I’m Having Trouble Logging In With My Mobile Phone Number What Should I Do

If you’re having trouble logging in with your mobile phone number, make sure that you are entering the correct number and that you have a strong internet connection. You may also want to try logging in with your email address. If you still can’t log in, please contact Wells Fargo Car Finance Login Help Center.

How To Make A Wells Fargo Bank Auto Loan Payment

If you sign for a Wells Fargo auto loan at the dealership, youll still make payments to the bank. Wells Fargo offers different ways to make your monthly car payment:

Online

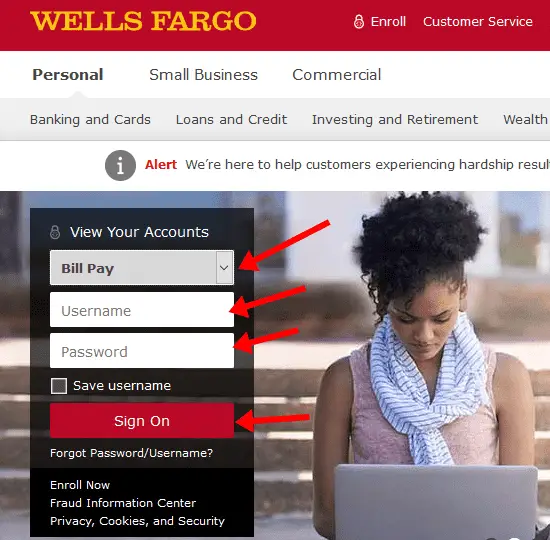

Log in to your account through the Wells Fargo website. You may make a payment immediately or schedule one up to 30 days in advance.

Automatic payments

Use your Wells Fargo auto-login to enroll in autopay, or fill out this form and return it by mail or fax to make automatic payments from another bank account.

Send a check or money order to Wells Fargo Auto, P.O. Box 17900, Denver, CO 80217-0900.

Should I Buy An Aftermarket Product

This is a personal decision for you to make based on your needs. When deciding to buy or keep an aftermarket product, consider the cost, what is covered and excluded, how long the coverage lasts, and how you plan to use the vehicle. The purchase of aftermarket products is optional and is not required to receive approval for your loan.

Don’t Miss: When Do I Need To Pay Back My Student Loan

How Do I Request Authorization To Take My Vehicle Out Of The Country

Before you drive or ship your financed vehicle out of the country, you need a signed authorization from us. Authorization is for temporary travel only, not to exceed 60 days for non-military travel. We do not approve permanent relocation for non-military purposes. Your account must be current and in good standing to qualify for authorization.

To request an authorization, please send us a written request with the travel dates and the destination country, along with a copy of the vehicle registration. Also, please provide the additional documentation for your specific request type:

Driving to other countries

Fax

1-844-497-8670

Please allow three to five business days for processing from the date that we receive the required documentation.

About Wells Fargo Bank

Availability: Select dealerships across the United StatesLoan Types: Purchase loans for new and used vehiclesBetter Business Bureau Rating: Not rated

Wells Fargo Bank has been in business for over 150 years and has a presence in all 50 states. The financial institution offers an array of personal banking and investment products for millions of customers. Wells Fargo also offers auto finance options for new and used cars through auto dealerships. However, it doesnt allow people to sign up online, nor does it offer refinancing loans or lease buyouts.

Also Check: How Much Down Do You Need For Fha Loan

About Wells Fargo Dealer Services Login

Once you have learned how to do the login process on the Wells Fargo Dealer Services website, then it is a must to know what all benefits that you can avail from this. Registering on the official website allows you to access the services anytime you want.

Once you have an account on Wells Fargo, you will be able to access the auto loan account any time of the day. After logging in, you can manage your account easily and also view details related to your account. For example, you can make loan payments, update your information, get a payoff quote, view the transaction history, and much more.

