What Is A 203 Loan

There are several FHA home loan programs available to you. Most single-family homes requiring minimal repairs are eligible for 203 loans the most common FHA loan.

But when a house needs extensive work for health, safety, and/or security reasons, you may need to apply for a 203 mortgage instead. Also known as a Section 203 loan, this rehab loan lets you buy the property as-is and use funds from the loan to complete the necessary repairs. You can also refinance your existing mortgage to perform structural and cosmetic repairs to your current home.

While Credible doesnt offer 203 loans, our streamlined process makes comparing rates for conventional loans easy. It only takes a few minutes to see prequalified rates and generate a streamlined pre-approval letter using our free online tools.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

What Are Fha 203k Loan Eligibility Requirements

Most lenders will have lender overlays on FHA 203k Renovation Loans. Mortgage Lender Overlays are additional mortgage guidelines on top of the minimum FHA Guidelines. However, Gustan Cho Associates Mortgage Group has no mortgage overlays on FHA 203k Loans. FHA 203k Loan Eligibility Requirements are no different than any traditional FHA Loans.

Standard FHA guidelines apply for someone to qualify for an FHA 203k Loan.

- Minimum credit scores required is 580 for a 3.5% of the after repaired value appraisal value down payment

- For example, here is a typical case scenario:

- if purchasing a home for $100,000

- need $100,000 in construction loan

- after repair value is $200,000

- 3.5% of the $200,000 is required as the down payment, or $7,000

What Are The Qualifications For A 203k Loan

Youll need to work with an FHA-approved lender in order to apply for the FHA 203 loan. Lenders require applicants to possess a credit score of at least 500. An FHA 203 loan requires a minimum down payment of 3.5% for those who possess a credit score of 580 or above, and 10% for those with a lower score.

Recommended Reading: Va Loan For Land And Manufactured Home

What Repairs Are Eligible For 203k Loans

When you apply for a 203K mortgage, you will also need to include a detailed plan of the work being done to the house. Some of the approved repairs include:

- Painting,

- Replace, or add an exterior deck, patio, porch

- Basement waterproofing

- Window and door replacement and exterior siding

- Improvements for accessibility

- Lead-based paint stabilization

Its important to remember that whatever repairs and renovations you hope to make, youre required to submit a detailed plan with your mortgage application.

How To Use The Fha 203k Loan Calculator

First things first, go to HUD’s FHA 203k Calculator page. Once there, youll need to complete three steps:

To start, enter the property address, your name, and the loan features. If you dont know, then copy the information from my example.

Step 1: Repair Costs, Fees, and Reserves.

The 203k Rehab Loan comes with extra fees and reserve requirements. They can total 10% – 25% of the cost of your rehab project. Fortunately, you can add the fees and reserves to the loan along with the repair costs.

Take a few minutes to read through Step 1. You want to know how much the fees and reserves cost and why you need them.

A. Repair and Improvement Costs and Fees fall into seven categories:

E. Add Step 1s Total Rehabilitation Cost to your FHA 203k Loan amount.

A. The As-Is Value

Also Check: Usaa Rv Loans

What To Expect When Applying For A 203 Mortgage Loan

Getting only one mortgage for both the construction and the purchase of your home might be the preferable choice since it reduces cost and paperwork but remember that a 203 mortgage is more complicated than a traditional mortgage. This is because it accomplishes two goals with only one mortgage.

Dont expect your FHA 203 lender to write a check to cover planned repairs by simply relying on your smile and promise to use the money as you planned. Borrowers must follow clearly defined steps to complete a 203 successfully. If you set your heart on an otherwise perfect home that needs T.L.C., this is how the 203 loan approval process works.

203 Pre-Approval Process

The most sensible approach to any mortgage financing undertaking is to begin by selecting an FHA-approved lender to analyze your particular financial situation before finding your dream home. Get a pre-approval letter before you even begin looking for a property.

Property

With your pre-approval in hand, you can begin to search for that perfect property, which, remember, must also meet FHAs 203 guidelines.

