Va Loan Income Qualification

Income qualification for VA loans is different. There is no specific housing DTI, but the total DTI is usually limited to 41%. However, that limit is frequently exceeded with good compensating factors. Many lenders will go as high as 50%.

But what distinguishes VA loans from other loan types is that DTI isnt the only income factor. VA loans also rely on whats known as the residual income method. It calculates the amount of money available after paying your housing and other fixed payments.

It starts with your stable monthly income, then subtracts the new house payment, recurring monthly debts, income taxes, utilities, and even an allowance for your household family size. The amount left over should be a positive number.

While it may seem VA loans have a higher income qualification standard, using two qualifying methods, the opposite is closer to the truth. A healthy residual income balance can be a justification for approving a loan with a DTI over 41%.

Va Loan Vs Conventional Loan Side By Side

You’ll need to weigh the pros and cons of each loan type when deciding which one is right for you. As you go down this list comparing VA loans and conventional mortgage loans, consider whether each factor is important in your situation.

| Recommended 20%, but can go as low as 3% | ||

| Interest rates | Lower | Higher |

| Property type | Can only be used for primary residence | Can be used for primary residence, vacation home, or investment real estate |

| PMI | Required if you’re making a down payment of less than 20% | |

| No specific requirement, but the average credit score is 722 for most lenders | 650, but the average credit score is 758 | |

| Average closing speed | 49 days |

Learn The Differences Between These Mortgage Choices

When you’re a veteran, you can often choose between a VA loan and conventional loan when you want to buy or refinance a home.

VA loans are backed by the government and offered by lenders like Freedom Mortgage. They are only available to veterans, active-duty military personnel, and surviving spouses who qualify. Conventional loans are offered by lenders without a government backing and are available to everyone who meets the requirements.

VA loans are often a better choice when you want to finance a house. That’s because VA loans frequently have lower interest rates, lower down payments, and easier refinancing options compared to conventional loans.

There are houses you can buy with conventional loans you can’t buy with VA loans, however. And both loan types come with requirements and costs you’ll want to understand. Check out our comparison table and read our discussion below!

| No |

VA loans are for primary homes only

You can only buy or refinance your primary residence with a VA loan. You can finance primary homes, vacation homes, rental properties, and investment properties with conventional loans.

VA loans have no down payments

In many cases, it is possible to buy a home without a down payment using a VA loan. When you buy a house with a conventional loan, you will need to make a down payment.

VA loans can have better interest rates

VA loans have lower credit scores

VA loans have funding fees

Conventional loans have mortgage insurance

VA loans have easier refinancing

You May Like: How Much Personal Loan Can I Get On 50000 Salary

Which Loan Is Easier To Qualify For

While VA loans are available throughout the country, each state has its own set of eligibility standards to qualify. Factors such as your length of service, duty status and character of service can all affect your eligibility to qualify for a specific VA loan.

When applying for a VA loan, you must verify your eligibility with a Certificate of Eligibility . To obtain a COE, you must meet the following VA loan eligibility requirements:

- Served for 90 days during a time of war

- Served for 181 days during a time of peace

- Served for 6 years or more in the National Guard or Reserves

- You are the spouse of a service member killed in the line of duty or as the result of a service-related incident

| Requirement | |

| VA loan funding fee, loan origination charge | Origination charge |

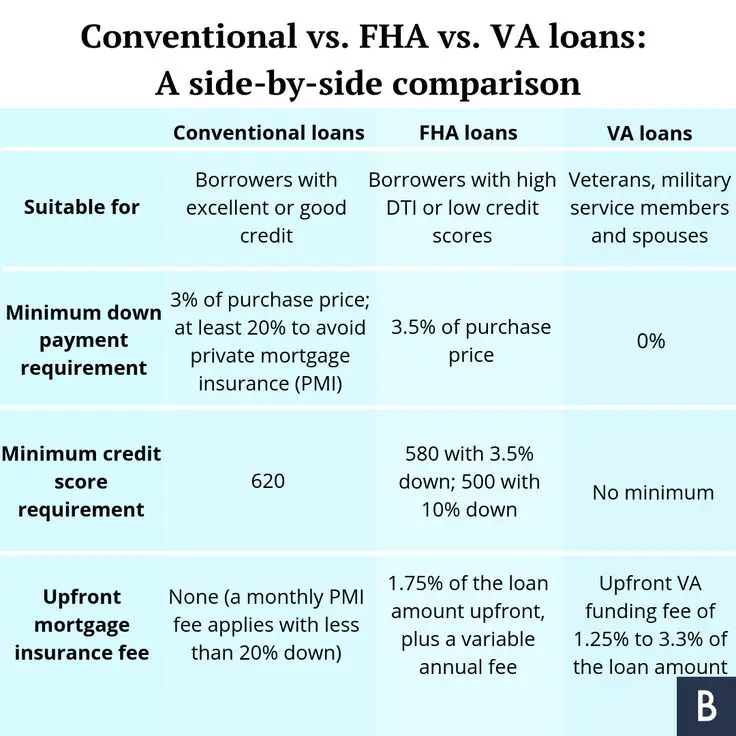

Fha Vs Conventional Loans Comparison

When contrasting the applications and limitations of conventional loans and FHA loans, there are a few key conclusions to draw.

