for a cash-out refinance loan can be up to 30 years.

A cash-out refinance loan is identical to a traditional home equity loan, except you will not have a second mortgage. This is because you are refinancing your existing mortgage into a new home loan for more than you owe, and you take the difference in cash. You should factor in the costs of refinancing when using a cash-out refinance. Generally, the rate on a cash-out refinance is lower than a home equity loan or HELOC, but there could be more fees and closing costs when refinancing. Discover Home Loans does not charge application, origination, or appraisal fees, and no cash is required at closing.

When you make monthly payments on a cash-out refinance loan, you pay principal and interest, just as you do with a traditional mortgage. By the time your loan term is up, your loan should be repaid in full.

Getting started with a home equity loan is easy! Discover Home Loans has Personal Bankers available to assess your needs and walk you through the entire home equity lending process. To find out how much you can borrow and what rates, terms and payment options apply to your personal situation, apply online now and see if you qualify in minutes, or contact a Personal Banker at 1-855-361-3435.

$0 Application Fees.

Possibly Look At Subprime Loans

As a last resort, you can turn to lenders offering subprime loans, which are easier to qualify for and targeted to poor-credit borrowers who dont meet traditional lending requirements.

Subprime lenders typically offer lower loan limits and significantly higher rates of interest. However, you should avoid these loans if at all possible, especially if you are already in credit trouble.

Also Check: How Long For Sba Loan Approval

Some Of The Disadvantages Of Using Your Home Equity

- You need to pay for various fees before you can borrow There are a number of costs that you have to pay for before you are allowed access to it, such as fees for the appraisal, the application, and legal documents.

- Variable rates = variable interest costs You might choose to borrow at a variable rate because initially, the rate might be cheaper than that of the fixed-rate option. However, be aware that if you choose a variable rate your interest rate can change.

- Using your equity for investment purposes comes with its own risks If you decide to use your home equity to make unsheltered investments, not only is it likely that you will have to pay taxes on them, but like any unsheltered investment, theres the possibility that you could lose your money because of how the stock market fluctuates.

- Failure to make your payments can result in your home being taken Defaulting on your payments can lead to your home being foreclosed. So, before taking out a second mortgage, you need to be absolutely certain youll be able to make regular payments.

When You Cant Pay Back Your Loan

Sometimes, even if youre granted a loan, you may encounter financial problems later on that make it difficult to pay it back. Though losing your home is a risk if you cant pay back your home equity loan or line of credit, it isnt a foregone conclusion. However, even if you can avoid losing your home, you will face serious financial consequences.

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan.

