Once Youre Stable: Refinance Your Student Loans

Once you graduate, refinancing your student loans can be a great option for lowering your interest rates.

When you refinance your loans, you can take out a new loan with completely different repayment terms. You could qualify for a loan with a lower interest rate, different repayment period and even a lower monthly payment.

Refinancing does have some drawbacks to keep in mind. For example, if you refinance federal loans, youll lose out on access to IDR plans and loan forgiveness. You also wont get borrower protections such as the ability to defer loan payments.

But if youre focused on becoming debt-free as quickly as possible, refinancing with a lower-interest loan can help you pay off your loan ahead of schedule.

How Can I Lower Interest On My Loans

If you are not content with your current interest payments, you can find ways to decrease them. One of the main options for lowering interest payments is student loan refinancing. Refinancing loans help borrowers to use the money for paying off the existing expensive loans. For example, imagine you have a loan with a 7% interest rate. If you can find a refinancing loan with 5% interest, you can use the money to get rid of 7% interest. As a result, you save money in the long run.

Interest Rates For Interested Students

Here at MoneyTips, we love to keep learning. There are so many ways that you can be a student in this world and not all of them are through traditional education. But if youre interested in going to school, you may need to get student loans through private lenders or federal student aid to help you pay for your education.

Know how interest rates work and what you can expect the current rates to be before you decide which student loan is best for you.

You May Like: The Mlo Endorsement To A License Is A Requirement Of

What Are Interest Rates

Put simply, interest rates are fees that lenders charge so they can make money on loans.

When you repay your loan each month, the money goes into two virtual buckets:

When you get your bill every month, the interest and principal will be broken out separately. Thats because theyre like separate pots of money, which well discuss in a few minutes. For now, just know that principal and interest are never added together as long as you keep your loan current.

Now, lets do some math.

How Do Student Loan Interest Rates Work

An interest rate is the cost of borrowing money from a lender and is usually expressed as a percentage. Student loans are amortized, which means you pay the principal and interest off at the same time over the life of your loan.

No matter what type of interest rate you have, interest accrues daily. That means its added up over the course of each month and included with your principal balance in your monthly payment.

You can use a simple formula to calculate how much interest you can expect to pay, which can help with budgeting.

With a fixed interest rate, even though there is a set amount of interest youll pay over the life of a loan, as time goes on the amount of your monthly payment that goes towards interest decreases and the amount that goes towards principal increases.

With a variable rate, the interest rate changes over the life of the loan and there isnt a set amount of interest you can expect to pay. The amount of your monthly payment that goes towards interest varies with any rate changes.

You can get two types of student loans federal and private and the interest rates work differently for each.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

Historical Average Federal Student Loan Rates

Some borrowers may not just be interested in the current average rates, but may be curious about the answer to the question, what is the average student loan rate over time? Again, this depends on the type of loan you’re taking out. Here are the historical rates for Direct Subsidized Loans and Subsidized Federal Stafford Loans. If you take a look at this chart, you can see, for example, that the average rate for this type of loan over the past five years was 4.108%.

You can do this type of calculation with each of the different kinds of loans for which the Department of Education has made historical data available.

Average Monthly Payment And Terms

Across the board, the average monthly repayment plans cost for student loans is $460. However, actual monthly repayment may vary depending on the level of education. For instance, the repayment amount for an associate student loan ranges from $281 to $384. Meanwhile, repayment for doctorate student loans ranges from $575 to $1,844.

Repayment terms may vary based on the level of education. While the average borrower repays student loan debt for 20 years, repayment plans can range from 10 to 30 years. For professional graduates, it may take up to 45 years.

For instance, the actual repayment term for a $30,000 graduate student loan is five years and 10 months. With an APR of 3% and a $465 monthly payment, the total repayment cost is $32,800. The table below shows how cost and repayment terms vary as the average debt gets adjusted.

Average New Graduates Loan Payments

- Average Debt

Recommended Reading: How To Get A Mortgage License In California

How To Calculate Your Monthly Student Loan Payment

A student loan calculator is the easiest method to estimate your average student loan payment. You are required to include the total loan amount, the interest rate , the span of time youll be paying, and any additional monthly contributions you can make over the baseline. This will provide you with an overview of your monthly and total payments over time.

