Additional Information On Borrowing

You can estimate your monthly payments with various repayment plans using repayment calculators available online from the U.S. Department of Education. The site also contains information on consolidating your PLUS loan with other personal loans or discharging your loan under specific circumstances.

For more information on the cost of borrowing or repayment, call the Federal Student Aid Information Center at 800-4FEDAID.

How To Determine Your Federal Student Loan Maximum

The maximum federal student loan amount how much you can borrow as direct subsidized, direct unsubsidized, or direct parent PLUS loans varies depending on your situation as you complete your FAFSA . You can figure out the limit to what you can borrow at a particular time by answering these three questions:

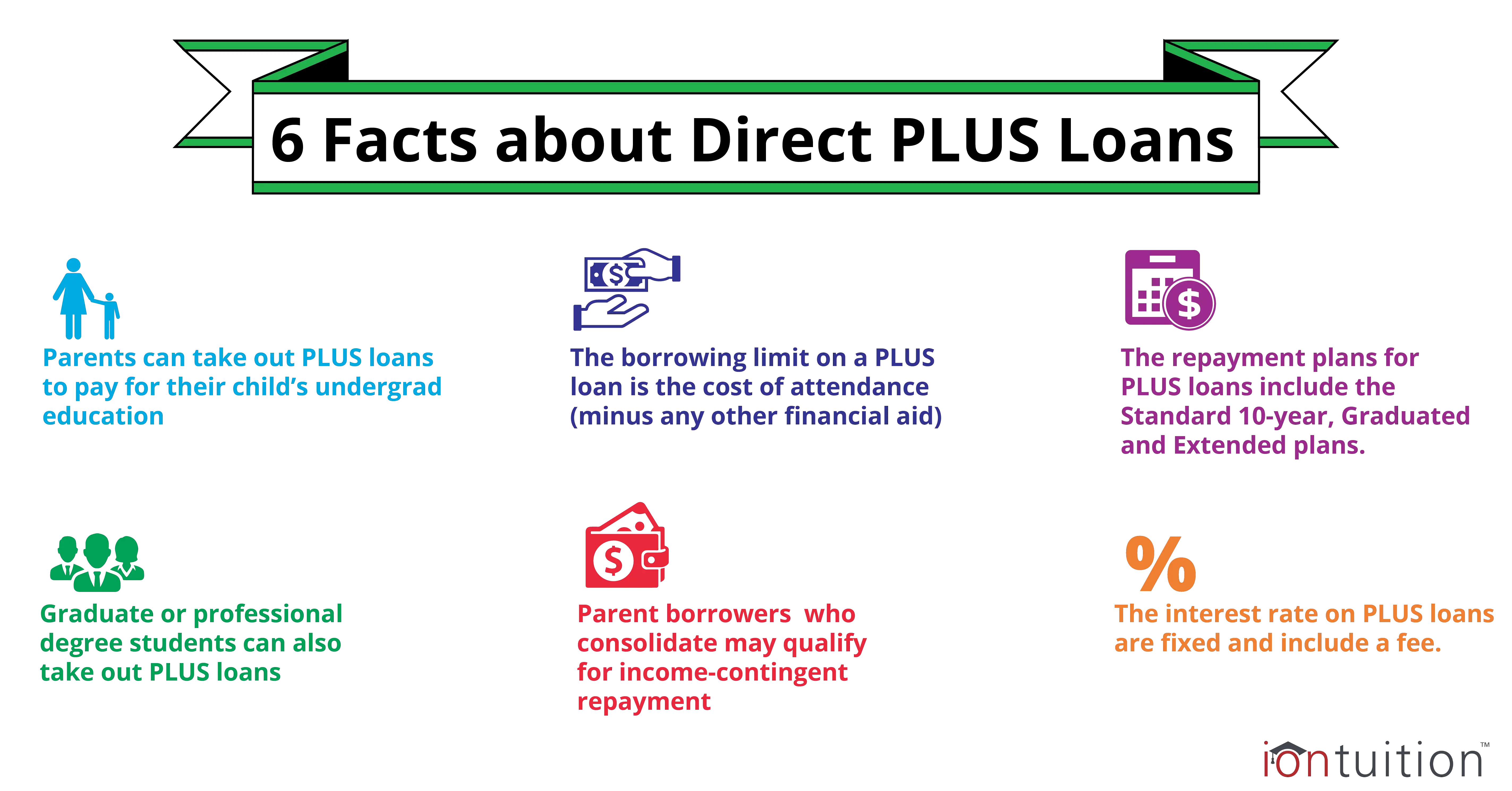

What Are Federal Parent Plus

Federal Parent PLUS Loans are loans taken out by parents of dependent undergraduate students, enrolled at least half-time, to help pay for their childs college expenses. Parents are responsible for repaying Parent PLUS loans.