There is a special service called ePayments. With the help of this service, you can access your statements of a period of the last 12 months. There are many more services that you get to enjoy with the Wells Fargo Login Portal which we will discuss afterward.

Why Didnt My Auto Loan Payment Decrease After A Refund Was Applied To My Account

The monthly loan payment is calculated from the terms in the original loan agreement. Your loan agreement is not rewritten because of the refund, so your payment does not change. The refund is applied to your current principal balance which means you have less money to pay back. This may reduce the amount of interest you pay, and it may help you pay off your loan more quickly than the original term.

Read Also: How Long To Get Pre Approved For Car Loan

Why Are My Home Assistance Program Payments Higher Than What I Was Paying Before

Your previous payments may not have included amounts that you were paying separately for insurance and taxes. These additional amounts, called escrow payments are included in your home assistance payments as a provision of your loan. The good news is that you will no longer need to make those payments separately, so your total costs likely are lower.

You may also be able to lower your overall monthly costs by having a private insurance policy. If you dont have one and instead Wells Fargo bought a Lender-Placed insurance policy for you you may be able to quickly reduce payments with a private policy. Learn more

Wells Fargo Dealer Services For Customers

Wells Fargo Dealer Services provides some of the best services to the customers and dealers alike. In this section, we will see some of the benefits that the customers get from the company. You simply have to create an online account on the official login portal to get started using the services.

We have already discussed that part in a previous section. You can make payments on your loan, view your transaction history, etc. You can also take part in the Wells Fargo automatic loan payment program which pays the monthly installment of your loan payment automatically.

Support

Wells Fargo Dealer Services not only provides top quality services but also a great support and customer service system. It solves your queries, and you can also contact them whenever you like in order to inquire about anything. You can either send them a message and wait for the reply or talk directly to them on the phone.

With the help of the support service of Wells Fargo, you can even make payments and update your account information. You can contact them using this number: 1-800-289-8004. Customers can reach them Monday to Friday in the time between 5 AM to 7 PM.

Don’t Miss: Debt Consolidation Loans For Fair Credit

Wells Fargo Reviews And Reputation

Wells Fargo is neither recognized nor evaluated by the Better Business Bureau, although it does have a BBB consumer rating of 1.1 out of 5 stars. However, that figure is based on just over 400 evaluations, which represents a small portion of Wells Fargos entire client base.

Good customer service experiences are mentioned in a few of Wells Fargos positive evaluations. Account closures, automated payments, and Wells Fargos online banking service presenting erroneous information are all mentioned in negative Wells Fargo reviews.

Does Refinancing My Loan Affect The Aftermarket Product I Purchased

Refinancing your loan may affect aftermarket products, but it depends on the product you purchased. Review the terms in the contract to understand whether refinancing your vehicle will affect coverage. While most products are generally not affected, Guaranteed Asset Protection coverage typically ends when the loan is refinanced or paid off.

You May Like: Is Max Loan 365 Legit

Wells Fargo Auto Loans: Conclusion

Wells Fargo auto loan was rated 2.5 out of 5.0 stars by our review team due to its poor reputation and lack of a streamlined application process. Overall, sentiment around the companys car loan services is not good and we recommend searching elsewhere. When searching for the best auto loan for you we recommend getting together companies in a list and comparing your options before committing.

Below you can start comparing auto loan rates from multiple top lenders.

Where Can I Find The Login For Yourloantracker

Simply go to www.wellsfargo.com/hometrack and sign in with your Wells Fargo Online® username and password or your last name, date of birth, last 4 digits of your Social Security number, and the unique Access Code that well send to you by email when youre eligible to use yourLoanTracker. Save the Access Code for future reference you’ll need to use it each time you sign on to yourLoanTracker.

Also Check: Why Mortgage Companies Sell Your Loan

I Have Gap And My Vehicle Was Deemed A Total Loss What Should I Do

You should contact your insurance company to begin the clams process. We will initiate the GAP claim once the insurance settlement has posted to your account. We will send you a letter informing you the claim has been started and stating whether we need your help gathering documents to complete the claim. If you have any questions during this process, call us at 1-800-289-8004.

