What Is Considered A Good Interest Rate On A Personal Loan

A good interest rate on a personal loan varies depending on what the loan is being used for, the loan balance and the loan term.

Unfortunately, you may not qualify for the best personal loan interest rates that a lender offers but keep in mind that the average rates ranged from about 9.00% to 22.00% in the spring of 2021.

You should apply to multiple lenders to see what personal loan rates you can qualify for based on your credit history and compare your offers to find a good interest rate.

If the rates you receive are too high and you won’t be able to pay back the loan with interest, consider other options or wait until you improve your credit score to apply for the loan.

The Average Interest Rates For Car Loans With Bad Credit

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market report from the third quarter of 2021 found that the average interest rates for both new and used auto loans look like this:

| Average New Car Loan Interest Rate | Average Used Car Loan Interest Rate | |

| Super prime | ||

| 12.99% | 19.85% |

As you can see, your credit score has a major influence on the interest rate you can qualify for. Auto lenders base interest rates on several factors, including the length of the loan, the vehicle’s age and mileage, and the state you live in but your credit score is by far the most important factor.

Your interest rate ultimately determines your monthly payment and the total cost of financing. So, unfortunately, a bad credit score means you end up paying more in the long run.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How Long Sba Loan Take

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Get Personal Loan Rates

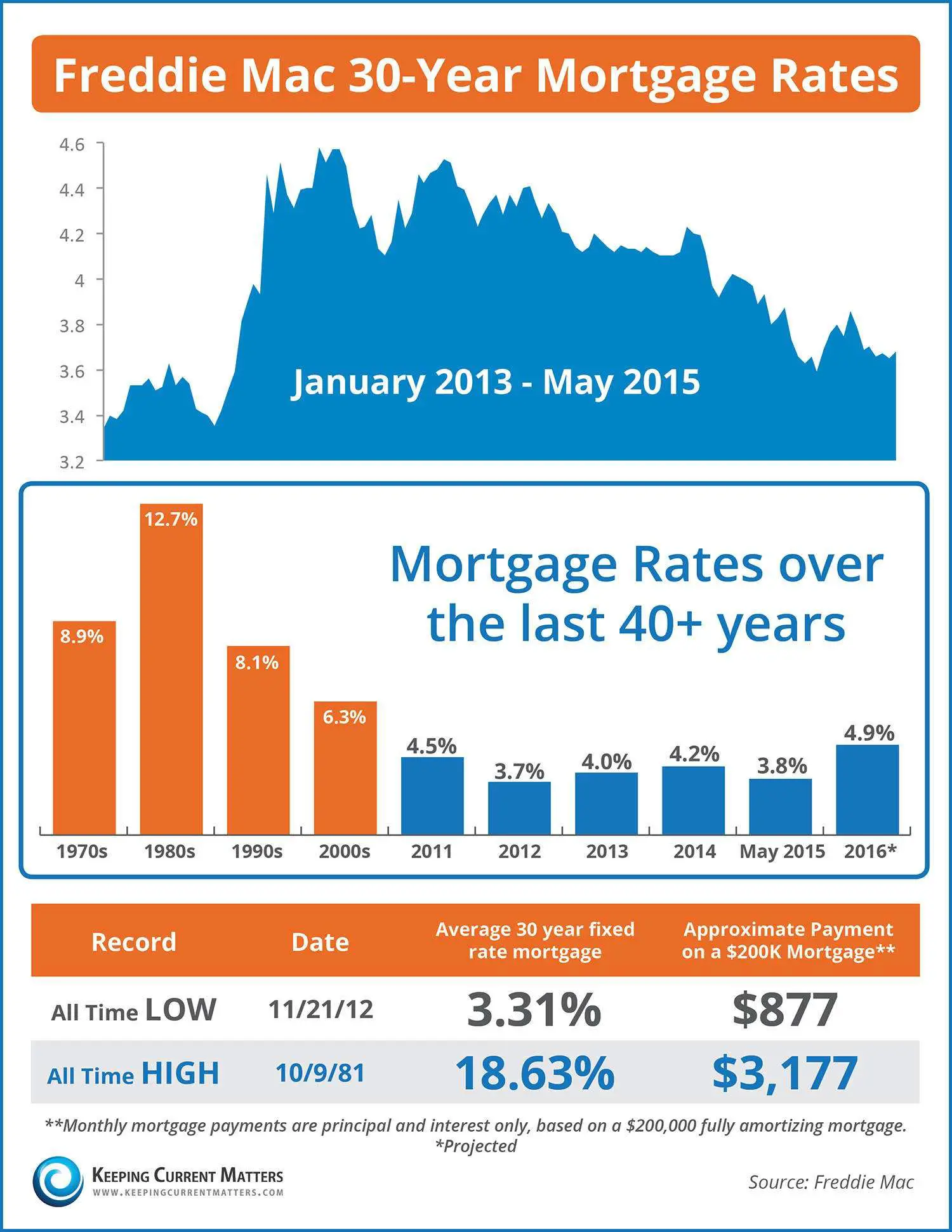

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.understandloans.net/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-tami-savage-realtor.png)

However, it still may not be the best option for you, especially if you don’t have a cosigner. To find the best personal loan lender for your situation, do some comparison shopping before deciding to take out a personal loan.

Your personal loan interest rates will depend on your credit score and other financial history. Each lender is different with various types of loan offerings and ways to evaluate a potential borrower.

You May Like: When To Refinance Fha Mortgage

The Difference Between Fixed And Variable Rates

Student loan interest rates can be either fixed or variable. Fixed interest rates dont change over your loan term, so youll know upfront how much your total cost to borrow will be and what your monthly payments will look like. Variable interest rates change based on market conditions, so your monthly payment may increase or decrease periodically.

How Do Lenders Decide What Interest Rate To Charge You

When it comes to deciding the interest rate for a car loan, lenders will consider many different factors, including:

Car Loan Terms

When buying a new car, lenders often offer longer loan terms to accommodate new buyers. However, the longer loan term will certainly be accounted for in the interest rate. Generally, a longer loan term equates to a higher interest rate and a higher overall price.

Vehicle Status