PLUS loans are in addition to the loans taken out by your child, and your PLUS loan will cover the entire cost of tuition, room and board, and other school-related expenses that your childs financial aid doesnt cover. These PLUS loans also have a fixed interest rate .

Note: Parents cannot borrow more than the cost of the childs education minus other financial aid receivedyour childs school will determine the actual amount parents can borrow.

Don’t Miss: Usaa Mortgage Credit Score

Newsa Catastrophe Is Looming For Us Colleges This Analysis Shows Just How Bad It Is

I dont think these loans should be presented with the financial aid offer at all, said Amy Laitinen, director for higher education at New America. I think it speaks more to the schools desire to bring in the students than to whats best for the family. To present it as if its really a way for paying for college when theres no way for those parents to pay it back is shameful and harmful.

In 2011, the Obama administration set restrictions on who could borrow through the Plus program, imposing credit and income requirements. But an outcry from colleges caused the administration to reverse course the following year, making it even easier for parents to borrow.

Related: Universities that boost the poorest students to wealth are becoming harder to afford

Critics compare the governments loans to those given out by banks to people who couldnt afford to repay in the lead-up to the 2008 financial crisis. Unlike student loans, parent loans offer no easy option for an income-based repayment plan. If a parent defaults, the federal government can garnish wages and Social Security checks to force repayment.

Rep. Marcia Fudge, D-Ohio, introduced a bill last year that would cap Parent Plus interest rates, allow for income-based repayment plans and mandate counseling for all borrowers, but it has been stuck in committee. Biden has not announced any plans regarding the program.

Sign up for The Hechinger Reports higher education newsletter.

Refinancing A Parent Loan

If you dont qualify for loan forgiveness, you may be able to lower your payments by refinancing. However, a federal loan can only be refinanced into a private loan. That means if you have a federal loan you will lose government benefits such as:

- Forbearance and deferment

- Choice of repayment option

- Potential student loan forgiveness

You may also have the option to refinance your parent loan in your childs name. This might make sense if your child is now graduated and working, and you are nearing retirement. Keep in mind, however, that not every loan servicer will offer this type of student loan refinancing for parents.

Also Check: Fha Mortgages Refinance

Parent Plus Loan And Retirement: Forgiveness And Repayment Options

Stanley tate

The government offers Parent PLUS Loan forgiveness programs and repayment options to help you handle the debt as you enter retirement.

Picture this: Your child has graduated and moved on to a successful career. Meanwhile, your job is coming to a close, and retirement is around the corner. And yet, you still owe thousands of dollars for your childâs education. Sound familiar? This scenario is a reality for many Americans who borrowed federal Direct PLUS Loans.

At the time, borrowing Parent PLUS Loans seemed like a good idea. But now that the high-interest rate has caused your loan balance to nearly double, taking on that student loan debt seems like one of the worst decisions you ever made.

As you near retirement, hereâs what you need to know about Parent PLUS Loan forgiveness and available repayment options.

Parent Plus Loans: Everything You Need To Know

Parent PLUS loans, also known as Direct PLUS Loans, are a type of student loan that the federal government offers. However, unlike Direct Stafford Loans, PLUS loans are taken out by parents to pay for their childs postsecondary education.

In this guide, well be talking about:

Dont miss: Scholarships360s free scholarship search tool

Also Check: Usaa Car Loan Requirements

Plus Loan Eligibility And Application Process

From the Department of Educations website:

To take out a Direct Loan for the first time, you must complete a PLUS Application and master promissory note . The MPN is a legal document in which you promise to repay your loan and any accrued interest and fees to the Department. It also explains the terms and conditions of your loan. The MPN will be provided either by your child’s school or the Department.

If your child’s school offers the option of completing the MPN electronically, you can do so online at the StudentLoans.gov website. If you are borrowing Direct PLUS Loans for more than one student, you’ll need to complete a separate MPN for each one. To complete an MPN online, you will be required to use your Department of Education-issued PIN . If you do not have a PIN, you may request one from the official PIN site.

