What If Im Getting An Fha Loan

FHA loans come with their own loan limits. Standard FHA limits for 2022 are listed below.

- 1unit homes: $420,680

- 3unit homes: $651,050

- 4unit homes: $809,150

You might notice that FHAs limits are considerably lower than the conforming limits. Thats by design.

The FHA program, backed by the Federal Housing Administration, is meant for home buyers with moderate incomes and credit scores.

But the FHA also suits home buyers in expensive counties. Singlefamily FHA loan limits reach $970,800 in highcost areas within the continental U.S. and a surprising $1,456,200 for a 1unit home in Alaska, Hawaii, Guam, or the Virgin Islands.

What Home Buyers Need To Know

Homeownership is within reach thanks to the increase in conforming loan limits. The bottom line: its easier to qualify for more home without requiring a non-conforming jumbo loan.

Rates remain competitive, so be sure to start the mortgage pre-approval process soon. Your lender can provide a pre-approval letter that tells you how much home you can afford.

New Conforming Loan Limits Help Borrowers Avoid Jumbo Loans

A lift in the loan limits for the countrys most popular loans is great news for home shoppers in 2022. This increase reflects the growing average cost of homes, allowing more home buyers to borrow within the newly capped amount to avoid getting jumbo loans . The result is beneficial to those looking to purchase a home in 2022.

How do conforming loan limits work?

Each year, a conforming loan limit is set by housing finance agencies Fannie Mae, Freddie Mac, and Ginnie Maes federal regulator, the Federal Housing Financing Agency . A large portion of mortgages in the U.S. are backed by these agencies which makes these loan limits an important part of the home buying process.

Conforming loan limits are based on median home valueswhich can vary from county to county across the U.S. So, typically as home prices rise, loan limits will too. This allows home buyers to continue to keep up with the real estate market.

Look at the numbers.

The FHFA announced the conforming loan limit will rise by over $98,000 for most counties in the U.S. Loan limits were raised to help with an increase in home prices . This is the sixth straight year the conforming loan limits have been raised after not increasing from 2006-2016.

General Loan Limits for 2022:High-Cost Area Loan Limits for 2022:

to see all 2022 conforming and high balance loan limits by county.

Whats the difference between conforming loans and jumbo loans?

Consider the whole package when looking for a new home.

- A budget breakdown

Also Check: Used Car Loan Usaa

Conforming Loan Limits 2022

For 2022, the conforming loan limit for single-family homes is $647,200, but it can be higher in some expensive housing markets. For example, conforming loans can top out at $970,800 in Alaska and Hawaii in Washington, D.C. and in some counties, such as San Francisco.

To get a conforming loan, youll want to shop for homes in a price range that will allow you to stay under the conforming loan limit in your area. Use the tool below to find out what that limit is.

What Will My Interest Rate Be

Conventional loan rates are determined by the program you qualify for and your credit score. You might be asking yourself what is the formula to calculate interest rates? Interest rates are driven off of Mortgage Backed Securities which are commonly referred to mortgage bonds. These value of these bonds determine whether the interest rates rise or fall. Your final rate will determine your payment using the standard calculate mortgage payment formula.

Read Also: Usaa New Auto Loan Rates

Rising Prices Bring Higher Limits In :

At the end of 2020, federal housing officials increased the conforming loan limits for California and in a November 24th, 2020 press release, the Federal Housing Finance Agency stated:

Washington, D.C. The Federal Housing Finance Agency today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021. In most of the U.S., the 2021 maximum conforming loan limit for one-unit properties will be $548,250, an increase from $510,400 in 2020

Baseline Limit

The Housing and Economic Recovery Act requires that the baseline CLL be adjusted each year for Fannie Mae and Freddie Mac to reflect the change in the average U.S. home price. Earlier today, FHFA published its third-quarter 2020 FHFA House Price Index report, which includes estimates for the increase in the average U.S. home value over the last four quarters. According to the seasonally adjusted, expanded-data FHFA HPI, house prices increased 7.42 percent, on average, between the third quarters of 2019 and 2020. Therefore, the baseline maximum CLL it in 2021 will increase by the same percentage.

Since 2008 the FHFA has used the HERA formula to calculate Conforming loan limits.

Why They Were Increased For 2022

We predicted that federal housing officials would increase the Seattle jumbo loan threshold in response to significant home-price gains that occurred during the year. That prediction turned out to be accurate. In fact, the FHFA raised limits across most of the country.

According to a recent news release from FHFA:

The Federal Housing Finance Agency today announced the conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2022. In most of the U.S., the 2022 CLL for one-unit properties will be $647,200, an increase of $98,950 from $548,250 in 2021.

So the vast majority of counties across the U.S. will see higher caps in 2022, compared to 2022. Home prices nationally rose by an average of around 19.2% during 2021. In Washington, the median house value rose by around 22.8%. That is why we are seeing higher Washington State conforming loan limits in 2022.

