How Maintenance Loans Work:

- Student Finance England will provide you with a maintenance loan for day to day living costs and a tuition fee loan to pay the university .

- The maintenance loan will be paid directly into your bank account in three instalments at the start of each term

- The loan amount will depend on your living circumstances and your household income, which you can work out before receiving the loan.

But wait, what if the loan doesnât arrive in my account before rent is due?

If you are staying in university accommodation there is nothing to worry about. They will only take rent once the maintenance loan has been deposited into your account.

If you are staying in private accommodation, be sure to let your landlord know when you expect the loan to arrive.

What You Can Do If You Reach Your Federal Student Loan Maximum

If youve reached the annual or aggregate maximums for federal subsidized and unsubsidized loans, PLUS Loans may be an option if you are a graduate student or if your parents are willing to borrow on your behalf.

If PLUS Loans arent an option and you cant afford to pay for college on your own, consider these other options to cover your expenses:

What Is The Interest Rate On Maintenance Loans

For students from England and Wales, the interest rate on Maintenance Loans is currently anything up to 4.5%. If youre still at uni, interest will be charged at the full 4.5%, but if youve graduated, interest will be charged between 1.5% and 4.5% depending on how much youre earning.

For students from Northern Ireland and Scotland, the interest rate on Maintenance Loans is currently 1.1%. Simple as that!

Its worth bearing in mind that the interest rates on Maintenance Loans can change every year based on inflation. For a full explainer of how it all works, have a read of this guide.

Don’t Miss: Does Va Loan Work For Manufactured Homes

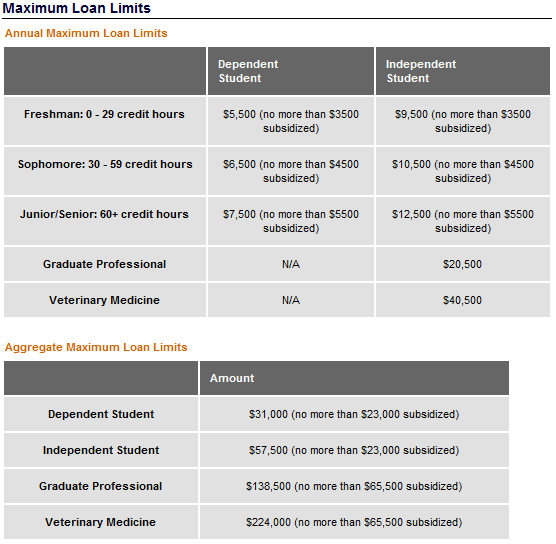

Direct Subsidized And Unsubsidized Federal Student Loan Limits

Subsidized and unsubsidized loans are capped at $31,000 through four years of an undergraduate education if youre a dependent student. As an independent undergraduate student, you can borrow up to $57,500 towards your undergraduate degree.

Dependent undergraduate students can borrow up to $5,500 as a first-year student, depending on financial need. Independent students, or those whose parents have been denied a direct PLUS loan , can borrow up to $9,500 per year. For each of four years of school, you can borrow an additional $1,000 every academic year. Regardless of whether or not you depend on your parents, only $23,000 of your federal student loans will be subsidized.

Additionally, you cant borrow more than the schools cost of attendance. Students can only receive direct subsidized loans during a maximum eligibility period. This is equal to 150% of the published length of the degree program. For example, you can only take out loans for six years if youre enrolled in a four-year bachelors program.

Graduate students can borrow up to $20,500 in federal loans each year. You can borrow a maximum of $138,500 as a graduate student, but that figure includes money youve borrowed as an undergraduate, too. All federal loan programs available to graduate students are unsubsidized.

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How To Apply For A Student Loan

Student finance usually consists of a Tuition Fee Loan and a Maintenance Loan to cover or at least partially help with your university costs.

All full-time undergraduate students are eligible for student finance, provided they meet some basic criteria:

- Residency youre a UK national or have settled status, normally live in your home country, and have been living in the UK, the Channel Islands, or the Isle of Man for three years before the beginning of your course.

- Your university or college youre studying at a recognised publicly-funded university or college .

- Your course youre studying a recognised full-time course e.g. a first degree, a foundation degree, a Higher National Diploma , or an initial Teacher Training course.

- Its your first higher education course you can still get some funding if youve studied a HE course before, but it will be limited and youll have to make up any shortfall.

Both Tuition Fee Loans and Maintenance Loans must be paid back once you graduate and youre earning above a minimum salary. Repayment systems vary from country to country.

You have to apply for student finance for each year of your course not just your first year. This is to guarantee you get the support youre entitled to throughout your studies.

It can take up to six weeks to process student finance applications. Make sure you apply early even if you have a conditional offer as you can amend or cancel your application if your plans change.

Ask Your Parents For Money

Credit: Rena Schild Shutterstock

Were not keen on Maintenance Loans being tied to household income, but the fact is that they are although at least in Wales its only used to determine the split between grant and loan, and not how much money you receive overall.

We wont go on for too long about why we dislike this way of doing things , but one of our biggest gripes is that we feel the funding bodies are nowhere clear enough about the fact that they expect your parents to support you financially if youre not receiving the maximum Maintenance Loan.

