What Is The Downside Of A Fha Loan

Costs of overall mortgage insurance are higher. On every FHA loan, regardless of down payment, borrowers pay a monthly FHA mortgage insurance premium of either .85% or .80% of the loan amount and an upfront mortgage insurance premium of 1.75%. On a traditional purchase loan, a 20% down payment eliminates the requirement for PMI. However, with a down payment of 3.5%, the only way to eliminate the MIP is to refinance to a Conventional loan.

Another downside of a FHA loan is the appraisal requirements are more strict. A FHA Appraiser inspects the property more closely and is looking at the safety and livability of the property more than a Conventional appraisal. If the standards are not met, the appraised value will be subject to the repairs being complete. Once the repairs are complete, a final inspection will be required, which will be an additional fee. If the property being considered is not in the best condition or is a fixer-upper, a standard FHA loan is not the best option.

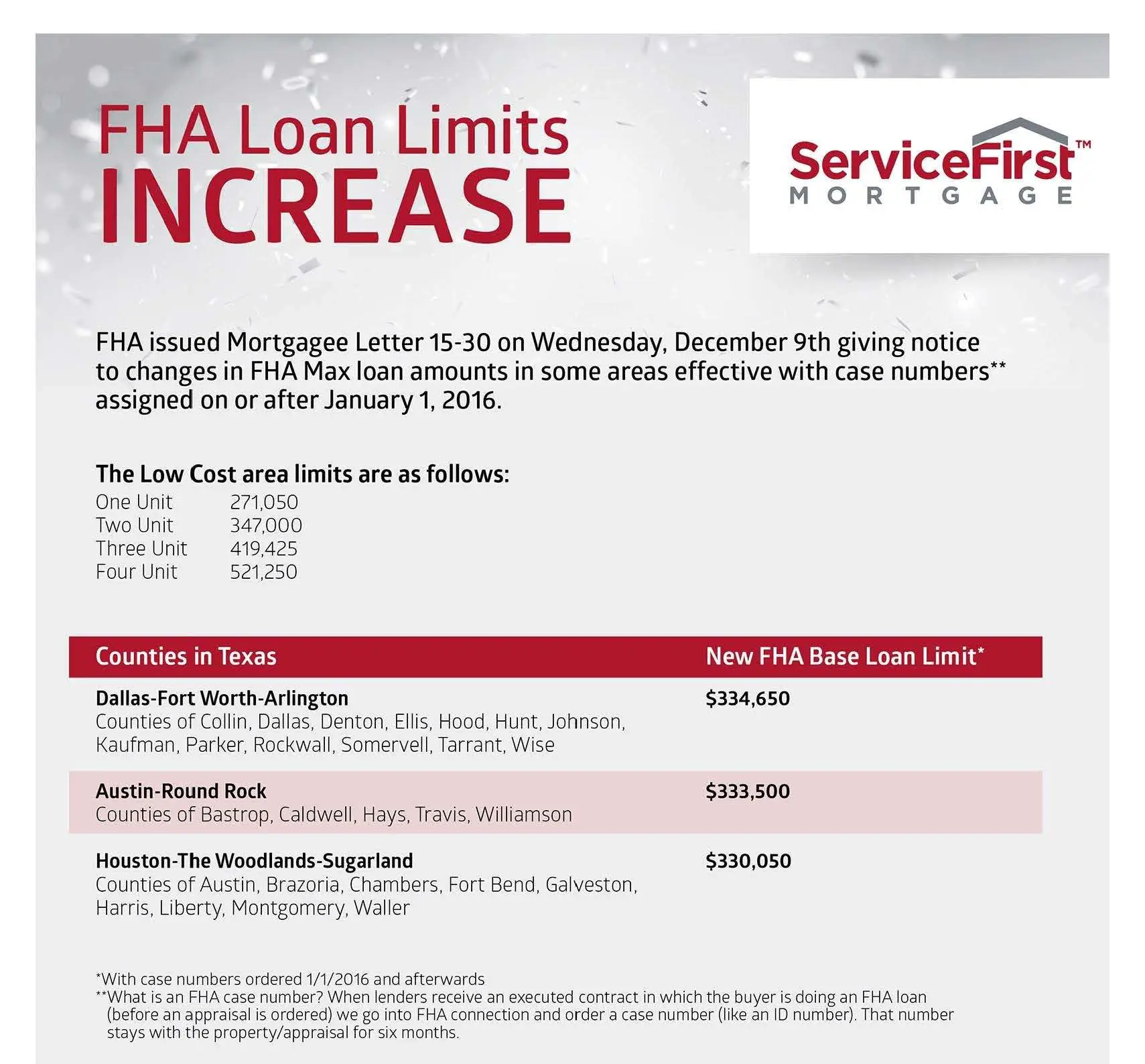

The FHA sets FHA loan restrictions per county every year. This could limit the amount of home you can buy with an FHA loan, particularly in high-cost locations. FHA lending limitations are typically 65 percent of conforming loan limits in a given area. In most parts of the country, conforming loan limitations are $510,400, compared to $331,760 for FHA loan limits in 2020.

Contact Mortgage Rates Today to get you the best rates with the best mortgage brokers.

What Is The Difference Between Fha And Conventional Loans

FHA loans are insured by the federal government, whereas conventional loans are not. FHA and conventional loans also differ in refinancing, loan limits, and owner-occupation requirements:

- Refinancing: While available for both loan types, refinancing is more detailed for a conventional loan and requires an appraisal, credit check, and income verification.

- Loan limits: Both loan types have maximum and minimum amounts you can receive, but they differ in how these limits are determined. The limits for an FHA loan are determined by the countys median home value, and conventional loans follow the protection standards under Fannie Mae and Freddie Mac.

- Owner occupation: While an FHA loan requires you to live in the property, a conventional loan does not.

Federal Housing Administration Loan Relief

When you get an FHA loan, you may be eligible for loan relief if youâve experienced a legitimate financial hardship such as a loss of income or an increase in living expenses. The FHA Home Affordable Modification Program , for example, can permanently lower your monthly mortgage payment to an affordable level.

