Compare Our Home Loans

While the comparison rate isnt the be-all-end-all, it is important, as even a marginal difference in the interest rate on your loan can cost tens of thousands of dollars overall,

To find a home loan with both a low advertised rate and a low comparison rate, check out some of ourlow rate home loans, or book an appointment with one of our friendly lending specialists.

Tags: compare home loans | comparison rate

Best Sibor Rate Home Loan For Hdb

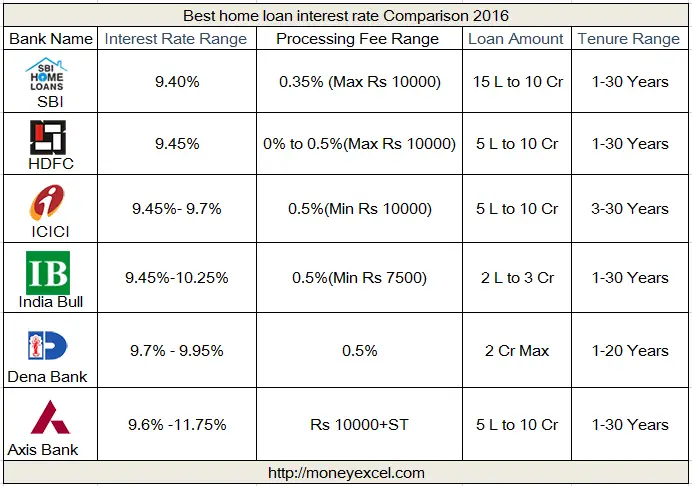

With reference to the table below, it is recommended to consider SBI, DBS, HSBC, Citibank, and Standard Chartereds loan packages if you are a prospective HDB buyer interested in loan rates that move in tandem with reference rates like SIBOR.

The Singapore Inter-Bank Offered Rate, or more commonly known as SIBOR, is an interest rate whereby banks offer to lend unsecured funds to other banks within the Singapore interbank market. While this means greater transparency as SIBOR rates are readily available online, your interest payments can increase or decrease based on SIBOR rates and a review by banks every few months.

As SIBOR rates are the same across banks, banks typically differentiate their SIBOR rate loans by having different spreads and incentives. At the time of writing, the 1-month SIBOR is about 0.725% lower than the current FHR of 1.025%. With SIBOR rates so closely linked to the U.S. dollar and such rates are expected to increase due to the U.S. economys recovery, perhaps we can explore and analyze other more predictable loans before making your final decision.

You will also notice SORA home loans making an increase in appearance, as SORA is slated to become the benchmark SGD interest rate within the next few years. Like SIBOR, SORA is a volume-weighted average rate. SORA loans, however, are purely transaction-based with no term components.

| Bank |

Things To Keep In Mind

Remember that when you look at comparison rates, the loan amounts and terms dont cover all possible situations so they may not be an accurate reflection of your particular loan. The amounts that a comparison rate is based on will be in the fine print. While comparison rates can be a good starting point, theyre not the only thing to consider when shopping around for a personal loan. Its also important to compare the other features of the loan to see if it works for you. If youd like to review the comparison rates on Westpac Personal Loans, take a look at our Unsecured Personal Loan and Car Loan.

Conditions, fees and charges apply. These may change or we may introduce new ones in the future. Full details are available on request. Lending criteria apply to approval of credit products. This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. Read the disclosure documents for your selected product or service, including the Terms and Conditions or Product Disclosure Statement, before deciding. Target Market Determinations for the products are available. Unless otherwise specified, the products and services described on this website are available only in Australia from © Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.

You May Like: Is Firstmark Services Legit

Whats The Difference Between The Interest Rate And The Comparison Rate

The interest rate is the percentage that you will be charged on the amount of money you borrow, a.k.a: your total loan amount, or, the principal.

So each time you make a repayment on your loan, you will also be paying a small percentage of money on top of that repayment to your lender.

Its important to remember that the interest rate doesnt apply to every single fee against your loan. Your lender might also charge fees such as:

- Account keeping fees

- Loan switch fees

- Rate lock fees or

- Government fees and charges.

With that in mind, you can see that this is different to the comparison rate, which is a single percentage figure of a lifetime cost of a loan that includes the interest rate and most fees. It can be a useful way to compare different home loan products in the market.

Common Factors In All Loans

Loans come in all shapes and sizes. The most common are mortgage loans, car loans and student loans. There are also consumer loans, home improvement loans and equity loans.

All loans have something in common called an interest rate. The interest rate determines how much extra you must pay for the privilege of borrowing the money. The lower the interest rate, the less you will pay for the total loan. The interest is expressed as a percentage rate.

You will also see listed an which includes the interest rate along with any fees, and in the case of a mortgage, includes points and closing costs. It can be fixed or variable. If fixed, you are guaranteed the same monthly payment throughout the life of the loan. There are no surprises. If variable, the rate can fluctuate according to the markets. Variable rates begin much lower than fixed rates and are therefore very attractive. But, they also carry the risk of increasing each year. There are caps, which are spelled out in the agreement as to how much the interest rates can increase and how often, so you will know what to expect.

