How Do You Get The Best Interest Rate

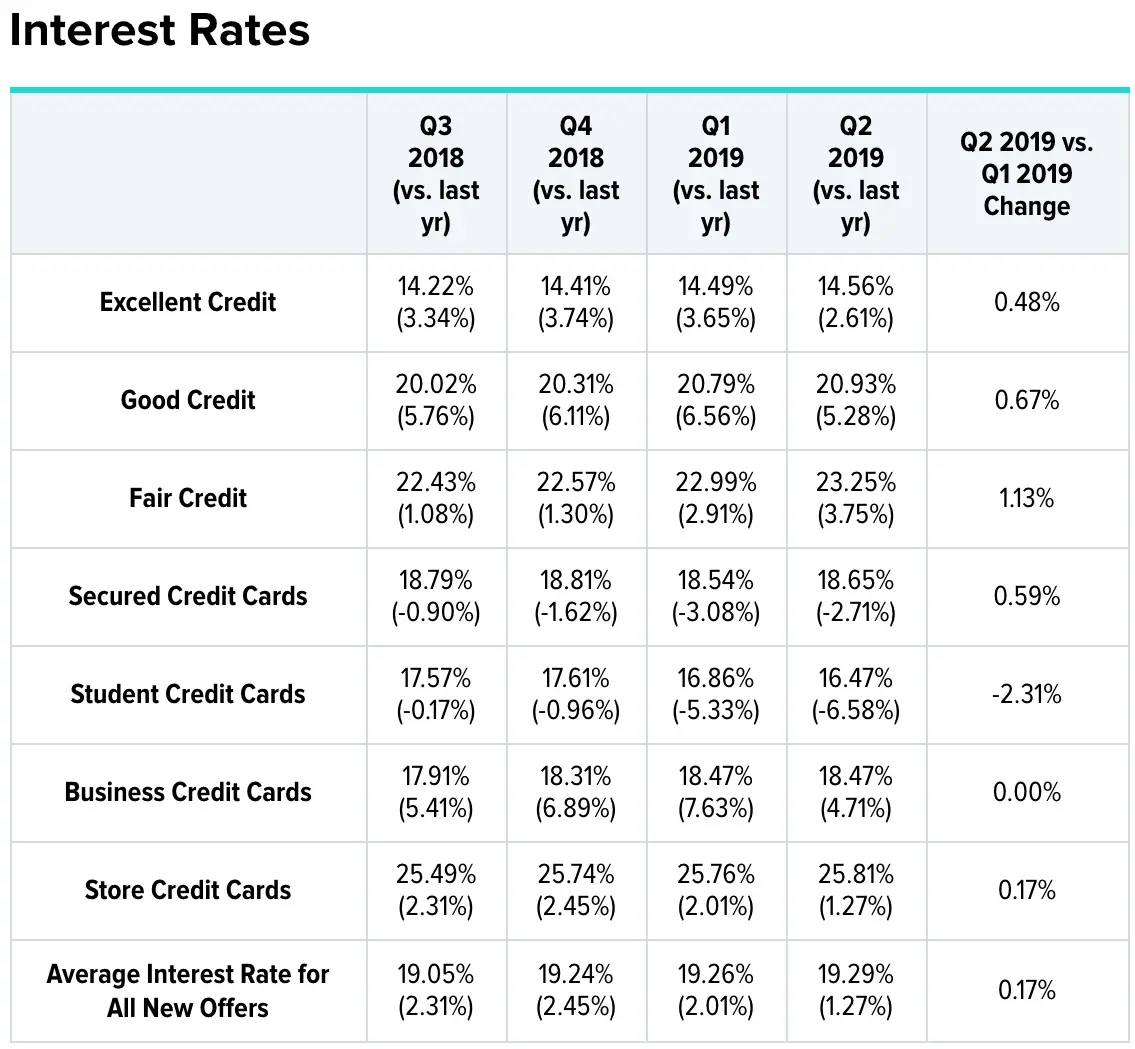

What is a good car loan rate? If you are looking to get the best rate possible, a little planning ahead can go a long way. The first step is to take a look at your credit history and credit score. As your credit score increases, your interest rate decreases. Another important step is to prepare for a negotiation. Depending on your credit score, a good interest rate for you can range from 3.17% to 13.76%.

The chart can be a helpful tool in the negotiation process. Before you accept what you are offered, be sure to carefully look at the entire offer, not just at what you will be paying each month.

High Prices And High Interest Rates Make New Cars A Luxury

Don Mason / Getty Images

Car loans have become more expensive since the Federal Reserve increased the prime interst rate in October and November 2022. The average interest rate on a car loan in October 2022 was 10.6%, almost double the cost of a loan in early 2022.

Interest rates are only part of the story, however. Cars are also more expensive now than they were before the pandemic, because automakers have been hit with supply chain difficulties. Ultimately, a combination of high prices and high interest rates might make new cars unaffordable for low- and middle-income families, at least in the short-term.

