What Is A Federal Direct Loan

The William D. Ford Federal Direct Loan Program, which issues Direct Loans, is the U.S. government’s student loan program. These federal loans are available to undergraduate students, graduate students, professional students and parents of undergraduate students. There are four types of federal Direct Loans, each with their own interest rate.

Federal Direct Subsidized & Unsubsidized Loans

Tulane participates in the Direct Loan Program. The federal government through the U.S. Department of Education is your lender for the Direct Loan Program. Federal Direct Subsidized and Unsubsidized Loans are offered to eligible students who are enrolled at least half-time and who meet all other eligibility criteria.

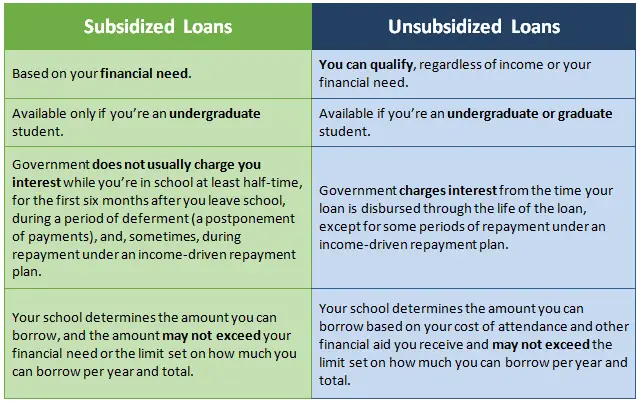

Eligible undergraduate students who have financial need may be offered a Direct Subsidized Loan, on which no interest will be charged before repayment begins or during authorized periods of deferment. Interest is charged during the repayment period on a Direct Subsidized Loan.

Regardless of financial need, eligible students may qualify for a Direct Unsubsidized Loan. Interest on the Direct Unsubsidized Stafford Loan will begin to accrue when the loan is disbursed and be capitalized to the principal balance when the repayment period begins.

Current Unsubsidized Loan Interest Rates

If you receive a federal student loan, you will be required to repay that loan with interest. Interest rates are fixed for the life of the loan.

- For undergraduates, the current interest rate for direct unsubsidized loans is 3.73% .

- For graduate or professional students, the current interest rate for direct unsubsidized loans is 5.28% .

If the borrower does not pay the interest as it accrues, it is capitalized .

You May Like: Defaulting On Sba Loan

Is An Unsubsidized Or Subsidized Loan Better

Subsidized loans have obvious benefits over unsubsidized loans, since the government pays the interest during certain periods of time. But that doesnât mean unsubsidized loans arenât worthwhile they help many students pay for college. Furthermore, many students wonât always have a choice between the two loan types, since direct subsidized loans are only offered to students who demonstrate financial need.

Unsubsidized loans provide a helpful alternative for families who may make too much money but still need help paying for the cost of tuition. If you have an unsubsidized loan, you might consider making a payment on the accrued interest while youâre in school. It will help free up more discretionary income down the road in the years after graduation.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

Elements Of A Federal Direct Unsubsidized Loan

The key elements of a Federal Direct Unsubsidized Loan are as follows:

- There is a fixed interest rate of 4.45% for undergraduate students and 6% for graduate students.

- You are not required to provide proof of financial need.

- There is a six-month grace period after you graduate, during which the same rules from your academic term apply.

- The interest is capitalized during your studies and the six-month grace period.

- There is a 1.069% loan origination fee taken out of each disbursement.

Unsubsidized loans act as a temporary solution to the immediate problem of high college fees. Today, most students tend to consolidate student loans with other loans to make the repayment process easier.