Read Also: Upstart Vs Avant

Raise Your Credit Score

If your credit score is below 760, then you might not qualify for the very best rate lenders offer. That doesnt mean you cant get a lower rate than what you currently have, but there is room to improve your score and boost your savings. Before you apply for a mortgage refinance, check your credit score and get a copy of your credit report.

If you find any errors on your credit report, be sure to report them to both the credit bureau and the business that made the error as soon as possible. Both parties must correct the information in order for it to change on your credit report and be reflected in your credit score.

You can bump up your credit score by paying off credit card debt and reducing how much you use your cards. If you do use credit cards for rewards and points, try to pay them off immediatelydont wait for your monthly statement to come in because your score can change daily.

Avoid applying for new lines of credit before you apply for a mortgage refinance, as credit applications can bring down your score. However, submitting multiple mortgage applications in an effort to get the lowest rate possible wont hurt your score.

How Important Are Comparison Rates When Selecting A Loan

Comparison rates give you an indication of home loan costs and are an excellent way of comparing loans critically based just on rates. But, its vital you look at other factors when selecting the right home loan for you, including:

- Loan type: There are loans for different purposes construction, owner-occupier, investor, bridging and renovation these loans are several of the most common home loans on offer. So, before looking at rates you need to make sure that youre looking at the right type of loan for you and your circumstances, as rates can vary depending on the loan type.

- Interest rate type: Home loans can come in interest only, principal and interest, variable and fixed rates. Deciding which rate is right for you depends on your personal and financial circumstances.

- Features: Loan features can include an offset account and redraw facility, the choice to pay back your loan faster without penalty and no charges to switch from a variable to a fixed rate. These features allow you to save more over the term of your loan and can be a significant factor in the loan selection process.

- Fees: Home loan fees include establishment and application fees, ongoing account fees, property valuation charges, overdue payment charges, redraw fees and switching fees, as well as break costs. In some instances, these fees can add thousands to the cost of your home loan, so its imperative that you calculate costs before applying for a loan.

Read Also: Usaa Auto Loans Review

What Does A Comparison Rate Mean

The use of a comparison rate means it will make it easier for you to compare different home loan products available by multiple lenders. This can be due to the fact that a loan with a lower interest rate, may have a high comparison rate and cost more in the long term due to higher establishment fees, ongoing costs, or a special rate period.

Speak to your local Mortgage Choice broker today, to understand how comparison rates work further and ensure you are getting the best loan for your situation.

Types Of Mortgage Refinancing

The three most common types of mortgage refinance options are: rate-and-term refinance, cash-out refinance and cash-in refinance.

The rate-and-term refinance allows homeowners to lower their interest rate and/or change the term, which is the length of time borrowers must pay on their loan. For example, you might want to refinance your 30-year mortgage with a 3.5% interest rate into a 15-year mortgage with a 3% rate. This will help you lower the amount you pay in interest and pay off the mortgage faster.

A cash-out refinance gives homeowners the opportunity to access the equity in their home, with the option to also lower their interest rate.

A cash-in refinance is when homeowners apply cash to the principal, which can help them lower their loan balance, eliminate private mortgage insurance, get a better interest rate or qualify for a refinance.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

What Is A Comparison Rate And How Is It Calculated

While many people talk about home loan interest rates, far fewer people talk about comparison rates. This is unfortunate, as home loan comparison rates can make a big difference when youre estimating the costs of different mortgage options, whether youre applying for your first home loan or refinancing.

Why Is The Comparison Rate Important

The average Australian generally doesnt have a great wealth of knowledge when it comes to banking or home loans. He or she also doesnt have the time to carefully peruse the terms and conditions of a product, to be sure there are no fees hidden on page 36 of a home loan document, written in size 6 font and italics.

Comparison rates give borrowers a full deck to play with when it comes to home loans, rather than a couple of jokers the lender may deal you. The information comparison rates provide is crucial, as just a marginal difference in the interest rate on your loan can cost tens of thousands of dollars.

As you can see in the overly simplified table below, home loan A has a better interest rate than home loan B.

However, once the various fees and charges have been accounted for in the comparison rate, home loan B is a far cheaper product than home loan A.

| Interest rate |

|---|

| 4.00% |

Recommended Reading: Fha Loans Manufactured Homes

Comparison Rate Vs Interest Rate

There is a very distinct difference between a comparison rate and the interest rate of a loan product.

The interest rate is the rate of interest the consumer will pay on the loan. Interest rates are generally expressed as an annual percentage, but interest is calculated daily and usually added to your loan balance at the end of each month. Unlike the comparison rate, a basic interest rate does not take into account any additional loan fees.