To put it another way: calculate the difference between your Maintenance Loan and the maximum amount available to a student in your living situation. The figure youre left with is how much the government expects your parents to give you every year.

Of course, plenty of parents whom the government thinks should be contributing are actually unable to , so the difficult conversation of asking them for financial support is made even more tricky.

Fortunately, weve put together a guide on asking your parents for money, as well as a calculator to help you work out exactly how much theyre expected to contribute.

Oh, and before you think you can hack the system by simply refusing to provide your funding body with your household income, theyre one step ahead of you. Students who dont submit this info are usually given the lowest Maintenance Loan by default.

Don’t Miss: Refinance Auto Loan Usaa

Parent Plus Loan Limits

If youre a graduate or professional student or have a parent with a good credit history, consider a PLUS loan. There arent any specific limits to the amount of money that you can borrow with a PLUS loan. This type of loan is capped at what your school lists as the cost of attendance less any other financial aid that the student receives. Parent PLUS loans come with higher interest rates, so be sure to max out your federal subsidized and unsubsidized loans first.

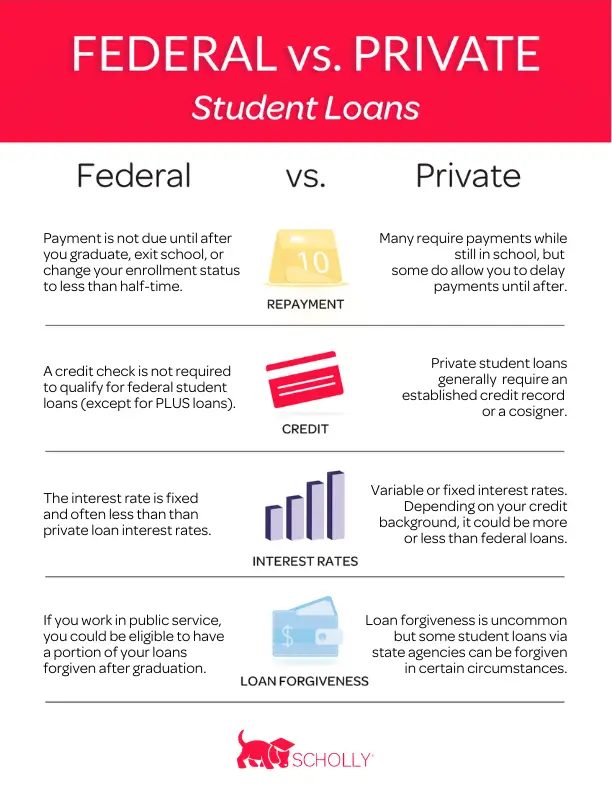

Private Student Loan Lifetime Limits

If you choose to borrow private student loans, your annual and lifetime limits can vary by lender . That said, the annual limits typically cannot exceed the cost of attendance at your school.

The total cost of attendance is a number determined by your school and typically includes tuition and fees, on-campus room and board, books, supplies, transportation, and dependent care.

As for lifetime limits , it may depend on whether youre an undergraduate student or a graduate student. Some private lenders may offer higher limits if youre doing an MBA or going to law or medical school, for example.

Some lenders have just one limit for all loans. But in some cases, you may even see two lifetime limits: one for loans through the private lender and one for total federal and private loans.

So, if youre considering borrowing from a private lender, ask about their loan limits before applying to make sure you get the funding you need.

Recommended Reading: Usaa Student Loan Refinancing

When Do You Start Repaying Your Maintenance Loan

No matter where youre from in the UK, youll only start repaying your Maintenance Loan from the April after youve graduated and even then youll need to be earning over the repayment threshold for your type of loan.

The current repayment thresholds for UK graduates are:

- Students from England and Wales £26,575 a year before tax

- Students from Scotland and Northern Ireland £19,390 before tax.

Like the interest rates on Maintenance Loans, the repayment thresholds can change each year. Any change is usually a positive one , but again, check out our Student Loan repayments guide for a full explanation.

What Counts As Household Income

Your household income includes any of the following that apply:

- your parents income, if youre under 25 and live with them or depend on them financially

- the combined income of one of your parents and their partner, if youre under 25 and live with them or depend on them financially

- your partners income, if youre over 25 and live with them

- income you get from your own savings, investments or property, for example dividends or rent

If youve supported yourself financially for at least 3 years or had no contact with your parents for over a year, you might be able to apply as an independent student.

Also Check: How Do I Find Out My Auto Loan Account Number

Consider Student Loan Refinancing

One way to pay off your student loans and potentially save money along the way is to refinance them with a private lender . Student loan refinancing can allow you to replace your current loans with a new one.

In some cases, you may qualify for a lower fixed or variable interest rate than what youre currently paying. You could also adjust your repayment schedule to pay off your student loans faster or take some more time to fit your budget better.

With a lower interest rate you could reduce the amount of money you spend on interest over the life of the loan. If you lengthen the term of your loan youd decrease your monthly payments but will pay more in interest over the life of the loan.