- Refinancing: Both FHA and conventional loans are eligible for refinancing. Nevertheless, refinancing conventional loans is more involved and calls for things like a home appraisal, a credit check, proof of income, and so on.

- Areas with high and low costs that influence loan values: There are loan ceilings and floors, or the maximum and lowest values that can receive, for both conventional and FHA mortgages. The median house price in a region is used to calculate FHA loans. The protection rules for conventional loans differ by lender, state, and county but are typically compliant with Fannie Mae and Freddy Mac.

- Debt-to-income: It’ll be more difficult to obtain a conventional loan the less your debt-to-income ratio. FHA mortgages allow DTIs up to 50% conventional loans normally tolerate DTIs in the 30-to-43% range.

Don’t Miss: What Is Personal Loan Used For

Additional Requirements To Consider

While the above comparisons are vital to know, theyre not the only differences between these two loan types.

For example, VA loans dont possess loan limits, but conventional loans do. These limits are set by each county, with most counties setting their limit at $726,200 for a single-family property in 2023.

They also differ in their mortgage rates. Typically, when you compare rates for the average 30-year VA loan and a 30-year conventional loan, VA loans usually have lower interest rates. The percentage difference tends to sit between 0.25% 0.42%.

The VA also caps closing costs, which along with competitive interest rates can make VA loans financially favorable.

Conventional Conforming Mortgage Loans

“Conventional conforming” mortgage loans adhere to guidelines that the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation set. These loans are subject to amount limitations.

Conventional conforming loans are available to everyone. But they’re more difficult to qualify for than VA-guaranteed and FHA-insured loans. Because conventional loans don’t have government insurance, these loans pose a higher risk for lenders.

So, credit and income requirements are stricter for conventional conforming mortgage loans than for FHA-insured and VA-guaranteed mortgages.

Eligibility requirements for a conventional conforming loan. Generally, you can get a conventional conforming loan if you:

- have good credit

- have a steady income, and

- can afford the down payment .

What credit score do I need to get a conforming conventional mortgage loan? Depending on the situation, Fannie Mae generally requires borrowers to have a of 620 or 640. Depending on the circumstances, Freddie Mac requires a score of 620 or 660 for a single-family primary residence. Lenders may also have stricter requirements.

You May Like: Online Installment Loans For Bad Credit

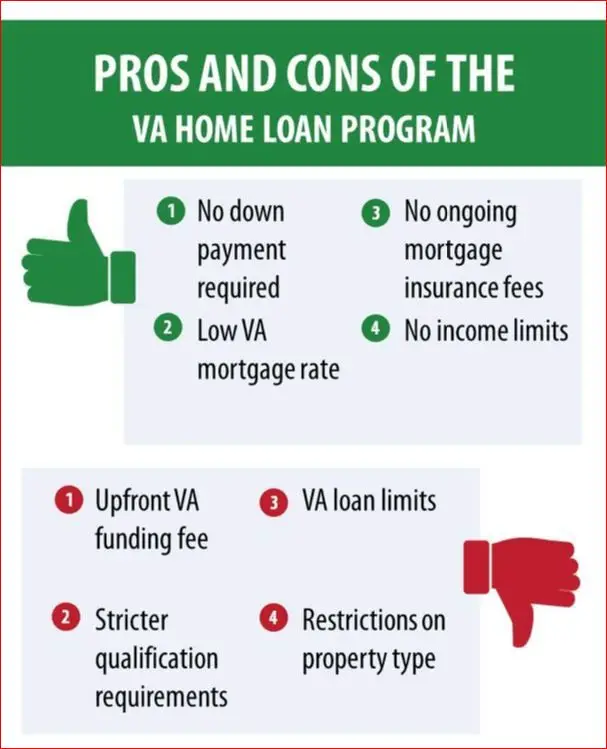

Funding Fee Requirements For Va Loans Vs Conventional

VA loans dont require a down payment or mortgage insurance, but it does have a funding fee which can make conventional loans a better option for certain borrowers.

