What Can Struggling Homeowners Do Now

While HAMP is no longer operational, there are still many homeowners who may be struggling and might need a loan modification. For some of them, the governments Home Affordable Refinance Program will do the trick, though this program is somewhat limited in scope, since it only permits Freddie Mac and Fannie Mae-insured loans to be modified. If your loan isnt insured by Freddie Mac or Fannie Mae, you might want to check with your lender, since many lenders have proprietary loan modification programs that can be used to prevent default and/or foreclosure.

The Fhas New Loss Mitigation Waterfall Will Offer Much

Of the 1.55 million US mortgage loans Black Knight estimates are more than 90 days past due, about half belong to Federal Housing Administration borrowers.

Most delinquent borrowers are in COVID-19 forbearance plans, but in the next few months, many will reach their 18-month forbearance limit. Although some borrowers may be able to resume their prepandemic mortgage payments, many will require loan modifications to reduce their monthly payments to levels they can afford.

On July 23, the FHA released its new loss mitigation toolkit, which simplifies the modification options for owner-occupants and allows for deeper payment reductions with less paperwork than current loss mitigation options. Our work shows that this streamlined process could reduce barriers to take-up and give more borrowers access to needed relief.

How the new waterfall works

Loss mitigation options are generally structured as a series of steps to give the borrowers the help they need at the lowest cost. If the first, lowest-cost alternative is insufficient, the borrower will move to the next option. This is referred to as a loss mitigation waterfall.

In the table below, we assume a delinquent borrower has a 30-year mortgage with an original loan amount of $300,000 and a mortgage rate of 3.5 percent, which equates to an original monthly principal and interest payment of $1,347. Assuming monthly taxes and insurance cost $450, the total monthly PITI payment is $1,797.

Mortgage Modification Vs Refinance

A mortgage modification program allows you to modify your mortgage, as the name suggests. Your lender changes the original terms of your mortgage by extending your loan term or reducing your mortgage rate, for example but you keep the same loan.

On the other hand, a mortgage refinance involves replacing your existing mortgage with a new loan that has better terms, such as a lower mortgage rate and monthly payment or a more stable loan type, such as switching from an adjustable-rate to a fixed-rate mortgage.

How did HAMP differ from HARP?

Another government-backed program, Home Affordable Refinance Program , was created to help mortgage borrowers who were underwater on their loans meaning they owed more than what their house is worth to refinance their mortgage. That program expired in 2018.

Unlike HARP, HAMP didnt provide borrowers the opportunity to refinance. Instead, they were able to modify their loan and receive smaller monthly payments, providing them with a mortgage that was more affordable and sustainable without going through the refinance process.

Read Also: Upstart Second Loan

Home Affordable Modification Program

The largest program within MHA is the Home Affordable Modification Program . HAMPs goal is to offer homeowners who are at risk of foreclosure reduced monthly mortgage payments that are affordable and sustainable over the long-term.

HAMP was designed to help families who are struggling to remain in their homes and show:

- Documented financial hardship.

- An ability to make their monthly mortgage payments after a modification.

HAMP is a voluntary program that supports servicers efforts to modify mortgages, while protecting taxpayers interests. To protect taxpayers, MHA housing initiatives have payforsuccess incentives. This means that funds are spent only when transactions are completed and only as long as those contracts remain in place. Therefore, funds will be disbursed over many years.

Starting in the summer of 2012, the scope of the program will expand to help even more families in need.

HAMP works by encouraging participating mortgage servicers to modify mortgages so struggling homeowners can have lower monthly payments and avoid foreclosure. It has specific eligibility requirements for homeowners and includes strict guidelines for servicers. The program includes incentives for homeowners, servicers, and investors to encourage successful mortgage modifications.

Before HAMP, there was no standard approach among loan servicers or investors about how to help homeowners who wanted to keep making payments, but needed mortgage assistance.

Trouble Paying Your Mortgage You Have Options

You might be wondering about mortgage loan modification if youre:

- Experiencing financial hardship due to the coronavirus

- Having trouble making your monthly mortgage payments

- Currently in mortgage forbearance but worried about what will happen when forbearance ends

The good news is, help is available. But mortgage relief options are not onesizefitsall.

Depending on your circumstances, you might be eligible for a loan modification. Or, you might be able to pursue another avenue like a refinance. Heres what you should know about your options.

> Related:The best way to refinance your mortgage

Recommended Reading: Transferring An Auto Loan

Qualifying For Fha Loan With Direct Lender With No Overlays

Borrowers who were told they do not qualify for an FHA Loan after loan modification by other lenders, no worries. Contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at We have no mortgage lender overlays on FHA Loans after loan modification. Gustan Cho Associates Mortgage Grouphas zero lender overlays on FHA Loans, VA Loans, USDA Mortgages, and Conventional Loans. We are also correspondent lenders on non-QM loans and bank statement loans for self-employed borrowers.

