Increased Direct Unsubsidized Loan Limits For Dependent Undergraduate Students

There are times when a dependent student can become eligible for the same Direct Unsubsidized Loan limits as independent students:

- Parents are denied eligibility for a Parent PLUS Loan

- Other documented “exceptional circumstances,” even if parents aren’t denied eligibility for a Parent PLUS Loan

In some exceptional circumstances, college financial aid administrators may allow a dependent undergraduate student to borrow at the higher Direct Unsubsidized Loan limits available to independent students without requiring the parent to obtain a denial of a Parent PLUS Loan. For example, you would need to successfully qualify for a dependency override.

College financial aid administrators aren’t required to make the student eligible for the higher loan limits, even if exceptional circumstances exist.

Federal Student Loan Maximums

Federal loans are an attractive option for many students. Most federal loans dont require credit checks, and interest rates were recently reduced to the lowest theyve been in over 15 years.

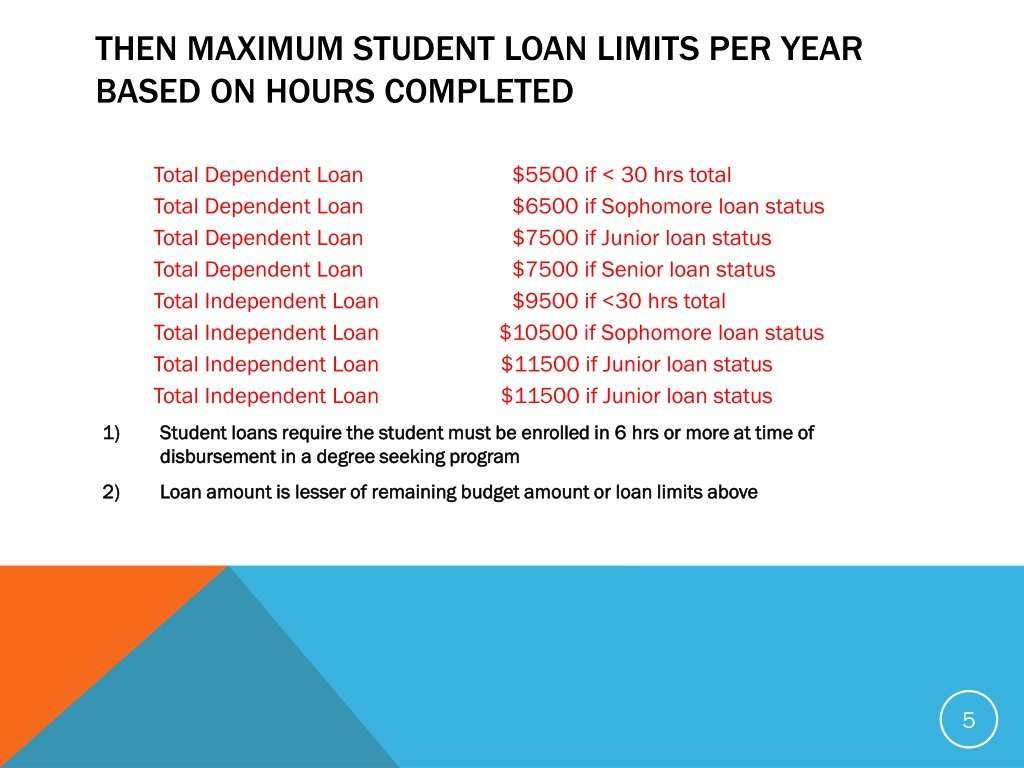

However, how much you can take out in federal student loans is limited. The student loan limits are based on your dependency status dependent or independent your year in school, and the type of federal loan.

If you need help paying for college, here are the types of federal student loans you can explore:

- Direct Subsidized Loans: Direct Subsidized Loans are designed for lower-income undergraduate students. With Subsidized Loans, the U.S. Department of Education covers the interest that accrues while youre in school and during your grace period. For loans disbursed after July 1, 2021, and before July 1, 2022, the interest rate on Direct Subsidized Loans is 3.73%.

- Direct Unsubsidized Loans: Direct Unsubsidized Loans can be used by both undergraduate and graduate students.For loans disbursed after July 1, 2021, and before July 1, 2022, the interest rate on Direct Unsubsidized Loans for undergraduate students is 3.73% and 5.28% for graduate students.