If you opt for a secured personal loan, your car will act as security or collateral in the event that you cannot pay the lender back. Cars are quickly depreciating assets so, lenders will account for that throughout the term of the loan. If you cannot pay your loan and your car has depreciated or malfunctioned, the lender takes a risk. They may increase the interest rate after some time has passed. Furthermore, old cars tend to encourage higher interest rates. New cars may encourage lenders to offer lower interest rates.

Experts recommend knowing your before you apply for a car loan. Your credit score is important to a lender, as it lets them look at your history of debt repayment. If you have a lot of debt and expenses, lenders will see you as a higher risk borrower, resulting in a higher interest rate. If you have a great credit score, you have a higher chance of securing a lower interest rate.

Down Payment

Debt-to-Income Ratio

Employment Stability

The Economy

Also Check: Can I Get An Investment Property Loan With 10 Down

How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

/1 Adjustable Rate Mortgage Eases

The average rate on a 5/1 adjustable rate mortgage is 4.27 percent, down 3 basis points over the last 7 days.

Adjustable-rate mortgages, or ARMs, are mortgage terms that come with a floating interest rate. In other words, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These loan types are best for people who expect to refinance or sell before the first or second adjustment. Rates could be considerably higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 4.27 percent would cost about $489 for each $100,000 borrowed over the initial five years, but could climb hundreds of dollars higher afterward, depending on the loans terms.

Don’t Miss: Auto Loan Self Employed

What Is The Average Interest Rate On A Personal Loan

The average interest rate on a personal loan is 9.41%, according to Experian data from Q2 2019. Depending on the lender and the borrower’s credit score and financial history, personal loan interest rates can range from 6% to 36%. It’s important to learn how personal loan interest rates work to better understanding how much your monthly payments will be for the loan, and how much you will pay for the lifespan of the loan.

A personal loan is a form of credit that allows consumers to finance large purchases, such as a home renovation, or consolidate high interest debt from other products like credit cards. In most cases, personal loans offer lower interest rates than credit cards, so they can be used to consolidate debts into one lower monthly payment.

The average personal loan interest rate is significantly lower than the average credit card interest rate, which was about 17% as of November 2019, according to the Federal Reserve.

Is It Cheaper To Build A House If You Already Own Land

It is the land that accounts for the majority of the expense of constructing a house on your own property . While land value is factored into current home pricing, building a home necessitates the purchase of land first, which is an additional investment that will decide the final price of your home.

You May Like: Aiq Ellie Mae

Refinance Loan Interest Rates

Federal and private student loans can only be refinanced through private lenders.

