Parent Plus Loan Eligibility Denials And Limits

Many parents want to help fund their childs college education. One common way to do this is through the Federal Parent PLUS Loan. Like with other student loans, the Parent PLUS Loan offers advantages to private student loans, including safer repayment terms and the option to enroll in repayment programs. As the name suggests, this loan goes to the parent of a dependent college student and limits how much debt the student will have to take on. But, parents with bad credit may not qualify. Parents should be aware of Parent PLUS Loan eligibility requirements, because a denial can impact their childs ability to finish college and can create more debt for the child. Parents and students also need to evaluate the cost of higher education carefully, because PLUS Loan amounts can be dangerously high at some schools.

Fill Out And Complete Your Parent Plus Loan Application

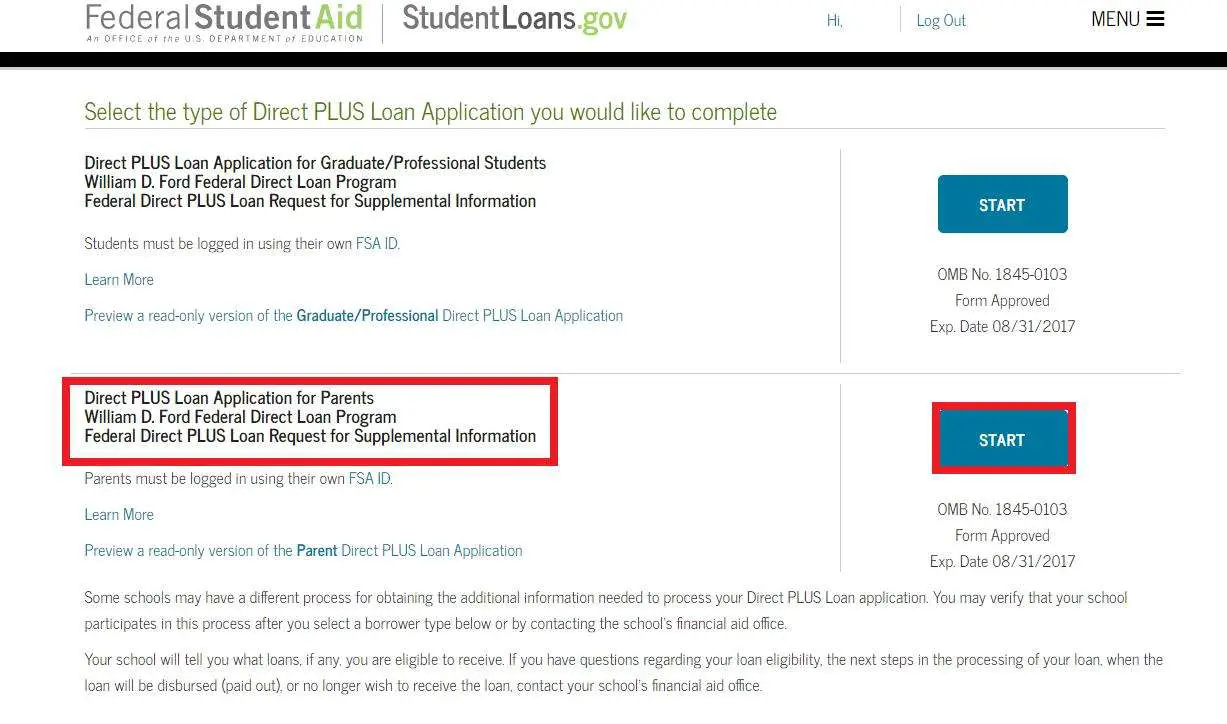

You can fill out and submit the direct PLUS loan application for parents through the Federal Student Aid website. Once you’ve applied, the application details will be forwarded to the school for processing.