- Direct PLUS Loans: Direct PLUS Loans are for graduate students and parents borrowing to pay for their childs undergraduate education. The interest rate on PLUS Loans disbursed after July 1, 2021, and before July 1, 2022, is 6.28%.

Aggregate Student Loan Limits For Graduate Students

The annual and aggregate loan limits for graduate and professional students are different than they are for undergraduate students.

As a graduate or professional student, you arent eligible for Direct Subsidized loans, and you are considered an independent student even if you are still supported by your parents.

The aggregate limit doesnt just include what you borrow for graduate school the limit also includes any Direct Subsidized or Unsubsidized loans you took out to pay for your undergraduate degree.

The aggregate loan limit for graduate and professional students is $138,500, and no more than $65,500 of that number can be Direct Subsidized loans.

Read Also: Pre Approved Auto Loan Usaa

Maximum Student Loan Amount For Graduate/professional Students

There is also a borrowing limit on federal loans for graduate or professional school. The loans borrowed during undergrad are included in the total loan amount.

Graduate/professional students can borrow up to $20,500 annually. The total amount of federal student loans a graduate/professional student can borrow is $138,500. No more than $65,500 of Direct Subsidized loans can be borrowed.

The maximum amount of PLUS loans that can be borrowed by parents or graduate students is equal to the schools cost of attendance, minus any other financial aid that was received.

If a student reaches the maximum amount of federal loans borrowed, they are not eligible for more. The only way to borrow more loans is to pay off some of your debt to bring it below the limit.

The Economic Impact Of Student Loan Forgiveness

While supporters of student loan forgivenes say it will stimulate the economy, Republicans in Congress say it will increase inflation. The White House has said any broad student loan forgiveness would have minimal impact on inflation. However, Biden is sensitive to any impact on inflation, which could influence the outcome of the midterm election. Wherever one stands on student debt relief, this approach is regressive, uncertainty creating, untargeted and inappropriate at a time when the economy is overheated, former U.S. Treasury Secretary Lawrence Summers, a Democrat, tweeted in April. Before Biden decides next steps on student loan forgiveness, he will closely monitor inflation. Biden could wait until later this summer to announce his final decision. This announcement would coincide with the end of temporary student loan relief on August 31, 2022. That said, dont wait until then to explore your best options for student loan repayment. Here are some smart ways to save money:

Recommended Reading: Refinance Student Loans Usaa

Types Of Federal Loans

Before addressing the total amount that graduate students can receive, it should be noted that there are specific types of loans available to them. Lets look at direct subsidized vs. direct unsubsidized loans.

Graduate students cannot receive direct subsidized loans. Those loans are only available to undergraduate students who show financial need. If students took out these loans as undergraduates, that amount will be included in the lifetime limit of federal loans theyre allowed to receive.

For direct unsubsidized loans, the limit is $20,500 a year. All graduate or professional students are considered independent for this loan. Unsubsidized loans arent dependent on students demonstrating financial need. The schools will decide how much students receive based on their annual costs and how much aid theyre receiving from other sources.

Recommended Reading: Is Myeddebt Ed Gov Legit

Cost Of Attendance Cap

Federal student loans may not exceed the colleges cost of attendance minus other aid received. This is often referred to as a COA Aid cap or as a cost of attendance cap.

In effect, the student cannot borrow more than it costs to attend the college.

Use our Student Loan Calculator to determine the monthly loan payment and total payments on your student loans.

The Federal Direct Stafford loan has fixed annual loan limits in addition to the cost of attendance cap. The Federal Direct PLUS loan does not have fixed annual limits in addition to the cost of attendance cap.

Also Check: Usaa Auto Refinance Phone Number

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

This chart from the Pennsylvania State University student aid office breaks down the limits depending on your situation:

| Dependent Undergraduate Student | Dependent Undergraduate Student with a Parent PLUS Loan Denial | Independent Undergraduate Student | Graduate or Professional Degree Student | |

|---|---|---|---|---|

| First Year | $5,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $20,500 |

| $6,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $20,500 | |

| Third, Fourth, and Fifth Years | $7,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $20,500 |

| $31,000. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $138,500. The graduate debt limit includes Direct Loans received for undergraduate study. |

Besides these student loan limits, there are two other limitations to be aware of:

Earnest Student Loan Limits

Earnest private student loans start at $1,000 and can be up to your entire cost of attendance for the academic year, on approved credit.