- One study found that if every eligible borrower refinanced their loans, the national average interest rate would drop to 4.2%.

- 52.8% of borrowers are eligible for refinancing.

- 33.3% of borrowers consolidate or refinance their loans.

For more information, see our report on Student Loan Refinancing.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

You May Like: Refinance Car Through Usaa

Can You Lower The Interest Rate On Your Student Loans

If you are in the process of taking out student loans, you should generally aim to exhaust eligibility for federal Direct Loans first. These tend to have lower rates and better borrower benefits than private loan options.

If you’ve maxed out your federal loans, shop around among different private lenders to get the most competitive rate. You should also consider asking a cosigner to apply with you, as this can often help you get a better loan offer.

If you already have student loans, refinancing could potentially help drop your rate and reduce your total interest costs. You likely don’t want to refinance federal loans and give up the unique benefits they offer, but there’s no downside to refinancing private loans if you can qualify for a new loan at a lower rate than your current one is charging.

What Factors Impact Business Loan Rates

No matter what type of interest rate a lender assigns, there are general factors that could impact whether its high or low.

Lenders assess both personal and business credit when reviewing loan applications. If you have a newer business that has yet to build up business credit, a lender may heavily weigh your personal credit when making a decision.

A higher credit score generally leads to a lower interest rate. Most lenders require a minimum credit score to qualify for financing. Banks may look for scores of 680 or higher, while alternative lenders may accept scores in the 500s.

Business finances

Your businesss financial standing indicates your likelihood of repaying a loan, which would impact your interest rate. If a lender perceives you as a high-risk borrower, you would likely receive a higher rate. Be prepared to share information illustrating items like your revenue, cash flow and profitability.

Lenders may have certain revenue requirements, similar to credit scores. You may also be required to explain how you plan to spend loan funds, should you be approved.

Time in business

The amount of time youve been in business also indicates how risky you may be as a borrower. Businesses or startups that have been open less than two years are often considered risky because they typically lack capital, collateral or business credit.

Don’t Miss: Cap One Auto Loan

How To Get The Lowest Personal Loan Interest Rates

Before submitting your application for a personal loan, its a good idea to shop around and compare offers from several different lenders to get the best rates. But dont worry this doesnt have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and youll be able to compare multiple lenders and their rates so you can choose the one that makes the most sense for you.

1Rate reduction of 0.25% when enrolled in autopay.

2You may be required to have some of your funds sent directly to pay off outstanding unsecured debt.

3After making 12 or more consecutive monthly payments, you can defer one payment as long as you have made all your prior payments in full and on time. Marcus will waive any interest incurred during the deferral and extend your loan by one month . Your payments resume as usual after your deferral. Advance notice is required. See loan agreement for details.

Kat Tretina is a freelance writer who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, MarketWatch, Business Insider, and more.

Are Student Loans Forgiven After 65

Nothing happens to student loans when you retire. You will still owe your federal student loans. Theyre also not forgiven because you retire. Federal student loans do, however, allow you make monthly payments based on your income, the number of people living with you that you support, and your student loan balance.

Recommended Reading: Specialized Loan Servicing Ceo

Don’t Miss: Fha Title 1 Loan

Types Of Loan Interest Rates

At this point, weve reviewed the average business loan interest rates based on different loan types and lenders, as well as how your interest rate will be determined.

This being said, however, its also important to understand the types of interest rates. Lenders will describe the cost of a loan in a few different ways, so youll want to understand what each of these terms means to ensure you know what the actual cost of your loan will beâas well as that youre getting the most affordable financing for your business.

What Are The Requirements For A Personal Loan

To get a personal loan, youll likely need to have steady income, a decent credit score, and a track record of making payments on time. Most loans are unsecured, but some are secured, which means you would need to put up an asset as collateral. If you have no credit, bad credit, or not established in your credit history, you may need to add a cosigner someone with good credit who will be on the hook for the loan if you fall behind on payments.

You May Like: Does Usaa Do Auto Loans

Browse The Latest Personal Loan Rates From A Range Of Lenders

Personal loan interest rates in Canada vary based on factors such as your credit score, income and debts, the type of lender, the loan term and whether you are putting up collateral or not. Find out what interest rates a borrower may encounter based on these factors and compare personal loan rates from multiple lenders in Canada.

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

Read Also: How Long For Prosper Loan Approval