How Congress Sets Federal Student Loan Interest Rates

Congress passes legislation each year to set interest rates for student loans. The rates apply from July 1 of the first year to June 30 of the second year.

In August 2013, the Bipartisan Student Loan Certainty Act was signed into law, which ties federal student loan interest rates to prevailing market rates.

In their current form, the interest rates for all federal student loans are based on the yield of the 10-year Treasury Note auction, plus a fixed increase.

Student Debt Continues To Rise

Student debt continues to be an epidemic in our society. Since the 20072008 Great Recession, federal funding for public universities has decreased by 22%, while tuition costs have risen 27%. This has led to student loan debt that has surpassed $1.6 trillion. The debt may get worse if the education system is forced to undergo more budget cuts and more unemployed Americans take advantage of low interest rates to go back to school.

There is an origination fee of 1.057% for federal direct subsidized loans and direct unsubsidized loans, in addition to 4.228% for parent PLUS loans. This fee isnt added to your repayment rather, its deducted from your initial loan disbursement.

Private lenders set a range for interest rates. Your actual rate will be based on the of you and your cosigner. According to Bankrate, private student loan annual percentage rates are currently:

| Loan Type |

|---|

| 1.74% to 7.75% |

Student Loan Interest Rates: What You Need To Know

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

* * *

Don’t Miss: How To Get Mobile Home Loan

Federal Student Loans Issued For 2020

While many students and families face challenges in planning for and affording college for fall, they received good news from a recent electronic announcement by the U.S. Department of Education setting the rates for new federal student loans to be disbursed between July 1, 2020 and June 30, 2021. The rates, which are based off the U.S. Treasury Departments auction of 10-year notes, mean that borrowers will benefit from changes in the governments cost of borrowing during this time.

The rates for undergraduate Stafford loans will be 2.75%, down from 4.5% in the current academic year, according to a recent CNBC article. As calculated by Mark Kantrowitz, publisher of SavingForCollege.com, this equates to about $1,000 in interest saved over the life of the loan for a student with a $10,000 loan. The last time interest rates approached this level was 15 years ago, when they fell to 2.875%.

Besides the undergraduate Stafford loan rate already mentioned, the Department of Education announcement also included loan rates for new graduate Stafford loans and new Grad PLUS and Parent PLUS loans .

You can count on us to be here with student loan information for you and the students and families you serve.

Student Loans In The United States

| This article uses bare URLs, which are uninformative and vulnerable to link rot. Please consider converting them to full citations to ensure the article remains verifiable and maintains a consistent citation style. Several templates and tools are available to assist in formatting, such as Reflinks , reFill and Citation bot . ( |

|

|

Student loans in the United States are a form of financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships, which are not repaid, and grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult.

Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor’s degree had about $30,000 of debt upon graduation.:1 Almost half of all loans are for graduate school, typically in much higher amounts.:1 Loan amounts vary widely based on race, social class, age, institution type, and degree sought. As of 2017, student debt constituted the largest non-mortgage liability for US households. Research indicates that increasing borrowing limits drives tuition increases.

Also Check: How To Pay Off Auto Loan Early

Sallie Mae And Nelnet

Sallie Mae and Nelnet are the largest lenders and are frequently defendants in lawsuits. The False Claims Suit was filed on behalf of the federal government by former DOE researcher Dr. Jon Oberg against Sallie Mae, Nelnet, and other lenders. Oberg argued that the lenders overcharged the United States Government and defrauded taxpayers of over $22 million. In August 2010, Nelnet settled and paid $55 million. Ultimately seven lenders returned taxpayer funds as a result of his lawsuits.

Current Student Loan Refinancing Interest Rates

Refinancing your student loans is a smart option if you can qualify for a lower interest rate, which will help you pay less interest over the life of the loan. Interest rates for student loan refinancing are often lower than rates for private student loans because borrowers become better loan candidates.

Refinancing is only available through private lenders, not the federal government. Federal borrowers who refinance their loans with a private lender will have to give up benefits like income-driven repayment plans, long forbearance options, and student loan forgiveness programs.

Here are the student loan refinance rates from several private lenders:

| Lender |

To compare your options, check out our picks for the best student loan refinance companies.

Recommended Reading: What Is The Cheapest Student Loan Repayment Plan

Student Loan Payments Restart In October

Tens of billions of dollars in interest on federal student loans have been canceled during the pandemic, Hounanian says. With payments waived until the end of September, the government will cancel an even larger amount of interest, he adds.

âMy fear is that people are just going to go through mass levels of delinquency in the fall because they havenât had to make loan payments in 18 months,â Muszynski says. âPeople over the next few months should look at their loans, understand what their interest rate is, and understand what their payment is going to be.â

Schaefer agrees: âDo your homework. Refinancing is certainly an option just given how low rates are right now across the board,â she says. âStart to think about how you may adjust your budget once these payments start kicking back in again.â

While thereâs been talk about student loan debt cancellation, the budget for it was nixed in President Joe Bidenâs recent proposal. While top congressional leadership has supported cancellation ranging from $10,000 to $50,000 per borrower, it is unsurprising to student loan experts that mass forgiveness hasnât happened yet.