UniCreds offers students a Student Loan Repayment Calculator on its website. This student loan payback calculator gives estimations that can only be used as a planning tool. The results are based on a normal repayment plan in which you pay a specific amount every month for a defined number of months, based on your loan term, the prepayment scenario you specify, and makes the following assumptions:

- A fixed interest rate The calculator does not take into consideration a variable interest rate

- Your loan is currently in repayment, and

- UniCreds can not guarantee the accuracy or relevance of the student loan payback calculator, and it is recommended that you consult a trained expert for assistance in reviewing your total financial position.

Ainsi Que We Shall Discover Statutes Who Grow Potential To Own Loan Forgiveness And You Can Active Advocacy Chatting

One of many instructions about student track to the Saturday, April 23 are Deciding to make the situation getting federal student loan forgiveness programs. With this course, thats scheduled for an effective.yards.

For those of us doing Congressional group meetings towards the Wednesday, April twenty-seven, we shall have an opportunity to talk about the impact away from student loans to the our health care program and have our people in Congress to help with laws that would convenience this load.

Since people, citizens and you can medical professionals of the osteopathic medical profession, it is all of our duty making our very own voices read and also to advocate on the laws and regulations one affects our degree and you may ability to like all of our areas and exercise form based on all of our hobbies, not our very own capability to repay our very own student education loans.

Read Also: Usaa Used Car Refinance Rates

How Compound Interest Works In Your Favor

Looking at the examples above, its easy to see how this effect works over time. You naturally make a little more headway on your principal every month, even though your payment amount remains the same. This is known as amortization.

If you use amortization to your advantage, you can save yourself a lot of money over the life of your loan.

If your loan doesnt have prepayment penalties, you can pay it off faster by making higher payments every month. Because youve already paid the interest for that payment period, any additional money will go right toward the principal.

That will have a lasting benefit, because a lower principal amount means that those daily compounding calculations will be applied to increasingly smaller numbers.

Paying as little $10 extra per month can yield significant savings over the life of your loan. Paying $100 extra or more can save you thousands.

What Is An Average Student Loan Interest Rate

It is necessary for students seeking loan from financing parties to be aware of the interest rates, how to calculate the accured charges, steps to be taken to avoid huge interest rates and the long term consequences that may arise if these are ignored

Does it seem fair if you have to pay a whopping extra amount of $10,000 for a 7% interest on a 15-year tenure for $50,000 loan compared to a borrower who is taking out the same loan with a 5% interest rate? I think not.

The cost of financing education usually varies with respect to countries and institution and most students seeking entry fail to pay close attention to the interest rate documented by the lending party. This failure can lead to the payment of huge interest in the long run which could have been avoided if proper knowledge about the deal or relevant background study and research was carried out in the first place.