The VA program has a fee called the VA funding Fee, its a cost that ranges anywhere from 2.3% to 3.6% depending on whether its your first time using the program or subsequent use.

This fee is usually rolled into the loan, but even though its not a cost you have to pay for out of pocket, it is still increasing the loan amount by a large percentage, which means that youll be paying more interest on the loan in the long run.

If you are doing a refinance, compare the monthly payment to a conventional loan.

Does the VA loan have a low enough payment to justify paying the funding fee or does a Conventional loan make more sense?

If you are purchasing, conventional loans always require a down payment. If you dont have a down payment than a VA loan would best option for you.

But, if you have the means to make a down payment, compare the costs and payment to decide which makes the most sense.

How To Choose Between A Va Loan And Conventional Loan

Both VA loans and conventional loans can be excellent options to help military veterans and service members finance a home purchase. Choosing which type of loan to use comes down to personal preference and identifying the mortgage that best suits your needs.

If youre having difficulty deciding, compare the benefits of VA mortgages and conventional mortgages to see which appeals to you more.

You May Like: When Do I Start Repaying My Student Loan

Va Loan Vs Conventional Loan: Closing Costs

Closing costs are various fees you pay your lender to process your loan. Included in these costs are origination fees, home appraisal fees, title search fees and more.

While VA loans cap their origination fees at 1% of the total loan amount, these fees similarly tend to only range from 0.5% 1% for conventional loans. Appraisal fees for conventional loans are usually lower, typically ranging from $300 $400 for a single-family home versus $425 $875 for a VA appraisal. Its important to note that appraisal fees for a home being financed with any loan can cost north of $600 or even $2,000 depending on where you live, how big your house is, etc.

Overall, youll generally pay 3% 5% of your loan amount to close on your VA loan, and youll likely pay 2% 6% to close on your conventional loan.

Can A Veteran With Bad Credit Buy A Home Using A Va Loan

You must meet your lenders minimum standards for credit, income and any other requirements for your loan to be approved. VA does NOT require a minimum credit score, but most lenders will use a credit score to help determine your interest rate and to lower risk. Typically, lenders may want borrowers to have a minimum credit score.

Also Check: Does Usaa Do Home Loans

Types Of Conventional Loans

- Fixed-rate conventional loans: The fixed interest rate remains the same for the entire length of the mortgage.

- Conforming conventional loans: This applies to any mortgage that is less than or equal to the dollar amount limit set by the Federal Housing Finance Agency , an organization that regulates the government-sponsored enterprises Fannie Mae and Freddie Mac.

- Adjustable-rate conventional loans: Also known as ARMs, or adjustable-rate mortgages, these loans have interest rates that fluctuate during loan length, often changing annually after the initial fixed-rate period that may be three, five, seven, or 10 years.

- Nonconforming conventional loans: These loans exceed the limits set by the FHFA, so they use different underwriting standards set by Fannie Mae and Freddie Mac.

- Low down payment conventional loans: Also known as 80/20 loans, these types of loans once required 20% down payments, but now have more flexible terms that require down payments of as little as 3% to 5%.

Conventional Loan And Va Loan Basics

Conventional loans are mortgages that arent insured by the government. VA loans are mortgages guaranteed by the U.S. Department of Veterans Affairs.

Anyone who meets a lenders credit and debt-to-income ratio requirements can qualify for a conventional loan. In contrast, VA loan eligibility is limited to certain service members, including those on active duty and in the National Guard or Army Reserve veterans of the U. S. military and their qualifying surviving spouses.

Conventional loans are either conforming, meaning they meet the eligibility requirements of Fannie Mae and Freddie Mac, or non-conforming, meaning they dont meet the minimum Fannie Mae and Freddie Mac standards to purchase the loan. Most conventional loans are conforming. However, some conventional mortgages, like jumbo loans , are not conforming.

For the 2022 calendar year, conforming conventional mortgages have loan limits of $647,200 for a single-family home. However, in certain higher-cost areas, that limit increases to $970,800.

Eligible VA loans over $144,000 no longer come with limits, meaning theres no down payment.

Lets take a closer look at some of the requirements for conventional loans and VA loans.

You May Like: Does Paying Off An Auto Loan Help Your Credit

Differences Between Conventional Loans And Va Loans

Conventional loans and VA loans have many differences. The one that stands out the most is that VA loans require a service history with the military in order to qualify.

Al Moreira, from the Moreira Team, says that with a VA loan, you will need VA eligibility through reserve service, military service, the National Guard service, or the surviving spouse of a veteran that was killed in combat or from a disability or illness that is service-connected. These same people are able to apply for conventional loans, but the majority of individuals that choose conventional loans generally dont qualify for a VA loan.