You will need your student’s verified Federal Student Aid ID and school name to get started. The application is divided into four segments:

- Loan information: You’ll enter the award year and your student’s name, address, phone number, Social Security number and date of birth. In this section, you will also include the school’s information, specified loan period and whether you want to defer loan payments while your student is enrolled in school and during the six-month grace period following graduation.

- Borrower information: This section asks for your citizenship status, address and employer’s information.

- Review: You will review your entries on this page and make any edits if needed.

- : The final page of the loan application requests your consent for a credit check. It also includes important notices and certifications you must agree to before you can submit your application.

If you have a security freeze in place on your credit report, reach out to the credit bureaus to have it lifted. Otherwise, your application cannot be processed.

You Want To Reduce Your Monthly Payments

With a 7.6% interest rate and a 10-year repayment term, your minimum payment for a $28,000 loan would be $334 per month. If you wanted to lower your payments, you could refinance your loans and opt for a longer loan term.

If you refinanced and selected a 15-year term at 6% interest, your monthly payment would decrease to $236 per month freeing up $98 in your monthly budget.

Youd pay more money in interest charges due to the longer loan term, but that downside may be worth it to improve your cash flow immediately.

Also Check: Usaa Personal Loan Credit Requirements

When Do I Have To Begin Repaying My Loan

The repayment period for a Direct PLUS Loan begins immediately after youve received the last disbursement of the loan, while your child is still in school. However, you may be able to defer making payments while your child is enrolled at least half-time, and for an additional six months after your child graduates or drops below half-time enrollment status. To learn more about deferment, .

When its time for you to begin repaying your Direct PLUS Loan, youll make payments to your loan servicer, an organization that handles billing and other customer service functions related to your Direct PLUS Loan. The servicer will contact you after you receive your first Direct PLUS Loan to provide you with information about repayment options, and the servicer also will communicate with you throughout the repayment period of your loan.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Can You Use The Va Loan To Buy Land

Can You Get A Better Interest Rate With Private Lenders

The current interest rate for Direct PLUS Loans is a fixed rate of 6.28 percent . If you have a good credit score, you may be able to qualify for a better interest rate with a private lender. Look into private loan options and determine where you can get the best rates before deciding to apply for a parent PLUS loan.

What To Do If You Have A Plus Loan

If you took out a Direct PLUS Loan for your child’s education and are struggling to pay it back, consolidation might be an option. Be aware, though, that while increasing the length of your loan will decrease your monthly payments, it will also increase the total amount you will have paid by the end.

Refinancing the PLUS loan is another possibility. In fact, even if you are not struggling to repay your loan, it’s worth looking into refinancing to see if you can secure a lower interest rate and monthly payments.

The smartest financial move is to try to pay as much as you can toward the loan while you’re still earning money, even if it means you have to tighten your budget, and not take it with you into retirement.

Also try to avoid borrowing against your retirement funds, such as 401 plans, or cashing out of them early to cover the loan costs. Instead, if you are nearing retirement, consider working a few more years, if you are in any position to do so, to pay off the loan before retirement.

Read Also: Becu Car Repossession

Do You Have To Apply For A Parent Plus Loan Every Year

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

College is expensive and costs continue to rise. In 1989, the average cost of a 4-year degree school term was $1,730. As of 2020, the average cost increased to an average of $10,440 per school term.

With college costs continuing to skyrocket, many parents apply for federal Parent PLUS loans. Since these loans are issued in the parents name, it is important that parents understand the details of what these loans entail and how often you have to apply to ensure students receive proper funding.

So, to avoid missing an application deadline, heres some helpful information about Parent PLUS loans and their application process.