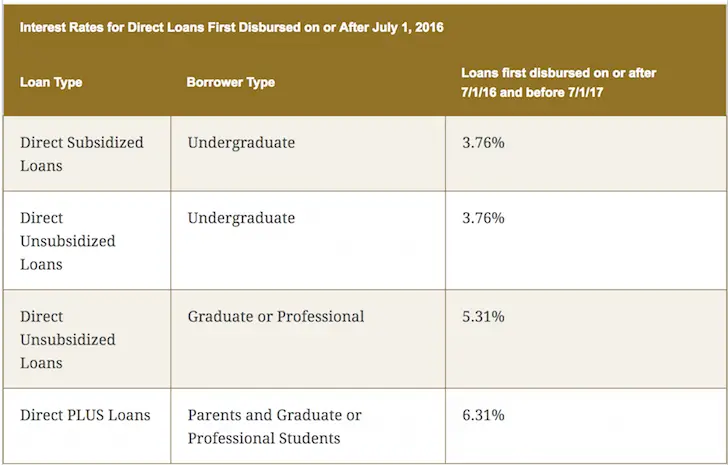

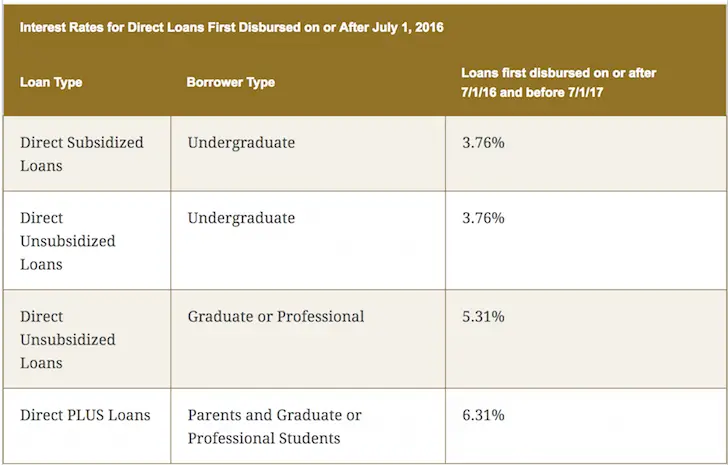

Let’s run through the different interest rates offered by both the federal government as well as the private funding institutions

Recommended Reading: Usaa Car Loan Rates

How Are Student Loan Interest Rates Trending

Federal and private student loan rates have shifted, trending sharply up and down over the past 10 years. Keep in mind that, while you may take out a loan with a specific interest rate as an incoming freshman or first-year graduate student, loan rates shift each year.

As a result, the interest rates change each year. This can greatly affect the status of your loan and, ultimately, your monthly bills upon graduation.

In general, federal student loan rates are on the rise. In 2008, the average student loan interest rate was 6.0% for undergraduates and 6.8% for graduate students.

In 2008, PLUS loan recipients took out loans with a 7.9% interest rate. Grad students and PLUS loan applicants interest rates remained stable from 2006 to 2012, then experienced a general downward trend. Direct Unsubsidized Loans for graduates are at 5.28% and Direct PLUS Loans are at 6.28% as of 2022.

Meanwhile, federal undergraduate loan interest rates declined significantly from 2008, bottoming out at 3.4% in 2011. Since then, they have risen, as well, and show signs of continuing to increase over the years to come. As of 2022, undergraduate loan rates stood at 3.73%, with signs pointing toward a continued upward trend.

How Is Interest Calculated

Lets focus on Direct loans to understand interest rates better. First, keep in mind that Direct loans are accrued daily.

If you miss the payment deadline, the interest will start accruing. Depending on your debt type, the accumulated interest can be capitalized, which we will discuss later.

You can calculate the accrued amount with the following formula:

Interest = x Number of Days Since Your Last Payment In addition, the average student loan interest rate factor can be determined by dividing interest by the number of days in a year.

Read Also: 1-800-689-1789

Loans For Graduate Students

Graduate students can only get unsubsidized loans. They do not qualify for subsidized debt, which means they do not need to prove financial need. Generally, the average student loan interest rate is higher for graduate students. Hence, it is not surprising that the federal student loan interest rate for such students is now 5.28% higher than loans for undergraduate students. For further information, last year, this rate was 4.30%.

Interest Rates For Fixed

Loan Status Any StatusWARNING This system may contain government information, which is restricted to authorized users ONLY. Unauthorized access, use, misuse, or modification of this computer system or of the data contained herein or in transit to/from this system constitutes a violation of Title 18, United States Code, Section 1030, and may subject the individual to civil and criminal penalties. This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures. Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel.

ANYONE USING THIS SYSTEM EXPRESSLY CONSENTS TO SUCH MONITORING.

Read Also: Auto Loan Amortization Formula

What Else Should You Consider

A student loan, whether federal or not, is a loan just like any other, which means it comes with both pros and cons. Be sure to shop around for the best rates possible and do the math ahead of time, rather than signing up for the maximum you can take out.

If possible, pay as much as you can from your own funds. Chip away at your debt as much as you can as soon as your grace period ends. Explore other funding options such as grants and scholarships, as well as work-study at your school and other creative ways to keep the sum of your loan as small as possible.