If youre considering a cosigned private student loan, the student and cosigner must live in the District of Columbia or a state that we lend in but they do not need to both live in the same state. For more information on Earnests private student loan, visit our eligibility guide.

Don’t Miss: Interest Rate For Car Loan With 650 Credit Score

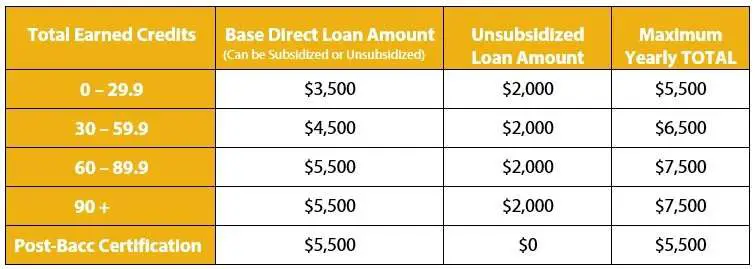

Federal Direct Student Loan Limits

The U.S. Department of Education sets borrowing limits for the Direct Lending programs as indicated in the table below. HCC has the right to deny any loan request based on such factors as unwillingness to repay, borrowing history, and academic progression. To view your previous borrowing history, please go to My Federal Student Aid to view your NSLDS information.

Subsidized Vs Unsubsidized Loans

Undergraduate students loans are classified as either subsidized or unsubsidized. Heres how they differ:

- Subsidized loans dont accrue interest when youre enrolled in school at least part-time, during periods of deferment and during your six-month grace period after you leave school. When you start to repay your loans, youll be responsible for your loan plus the interest that starts accruing after you leave school.

- Unsubsidized loans accrue interest even while youre in school. The good news is that you dont have to start making payments until your grace period ends. The bad news is that your payments will be higher compared to subsidized loans since your interest started accruing immediately upon disbursement, not graduation.

Recommended Reading: Usaa Proof Of Residency Request Form

How Much Should You Borrow In Student Loans

You should borrow as much as you need and not necessarily all that lenders make available to you. The more you borrow now, the more student loan debt youll have to pay off laterwith interest.

To determine how much you should borrow in student loans, calculate your cost of attendance. This includes:

- Tuition and fees

- Room and board or other living expenses

- Books

- Supplies and technology costs

- Loan fees

- Transportation

If your cost of attendance is less than what youd get from the maximum federal student loan limit, borrow only what you need.

If your cost of attendance exceeds what youll receive from federal student loans, you may need to tap into other resources. This includes private student loans or borrowing money from friends and family. If a certain college is just too much of a stretch financially, consider less expensive schools. Use resources like collegesnet price calculators on their websites to determine how much theyll cost you after taking into account grants and scholarships you could receive.

You also can set how much you borrow based on your anticipated future earnings, which might be a bit harder to estimate. But if you know the starting salary of your future post-graduate position, that can help you determine what you can afford when the time comes to repay your student loans. Some experts recommend limiting your total student loan borrowing to the amount you plan to earn your first year out of school.

Are You Eligible For A Maintenance Loan

Whether or not you’re eligible for a Maintenance Loan depends on a few factors. We’ll run through each of the criteria in a moment, but don’t panic most undergraduates starting university are usually eligible to receive funding.

These are the factors that determine whether or not you qualify for a Maintenance Loan:

Also Check: When Can You Refinance An Fha Loan

What Is The Maximum Student Loan Per Year

Subsidized and unsubsidized student loans have two main limits:

Annual: how much you can borrow during each school year.Aggregate: how much you can borrow during your time in college and graduate school.

| Dependent undergraduate students | |

| 59.1 + credits/Third, fourth and fifth years | $7,500 |

| Career maximum total loan amounts | $31,000 |

Choose More Affordable Options

If youve maximized your scholarship and grant potential and dont qualify for work-study, consider more affordable options. Some small-scale changes include opting to rent or buy used textbooks instead of new, living off campus or getting roommates. You can also consider transferring to an in-state school, trying out an online program or dropping to half-time enrollment while you work a part-time job.