To become a full participant in the program, you must successfully complete a trial payment plan in which you make three scheduled paymentsâon timeâat the lower, modified amount.

Recommended Reading: Can My Business Loan Money To Another Business

Qualifying For An Fha Loan

Your lender will assess your eligibility for an FHA loan in the same way that it would any other mortgage application. If youve had a bankruptcy or foreclosure, you can still qualify for an FHA loan as long as you have rebuilt your credit and the required wait times have passed. Its vital to remember that, in general, the lower your credit score and down payment, the higher your mortgage interest rate will be. The qualifications of a FHA loan are very different than a Jumbo home loan.

There are special FHA mortgage lending standards stated by the FHA for these loans, in addition to credit score and down payment requirements. You must have a stable employment history and work with a FHA-approved Greenville South Carolina mortgage lender.

Where To Get An Fha Loan

FHA loans are backed by the government, but you apply and obtain them through FHA-approved lenders. You can find a list of approved lenders on the Housing and Urban Development website.

Keep in mind that because the government doesnt directly finance these loans, it doesnt set the interest rates or termsthe lenders do. That means the costs of FHA loans can vary, so it could be worth shopping around to find the best deal.

Additionally, while FHA loans tend to have competitive interest rates, HUD recommends homebuyers still compare FHA loans with other types of mortgages in case an FHA loan isnt the most affordable option. While FHA loan interest rates may be the lowest option for those with credit issues, a conventional loan may have better rates for those with stronger credit.

Read Also: What Interest Rate For Used Car Loan

Can You Get An Fha Loan With Student Loan Debt

Yes. Recent changes to FHA guidelines make it even easier for aspiring homeowners to apply for a mortgage with student loan debt and qualify based on the actual student loan payment. Prior to the change which went into effect in the summer of 2021, FHA-approved lenders were required to calculate 1% of the student loan balance to qualify, regardless of whether the actual payment was lower.

Calculated And Updated Annually

The FHA sets annual lending limits for home loan amounts that it will insure. These limits are determined based on the county in which you live and the type of property you’re purchasing. Low-cost areas of the country have a lower limit, known as the “floor,” and high-cost areas have a higher figure, called the “ceiling”. It’s not uncommon for the ceiling loan limit to be more than double the floor for single-family properties.