203 Offer Preparation

Complete the FHA mortgage application after your lender gives you an approval to move ahead with the loan process. This usually requires you paying an application fee.

203 Offer Acceptance

Closing

If you have never been involved in to a mortgage closing, you might be surprised at what seems like an endless pile of paperwork you must sign and initial at closing.

Renovation

Fha 203k Loans: How Does It Work

Have you found a home that you love, but its in bad shape? The 203k loan may be a perfect way to purchase a home that is a little rough around the edges.

The FHA 203k rehab loan has become a popular loan choice in todays market where many homes need a little, or a lot, of TLC.

The 203k loan allows a buyer to finance the purchase price of the house and renovation costs all with one loan. No scrambling around before closing trying to repair the home so the bank will lend on it. No pounding the pavement looking for a 2nd mortgage to finance repairs. No living with leaky roofing for five years while you save up the money to fix it. A 203k loan can take care of these repairs and more with one loan transaction.

You May Like: Refinance Auto Loan With Same Lender

Do Foreclosures Qualify For Fha Loans

May 8, 2018

If you are in the market to buy a home, you might consider the opportunity to look at foreclosures. After all, they are generally sold at a fraction of the cost of the homes value. If you plan to use FHA financing for the purchase, though, you might run into a little trouble. If the home is not in perfect condition or at least acceptable to the FHA, they wont guarantee financing on the home. Dont worry though, this doesnt mean all hope is lost. There is one way you can buy a foreclosure and use FHA financing to do so.

Fha 203k Rehab Loan Faq

Who qualifies for a 203k loan?

Generally, most applicants who would qualify for an FHA loan will be approved for a 203k loan, too.

You must have at least a 580 credit score at least a 3.5% down payment based on purchase price plus repair costs adequate income to repay the loan not too much existing debt and U.S. citizenship or lawful permanent residency. In addition, you must be purchasing a home you plan to live in.

How does a 203k loan work?

The 203k process includes a few extra steps compared to a standard FHA loan.

First you will apply and get approved. Then you find a contractor, get repair bids, and determine your final loan amount including construction costs.

Next, the mortgage company has to underwrite and approve your loan. After that the loan can close, the contractor can start renovations, and the mortgage company will pay them as construction is completed.

After a final inspection, youre free to move into your new home.

What does a 203k loan cover?

The 203k loan covers the full purchase price of the home plus any eligible repairs . For example, if the home price is $250,000 and $20,000 in repairs are needed, the new loan will be $270,000 plus a required contingency or buffer percentage.

What is the maximum 203k loan amount?Is a 203k loan worth it?Can I use a 203k loan to flip a house?Can you buy furniture with a 203k loan?How much do you have to put down on a 203k loan?How long do you have to live in a house with a 203k loan?

You May Like: Mortgage Loan Originator License California

How To Buy A House With No Down Payment

- Loans for housing in rural areas. The Department of Agriculture offers loans that allow 100 percent financing, i.e. HOURS. Borrowers can deposit zero dollars and finance the full purchase price.

- Get started. To find out how much you can afford on a home, use Redfin’s Home Affordability Calculator, which uses your annual income, down payment, and recurring month.

Fha 203k Rehab Mortgage Comedy Continues

Its just not that difficult for things to go wrong when you break open walls, kick in doors, and tear kitchens out of a house.

- Although sometimes the mishaps are amusing, sometimes they are so funny

- The comedies tend to be more Shakespearean and less Beverly Hill Billy like and dont forget there is always an Archie Bunker calling someone a Meat Head at every mistake

- The jokes arent as funny because sometimes the meathead is you, or me, or our contractor

- Please dont forget the subcontractors and the building inspectors as they are often the biggest jokes of all

- These jokes slow you down, stop you from working, eat into your repair reserve, cause you to change plans, and sometimes completely alter renovation outcome

As family pays to rent a little longer, stays in a hotel an extra month, or moves in with family for a much longer temporary visit, making a mortgage payment for a property you cant live in because it doesnt have a kitchen or working water becomes less and less funny.