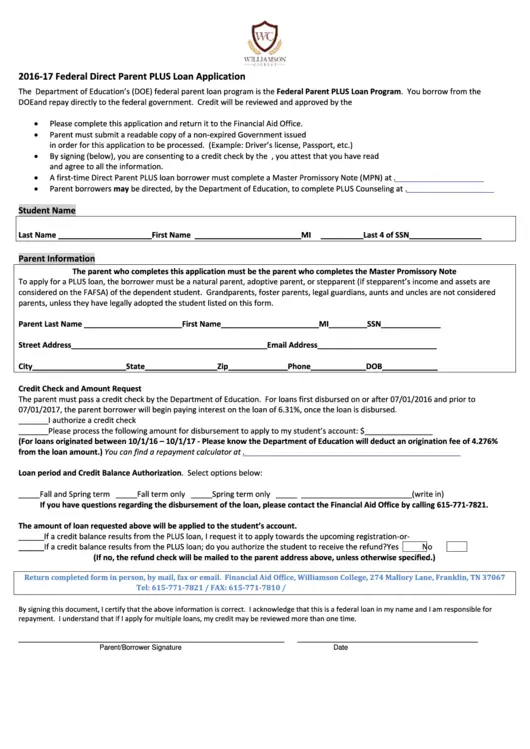

Federal Direct Parent Plus Loan Borrower Instructions

- Please be sure to complete the Master Promissory Note for the PLUS loan which is part of the application process.

- All PLUS Loan funds will be processed as a Fall/Spring loan with two equal disbursements unless specified during the loan application process. If you choose “Maximum Loan Amount,” “Unknown” or “School Credit Balance Options”, on the application, please be aware your loan amount will be calculated by subtracting your student’s aid package from the overall cost of attendance. Please have your student visit “YOUR CONNECTION” for exact cost of attendance figures.

- It will take approximately 2-3 weeks for the Financial Aid Office to process your Federal PLUS loan.

Also Check: Mortgage Loan Originator License California

What Are The Eligibility Requirements For A Parent To Get A Direct Plus Loan

- You must be the biological or adoptive parent of the student for whom you are borrowing.

- Your child must be a dependent undergraduate student who is enrolled at least half-time at a school that participates in the Direct Loan Program. Generally, your child is considered dependent if he or she is under 24 years of age, has no dependents, and is not married, a veteran, a graduate or professional degree student, or a ward of the court.

- You cannot have an adverse credit history .

- In addition, you and your child must be U.S. citizens or eligible non-citizens , not be in default on any federal education loans, not owe an overpayment on a federal education grant, and meet other general eligibility requirements for the federal student aid programs.

S To Apply For A Federal Direct Parent Plus Loan On Studentaidgov

|

Loan Period Requested |

Read Also: Usaa Loan Credit Score Requirements

Why You Should Plan Carefully When Borrowing A Parent Loan

Once youve carefully researched loan options and learned when and how to apply for a parent PLUS loan, you can make an informed decision about how best to fund your childs education.

Remember to consider how student loan debt will affect your future. You dont want to jeopardize your retirement security, so find the most affordable loan you can and consider creating a plan for early repayment.

Christy Rakoczy and Andrew Pentis contributed to this report.

Applying For Unsubsidized Federal Loans

If a parent is ineligible for a Parent PLUS loan, the student may be eligible to receive additional Direct Unsubsidized Loan funds up to the loan limits for independent students.

Federal student loans can be reliable borrowing options because they often have lower interest rates and could have better repayment terms than other loans available to students. However, its worth making sure that a student isnt taking out more debt than they can handle after graduation.

Also Check: Usaa Auto Loan Rates And Terms

Correct Errors In Your Credit Report

Dont wait to find out whether you have an adverse credit history by applying for a Parent PLUS loan. Check your credit report in advance. You are entitled to receive a free copy of your credit report at annualcreditreport.com every 12 months from Equifax, Experian, and TransUnion, the three national credit reporting agencies.

Carefully review your credit report for derogatory marks. These marks are what will determine if your credit history is adverse or not. If you see any derogatory marks you believe were made in error, you can dispute those errors with the credit reporting companies. This can take some time, so be sure to get a copy of your credit report ahead of time to prepare for Parent PLUS Loan filing deadlines.

If you have a low FICO credit score, but you do not have any of the adverse credit criteria, you are eligible for a Parent PLUS loan. The Parent PLUS loan does not depend on credit scores or debt-to-income ratios.