The limits also vary based on the type of property. For instance, Houston, TX loan limits for duplexes can be almost 30% higher than for a single-family home. That number increases to more than 50% for a triplex.

Also Check: How Do I Find My Ppp Loan Number

Fha Credit Score Standards

You credit score and credit history are different but related sources of information lenders use to decide whether to approve your loan application. Your score is a predictive statistic and guess at your likelihood of repaying a loan.

When it comes to credit scores, bigger is better. Why? Lenders offer the best rates to borrowers who have the highest FICO credit scores.

The FHA minimum credit score is 500. However, if you want a loan with a 3.5 percent down-payment, then you must have a credit score of 580 or higher.

If you have a FICO credit score between 500 and 579, you are still eligible for an FHA loan. Borrowers with low scores must come up with a 10 percent down payment.

The 580 credit score standard is a bit deceiving in practice. It is common for lenders to place the bar higher and require a 620, a 680 or even higher score. Lenders may not go below the FHAs minimum credit score, but are free to require higher scores.

These higher standards are known as lender overlays and they vary from lender to lender. Lenders add overlays as a precaution, especially on credit score requirements, because borrowers with low credit scores are more likely to default. Lenders worry about their overall FHA default rate. Lenders with high default rates are not allowed to stay in the FHA program and may receive financial penalties for making too many bad loans.

Also Check: Usaa Personal Loan Approval Odds

Other Requirements For An Fha Loan

To qualify for an FHA loan, you must be purchasing the home for your own use as a primary residence. You may have non-occupant co-signers, such as your parents, to help you qualify.

You can use an FHA loan to buy a multi-unit property of up to four residences, as long as one of the units is for your own use as your primary home.

You must be 18 years old or older, be able to document steady employment and have at least two years with the same employer or running the same business.

As far as income, your debt-to-income ratio matters more than how much you earn each year. For an FHA loan, lenders generally want your total debt payments your FHA loan and all other payments on debts to be no more than 41 percent of your gross monthly income, though they may go as high as 50 percent for borrowers with excellent credit. Lower limits may be applied to borrowers with poor credit.

Your debts include payments on any money you have borrowed credit cards, auto loans, personal loans, etc. Your mortgage debt includes any expenses included in your mortgage payments, such as homeowner’s insurance, property taxes and mortgage insurance.

Before you can be approved for a loan, FHA requirements specify that the home must pass an inspection to ensure it is safe for habitation. That’s a step beyond the appraisal required for a conventional mortgage, which merely determines if the value of the home is enough to support the loan.

You May Like: Which Bank Is Best For Construction Loan

Fha Loans Arent Just For First

FHA loans are not for first-time buyers only. First-time and repeat buyers can finance houses with FHA mortgages.

The FHA loan is often marketed as a product for first-time buyers because of its low down payment requirements.

But not all repeat homebuyers have excellent credit or lots of money saved for a down payment on a home. The FHA home loan program is open to them, too.

You couldnt use this type of mortgage for a second home, investment property, or commercial real estate only home purchase loans for primary residences.

The FHA will insure mortgages for any primary residence. There is no requirement that you must be a first-time buyer to use the FHA loan program.

How Much Can You Borrow

FHA loan requirements limit how much you can borrow. In most of the United States, the loan limit is $420,680 for a single-family home. However, in counties with high real estate values, that limit can go as high as $970,800.

Higher loan limits are allowed for 2, 3 or 4-unit residences, ranging as high as $1,437,500 for a 4-unit residence in Honolulu. For a complete table of loan limits by county, see the FHA Mortgage Limits List on the HUD website.

You May Like: How To Lower Student Loan Repayment

Fha Loan Requirements For 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you dont have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Heres a rundown of the key FHA loan requirements.

Fha Mortgage Insurance Premiums

An FHA loan requires that you pay two types of mortgage insurance premiumsâan upfront MIP and an annual MIP, which is paid monthly. In 2022, the upfront MIP is equal to 1.75% of the base loan amount.

You can either pay the upfront MIP at the time of closing, or it can be rolled into the loan. For example, if youâre issued a home loan for $350,000, youâll pay an upfront MIP of 1.75% x $350,000 = $6,125.