In other words, if you refinance your student loans, you may get more flexibility with your payments as you eliminate your debt. However, it is important to note that if you refinance your student loans with a private lender, you may forfeit eligibility for federal benefits, such as student loan forgiveness.

What If I Still Need To Borrow More Money For School

Also Check: How To Get A Loan Officer License In California

Your Nationality And Residency Status

Credit: SevenMaps Shutterstock

Nationality and residency status is undoubtedly the murkiest of all the eligibility criteria, and it’s the one that tends to catch students out the most.

As a general rule, you should be eligible to receive a Maintenance Loan if you’re a UK national , normally live in the UK and have done so for the three years prior to the start of your course.

But it’s worth noting that all three of those things must apply to you to guarantee your eligibility. There are countless stories of students who were born and raised in the UK but moved to, say, the USA at 11-years-old and assumed that they’d be eligible for a Maintenance Loan as a British citizen. No dice.

In some instances, you may be able to successfully appeal and receive a Maintenance Loan anyway to do this, you’ll often need to prove that you’ve retained economic ties to the UK in your absence , or that one/both of your parents had to move abroad for work.

There are also special exceptions made for specific groups, including refugees and stateless people.

As we said earlier, it’s best not to let these eligibility criteria confuse you too much.

We stand by our statement that the majority of students at the majority of universities will be eligible to receive a Maintenance Loan especially if you’ve been studying at a school in the UK and will be attending a relatively well-known university.

How Much Student Loan Can You Take Out

Dependent and independent undergraduate students can borrow up to a total of $31,000 and $57,500 in federal student loans, respectively, and many private loans set lifetime limits. Regardless of the maximum loan amount, you should only borrow what you truly need. The more you borrow, the more interest will accrue.

What is the maximum amount of student loans you can get?

The maximum amount you can borrow depends on factors including whether theyre federal or private loans and your year in school. Undergraduates can borrow up to $12,500 annually and $57,500 total in federal student loans. Graduate students can borrow up to $20,500 annually and $138,500 total.

Can you take out a student loan at any time? Yes, you can apply for a student loan during the year. Additionally, if you have filled out your FAFSA before the deadline, you can apply for federal student loans at any point during the school year. Fortunately, you can generally take out private student loans at any point in time.

How much can college students borrow?

The maximum amount undergraduate students can borrow each year in federal direct subsidized and unsubsidized loans ranges from $5,500 to $12,500 per year, depending on your year in school and whether you are a dependent or independent student a determination made based on your Free Application for Federal Student Aid

You May Like: Does Va Loan Work For Manufactured Homes

Student Loan Application Approved After Course Starts

If your loan application is approved after your course starts and you applied for it:

- before your course started, you’ll get a back payment to when your course started

- after your course started, you’ll get a back payment to when you applied.

This will be paid to you in a lump sum. You’ll then get your first weekly payment a week later.

You won’t get your first weekly payment until a week later because we pay you in arrears. This means you study for one week and get paid for that study in the next week. When you finish your course, you’ll get your last payment a week later.

What Is The Average Maintenance Loan

The average Maintenance Loan is approximately £5,640 a year, based on calculations we made using data from our National Student Money Survey and information supplied by the Student Loans Company.

However, as we’ve explained above, the amount you’ll receive isn’t really affected by what the ‘average’ student gets. Instead, the size of your Maintenance Loan will be determined by your household income, where you’ll be living while studying and, of course, where in the UK you normally live.

Don’t Miss: Usaa Refinance Auto Loan Calculator

How Much Should You Borrow In Student Loans

You should borrow as much as you need and not necessarily all that lenders make available to you. The more you borrow now, the more student loan debt youll have to pay off laterwith interest.

To determine how much you should borrow in student loans, calculate your cost of attendance. This includes:

- Tuition and fees

- Room and board or other living expenses

- Books

- Supplies and technology costs

- Loan fees

- Transportation

If your cost of attendance is less than what youd get from the maximum federal student loan limit, borrow only what you need.

If your cost of attendance exceeds what youll receive from federal student loans, you may need to tap into other resources. This includes private student loans or borrowing money from friends and family. If a certain college is just too much of a stretch financially, consider less expensive schools. Use resources like collegesnet price calculators on their websites to determine how much theyll cost you after taking into account grants and scholarships you could receive.

You also can set how much you borrow based on your anticipated future earnings, which might be a bit harder to estimate. But if you know the starting salary of your future post-graduate position, that can help you determine what you can afford when the time comes to repay your student loans. Some experts recommend limiting your total student loan borrowing to the amount you plan to earn your first year out of school.

Subsidized Vs Unsubsidized Loans

Undergraduate students loans are classified as either subsidized or unsubsidized. Heres how they differ:

- Subsidized loans dont accrue interest when youre enrolled in school at least part-time, during periods of deferment and during your six-month grace period after you leave school. When you start to repay your loans, youll be responsible for your loan plus the interest that starts accruing after you leave school.

- Unsubsidized loans accrue interest even while youre in school. The good news is that you dont have to start making payments until your grace period ends. The bad news is that your payments will be higher compared to subsidized loans since your interest started accruing immediately upon disbursement, not graduation.

Read Also: Loans Without Proof Of Income