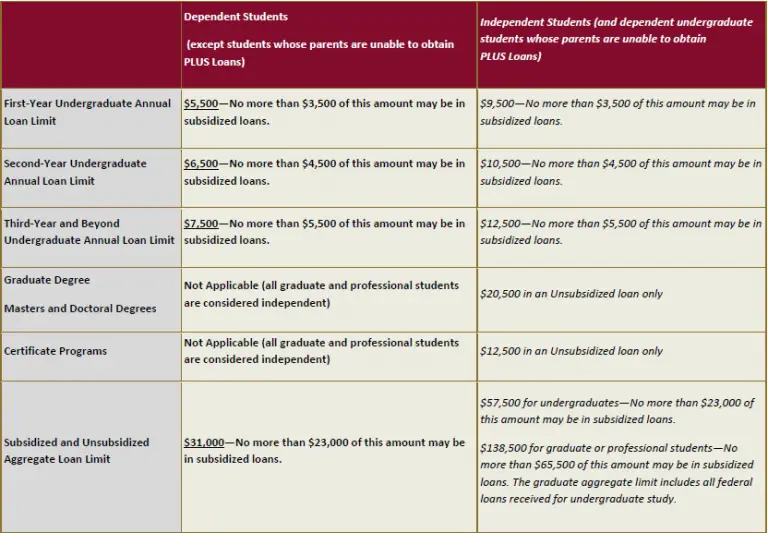

Also, there is a limit on the amount in subsidized and unsubsidized loans that you may be eligible to receive each academic year .

Don’t Miss: Refinance Usaa Auto Loan

Federal Subsidized Loans Vs Unsubsidized Student Loans

Direct Unsubsidized Loans are the loans offered to eligible undergraduate, graduate, and professional students, but eligibility is not based on financial need. It is a loan which is meant for those who do not qualify under the requirements of financial need but still require help in paying for their schooling expenses. Direct Subsidized loans are offered on need-based to the students. It is also provided to the eligible undergraduate students.

General factors of comparison of both the types of federal loans are given below.

| Factors | ||

| Up to 150% of the school term | Up to 150% of the school term | |

| Interest rate | 5.05% for undergraduates 6.6% for the rest | |

| Applicable to | ||

| The necessity of a financial need | Yes | |

| Interest paid by the government during school and grace period. | Interest to be paid by the borrower at all times | |

| The amount that can be borrowed | Low and differs depending on the year and level of study | Higher than Subsidized loans, also differs from year and level of study. |

As we reach the repayment phase, interest payments can be a concern. Getting approved for a subsidized loan is harder but it is worth giving a shot

Whats The Difference Between Direct Unsubsidized Loans

by Nikki | Apr 5, 2020 | Quick Cash Payday Loan

Whats the difference between Direct Unsubsidized Loans?

In quick, Direct loans that are subsidized somewhat better terms to simply help down pupils with monetary need.

Heres an overview that is quick of Subsidized Loans:

- Direct loans that are subsidized offered to undergraduate pupils with economic need.

- Your college determines the quantity you are able to borrow, while the quantity might maybe perhaps maybe not meet or exceed your economic need.

- The U.S. Department of Education will pay the attention on a Direct Subsidized Loan while youre in college at the very least half-time, for the initial half a year when you leave school , and during a time period of deferment .

*Note: in the event that you received a Direct Subsidized Loan which was very first disbursed between July 1, 2012, and July 1, 2014, you are in charge of spending any interest that accrues throughout your elegance period. The interest will be added to your principal balance if you choose not to pay the interest that accrues during your grace period.

Heres a fast breakdown of direct Unsubsidized Loans:

$138,500 for graduate or students that are professional more than $65,500 with this quantity might be in subsidized loans. The graduate aggregate limitation includes all loans that are federal.

Recommended Reading: Upstart/myoffer

Federal Direct Unsubsidized Loans

Federal Direct Unsubsidized Loans are available to graduate and professional students, including those who do not qualify for need-based financial aid. These federally supported, low-interest student loans offer flexible repayment options.

- Fixed interest rate available to Metropolitan College graduate students

- Classroom, blended, and/or online students are eligible

- Maximum amount of borrowing per academic year: $20,500

- Interest will accrue and must be paid or capitalized during periods of in-school enrollment and/or deferment

What Is A Federal Direct Loan Everything You Need To Know

A federal Direct Loan is a type of student loan issued by the U.S. Department of Education that both undergraduates and graduates can use to cover the cost of education. Because of their low interest rates and additional benefits, these are usually the best starting point if youre considering taking out loans for school.