Loan Modification And Workouts

For homeowners that wish to keep their home, loan modification is oftentimes the right solution for avoiding foreclosure. As you might expect, the unfortunate truth is that lenders are not helpful to distressed homeowners and the process is often arduous. The foreclosure defense attorneys at Ferikes & Bleynat provide consultation, negotiation, and application management for loan modification candidates in an effort to help clients maintain their homes.

A loan modification can be a permanent or temporary restructuring of a mortgage where the terms of a borrowers loan is changed to provide a more affordable payment. A loan can be changed in several ways, however, the ultimate goal is to make it easier to continue making payments so you can keep your home and, most importantly, avoid foreclosure.

Some of the loan modifications and foreclosure alternatives offered through most lenders include:

- forbearance plans

- application to the NC Hardest Hit Fund for assistance

- short sales of the home

- deed in lieu of foreclosure

- short payoff agreements and

- reinstatement of the loan.

Some of these options are better than others and you should consider which option would benefit you and your situation. In addition to lender-specific options, there are several government sponsored programs and/or work-out options available to avoid foreclosure. Some MHA programs are:

DRHUMOR BUILDING48 Patton Avenue, Suite 300Asheville, NC 28801828-251-1588

Also Check: How Long Does It Take Sba To Approve Loan

Homeowners Getting Additional Help From Fha Because Of Covid

The Federal Housing Administration recently announced measures to help some homeowners overcome financial barriers that were brought on by the COVID-19 pandemic.

These home retention measures, which are immediately effective, will assist homeowners with FHA-insured single-family mortgages and help them to get current on their mortgage at the end of the COVID-19 forbearance period assuming they were current on their mortgage as of March 1, 2020 or were less than 30 days past due.

Our goal throughout this crisis has been to prevent American homeowners from losing their homes through no fault of their own, said HUD Secretary Ben Carson in a press release. Providing more solutions now to save homes in the future is part of the Administrations unprecedented response to the crisis and will contribute to the larger economic recovery already underway.

Mortgage servicers are now able to use additional loss mitigation tools known as a waterfall to assess a homeowners eligibility for other retention options if they dont qualify for FHAs COVID-19 National Emergency Standalone Partial Claim.

That claim takes all past due amounts and puts them into a separate junior lien on the property, maxing out at 30 percent of the mortgages unpaid principal balance. This lien is only repayable at the end of the mortgage, which in most cases occurs during a refinancing of the mortgage, or when a home is sold.

How To Lower Monthly Mortgage Payment Without Refinancing

Category: Loans 1. Lower your mortgage payment without refinancing Feb 25, 2020 A mortgage recast lets you lower your monthly payment, without the large upfront cost of refinancing. Learn more about mortgage recast here. Aug 11, 2021 You might also be able to lower your mortgage payment without

You May Like: Va Loan Requirements For Manufactured Homes

How Do I Get My Loan Modification Approved

Keys to Getting Approved for a Loan Modification

How Many Months Behind On Mortgage Before Foreclosure

Category: Loans 1. How Many Mortgage Payments Can I Miss Investopedia Once the 30-day has ended, if there has been no payment made and no agreement reached, foreclosure starts. By this point, youre at four missed monthly mortgage Your Lenders Policies · Housing Market Factors · Typical Foreclosure Timeline

Recommended Reading: Va Partial Entitlement Worksheet

Is Harp Right For Me

HARP was designed to allow underwater homeowners, no matter how far underwater, the chance to refinance their mortgage at a lower interest rate.

Similar to conventional refinance, a HARP refinance requires an underwriting process, loan disclosures and supporting financial documentation.

If you’re not behind on your mortgage payments but still find it difficult to get traditional refinancing because the value of your home has declined, you should pursue a refinance through HARP.

The HARP program expires on December 31, 2018. A streamline refinance replacement program is already in place and up and running and has fewer restrictions than HARP.

Other Mortgage Relief Programs

If you dont qualify for one of the HAMP alternatives mentioned above, consider one of the below mortgage relief programs to help you better manage your mortgage:

- High-LTV refinance. If your loan-to-value ratio is too high for a standard refinance or if youre underwater, you could qualify for a high-LTV refinance through Fannie Mae or Freddie Mac, depending on which agency owns your conventional loan. The minimum required LTV ratio for both programs is 97.01%.