These payments are deposited into an escrow account that the U.S. Treasury Department manages. If you end up defaulting on your loan, the funds will go toward the mortgage repayment.

Despite its name, borrowers make annual MIP payments every month, with the payments ranging from 0.45% to 1.05% of the base loan amount. The payment amounts differ depending on the loan amount, the length of the loan, and the original loan-to-value ratio.

Lets assume you have an annual MIP of 0.85%. In that case, a $350,000 loan would result in annual MIP payments of 0.85% x $350,000 = $2,975 . These monthly premiums are paid in addition to the one-time upfront MIP payment. You will make annual MIP payments for either 11 years or the life of the loan, depending on the length of the loan and the LTV.

You may be able to take a tax deduction for the amount you pay in premiums. You have to itemize your deductionsârather than take the standard deductionâin order to do this.

| How Long You Will Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

You May Like: How Many Payments Left On Mortgage

Also Check: What Score Do You Need For Fha Loan

Lenders Can Set Their Own Fha Loan Requirements

All FHA loans are not the same. There are many types of FHA loans, and mortgage rates vary by lender.

The FHA sets minimum eligibility requirements for all the loans it insures. But each FHA lender can enforce its own rules. The FHA calls these lender-specific rules overlays.

For example, a lender could have higher credit score requirements than the FHAs. Or, a lender could enforce stricter rules about previous foreclosures in your credit report.

It works the other way around, too.

For instance, one FHA lender could allow a higher DTI than another one. Or, one lender could let you use tax returns to show your income while another may insist on pay stubs to prove your employment history.

Because of these variations, when youve been turned down for an FHA mortgage by one lender, you should always try to apply with another which may approve your FHA loan request. Plus, mortgage rates can be very different from bank to bank.

In addition, the FHA offers special refinance loans, cash-out refinance loans, home construction loans, and other benefits to its applicants.

If youve been turned down for an FHA loan with your lender, consider applying somewhere else. Your loan may be approved once you re-apply.

Requirements Of Fha Loans

The requirements of an FHA loan are designed to put homeownership in reach of a broad swath of middle-class Americans who can afford a mortgage payment but otherwise would have difficulty qualifying for a home loan.

Those requirements including low down payments and lenient credit demands have made FHA loans the go-to choice for generations for first-time homebuyers and others. They’re also why FHA loans currently make up about one-fifth of all home purchase mortgages in the United States.

So what do you need to qualify for an FHA loan? You may know the basic requirements as little as 3.5 percent down, low credit scores are allowed, the home must pass an inspection, etc. but that’s just the beginning.

Here’s a closer look at the various requirements of an FHA loan and what you need to do to meet them.

Also Check: How To Refinance An Avant Loan

Down Payment Assistance Grants

The down payment is the initial upfront payment you make when buying a home. It is seen as your investment in the mortgage, since you stand to lose it if you default on the monthly payments that come after. While many conventional loans require a down payments as high as 20 percent of the total purchase price, FHA loans make things a little easier by requiring 3.5 percent down.

Either way, saving for a hefty down payment on a home can be a burden, so its a smart move to look for available assistance that will help lessen some of that cost. Many state and local government agencies offer assistance programs such as Down Payment Grants to eligible, first-time homebuyers in order to help them meet down payment and closing cost requirements.

Make sure to take advantage of any Down Payment Assistance Programs offered by your county, municipality, or state to help lower your upfront mortgage costs. Find a Down Payment Assistance Program in your area.

Also Check: What Size Mortgage Loan Can I Qualify For

Fha Loan Credit Score And Credit History

Homebuyers often choose FHA loans if theyve had rough patches in their credit history. While 620 is the standard credit score benchmark for a conventional loan, FHA guidelines set lower minimum score requirements:

- Youll need at least a 580 score if youre making the minimum 3.5% down payment.

- Youll need at least a 500 score for the 10% down payment.

Don’t Miss: How To Get Business Loan With No Money

How To Apply For An Fha Loan

Applying for an FHA loan is simple when you know how. Follow the steps below to get started:

Getting an FHA loan can be easy when you understand how the process works. Though it can seem difficult to understand all the details, our Home Lending Advisors are here to guide you through each step.