Read Also: Usaa Auto Loan Eligibility Requirements

How Much Can You Borrow In Unsubsidized Loans

Another benefit of unsubsidized student loans is that they have much higher annual and aggregate loan limits than their subsidized loan counterparts.

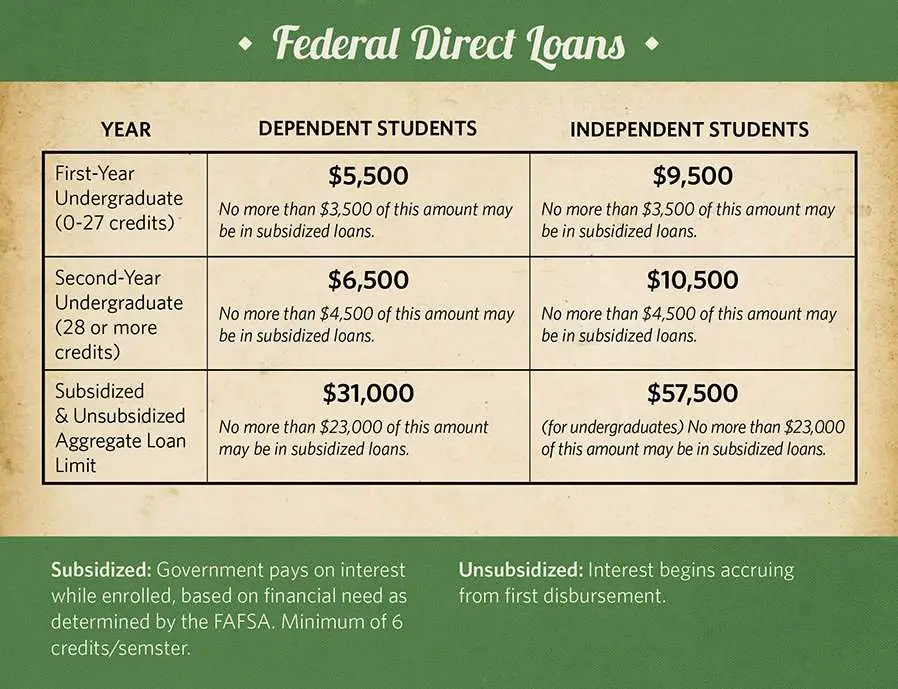

For example, first-year independent students can borrow no more than $3,500 in subsidized loans, but they can borrow up to $9,500 in unsubsidized loans. Here’s a quick breakdown of the yearly and aggregate loan limits for unsubsidized student loans:

Your school will ultimately determine how much you can borrow in unsubsidized student loans by comparing their cost of attendance to any additional financial aid that may be available to you.

Cons Of Unsubsidized Student Loans

Here are some of the problems with getting an unsubsidized student loan:

- You, as a borrower, are technically taking out a general loan, which makes you liable to pay the entirety of it on your own, including all the interest payments.

- You do have a 6-month grace period during which you dont have to pay interest. However, that interest isnt dissolved but is accrued in your principal amount. This is true for the interest accumulated during your studies, as well, provided you didnt pay it at that time.

- If you file for deferment or forbearance, you still have to pay the interest accrued during that time.

When figuring out how to pay for college, its best to prioritize your interest. The interest eventually appears in your monthly payments, therefore, not paying it at the will result in a greater principal loan amount. The increased principal amount will also result in higher interest payments in the future.

Recommended Reading: Usaa Car Loan Number

A Brief History Of Federal Student Loans

In the 1950s, the US government started taking serious measures to encourage the pursuit of post-secondary education. The Department of Education started offering government-backed loans under the National Defense Education Act, or NDEA – as more people pursue college educations, these loan programs have expanded. As of 2012, almost 70% of students graduating from 4-year colleges have taken out some amount of student loans.