Read Also: Can I Get A Car With A 600 Credit Score

Conventional Loan Down Payment Requirements

The minimum down payment requirement for a conventional loan is 3% of the loan amount. However, lenders may require borrowers with high DTI ratios or low credit scores to make a larger down payment.

Even if it’s not required, if you’re able to make a higher down payment, you may want to consider doing so. This can often help you get a lower interest rate.

Its also important to note that if you put down less than 20%, you will pay for private mortgage insurance until you have at least 20% equity in your home. PMI will typically cost you an additional 0.3% to 1.5% of the loan amount each year.

If youre taking out a jumbo loan, your lender may require you to make a larger down payment. This can range from 10% to 20% or higher depending on your lender, the amount you’re requesting and the type of building you’re purchasing.

Choose A Conforming High

Also, like we mentioned before, you can also choose to find a conforming high-balance loan. These types of loans may have more strict requirements, such as a higher minimum down payment amount and lower debt-to-income ratios. They also may come with higher rates.

Then there are jumbo loans. A jumbo loan is a conventional mortgage, but its considered non-conforming. Technically, jumbo loans dont have loan limits. Each bank or lender sets its own jumbo limits. Jumbo loans can go up to $10 million or more. Theyre designed to help people buy high-cost and luxury homes.

Jumbo loans are only offered by private lenders and are not insured by the government or by Fannie Mae or Freddie Mac. Some lenders require down payments of 10-20%, though each company can set their own terms, so you may find some who accept a lower amount down. Oftentimes, credit score requirements are higher as well.

Read Also: How Much Car Can I Afford Based On Income

How Conventional Loan Limits Work And How To Find Yours

Every November, the Federal Housing Finance Agency announces new loan limits for conventional loans for the following year. And each limit is usually higher than the last, in line with rising home prices.

So, in the early 1970s, the standard limit for single-family homes was $33,000. By 2019, it was $484,350. And now, in $2022, its 420,680.

But dont assume that rising loan limits are inevitable. When the FHFA announced 2020s caps, 43 counties had ones that remained unchanged.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Usaa Rv Loan Reviews

Why Jumbo Loan Limits Matter

If the amount you want to borrow goes beyond the limits of a conforming loan and you need to get a jumbo loan, your lender may require:

-

A stronger credit score. The minimum credit score for a jumbo loan is typically at least 680, but some lenders may require an even higher one. The higher your credit score, the lower your interest rate is likely to be.

-

More cash in the bank. Knowing you have cash reserves, and not too much debt, makes lenders more likely to approve your jumbo loan.

-

A larger down payment. Requirements vary by lender and depend on your financial history.

-

An extra appraisal. Some lenders may require a second opinion on the homes value to be sure its worth the amount youre borrowing.

-

Additional fees. Since youre borrowing a larger amount, there may be some extra steps in the loan process, leading to higher closing costs.

-

Higher interest rates. Although this can fluctuate based on market conditions and individual lender offerings, jumbo loan rates may be higher than those for conforming loans.

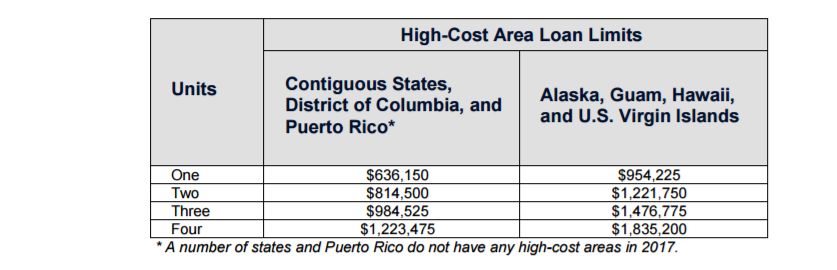

Conforming Loan Limits For High

Some areas that satisfy requirements for higher maximum conforming loan limits will be assigned higher limits. This is typically true in notably expensive metropolises where the local median home value exceeds the baseline conforming loan limit by at least 115%.

This higher limit exists because of the level of difficulty when comparing the cost of homes in rural areas versus large cities where prices tend to be significantly higher. The ceiling on the limits in these areas is 150% of the baseline loan limit.

These high-cost areas include cities such as San Francisco, New York City and Washington, D.C. The FHFA also has higher baseline conforming loan limits for Alaska, Hawaii, Guam and the U.S. Virgin Islands. You can also use the FHFAs interactive map to see if your county qualifies for these higher limits.

If your home exceeds the conforming loan limit, you have a couple of options. You can pay a higher down payment to ensure youre not borrowing more than the conforming loan limit. Additionally, you may be eligible for a Federal Housing Administration loan. With an FHA loan, you can take out a conforming loan and then take out an FHA loan to cover the difference in home value.

For example, lets say youre purchasing a home in a county thats assigned the national baseline limit of $647,200, but the home youre buying costs $700,000. You can make a down payment of at least $72,216 and take out a conforming loan to cover the rest.

Don’t Miss: Usaa Auto Loan Reviews

Wait The Government Can Limit My Loan

Contrary to their name, loan limits arent about keeping you from getting an amazing house. Theyre actually designed to help as many people as possible get their dream homes.