The second difference is that VA loans allow for 100% financing, while most conventional loans usually require a minimum of 3% down.

Thirdly, a conventional loan also requires that you buy PMI if your down payment is less than 20%.

Al Moreira also states that the majority of individuals that settle for conventional loans arent eligible for VA loans.

A VA loan wont require PMI, but the applicant will be charged a funding fee, which is usually between 1% and 3.6% of the total loan amount, which also depends on the down payment.

Fourth, you can only use your VA loan to buy your primary residence. Conventional loans are more flexible and allow you to use the loan for a primary residence, an investment property, or a second home.

Moreira continues that when looking at the similarities both these loan programs typically require debt-to-income ratios that are under 50% .

Va Mortgage Insurance The Va Funding Fee

There is no monthly mortgage insurance premium on VA loans. There is only a one-time, upfront premium, referred to as the VA funding fee. However, it is also possible to have the funding fee waived if you have a VA Service-Connected Disability Rating.

The exact amount of the fee depends on the type of loan , and the type of veteran .

- Regular Military: 2.15% of the loan amount for first-time use, 3.3% for subsequent uses.

- Reserves/National Guard: 2.4% for first-time use, 3.3% for subsequent uses.

Cash-out refinances, regardless of equity:

- Regular Military: 2.15% for a first-time use, 3.3% for subsequent uses.

- Reserves/National Guard: 2.4% for first-time use, 3.3% for subsequent uses.

The funding fee is typically added to the loan amount, which means the veteran can conceivably owe more on the property than its worth.

Don’t Miss: How Do I Pay My Student Loans

How To Choose The Right Mortgage For You

Ultimately, the right financing choice for you will depend on several factors, including:

- Your ability to qualify for the loan

- The type of home youre buying

- Your personal finances

- The local real estate market

- Your urgency to purchase a property

Talk with an experienced loan officer to identify the best loan and the best way to structure your financing, recommends Davis. There is not a one-size-fits-all approach, and what is best for one person may not be best for another.

When Is A Conventional Loan Better

Despite all the perks of a VA loan, a conventional loan may be a better option under certain circumstances.

Imagine you want to purchase that same $300,000 home as a first-time buyer. But in this scenario, you have $60,000 to put down and there are 15 other offers on the house you want to purchase, Davis explains. Here, a VA offer is unlikely to get accepted over a conventional offer because there is a greater perceived risk of issues with appraisal. But since you have 20% to put down, you can purchase the home with no mortgage insurance.

Davis adds, If your main priority is to get the house, a conventional loan might be the way to go even if you qualify for both a conventional loan and a VA loan.

Don’t Miss: Car Loan For No Credit

Requirements For Conventional Loans

Borrowers contemplating conventional loans must meet more stringent conditions to be approved by private lenders. These qualifications include, among others:

- If a borrower deposits below 20%, they must also purchase private mortgage insurance, which is payable in monthly installments. However, private mortgage insurance is not necessary for down payments greater than 20%.

- To qualify for a loan, many private lenders impose a minimum credit score.

- Debt-to-income ratio: Lower DTIs are preferred by traditional lenders. Additionally, the maximum DTI for conventional loans is restricted to a moderate to mid-range credit score however, there are some exceptions for borrowers with credit scores over 700 or even for those with pristine credit.

Verifiable employment and income are requirements for conventional mortgage approval, just like they are for FHA loans. The requirements for after-tax income may also be greater, based on the financial institution.

Do Sellers Have A Preference

Home sellers tend to favor offers from buyers using conventional loans over offers from buyers with VA loans. Conventional loans are generally more flexible than government-backed loans, and they close faster on average. Some sellers may also perceive buyers with conventional financing as more reliable and financially secure, since conventional loans have tougher credit requirements and often include larger down payments.

Recommended Reading: How Do I Pay Off My One Main Financial Loan

Do Va Loans Have Fees

If you take out a VA loan you’ll have to pay a one-time funding fee when you close on your home. You can pay the fee upfront or finance it over time by rolling it into your mortgage. The amount of the fee will depend on the type of loan and the size of the loan. For instance, if your down payment is less than 5%, your fee will cost 2.3% of your loan. If you make a down payment between 5% and 10%, the fee will only be assessed at 1.65% of your loan.

There are some exceptions to the VA loan funding fee requirement. For example, an active duty service member who has received a Purple Heart does not have to pay the funding fee. Keep in mind, however, that you’ll still have to pay other standard lender fees that all buyers must pay when purchasing a house, such as closing costs.