Because federal loans are government-backed , interest rates tend to be better than those of private loans. We’ll go more into why interest rates are important in the next section.

Federal Direct Unsubsidized Stafford Loan

Students who are first-time borrowers of the Federal Direct Stafford Loans, must complete an electronic Master Promissory Note and on-line Entrance Loan Counseling to receive the funds. In most cases, the student will be required to complete the MPN and entrance counseling session only once during their years in college. Each year students will need to accept their loan on the Financial Aid To Do List page in MyUI.

Obtain information regarding grace periods and repayment plans from the Federal Student Aid website.

Lender: Federal Government

- Fixed at 3.73% for loans disbursed July 1, 2021 – June 30, 2022

- Fixed at 2.75% for loans disbursed July 1, 2020 – June 30, 2021

- Fixed at 4.53% for loans disbursed July 1, 2019 – June 30, 2020

- Fixed at 5.05% for loans disbursed July 1, 2018 – June 30, 2019

- Fixed at 4.45% for loans disbursed July 1, 2017 – June 30, 2018

Interest Rate – Graduate Students:

- Fixed at 5.28% for loans disbursed July 1, 2021 – June 30, 2022

- Fixed at 4.30% for loans disbursed July 1, 2020 – June 30, 2021

- Fixed at 6.08% for loans disbursed July 1, 2019 – June 30, 2020

- Fixed at 6.60% for loans disbursed July 1, 2018 – June 30, 2019

- Fixed at 6.00% for loans disbursed July 1, 2017 – June 30, 2018

Interest Rate Cap– For loans disbursed on or after July 1, 2013:

- 8.25% for undergraduate students

Interest Free in School: No

Loan Fee:

Annual Maximums – Dependent Student :

- $5,500 freshman

- $6,500 sophomore

- $7,500 junior and senior

Annual Maximums – Self-Supporting Student :

Don’t Miss: Va Manufactured Home Guidelines

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .

How Much Can I Borrow With A Subsidized Loan

The amount you can borrow with a subsidized student loan is determined by your school, and the amount can’t exceed your financial need. The amount you can borrow each year also depends on your year in school and your dependency status. The following chart shows the annual and aggregate limits for subsidized loans as determined by the U.S. Department of Education.

| Borrowing Limits for Subsidized Loans |

|---|

| Year |

Recommended Reading: Transferring Auto Loan To Another Bank

Borrowing & Interest Rates

The total amount that you can borrow in a Federal Direct Unsubsidized Loan cannot exceed your Estimated Cost of Attendance minus other aid received. In addition, the total Federal Direct Subsidized Loan and Federal Direct Unsubsidized Loan cannot exceed your annual maximum loan limit.

The interest rate on loans borrowed by undergraduate students between July 1, 2021 and June 30, 2022 is 3.73%, and the interest rate for graduate students is 5.28%. The loan origination fee for loans borrowed after October 1, 2020 and before September 30, 2022 will be 1.057%, and will be deducted from your loan at time of disbursement.

Youre charged interest on this loan from the time the loan is disbursed until it is paid in full. If the interest is allowed to accumulate, the interest will be added to the principal amount of the loan and increase the amount to be repaid.

Eligibility For Unsubsidized Student Loans

Eligibility for an unsubsidized student loan does not depend on financial need. More students will qualify for an unsubsidized student loan than for a subsidized student loan. Everybody, including wealthy students, may qualify for an unsubsidized student loan.

The borrower must be enrolled at least half-time as a regular student in a degree or certificate program at a college or university that is eligible for federal student aid. Some private student loans will lend to continuing education students who are enrolled less than half-time. For federal student loans and most private student loans, repayment begins six months after the borrower graduates or drops below half-time enrollment.

Eligible students must have a high school diploma, GED or the equivalent.

For federal student loans, the student must be a U.S. citizen or permanent resident. Some private student loans will lend to international students, if the borrower has a creditworthy cosigner who is a U.S. citizen or permanent resident.