Read Also: Usaa Personal Loan Credit Score Requirements

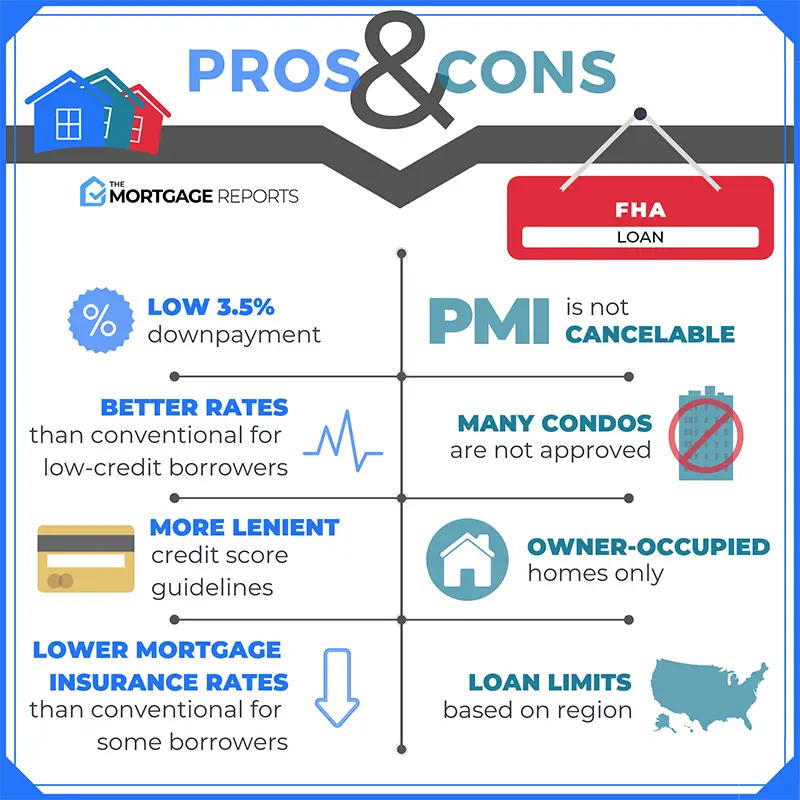

Their Mortgage Insurance And How They Differ

Both loans require mortgage insurance. However, the terms and flexibility that come with a homestyle loan are comparatively better than those of an FHA 203k loan. With FHA 203k loans, youll have to pay a flat percentage every month. Your credit score and LTV have no impact on the cost of your mortgage insurance, nor will you be able to cancel it once youve built a certain amount of equity in your home.

With the homestyle loan, you wont have to pay for mortgage insurance upfront. Additionally, the amount youll have to pay on mortgage insurance every month will be based on your credit score and LTV. The lower your LTV and the higher your credit score, the less youll have to pay for mortgage insurance. Once your LTV is less than 80 percent of your homes value, youll also be able to cancel your mortgage insurance.

Additional Fha 203k Loan Considerations

Interest Rates

Borrowers should expect 203K interest rates approximately .75% to 1% higher than standard FHA loans. Fortunately, FHA loans typically offer extremely competitive rates, which slightly offsets this premium.

Mortgage Insurance

As with all FHA loans, 203K loans require mortgage insurance. This insurance includes two parts. First, buyers must pay 1.75% of the loan amount as a lump sum, which is typically rolled into the loan. Second, you must pay .85% annually, which lenders generally divide by 12 and add to your monthly mortgage payments.

Time & Paperwork

FHA 203K loans also typically take more time to close than a standard loan, generally closer to 60 days not 30 to 45. This increased time is largely due to the significant paperwork burden. On average, 203K loans require two to three times more paperwork than a standard FHA loan. Recognizing this reality, make sure to set clear expectations with the seller. Its better to plan for 60 days from the beginning than to set an unrealistic closing date and need to change it.