Read Also: What Is The Commitment Fee On Mortgage Loan

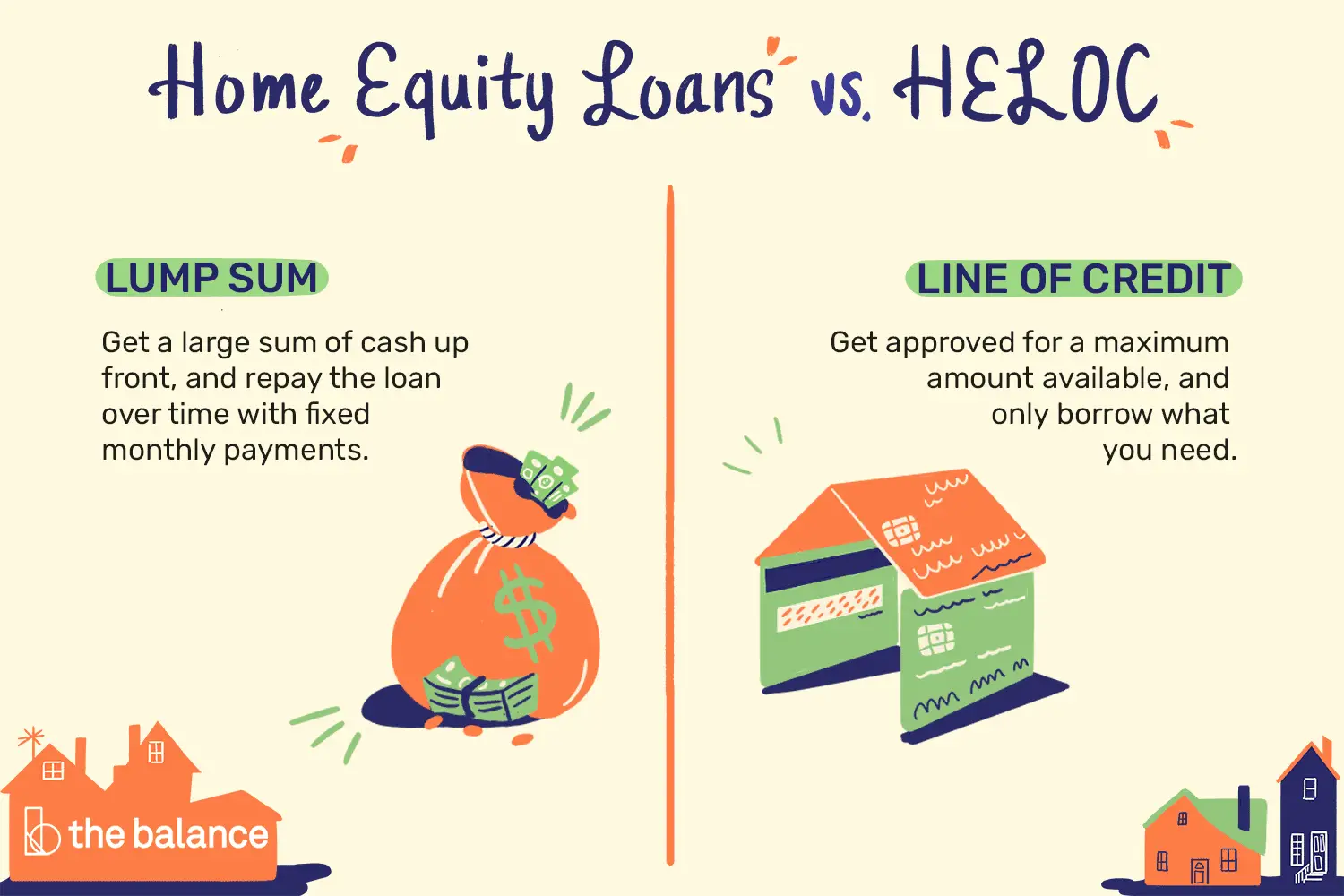

Home Equity Loans Vs Helocs

There are two main options for home equity financing. With a home equity loan, you borrow a lump sum of money and repay it in regular installments, typically at a fixed interest rate,over anywhere from 10 to 30 years.

The second type is a home equity line of credit , in which the lender sets aside an amount of money that you can borrow from as needed on a revolving basis. Most HELOCs charge adjustable interest rates, offer interest-only payments, and have a five- to 10-year draw period, during which you can access the funds. After the draw period ends, you have to repay the outstanding balance over a specific period, typically 10 to 20 years, but sometimes it is a balloon payment that requires payment in full.

Information Youll Need To Apply For A Home Equity Loan

To make completing the home equity loan application process as easy as possible, you should gather all of your financial information and required documentation in advance.

The following is a brief list of information you may need to obtain to complete your home equity loan application quickly:

- Social Security number

- Unreported debts or support obligations, like alimony and child support

- Two years of prior employment history and your employers contact information

- Evidence of your income for the past two years

- Proof of homeownership and home insurance declarations page

- Copy of your most recent pay stub

- Current mortgage statement

- Past two years of W-2 statements

- An appraisal or valuation of your home

- Evidence of existing debts and existing liens on your home

You will also need to provide several signed forms required by your lender.

We have created an easy to use printable application checklist outlining all of the documents youll need to complete your home equity application. In the event you have special circumstances surrounding your income, like self-employment or youre receiving social security income, youll need to provide additional information. The checklist outlines those situations.

Once youve gathered all of your required information, its time for you to talk to a lender about completing a loan application.

Read Also: Is Bayview Loan Servicing Legitimate

Apply With Your Chosen Lender

At smaller banks or credit unions, you may fill out your application in person with the lender. Larger banks may have you apply over the phone or online, requesting that you email or fax documents. Gathering government-required paperwork ahead of time can make the application process smoother.

During this process, your lender will give you disclosures to read. Review these carefully, and dont be afraid to ask questions.

How Many Home Equity Loans Can I Have

It’s possible to get more than one home equity loan on your house, but it can be difficult. You’ll need to have enough equity in your home to support your primary mortgage and multiple additional loans. Additionally, many lenders won’t want to be third in line for repayment if you run into financial troubles.

Don’t Miss: Can You Transfer Car Payments To Another Person

Home Equity Loan Requirements

Qualification requirements for home equity loans will vary by lender, but here’s an idea of what you’ll likely need in order to get approved:

-

Home equity of at least 15% to 20%.

-

A credit score of 620 or higher.

-

Debt-to-income ratio of 43% or lower.

In order to confirm your home’s fair market value, your lender may also require an appraisal to determine how much you’re eligible to borrow.

How Do I Apply

3 Easy Steps to Apply

Also Check: Do Pawn Shops Loan Money

Can I Get A Home Equity Loan Without Proof Of Income

No income equates to no ability to repay the home equity loan. You will be hard-pressed to get a home equity loan with no income at all. To get a home equity loan, you’ll need to prove you have enough income coming in each month to pay all of your existing debts, plus the new debt you’ll be taking on with this loan.

Underwriting Commitment And Closing

- A loan underwriter will review your financial profileThe underwriter will compare it to the home equity loan requirements and guidelines for your chosen loan or line of credit. If approved, you will receive a written commitment of terms and conditions

- With the written commitment, we can process your lending optionProcessing may include: the verification of your financial information, collection of documents to satisfy conditions of the commitment, and a review of the appraisal of the property

- Closing on your TD Bank Home Equity Loan or Line of CreditYou’ll meet with the lender and anyone else needed to finalize the transaction to sign paperwork and arrange for the loan to be disbursed to you. You must close at a TD location of your choice

Don’t Miss: What Happens If You Default On Sba Loan

Consider How Much Cash You Need

Ask yourself: What is the purpose of this loan? And how much money do I need for that purpose? It can be tempting to shoot for the stars and maximize your loan amount, perhaps to provide a financial cushion just in case. Still, thats only if youre sure you can resist the temptation to spend it all. If your spending habits are under control, it may make sense to borrow up, and by using a HELOC, youre only paying interest on the money you actually take out.

However, in the case of a home equity loan, youll be paying full interest on the entire lump sum, so it makes sense to borrow no more than you need.