The student must be in good academic standing with at least a 2.0 grade point average on a 4.0 scale and making progress toward a degree that is consistent with graduating within 150% of the normal timeframe.

The borrower must not be in default on a previous student loan.

Most private student loans will require a credit check and a creditworthy cosigner.

Read Also: Usaa Refinance Auto Loan Calculator

What Is An Unsubsidized Loan

An unsubsidized loan is a federal student loan that’s available to all students who are enrolled at least half-time in an eligible school. The main difference between unsubsidized and subsidized loans is that unsubsidized loans are accessible to a large number of students.

Unlike subsidized loans, students do not need to demonstrate financial need to qualify for an unsubsidized loan. And Direct Unsubsidized loans are the only type of Direct Stafford loan that can be used to help cover the cost of a graduate or professional program.

But if accessibility is the biggest benefit of unsubsidized loans, their biggest disadvantage is that students are responsible to pay the interest that accrues on them during all periods. With subsidized loans, on the other hand, the government will cover your interest charges while you’re still in school and during your six-month grace period.

Find Out Which Is The Cheapest Option For You

Federal Direct Subsidized Loans are ideal if youre an undergraduate student with significant financial need. The government covers some of your interest payments, so theyre the cheapest option available. But if youre a grad student or dont have financial need, you may have to stick to Direct Unsubsidized Loans.

Also Check: Usaa Student Loan Refinancing

How To Apply For A Direct Unsubsidized Loan

Examples Of Unsubsidized Student Loans

Unsubsidized loans include the unsubsidized Federal Stafford Loan, the Federal Grad PLUS Loan, the Federal Parent PLUS Loan, private parent loans and loans that consolidate and refinance these loans .

Private student loans and parent loans give borrowers more options than unsubsidized federal loans for making payments on the student loans during the in-school and grace periods. The most common of these are full deferment of principal and interest, interest-only payments and immediate repayment of principal and interest. Slightly more than a quarter of the private student loans offer fixed payments per loan per month, with $25 as the most common monthly payment amount.

Federal student loans provide for full deferment during the in-school and grace periods. Immediate repayment is an option on federal parent loans. There are no prepayment penalties on federal and private student loans, so nothing stops a borrower from making interest-only or fixed payments on unsubsidized loans that dont offer these options.

About four-fifths of all student loans are unsubsidized.

You May Like: Usaa Personal Loan Approval Odds

Unsubsidized Vs Subsidized Loans

If you have a subsidized loan, then the government will pay the loan interest under certain conditions, such as when the student is enrolled in school at least half time, during the grace period, and during deferment. Also, direct subsidized loans are based on need if you donât meet the financial eligibility requirements you will not be able to borrow this type of loan. Additionally, you must be enrolled in an undergraduate program to qualify for a subsidized loan graduate and professional students cannot apply.

Other than who pays the interest and the qualifications, unsubsidized and subsidized loans have similar features.

| Feature | |

|---|---|

| None | Undergraduate only based on financial need |

Next weâll discuss the features of an unsubsidized loan, and how they compare to the subsidized loan.

Who Qualifies For Federal Direct Loans

Federal subsidized and unsubsidized loan borrowers must meet the following requirements:

- Enrollment at least half-time at a school that participates in the Federal Direct Loan program

- A U.S. citizen or eligible non-citizen

- Possession of a high school diploma or the equivalent

- No default on any existing federal loans

Direct subsidized loans are only available to undergraduates who demonstrate a financial need. Both undergraduates and graduate students can apply for direct unsubsidized loans, and theres no financial need requirement.

If you qualify for a subsidized loan, the government pays your loan interest while you’re in school at least half-time and continues to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment.

To apply for either type of loan, you will need to fill out the Free Application for Federal Student Aid . This form asks for information about your income and assets and those of your parents. Your school uses your FAFSA to determine which types of loans you qualify for and how much youre eligible to borrow.

Read Also: Usaa Auto Refinance Calculator