- As the Fed raises interest rates to combat inflation, auto loan rates are rising.

- Though the Best Auto Loan rates are still as low as 4%, in the last month the weighted average auto loan rate across all loan types has increased by 2.8 percentage points to 10.6%.

- New cars are also expensive at the moment, with the average sale price in September 2022 above $48,0000.

- Some analysts fear that high prices and high interest rates will soon make new cars a luxury that only high-income families can afford.

Economic Trends Affecting Auto Loan Rates

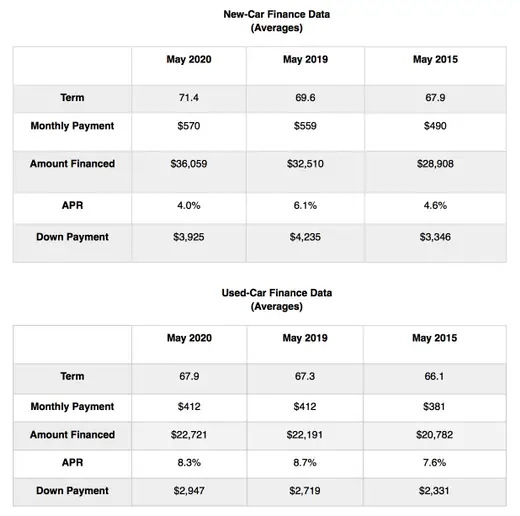

Overall consumers are borrowing more to finance new vehicles. The average new loan amount increased by $3,911, or by 10.4%, in the third quarter of 2022 from a year prior, according to Experian. Used loan amounts increased by $2,255 during that period.

The Federal Reserve has been raising its key interest rate the past year in an effort to combat inflation, and interest rates on other financial products, including auto loans, have beenrising in tandem.

Meanwhile, the prices for both new and used vehicles have been rising amid semiconductor shortages causing supply issues with lagging production. Facing higher prices, more consumers have been opting for used cars. The average cost of a new car was a record $48,681 in November, according to Kelly Blue Book data.

Don’t Miss: Can You Get Fha Loan With Collections

What Is The Average Car Loan Interest Rate

How auto loan interest rates can impact your next purchase.

When you shop for a car, one of the biggest challenges can be finding a loan you feel comfortable with. Lots of factors impact what type of financing you can get and your rates, like your credit score.

When you know the average car loan interest rates for your credit score, you can determine what kind of annual percentage rate, or APR, you can expect. In general, you’ll get a lower interest rate if you have a high credit score.

Here’s what you need to know about average car loan interest rates, including how you can find a better interest rate for your situation.

How To Calculate Car Loan Interest

Before you decide on the bank from which you want to take the car loan, it is better to know more about the car loan interest rate calculator. This will help you to decide if you can afford the EMIs for the concerned bank loan or not. This section below describes how you can calculate the EMI for the car loan you want to take from a specific bank.

Also Check: Can I Get An Equity Loan

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what is known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Chip Shortage Amid Pandemic

The chip shortage began in spring 2020, when automakers were forced to close factories due to the coronavirus pandemic. Chip makers shifted production to digital devices to feed a boom in computer and gaming sales as people were stuck indoors. When auto plants eventually restarted, chip makers weren’t making as many semiconductors for automobiles.

A third of drivers who purchased vehicles in 2022 settled for a used car or a model they didn’t want because dealerships had limited supplies last year, respondents told a survey from auto insurance website Jerry. A quarter of drivers plan to shop for a vehicle in 2023, according to the survey, which was released this week.

While about half of survey respondents said they didn’t plan on buying a new vehicle at all in 2023, some noted that lower interest rates could persuade them.

Drury said one way to get a lower auto loan rate on a new car is by purchasing the vehicle automakers want to sell the most. Dealerships slap a slightly lower rate on the makes and models they’re particularly interested in moving, he said.

Still, if you can find something certified pre-owned, dealerships offer a much lower rate because “they see it as a gateway to buying a new car from them.”

With reporting by the Associated Press.

Read Also: Do Loan Companies Verify Bank Statements

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

Also Check: What Does Usda Home Loan Stand For

Next Steps For Consumers

The truth is, there is no perfect time to purchase a car, and high costs across the board make it challenging to find a good deal. If you can wait, patience may save you money. Otherwise, get ready to spend more and consider how to buy in a high-cost, high-rate environment.

For an explanation of why so many households are living paycheck to paycheck and have strained budgets, look no further than the driveway, says McBride. The average monthly payment on a new car is north of $700 and even the average used car buyer is signing up for $500 monthly payments. Those are budget-busting payments.

To keep your budget healthy and find the best deal on your car purchase, follow these steps.

- Stay current on credit card and loan payments a history of timely payments boosts your credit score, which will qualify you for lower interest rates.

- Shop around with a few auto loan lenders to see which offers you the best deal.

- Time your car purchase to align with any seasonal deals dealerships may still offer.