In most cases, once you’ve submitted the MPN and it’s been accepted, you won’t have to fill out a new MPN for future loans you receive to pay for the educational expenses of the same student. Unless your child’s school does not allow more than one loan to be made under the same MPN, you can borrow additional Direct Loans on a single MPN for up to 10 years.

You’ll receive a disclosure statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the loan amount and loan fees, and the expected loan disbursement dates and amounts.

Are There Any Parent Plus Loan Forgiveness Programs

The federal government offers parent borrowers two primary paths towards loan forgiveness:

- Public Service Loan Forgiveness Program – forgives the loan balance tax-free for parents who work full-time for the government, 501 nonprofit, or other qualifying employers after 10 years of monthly payments. Parent PLUS Loans aren’t eligible for the limitedPSLF Waiver.

- Repayment Plan Forgiveness – wipes out your remaining balance after 25 years of qualifying payments under the income-contingent repayment plan.

In addition to those two programs, there are federal Parent PLUS Loan forgiveness options for permanent disability, fraud, identity theft, etc. However, those programs typically have narrow eligibility requirements that most parent borrowers wonât meet.

Read Also: Www Capitalone Com Auto Pre Approval

Applying For A Parent Plus

Youre Expected To Start Repayment Right Away

When your child takes out a student loan, they typically dont have to start paying it back while theyre still in school or for six months after graduation.

But what is a Parent PLUS Loans timeline for repayment? It turns out you have to start paying back a Parent PLUS Loan right away. Repayment kicks in right after your entire loan has been paid out.

That said, its possible to apply for student loan deferment while your child is in school and for six months after they graduate.

If youre granted a deferment, remember that interest will continue to accrue on your Parent PLUS Loan even while payments are paused.

Also Check: Fha Vs Conventional 97

Parent Plus Repayment Plans

Parent PLUS loans are eligible for four federal student loan repayment plans that can be used by parents:

- Standard Repayment: Fixed monthly installments over 10 years

- Extended Repayment: Fixed monthly installments over 25 years

- Graduated Repayment: Lower initial monthly installments that increase every two years, repaid over 10 years

- Income-Contingent Repayment : Income-based monthly installments are the lesser of 20% of discretionary income or fixed payments over 12 years the remaining balance is forgiven after 25 years

The only income-driven option open to parent PLUS loans is ICR, which requires you to combine those loans into a Direct Consolidation Loan.

Need Money For College

Summary of how Parent PLUS Loans work

- Applying for Parent PLUS loans starts by filling out the FAFSA.

- The next step is downloading a promissory note from the school financial aid website.

- The approved loan amount can be up to the full cost of attendance minus other forms of financial aid.

- Parent PLUS loans arent an all or nothing game. You can choose to borrow part of the amount offered and find other sources for the remaining cost of attendance.

Parent PLUS loan eligibility requirements

The eligibility requirements for a Parent PLUS loan are fairly simple. You must be the biological or adoptive parent of a dependent undergraduate student enrolled at least half-time. You generally must meet minimal credit standards, and the student must meet general eligibility requirements for financial aid.

Student eligibility requirements are also straightforward. Students must be a U.S. citizen or eligible non-citizen, and not have previous student loan defaults that havent been resolved or consolidated into a federal direct loan. Male students who are citizens and age 18 to 25 need to register for the Selective Services. Parents also must be U.S. citizens or eligible non-citizens.

If you dont qualify, there are alternative ways to get funding that the federal government supplies.

Heres what you need to know about the credit requirements for a Parent PLUS Loan:

In the two years before the date your credit is pulled:

In the five years before the date your credit is pulled:

Recommended Reading: Www.lowermycarloan.com

The Riskiest Federal Student Loans Have Been Left Out Of Forgiveness Debate

The debate around forgiving $10,000 in federal student loan debt leaves the “riskiest” loans out of the conversation completely, according to a new report from the Century Foundation. And that hurts non-white borrowers in particular.

Parent PLUS loans are federal student loans taken out by a parent or grandparent to help pay for their child or grandchild’s college education. More than 3.7 million families owe at least $104 billion, per the report.

These loans were developed to give middle-class families another college financing option. But they can lead to a debt spiral for many low-income families and have become the “driving cause of some of the worst outcomes for families who receive federal student loans,” the report reads.