You see, when you apply for a mortgage, you work with a lender or a bank. But lenders and banks dont have unlimited money. And if they tied up all their money in peoples houses, they would quickly run out!

Heres what they often do instead: Congress created government-sponsored entities like the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, and the Federal Housing Administration. You likely know them as Freddie Mac, Fannie Mae, and the FHA. The whole purpose of these GSEs is to make sure theres enough money for mortgages throughout the country.

So, you take out your loan. Your bank or lender sells your loan to one of these GSEs. Then, the GSE sells the loan to private investors, who ultimately fund the loan.

Why do you need all this background? Well, remember that the purpose of these GSEs is to make sure theres enough money for everyone to get the loans they need. That means they need to be careful about the size of the loans theyre buying. So, the FHFA sets a limit for the GSEs. They can only buy mortgages under a certain limit. These are called conforming loans because they conform to the FHFAs rules.

What Are Conventional Loans

A conventional loan is one that isnt directly guaranteed or backed by the federal government. These are loans issued by private mortgage companies and approved by rules created by Fannie Mae or Freddie Mac.

Government-backed loans still have loan limits but they are generally lower than those for conventional loans.

The exception is VA loans, which no longer have a formal limit. However, VA borrowers still need to meet qualifying thresholds set by lenders. And those lenders must always be sure that their borrowers can comfortably afford the monthly payments on a new mortgage.

You can divide conventional loans into two types:

Given were talking loan limits here, the following is about conforming loans. And that includes most conventional ones.

Read Also: Usaa Car Loans Reviews

Avoid Jumbo Loans With A Piggyback Loan

Some find it better to avoid jumbo loans by having two smaller ones: a conforming main mortgage and a piggyback loan. Thats a second mortgage that bridges the gap between the conventional loan limits and your purchase price.

For example, lets say you wanted to buy a $750,000 home where the local loan limit was $550,000. You have $100,000 for a down payment. If you got a $650,000 loan, you would be over the conforming limit for the area, and youd need a harder-to-get jumbo loan. Fortunately, thats not your only option.

You could structure it as follows:

- Primary loan of $550,000

- Second mortgage of $100,000

- Down payment of $100,000

You potentially qualify much more easily for the primary loan since its a conforming loan, not a jumbo.

This doesnt work for everyone. But its an idea worth exploring. All you can do is run the numbers. A mortgage calculator is a good place to start.

What Is A Conventional Loan

6-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

A conventional mortgage loan is one thats not guaranteed or insured by the federal government. Most conventional mortgage loans, aka conventional mortgages, are conforming, which simply means that they meet the requirements to be sold to Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and sell them to investors. This frees up lenders funds so they can get more qualified buyers into homes.

Conventional mortgages can also be non-conforming, which means that they dont meet Fannie Maes or Freddie Macs guidelines. One type of non-conforming conventional mortgage is a jumbo loan, which is a mortgage that exceeds conforming loan limits.

Because there are several different sets of guidelines that fall under the umbrella of conventional loans, theres no single set of requirements for borrowers. However, in general, conventional loans have stricter credit requirements than government-backed loans like FHA loans. In most cases, youll need a credit score of at least 620 and a debt-to-income ratio of 50% or less.

Recommended Reading: Can You Refinance An Upside Down Car Loan

What Are The Conventional Loan Limits In 2022

The 2022 conventional loan limit for a single-family home is $647,200, up over 18% from 2021, when the limit was $548,250.

These limits are available effective immediately, even before the new year.

This represents the largest one-year jump in history, and reflects the massive home price increases seen in 2021.

Loan limits are even higher for multifamily homes and in areas with higher-priced housing. High-cost cities and counties, and in Hawaii, Alaska, and some U.S. territories allow multi-unit home loans above $1.8 million.

When Is A Loan Considered Jumbo In Your Area

A jumbo loan is a type of mortgage that is too high to be guaranteed by Fannie Mae or Freddie Mac, which are government-sponsored enterprises that set mortgage underwriting standards and purchase qualified loans from lenders. Loans that can be purchased by Fannie Mae or Freddie Mac also called conforming loans are considered safer investments for lenders than jumbo loans, and it can be easier for borrowers to meet their requirements.

With home prices rising in most areas of the United States, the FHFA has increased conforming loan limits for 2022. How large a loan you can get before its considered jumbo depends on where you live, as certain more expensive areas like Hawaii or San Francisco have higher limits. If youre concerned about meeting the more stringent lender criteria required for approval for a jumbo loan, these new limits could allow you to finance a high-priced home with a conventional loan instead.

For 2022, the maximum limits for conforming loans are:

-

$647,200 for a single-family home in most areas of the country.

-

Up to $970,800 for high-cost areas where single-family home prices tend to be above average. When setting conforming loan limits, the FHFA has defined high-cost areas as places where 115% of the local median home value is more than $647,200.

You can find the exact conforming loan limits for your area using the tool below.

» MORE: Find and compare the best jumbo mortgage rates

You May Like: Parent Plus Loan Interest Deduction