âRecent rhetoric would suggest that mass cancellation is unlikely from the federal government,â Muszynski says. âObviously itâs still up in the air, but it was removed from President Bidenâs budget.â

Educational Loan Minimum Monthly Payments

Some educational loans have a minimum monthly payment. Please enter the appropriate figure in the minimum payment field. Enter a higher figure to see how much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment.

Read Also: How Much Will My Federal Student Loan Payment Be

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

- Interest Amount= × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

Private Student Loan Fees

Some private lenders charge application, origination, or late payment fees. Some lenders who waive application or origination fees will still charge you for late or returned payments. So, read your loan agreement carefully.

Your loan agreement will also detail which fees you’re subject to. These fees may include:

- Application Fee: What it costs to get approved for a loan.

- Origination Fee: A processing fee at the start of your loan term.

- Late Payment Fee: A charge for missing your payment date typically a percentage of your payment.

- Returned Payment Fee: If the lender can’t process your payment due to insufficient funds in your account.

You May Like: Can You Get An Fha Loan On New Construction

How Has The Coronavirus Affected Student Loan Interest Rates

When the coronavirus hit in spring 2020 and the Fed cut interest rates, student loan rates plummeted. Federal student loan rates were at their lowest point in years, and borrowers could take out private student loans or refinance existing loans with rock-bottom rates as well. Federal student loan interest has also been waived and will remain waived through Aug. 31, 2022.

However, as the economy recovers from the pandemic, the Fed has been regularly raising rates. Federal student loan interest rates are up more than a percentage point for the 2022-23 school year, and private student loan rates are also starting to rise again. Rates will likely continue to rise as 2022 progresses.

What To Know About Student Loan Debt Relief

Many will benefit.President Bidens executive order means the federal student loan balances of millions of people could fall by as much as $20,000. Here are answers to some common questions about how it will work:

Who qualifies for loan cancellation?Individuals who are single and earn $125,000 or less will qualify for the $10,000 in debt cancellation. If youre married and file your taxes jointly or are a head of household, you qualify if your income is $250,000 or below. If you received a Pell Grant and meet these income requirements, you could qualify for an extra $10,000 in debt cancellation.

Whats the first thing I need to do if I qualify?Check with your loan servicer to make sure that your postal address, your email address and your mobile phone number are listed accurately, so you can receive guidance. Follow those instructions. If you dont know who your servicer is, consult the Department of Educations Who is my loan servicer? web page for instructions.

How do I prove that I qualify?If youre already enrolled in some kind of income-driven repayment plan and have submitted your most recent tax return to certify that income, you should not need to do anything else. Still, keep an eye out for guidance from your servicer. For everyone else, the Education Department is expected to set up an application process by the end of the year.

Recommended Reading: What Determines Your Mortgage Loan Amount

How Likely Is It That My Student Loans Will Be Forgiven Anyway

A lot of buzz these days remains on student loan debt forgiveness possibilities.

President Joe Biden supports forgiving up to $10,000 in federal student loan debt per borrower. The more radical Warren-Schumer proposal calls for forgiving up to $50,000 in federal student loan debt.

Just because there’s hope that you might see some student loans wiped out by Washington, though, isn’t a good reason to endlessly borrow money now to go to college.

“It’s not necessarily a sound financial strategy to be basing your life’s financial decisions on different posturing by folks in Washington,” Humann said.

We don’t know what will really happen. And borrowers need to remember that private student loans which did not get relief during the pandemic through the CARES Act face very high odds against seeing loan forgiveness down the road.