For a more detailed investigation of the difference between the advertised interest rate and the comparison rate, please refer to our guide for interest rate vs comparison rate.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: Can You Refinance Sallie Mae Student Loans

What Does ‘comparison Rate’ Mean When Shopping For A Home Loan

16 September 2019

Understanding how you can get the best from your home loan is incredibly important and could be the difference in hundreds, if not thousands of savings. If youre in the market for your first home and have come across the term comparison rate but aren’t quite sure what it mean, we’re here to help!

What is a comparison rate?

Comparison rates help you calculate the true cost of a home loan. They combine the interest rates on your loan with a number of other fees and charges to create a single percentage rate that can be used to compare various home loans from different lenders. Comparison rates let you know how much a home loan will cost you and how it will affect your financial situation, ultimately giving you the information you need to make a more informed decision.

What does a comparison rate cover?

As briefly mentioned earlier, the comparison rate is made up of interest rates on the loan along with other costs and fees.

When calculating individual comparison rates, lenders will use a formula that takes into account the above, and the following elements:

While there are many important inclusions in calculating the comparison rate for a home loan, it doesnt take everything into account.

What doesnt a comparison rate cover?

When comparing comparison rates, its important to keep one eye on excluded costs as they may make a difference overall. Here are some of the factors a comparison rate doesnt cover:

Interest Rate Vs Comparison Rate: Whats The Difference

Think of the interest rate as the small picture and the comparison rate as the big picture. The interest rate on a home loan, often referred to as the advertised or headline rate, is typically what the lender will advertise the most and what punters are most familiar with. It refers to the rate of interest you will be charged on the loan balance per year and affects how much your minimum monthly repayments will be.

In contrast, the comparison rate represents the overall cost per year of the loan, including most of the fees and charges that will occur over the course of the loan. It also includes the interest rate itself.

Also Check: Refi An Fha Loan

Is A Comparison Rate Accurate

While a comparison rate can help you get a general idea of whether one home loan option is likely to have higher fees and charges than an alternative option, it may not give you a 100% accurate estimation of your home loans total cost.

This is partially because the assumptions used to calculate a comparison rate may not match the circumstances of your home loan. For example, comparison rates are calculated on the assumption of a $150,000 home loan, when the average owner-occupied home loan in November 2017 was $388,900, according to the Australian Bureau of Statistics . The larger a home loan, the smaller the impact that fees and charges are likely to make on the total cost compared to the interest rate.

Its also important to remember that a comparison rate doesnt necessarily include every cost of a home loan, as some mortgages have nonstandard charges to consider, such as fees associated with loan options that you may not choose to use .

Finally, a comparison rate doesnt account for some of the extra features and benefits offered with some home loans, such as an offset account youll need to decide for yourself whether this potential extra value justifies any extra cost.

Did you find this helpful? Why not share this article?

Personal Finance Editor

What Causes Mortgage Rates To Rise Or Fall

Mortgage rates are determined by a complex interaction of macroeconomic and industry factors, such as the level and direction of the bond market, including 10-year Treasury yields the Federal Reserve’s current monetary policy, especially as it relates to funding government-backed mortgages and competition between lenders and across loan types. Because fluctuations can be caused by any number of these at once, it’s generally difficult to attribute the change to any one factor.

Macroeconomic factors have kept the mortgage market relatively low for much of this year. In particular, the Federal Reserve has been buying billions of dollars of bonds in response to the pandemic’s economic pressures, and continues to do so. This bond-buying policy is a major influencer on mortgage rates.

On Dec. 15, the Fed announced that, in light of stronger and more persistent inflation pressure than originally expected, it will speed up its timeline for throttling Fed bond buying, reducing the amount they purchase by a larger increment each month than originally planned. This so-called taper began in late November.

The Fed’s rate and policy committee, called the Federal Open Market Committee , meets every 6-8 weeks. Their next scheduled meeting will be held Jan. 25-26.

Don’t Miss: Usaa Car Loan Requirements

Types Of Bank Loans For Property Purchase Interest Rates

One of the most difficult choices for home loan borrowers is to decide between getting a fixed or variable rate loan. In considering this, it is key to understand how interest rates will behave in the next two to five years and how they can affect your overall cost.

Lets take a look at the different types of home loan interest rates:

1. Fixed rates

With fixed interest rates, your interest payment for the home loan will stay the same for the entire lock-in period which is usually between 1 and 3 years. Once the lock-in period is over, itll most likely be updated to a new rate determined by the bank or changed to a floating rate. This means that using a fixed-rate loan offers the certainty of the amount that youll need to set aside for repayments each month.

2. Floating rates

Variable-rate, or a floating rate loan, usually pegs the loans interest rate to either the Singapore Interbank Offer Rate or the Swap Offer Rate . Youll typically be offered a 1-month SIBOR or 3-month SIBOR as a peg, plus an additional spread on it.

These rates are less stable compared to a fixed-rate loan since they fluctuate based on market conditions and volatility, but could offer the opportunity of lower interest rates depending on the global interest rate environment.

3. Fixed deposit-linked rates

4. Board rates

So which is better fixed or variable rates?