Wells Fargo Car Loans Reviews

This is one of the worst banks! It has been a nightmare for me. I pay my car note every month on time via bill pay and even after uploading documents as proof of payment… I have had to call and email multiple messages and every time I get an email that it has been forwarded to âthe right department â and will be resolved but nothing happens and I keep getting notifications of late payment. The most pathetic bank ever!! Today I had to upload proof of payment since January and still nothing has been done!! This bank is rotten to the core!!!!

Don’t Miss: How Do You Refinance Your Home Loan

Why Consider Wells Fargo For An Auto Loan

Wells Fargos network of 11,000 retailers provides competitive pricing and a wide range of credit options.

The bank does not directly issue Wells Fargo car loans to borrowers and instead requires all applications to be submitted via a merchant.

Wells Fargo, on the other hand, is not recognized for its customer service and may not meet your expectations if you need prompt responses and assistance when you have a problem.

How To Apply For A Loan With Wells Fargo

To apply for a loan with Wells Fargo, you will have to work with one of the dealers found in its network. This means that the entire process of application is done through the dealership of your choosing. The loan application process varies, but youll likely need a few common items.

You will likely need to provide:

- Proof of income

- Proof of U.S. citizenship or permanent residency

- Vehicle information, including make, model and vehicle identification number

- Trade-in information, if applicable

Don’t Miss: Can You Get An Fha Loan After Bankruptcy

Is A Wells Fargo Auto Loan The Right Fit For You

Taking up Wells Fargo car loans may not be in most peoples plans. Your loan application will normally be routed to many lenders for approval when you apply for a loan through a dealer.

If you bank with Wells Fargo and want to keep all of your financial affairs in one place, it may be more cost-effective to work with them exclusively rather than any other lender.

Suggested: Cheapest Auto Insurance Quotes Online in the USA + Top 11 Companies

However, be careful to inquire about any bids the business has received so that you may compare costs and terms. However, if you want a pre-approval auto loan before going to the dealer, youll have to search elsewhere because Wells Fargo doesnt provide that service.

How Do I Use Yourloantracker To Send Documents

yourLoanTracker will walk you through the process step-by-step:

- Locate the type of document thats needed in the To-Do list.

- To the right of the documents name, click Upload if it’s a document you already have or click Download and Provide if it’s a form you need to download and fill in.

- Follow the instructions to either select a file you already have on your computer or photograph a document with your mobile phone.

- Add multiple files, if needed.

Also Check: Can I Roll My Car Loan Into Another Car Loan

How Do I Update An Account Holder Name On My Auto Loan

Your request should include a copy of your birth certificate, U.S. passport, or state-issued identified identification as well as your signature.

You can send the documentation to us online through your Wells Fargo account. Sign on and select Upload Documents from your auto loan. Follow the steps to upload and submit your documents.

Keep these guidelines in mind:

- Attach accepted file formats: PDF, JPEG, JPG, PNG, or GIF

- Upload no more than 25 files and 25 MB total

- Make sure your files are not encrypted or password-protected

- Make sure your documents are clear, legible, and include all pages even blank ones

We will review your documents and contact you if we need additional information.

Note: Changing a name on your auto loan does not update the name on the vehicle title. Learn more about changing a name on a vehicle title.

How Do I Make Payments On My Auto Loan Account

Set up automatic payments

You decide which savings or checking account you would like the money to come from each month. There is no charge for enrollment, and you can easily change or cancel the automatic payments online.

To set up automatic payments, download and complete the automatic payment form , and return by mail.