- Be flexible with less inventory, you may need to come prepared with backup car colors or models.

- Expand your search to several dealerships and research MSRPs before you head in for a test drive.

What Is A Good Interest Rate On A Car Loan In Canada

You can aim for a car loan interest rate below the national average of 6.79%. However, car loan rates depend on many factors such as credit score, income, interest rate type, loan term and the car. If you have good credit, new car loan rates are typically 0% to 6.5% depending on the brand, while used car loan rates are 6.5% to 8.5%.

Also Check: How Long Does Loan Pre Approval Take

What To Know Before Applying For An Auto Loan

When looking for a car loan, it is best to shop around with a few lenders before making your decision. Each lender has its own methodology when reviewing your application for a loan and setting your interest rate and terms.

Generally, your credit score will have the biggest effect on the rates offered. The higher your credit score, the lower APR you will receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms, but there are still ways to finance a car with bad credit. Choosing a longer repayment term will lower your monthly payments, although you will also pay more interest overall.

If you find a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without affecting your credit score.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Don’t Miss: Interest Rate On Car Loans

Why Newcomers Choose Rbc

We know a vehicle offers freedom, flexibility and easy access to the places you need to go. A car is especially important to newcomers working to settle in a new country. Thatâs why we offer convenient and flexible financing options to help you drive away with your first car in Canada.

No Canadian credit history required

You may be eligible for an RBC car loan even if you have no Canadian credit history!4

Financing terms up to 96 months available

Take up to 96 months to repay your loan â financing is available up to $75,000 or more4.

RBC financing available at over 4,500 dealerships

Finance a new or used vehicle up to 10 years old right at the dealership

Enjoy flexible repayment options

Dont Miss: Us Interest Rates Chart 2021

What Is A Car Loan Interest Rate

Interest rates fluctuate based on lenders and the current economy. The cost is usually a percentage of the loan amount thats paid over the life of the loan. An interest rate is listed as an annual percentage rate . Borrowers may notice that interest rates vary depending on a number of factors, including:

- Borrowers with a higher credit score typically receive lower interest rates.

- Lender: Lenders may set their own interest rates.

- Car details: Details about the car you plan on buying also affect interest rates, with used cars costing more in interest.

- Buy/refinance: Buying a new or used car comes with a higher interest rate than refinancing an existing loan.

- Federal Reserve: The Federal Reserve also sets and influences interest rates.

Considering all these factors, the average car loan interest rate significantly varies. Comparing interest rates among lenders is one of the best ways to secure a competitive rate.

Don’t Miss: Which Type Of Loan Is Cheapest

Why Does Your Auto Loan Interest Rate Seem High

Your loan’s interest rate may seem high for factors beyond your control. Even if you have great credit, the lender is likely still considering interest rates set by the Federal Reserve. The Reserve can increase or decrease auto loan interest rates, depending on the market.

Your interest rate could also seem high because some lenders simply charge higher interest rates. Some lenders may start offering financing at 3.29% for borrowers with excellent credit, whereas others might start at 4.74% for the exact same applicant. Getting information from multiple lenders could save a lot of money.

What Is A Fico Auto Score

The FICO Auto Industry Option is a credit score specifically marketed and sold to the automobile industry to determine your creditworthiness when purchasing a vehicle. Its an industry-specific credit score used by the majority of auto lenders. FICO Auto Scores are available only to those in the auto industry. Consumers cannot purchase them.

A typical score ranges from 300 to 850, but a FICO Auto Score ranges from 250 to 900. While its impossible to know exactly what criteria FICO uses, Auto Scores weigh your credit history differently than the average credit score. It determines, with more accuracy, your likelihood to repay a car loan.

The FICO score isnt much different from a typical credit score, but it is based on different standards. It focuses more on your ability to repay a car loan than, say, a mortgage or credit card.

If you have excellent credit, the FICO Auto Score wont matter much when determining your rate. However, if you have average or poor credit, minor differences can make a big difference when lenders determine your interest rate.

Read Also: How Can I Apply For Loan Forgiveness

Bmw Launches The X3 M Suv In India

German automaker BMW has recently launched the BMW X3 M SUV in India. The price tag that the car comes with is Rs.99.90 lakh .

This is the first time that the automaker has brought a high performance M version of the SUV in the country. The company claims that the BWM X3 M comes with the most powerful straight-six engine ever which has been put under the hood of a BMW M series car. The car comes with a host of features and safety fitments such as adaptive LED headlamps, rain sensing wipers, parking assistant, powered tail gate, head-up display, tyre pressure monitor, vehicle immobiliser, ABS with brake assist, EBD, and so on. The engine powering the car is a Twin Power Turbo, 3.0-litre, inline six cylinder engine that churns out 480 hp of max power and 600 Nm of peak torque. It is capable of clocking 0 to 100 kmph in 4.2 seconds and can hit a top speed of 250 kmph.

3 November 2020