Recommended Reading: Va Loans Modular Homes

Fha 203 Vs Construction Loans

Though an FHA 203 loan is a type of FHA construction loan, itâs possible to get construction loans outside of the FHA program. A construction loan is typically a short-term loan that provides funding to cover the cost of building or rehabbing a home.

Construction loans may have higher interest rates than conventional mortgage loans. The money may be paid out in installments as construction gets underway and continues, rather than as a lump sum. The balance due on a construction loan may be paid in a lump sum at the end of the loan term. Alternately, homeowners may choose to convert a construction loan to a conventional mortgage.

If your lender doesnt allow for automatic conversion of a construction loan to a conventional mortgage, you may need to apply for a brand-new loan to avoid having to make one large balloon payment.

Donât Miss: Are Loans Bad For Your Credit

Fha 203 Loan Qualifications

Home buyers or homeowners must meet certain minimum requirements in order to qualify for a rehab loan. These requirements are similar to normal FHA loan requirements. Among them, youll find that:

- Youll need to work with an FHA-approved lender in order to apply for the FHA 203 loan.

- Lenders require applicants to possess a of at least 500.

- An FHA 203 loan requires a minimum down payment of 3.5% for those who possess a credit score of 580 or above, and 10% for those with a lower score.

- Lenders calculate your debt-to-income ratios, where your front-end DTI should not exceed 31% and your back-end DTI should be no more than 43%. If you have a higher credit score, you may be able to have a slightly higher DTI depending on lender policies.

- A 203 loan can only be used if the property is to be the borrowers primary residence.

- Repairs and renovations must be performed by a contractor and not by the borrowers themselves.

Also Check: Can You Do A Va Loan On A Second Home

How Does An Fha 203k Loan Work

The FHA 203k loan is a way of financing both a home purchase and repairs or renovations on the home with one single loan.

In addition to applying for the loan, as you would any mortgage, youll also need to select the necessary contractors and get accurate bids for your repairs.

After the loan closes, the contractors can move forward with the repairs and you can move into the property.

What Repairs Can Be Made With A Standard Fha 203k Loan

With the standard 203k rehab loan, homeowners can borrow the funds needed to complete repairs or the remodeling project types listed below. It is important to note that the rehab funds go into an FHA escrow account. As the work is completed, the funds are released directly to the contractor.

- Improvements to the homes air conditioning, heating and other major functions.

- Updating of plumbing and electrical systems.

- Structural repairs and alterations .

- Elevating the structure or foundation.

- Purchasing a structure on one site and moving it to a foundation on another site.

- Improvements that help with the homes appearance or bring it up to current standards.

- Installation or replacement of well and septic systems.

- Connecting the home to public sewer and water systems.

- Replacement of roofing, siding, gutters and downspouts.

- Replacing the floors.

- Making aesthetic changes to make the home look better.

- Removing any health and safety concerns from the home such as lead paint.

- Improvements to make the home energy efficient .

- Landscaping and other exterior improvements.

- Installing or repairing driveways, walkways and fences.

- Repairing or removing an inground swimming pool but NOT installing a new one.

- Repairing or installing a new porch, deck or patio.

- Making the home handicapped accessible.

- Converting a 1 family to a 2, 3 or 4-unit property.

With the standard 203kb loan, these extensive repairs can be made.

Recommended Reading: Bayview Loan Servicing Charlotte Nc

What Is An Fha 203k Loan

The FHA 203 loan is designed for individuals seeking to purchase real estate that requires extensive repairs. This is actually a subcategory of the FHA Mortgage.

One benefit of this type of this financing is that you can combine the cost of the property, as well as the home improvement expenses, into one loan, explains Rhett M. Struve of Keller Williams Premier Realty.

It aims to help revitalize neighborhoods and expand opportunities for homeownership.

Struve adds, As with the FHA Mortgage, the 203k Rehab Loan requires mortgage insurance and interest rates are typically higher than conventional loans.