Pay online

Sign on to your account to make a payment. Not enrolled in Wells Fargo Online®? Enroll now

Pay by phone

Read Also: Loan Companies That Take Life Insurance As Collateral

Wells Fargo Cuts Back On Auto Student Loans To Minimize Risk

UPDATE: July 5, 2020: Wells Fargo will only grant student loans for the upcoming academic year to people who submitted applications before July 1 or to customers who have an outstanding balance on a previous student loan from the bank, Bloomberg reported Thursday.

Its the latest type of loan the bank has de-emphasized in an effort to minimize risk. More than 40 million student-loan accounts were in deferment as of mid-June, according to Equifax.

Wells Fargo said last month it would no longer accept auto loan applications from most independent car dealerships. The bank in late April retreated from part of the mortgage market, too, saying it would temporarily stop accepting new applications for home equity lines of credit.

Wells Fargo has decided to narrow its student-lending focus, Manuel Venegas, a spokesperson for the bank, said in a statement.

The bank held $10.6 billion in private student loans at the end of the first quarter.

Also Check: How Do They Determine Mortgage Loan Amount

What Are Aftermarket Products

Aftermarket products are optional products, services, or insurance that may be purchased when you buy your vehicle. They may cover unforeseen vehicle repair needs or assist with loan payments.

Common examples include:

- Guaranteed Asset Protection pays all or a portion of the loan balance after the payment of a total loss insurance claim.

- Service contracts provide coverage in the event that a major mechanical component of the vehicle, such as engine, transmission, heating/cooling system, seals, gaskets, and fuel system, need repair. The coverage typically lasts for a specific period of time or vehicle mileage.

- Anti-theft protection includes devices or services, such as tracking, that make the vehicle more difficult to steal or easier to recover if it is stolen.

- Maintenance packages are prepaid plans that typically cover scheduled maintenance, such as oil changes, on the vehicle.

- pays off all or some of your loan if you pass away.

- assists with making your loan payments if you become unable to do so due to disability.

Recommended Reading: How To Get 100 Loan

Wells Fargo Car Loans Fees And Rates

The credit conditions and rates are not publicly published since Wells Fargo offers credit through dealers. You wont know the loans interest rates until youve completed and authorized the application. The interest rate on a Wells Fargo vehicle loan is determined by several factors:

- History of credit

- Period of repayment

- The car to be financed is of a certain age.

- The Loan-to-Value-Ratio is a measure of how much a loan costs relative to how much it costs

Purchase credits with maturities of up to 75 months are available. Repayment lengths range from 24 to 72 months if you wish to refinance.

Every Year Millions Of Americans Turn To Private Sellers To Buy Their Next Car Unlike Most Auto Dealers However Private Sellers Rarely Offer Financing Private Party Auto Loans Can Fill That Gap

When buying a car directly from an owner rather than an auto dealer, your financing options can be limited. If you dont want to pay entirely in cash, you might be able to get an unsecured personal loan or you could consider a private party auto loan, which often has lower interest rates. As a result, a private party auto loan can be less expensive than a personal loan because the car serves as collateral. Heres what youll want to know about private party car loans before you get started:

Also Check: What Does Pre Qualified Loan Mean

You May Like: What’s Better Refinance Or Home Equity Loan

Is Wells Fargo Financial A Reliable Company

Wells Fargo & Company is a leading global financial services company headquartered in San Francisco . Wells Fargo has offices in over 30 countries and territories. Our business outside of the U.S. mostly focuses on providing banking services for large corporate, government and financial institution clients.

Wells Fargo Auto Loan

Considering financing a vehicle through Wells Fargo? This review explains everything you need to know about Wells Fargo auto loans, including loan details, minimum qualifications, and the application process. Well also take a look at Wells Fargo reviews from customers.

Finding the best auto loans can save you thousands of dollars in the long run, so be sure to weigh your options before signing the dotted line. To learn if a Wells Fargo car loan is the right choice for your vehicle, continue reading.

Up to 722.94%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A leading provider in refinance loans

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

All APR figures last updated on 6/13/2022 – please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

Read Also: Can I Roll My Closing Costs Into My Va Loan