- Forbearance. Mortgage forbearance is an agreement between you and your lender to temporarily suspend or reduce your mortgage payments when youre facing financial hardship. Once your forbearance term ends, youll typically repay whats owed in a lump sum, pay a portion of it monthly until its paid in full or modify your loan.

- Repayment plan. Another mortgage relief option is a repayment plan, which works best in situations where youre already behind on your mortgage payments. Under a repayment plan, you agree to repay your past-due amount over a set period of time to bring your mortgage current. The balance owed is divided up and added to your monthly mortgage payments.

Also Check: How To Stop A Student Loan Garnishment

Are Hamp And Harp The Same

Both HAMP and HARP are part of the governments Making Home Affordable program. In order to qualify for either one, you’ll need to have a mortgage that’s owned by Fannie Mae or Freddie Mac. While seemingly similar, HAMP and HARP do, however, serve two different audiences:

HAMP: HAMP offers a modification to your current loan so that you can avoid foreclosure. To qualify, your housing payment, including principal, interest, property taxes, HOA dues and insurance, must exceed 31 percent of your gross monthly income. You must also have a documentable hardship — a significant reduction in income or increase in expenses that was beyond your control.

You’ll have to document your income, debts, assets and hardship before you can get a trial modification, and ultimately a permanent one.

HARP: HARP, on the other hand, offers a complete refinance into the lowest available mortgage rates. That means closing out your old mortgage and getting a brand new one. In order to qualify, you’ll have to be creditworthy, up-to-date on your payments and present the necessary financial documentation.

How Does Fha Streamline Work

How does the FHA Streamline Refinance work? The FHA Streamline Refinance resets your mortgage with a lower interest rate and monthly payment. If you have a 30-year FHA mortgage, you can use the FHA Streamline to refinance into a cheaper 30-year loan. 15-year FHA borrowers can refinance into a 15- or 30-year loan.7 days ago.

Also Check: Usaa Credit Score Range

What Is Loan Modification

Loan modification is when a lender agrees to alter the terms of a homeowners mortgage to help them avoid default and keep their house during times of financial hardship.

The goal of a mortgage loan modification is to reduce the borrowers payments so they can afford their loan monthtomonth. This is typically done by lowering the mortgage rate or extending the loans repayment term.

A mortgage loan modification does not replace your existing home loan or your lender, explains Karen Condor, a finance and insurance expert with Loans.org.

However, it restructures your loan in the interest of making it more manageable when you experience difficulties in making your mortgage payments.

The Home Affordable Modification Program Vs The Home Affordable Refinance Program

HAMP was complemented by another initiative called the Home Affordable Refinance Program . Like HAMP, HARP was offered by the federal government. But there were a subtle few differences.

While HAMP helped people who were on the verge of foreclosure, homeowners needed to be underwater or close to that point to qualify for HARP. The program allowed people with homes worth less than the outstanding balance on their mortgages to refinance their loans, as well as homeowners with a loan-to-value ratio of more than 80%up to 125%.

Only those whose loans were guaranteed or acquired by Fannie Mae or Freddie Mac prior to May 31, 2009, were eligible. Eligibility was also contingent on whether the homeowner was up-to-date on their mortgage payments. In addition, mortgagors should have been able to benefit from lower payments or from switching to a more stable mortgage product.

The deadline for HARP was originally intended for Dec. 31, 2017. However, that date was extended, pushing the program’s expiration date to December 2018.