As college in the U.S. has become more and more expensive, Parent PLUS loans have ballooned, especially among low-income families. But unlike other types of federal loans, parents and grandparents have little hope of ever seeing the debt forgiven. The loans also don’t qualify for reduced monthly payment plans, like income-based repayment, and they cannot be discharged easily in bankruptcy.

“The terms of these loans are less favorable for borrowers than those of other federal student loans for undergraduate education,” reads the report. “This makes Parent PLUS loans one of the riskiest federal student loan options.”

Youre Asking For Too Much

Trying to borrow more than your school-certified cost of attendance or more than the lenders maximum loan balance could also result in a loan denial.

Each school specifies the amount of money that they believe it should cost a student to attend for the yearincluding tuition, room and board, and other expenses. Youre typically not allowed to borrow more than the school says it should cost you to attend. If you already have borrowed for school or have received scholarships or grants, these other sources of funding will reduce the amount youre eligible to borrow.

> > Read More: Federal Student Loan Limits

You May Like: Refinance Conventional Loan

Does A Parent Plus Loan Affect A Parents Credit

The repayment term for a parent PLUS loan is generally 10 years. Extended or graduated plans can be available as well, and loan consolidation can open additional payment options.

Because the loan is in your name, as the parent, a missed payment does not impact your childâs credit history. Instead, it impacts yours.

In addition, the debt is recorded as part of your debt-to-income ratio and may impact future borrowing applications.

Even if you make a spoken agreement with your student that you will take the loan and they will make the payments, keep in mind that PLUS loans cannot be transferred.

Using a private loan to transfer the debt to your child will remove it from the federal program, and you will lose the borrowerâs protections and repayment options you would otherwise have.

If you fall behind on a parent PLUS loan, contact the lending agency and see what payment options are available. You may be able to change the term of the loan, or use federal consolidation to access income-contingent repayment.

If you have a PLUS loan and work in a non-profit or other eligible public service job, such as teaching, you may qualify for loan forgivenessafter making payments for 10 years.

All education loans, including parent PLUS loans, are very hard to discharge through bankruptcy. So make sure that you are clear on how much you are borrow in the big pictureânot just in one yearâand that you can handle the debt!

Check out our other posts on loans and your credit:

Parent Plus Loan Alternatives

Before you take on personal debt to fund your childs education, exhaust other options for funding. Look for any scholarships and grants you might have missed.

When you decide to take out a loan, compare your options to make sure you get the best deal. Check out our guide to the best student loan options for parents to find the right federal or private lender for your family.

Don’t Miss: Fafsa Entrance Counseling Quiz Answers

Student Loan Repayment Assistance Programs

If you dont find any federal options that can help you with your parent PLUS loans, look elsewhere. Many state agencies offer repayment programs for student loans. You usually have to work in certain careers, like a teacher, nurse, doctor or lawyer. Additional requirements often apply, such as working in a rural or high-need area for a specific number of years. While this isnt the same as forgiveness, you can earn free money to pay off your student loans faster.

Student loan repayment is becoming more popular among the private sector as well. Companies are increasingly offering loan repayment as a benefit for employees. If youre in the market for a new job, research employers that offer loan repayment as a perk.

Loan Limits On Federal Plus Loans

The Federal PLUS Loan has an annual limit equal to the colleges cost of attendance, minus other aid received. The Federal PLUS Loan does not have an aggregate loan limit. The students college will determine how much the parents can borrow through the Federal Parent PLUS loan or a graduate student can borrow through the Federal Grad PLUS loan.

If the parent of a dependent undergraduate student is denied a Federal PLUS Loan, the student becomes eligible for higher unsubsidized Federal Stafford Loan limits, the same limits as are available to independent undergraduate students.

Since the Federal Parent PLUS Loan allows a parent to borrow almost unlimited amounts of money for their children, they need to be careful to avoid over-borrowing. Parents should borrow no more for all their children than their annual income. If total Federal Parent PLUS Loan debt is less than the parents annual income, the parents should be able to repay the loans in 10 years or less. If retirement is less than 10 years away, they should borrow proportionately less money. For example, if retirement is in just 5 years, the parents should borrow half as much.

See also:Complete Guide to Parent Loans

Read Also: Max Fha Loan Amount Texas 2021