Unfortunately, you may have to consider the overall price, too, as some private institutions are exorbitantly expensive. If you receive funding from a school without the hefty price tag, it may be worth it to reconsider your school of choice.

On the other hand, education is a unique experience, and everyone has their own priorities. Just dont count out your options until youve explored them all. And that includes taking into account student loan interest rates.

Student Loan Interest Rates

Student loan interest rates were at historic lows for the 2020-2021 academic year in response to the ever-ballooning national student debt, which was labeled a crisis as early as 1995.

- 5.8% is the average student loan interest rate among all student loans, federal and private.

- The average federal loan interest rate is 4.12%.

- Between 2019-20 and 2020-21, all federal student loan interest rates fell an average 31.24%.

- Interest rates for undergraduate loans fell 62% faster than interest rates for graduate and professional students.

- The undergraduate federal interest rate has declined 80.36% since rates peaked at 14% in the early 1980s.

- Consolidating federal loans does not decrease interest rates, but refinancing may.

Don’t Miss: Mortgage Loan Originator License California

What Are Current Student Loan Interest Rates

The 10-year Treasury rate saw record lows in 2020, and, as a result, federal student loan rates beginning July 1, 2021, are some of the lowest in history.

- Direct Subsidized and Unsubsidized Loans for undergraduates 3.73%

- Direct Unsubsidized Loans for graduates or professional borrowers 5.28%

- Direct PLUS Loans for parents and graduate or professional students 6.28%

There is an origination fee of 1.057% for federal Direct Subsidized Loans and Direct Unsubsidized Loans, in addition to 4.228% for Parent PLUS Loans. This fee isnt added to your repayment rather, its deducted from your initial loan disbursement.

Private lenders set a range for interest rates. Your actual rate will be based on the creditworthiness of you and your cosigner. According to Bankrate, private student loan annual percentage rates are currently:

| Loan Type | |

| 2.44% to 9.99% | 1.74% to 7.75% |

With the announcement that the Federal Reserve will be keeping the federal funds rate close to zero for the foreseeable future, its unlikely that private student loan interest rates will increase significantly in 2021.

You Put In The Work Now Reap The Rewards

- Variable Rates between 1.87% – 6.52% APR1

- Fixed Rates between 2.30% – 5.96% APR1

- No application or prepayment fees

- Cosigner release with 24 consecutive on-time payments2

- Show more info »

1Interest Rates

Fixed interest rates range from 2.30% APR to 5.96% APR . Your interest rate will depend on your credit qualifications. The fixed interest rate will remain the same for the life of the loan.

Variable interest rates range from 1.87% APR to 6.52% APR . Your interest rate will depend on your credit qualifications. Variable rates may increase after consummation. Variable rates for Nelnet Bank Refinance Loans are calculated as the One-Month SOFR plus the applicable Margin percentage. Variable rates will be based on the highest One-Month SOFR as published by the Federal Reserve Bank of New York and/or the Wall Street Journal Money Rates table on the twenty-fifth day of the immediately preceding calendar month. The variable rate may change on the first day of each month if the SOFR index changes. This may result in higher monthly payments. The current One-Month SOFR index is 0.05% as of January 1, 2022.

2Cosigner Release. A request for the cosigner to be released can be made by either the borrower or cosigner when each of the following conditions has been met:

Refinance Loan Limits:

Read Also: Capitol One Car Loans

Whats A Reasonable Interest Rate For Student Loans

- Whats a Reasonable Interest Rate for Student Loans?

There are two types of lenders for student loans:

- The federal government and the U.S. Department of Education, which distributes federal student loans

- Private financial institutions that offer private student loans

Typically, federal student loans have the most favorable interest rates and repayment terms. Federal student loan interest rates are set by Congress for each school year. Once you borrow, the rates remain set for the life of the loan.

Private student loans can be either fixed or variable. Average interest rates can range from 3.95% annual percentage rate to 14.28% APR. Variable-rate loans can change over the life of the loan. Private student loan rates vary based on your personal credit history and rating, the type of loan and repayment options you choose, and your debt-to-income ratio.

The better your interest rate, the less money you will pay over the life of your loan.