You May Like: Advance Auto Parts Loaner Tools

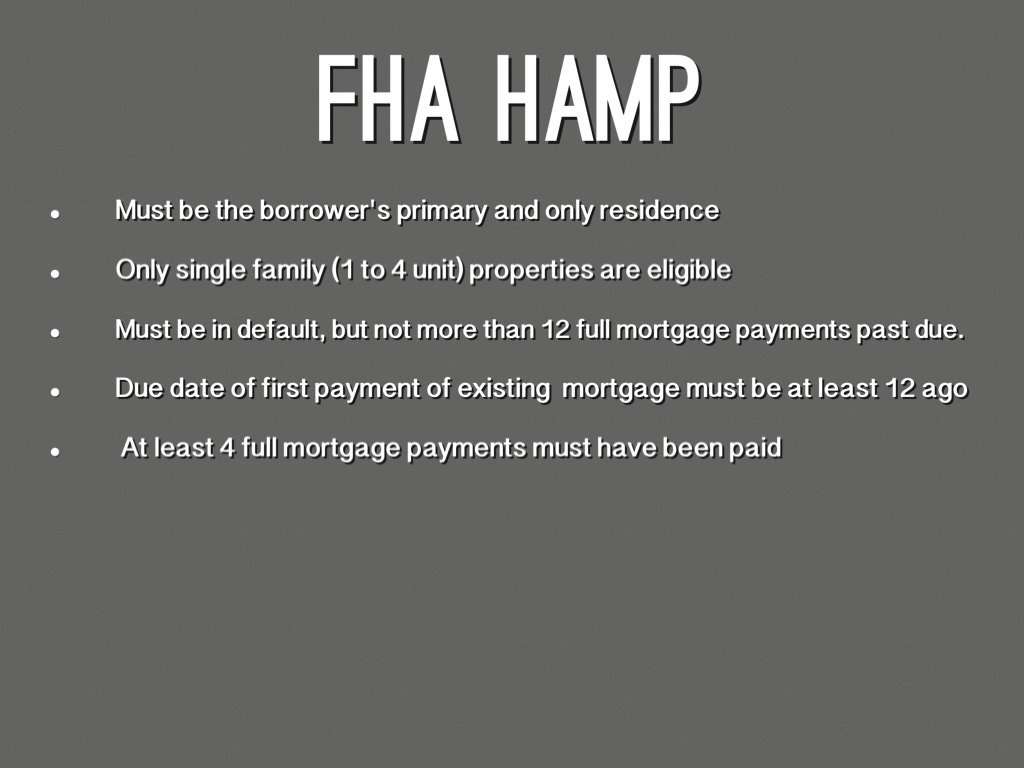

Qualifying For Fha Hamp Loan Modification

Housing and Urban Development Secretary Shaun Donovan published today the FHA has made modifications to its home loan modification procedure so that it will further imitate President Obama’s Home Affordable Modification Program under Making Home Affordable. It is anticipated that the new FHA loan workoutguidelines will be in place by August 15th.

How does this help you? Well, if you now own a home mortgage secured by the Federal Housing Administration , you should be able to extensively moderate your monthly home loan payments, interest rate, and possibly realize a partial principal forbearance or balance reduction , provided you meet the new guidelines.

Homeowners that have effectively gotten a mortgage modification through Obama’s Making Home Affordable Program have had marvelous results, some easing their mortgage rates to as low as 2% on 30 and 40 year fixed loans, saving a good deal of moneyeach month on their mortgage.

Now is a very exhilarating period for borrowers in FHA loans, as they now also can achieve similar benefits. Qualifying for the FHA -HAMP can be a little tricky, and there’s a good deal of junk out there on how to succeed. We’re going to clear up the tittle-tattle, and help you understandhow to get qualified, ModificationZoom style.

For supporting documentation, you will need to submit the following:

Hardship Letter

3 Months Bank Statements

Financial Worksheet of Income & Expenses

Hardship Affidavit

Get your loan modified!

How Does The Home Affordable Modification Program Work

The Home Affordable Modification Program relief took several forms all of which would have the effect of reducing monthly payments. Eligible homeowners could receive reductions in their mortgage principal Reductions in their interest rate Temporary postponement of mortgage payments, also known as forbearance

Read Also: Usaa Used Car Loan Calculator

Loan Modification Vs Refinance

A refinance is typically the first plan of action for homeowners who need a lower mortgage payment.

Refinancing can replace your original loan with a new one that has a lower interest rate and/or a longer term. This may offer a permanent reduction in mortgage loan payments without negatively affecting your credit.

However, borrowers going through financial hardship might not be able to refinance.

They may have trouble qualifying for the new loan due to a reduced income, lower credit score, or unexpected debts .

In these cases, the homeowner might be eligible for a mortgage loan modification.

Loan modification is usually reserved for homeowners who are not eligible to refinance due to a financial hardship.

Mortgage modification is usually reserved for borrowers who do not qualify for a refinance and have exhausted other possible mortgage relief options.

With a loan modification, you work with your existing bank or lender on modifying the terms of your existing mortgage, explains David Merritt, a consumer finance litigation attorney with Bernkopf Goodman, LLP.

If youve defaulted on your existing mortgage, chances are your credit has been negatively impacted to the point where a new lender would be wary to give you a new loan.

Typically a refinance is not possible in this situation, says Merritt.

Q: Does A Homeowner Have Income As A Result Of The Government’s Having Paid Some Of The Homeowners Mortgage Loan By Making A Pra Investor Incentive Payment To The Holder Of The Loan

A2: No. This payment by the government on behalf of the homeowner is excludible from the homeowners income under the general welfare exclusion. Excluding this amount from the homeowners gross income is consistent with the treatment of Pay-for-Performance Success Payments, which are addressed in Revenue Ruling 2009-19 PDF.

Read Also: How Long Does The Sba Take To Approve Ppp Loan