If Your Application Is Denied

If the application is denied, the parent has three options that will be displayed after completing the online application:

- Not pursue the PLUS Loan — If the borrower is not interested in the following other two options, a borrower can select the option for their student to be offered additional Federal Direct Unsubsidized Loans. Additional loan limits are available up to $4,000/academic year for first- and second-year students , and up to $5,000/academic year for third- and fourth-year students . Note: Once Binghamton University receives information from Direct Loan Applicant Services that you have chosen this option , the additional Unsubsidized Loan will be offered to the student based on class year and eligibility.

- Provide an endorser — The endorser must pass a credit check and sign a promissory note. An email with the Loan Reference ID and an endorser packet will be mailed to the borrower. The endorser will need the Loan Reference ID to complete the paper packet or complete Endorser Addendum. The endorser must create an FSA ID and password to sign in and go to “Endorse a PLUS Loan.”

- ” — A package of additional information will be automatically sent to the borrower and the parent will be prompted to send an email with contact information to applicant services. *If you obtain a loan with an endorser or through an appeal you will need to complete online credit counseling.

You May Like: Notary Loan Signing Agent Databases

Can I Ever Postpone Making Loan Payments

Yes, under certain circumstances you may receive a deferment or forbearance, which allows you to temporarily stop or lower your payments.

You may receive a deferment in the following circumstances:

- While you are enrolled at least half-time at a school thats eligible to participate in EDs federal student aid programs.

- While the student for whom you obtained a Direct PLUS Loan is enrolled at least half-time at a school thats eligible to participate in EDs federal student aid programs.

- During the six-month period after the student for whom you obtained a Direct PLUS Loan ceases to be enrolled at least half-time.

- While you are in a full-time course of study in a graduate fellowship program.

- While you are in an approved full-time rehabilitation program for individuals with disabilities.

- While you are unemployed or meet our rules for economic hardship .

- While you are serving on qualifying active duty in the U.S. armed forces or National Guard.

If you dont qualify for a deferment but are temporarily unable to make loan payments for such reasons as illness or financial hardship, your loan servicer may grant you a forbearance. With forbearance, you may be able to stop making payments on your loan, temporarily make smaller payments, or extend the time for making payments.

For more information on deferments and forbearance, including specific eligibility requirements, contact your loan servicer and visit here.

Building Credit Can Improve Your Options

If you have time before you need to apply for a parent student loanor if you don’t but plan to borrow for future academic periodsimproving your credit score can help you qualify for more favorable terms with private loans, giving you a better chance to save money.

Start by checking your credit score and credit report to see where you stand. Your credit report will give you the information you need to understand where to focus your efforts as it alerts you to the risk factors helping and hurting your credit score. For example, it may help you realize late payments in your past or high credit card balances are affecting your scores, and encourage you to be more vigilant in the future.

Building credit can take time, but the potential savings can be more than worth the effort it takes to get there.

You May Like: Is The Student Loan Forgiveness Program Legit

Danger : You Can Easily Borrow More Than You Need

When you apply for a Direct PLUS Loan for your child, the government will check your , but not your income or debt-to-income ratio. In fact, it does not even consider what other debts you have. The only negative thing it looks for is an adverse . Once you’re approved for the loan, the school sets the loan amount based on its cost of attendance. However, a schools cost of attendance is usually more than most students actually pay. This can lead to parents borrowing more than their child needs for college.

If you have other outstanding debt, such as a mortgage, you may find yourself in over your head when it comes time to repay the PLUS loan.

To Apply For A Parent Plus Loan:

TJC will receive the application within 3-5 business days.

If your application was approved, the award will be made to the students account on Apache Access. You will then be required to complete a PLUS Master Promissory Note .

If your application was denied, an increase will be made to the students loan awards, according to their eligibility. This may take up to 2 weeks.

Also Check: Classic Car Loans Usaa