Recommended Reading: How To Become A Mlo In California

Private Student Loan Lifetime Limits

If you choose to borrow private student loans, your annual and lifetime limits can vary by lender . That said, the annual limits typically cannot exceed the cost of attendance at your school.

The total cost of attendance is a number determined by your school and typically includes tuition and fees, on-campus room and board, books, supplies, transportation, and dependent care.

As for lifetime limits , it may depend on whether youre an undergraduate student or a graduate student. Some private lenders may offer higher limits if youre doing an MBA or going to law or medical school, for example.

Some lenders have just one limit for all loans. But in some cases, you may even see two lifetime limits: one for loans through the private lender and one for total federal and private loans.

So, if youre considering borrowing from a private lender, ask about their loan limits before applying to make sure you get the funding you need.

You May Like: How To Get Mlo License California

Federal Borrowing Limits For Dependent Undergraduates

| Year in school | |

|---|---|

| $31,000 | $23,000 |

If you depend on your parents for support, youre considered a dependent student. Dependent undergraduate students can take out $5,500 to $7,500 in federal student loans each year in theyre in school, up to a total limit of $31,000. If your family qualifies, up to $23,000 of your total borrowing can be in subsidized loans.

If you hit your annual or total borrowing limit and your parents cant qualify for a PLUS loan, the higher loan limits for independent undergraduates apply.

Also Check: Usaa Loans Auto

What Student Loan Borrowers Need To Know About Filing Taxes In 2022

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. Weâre proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific productâs website. All products and services are presented without warranty.

Plus, H& R Block Free Online is one of the most robust free filing options for simple returns and includes the student loan interest deduction. Check out H& R Block here > >

5 Tips For Filing Taxes With Student Loans In 2022

What Is The Maximum Amount Of Student Loan Money You Can Borrow

Student loans can be used to fund your education, but they are not limitless. For federal and private lenders, there is a maximum student loan amount. The maximum amount that can be borrowed depends on a variety of factors. Continue reading to learn more about student loan borrowing limits!

Recommended Reading: Can I Use A Va Loan For A Second House

What Happens If You Hit Federal Loan Limits

If your cost of attendance exceeds what you can borrow in federal student loans, you may not have enough cash on hand to cover the extra costs. If youre worried about not having enough money to pay for school, you have a few options, including:

Working part-time. Find a job that lets you work non-traditional hours so you can pay for school. You can look on- or off-campus, depending on your living situation and transportation options. Consider a side-hustlelike delivering groceries, tutoring or freelancingto cover your extra schooling costs.

Requesting payment assistance. Many schools require payment in full, whether that comes from your lender or you. If you cant pay your outstanding bill, talk to your schools financial aid office about a payment plan, like making monthly payments instead of one lump-sum payment. Also inquire about emergency grants or interest-free loans, which vary by school but might be available based on your need.

Switching schools. Cost of attendance varies by each school. Since every institution has different service fees, you might pay more at a private or big-name school compared to community colleges, which tend to have fewer fees. If you can, consider attending local colleges for the first couple years and then transferring to your school of choice to complete your bachelors degree.

Maximum Student Loan Amount For Undergraduate Students

The maximum amount of federal student loans an undergraduate can borrow per academic year is between $5,500 and $12,500. The exact annual limit depends on your year in school and dependency status.

Undergraduate students can receive both Direct Subsidized and Direct Unsubsidized federal loans. There is an annual and total limit of how much can be borrowed in Direct Subsidized loans.

This chart shows the annual and total limits an undergraduate student can borrow based on their year and dependency status.

| Year | |

| $31,000 no more than $23,000 subsidized | $57,500 no more than $23,000 subsidized |

Don’t Miss: Usaa Loans For Bad Credit

Dip Into Your Emergency Or Retirement Savings

Although its never ideal to spend your savings, sometimes its necessary. If you have an emergency fund, you could use some of this money to cover tuition. Just make sure to work on replacing what you took out.

If youve been in the working world for a while, you could tap your retirement savings for tuition. For example, if youve had a Roth IRA open for more than five years, you can withdraw contributions for your education penalty- and tax-free.

Think long and hard before you do so, however. The best thing to do with retirement investments is to let them sit and grow.