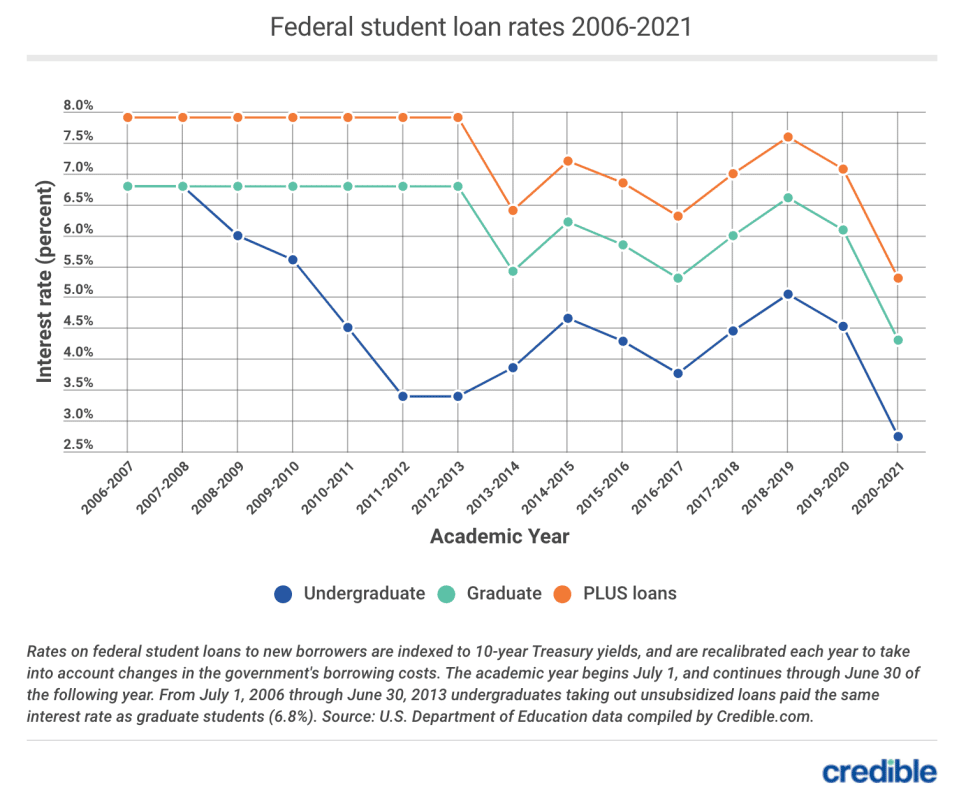

Historical Federal Interest Rates

While the earliest federal student loan progams date to 1944, they were only available to military veterans until 1958.

- In 1982, federal interest rates ran as high as 14%.

- In 1988, undergraduates could get loans at an interest rate of 9%.

- In 1992, federal interest rates ran from 7% to 10%.

- Federal interest rates fell by an average 36.19% between 2010 and 2020.

- The average federal loan interest rate has declined % since 2006.

- Federal interest rates for undergraduates have declined % since 2006, an annual rate of %.

- From 2006 until 2013, the fixed interest rate for Direct Unsubsidized Loans for undergraduates was 6.80%.

- From 2006 until 2012, teh fixed interest rate for graduate and professional students was 6.8%.

- As of July 1, 2012, graduate and professional students are no longer eligible for subsidized loans.

- Starting with the 2013-2014 academic year, Undergraduate Direct Loans carry the same interest rate whether they are subsidized or unsubidized.

- Also starting in 2013, interest rates adjust annually.

- Prior to the 2013-2014 academic year, interest rates were generally higher and didnt always change from year to year.

| Disbursement Period |

|---|

| 6.8% |

Read Also: What Does Refinance Auto Loan Mean

Should I Opt For A Private Student Loan Instead Of A Federal Student Loan

College students need to look at financing their education as part of a three-step process, said Credible’s Humann.

First, you want to bring money to the table through part-time jobs, savings, gifts from family, grants and scholarships.

Second, you want to max out all that’s available to borrow when it comes to federal student loans. Federal student loan rates are low and you may later qualify for some benefits, such as income-driven repayment plans and some loan forgiveness programs.

Kantrowitz noted that even Parent PLUS loans are eligible for some federal student loan forgiveness programs, such as public service loan forgiveness, but not teacher loan forgiveness. Parent PLUS loans are also eligible for death and disability discharges.

Third, you often need to fill that gap with more loans.

Some borrowers, Humann said, may want to take advantage of extremely low rates on private student loans instead of turning to higher rate Parent PLUS loans to fill the gap.

But you’d need to compare what rates are available to you, determine whether the rate is variable and could go higher or if the low rate is fixed. You’d also need to find out if you’d need a co-signer like a parent to get a better rate. On co-signed loans, the co-signer’s credit score is used if higher than the borrower’s score.

Private student loan rates will vary significantly, based on one’s credit. Some variable rates range from 1.04% to around 13%.

Interest Rates Rise For New Federal Student Loans

The interest rates on federal student loans will increase by nearly a full percentage point for new loans made from July 1, 2021 to June 30, 2022.

Thats a 20% to 38% increase in the interest charged on federal education loans over a 10-year repayment term.

Federal student loan interest rates will increase from 2.75% to 3.73% for new loans on or after July … 1, 2021.

getty

Interest rates on federal student loans reset each July 1, based on the last 10-year Treasury Note auction in May plus a margin of 2.05%, 3.6% or 4.6%. The high yield on the May 12, 2021 auction was 1.684%, up from 0.70% the year before.

This yields the following interest rates for new loans made during the 2021-22 academic year:

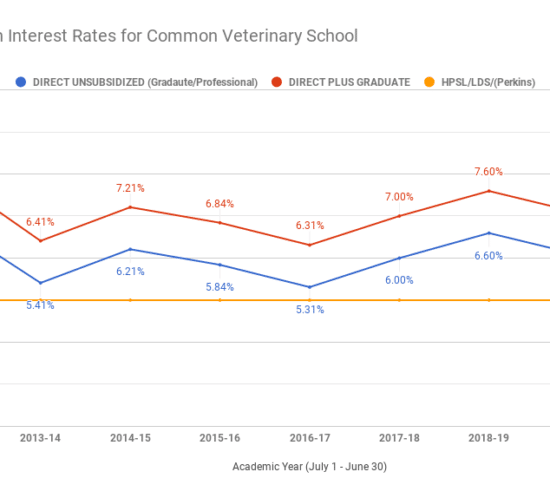

- The interest rate on Federal Direct Stafford loans for undergraduate students for 2021-22 will be 3.734%, up from the 2.75% rate for 2020-21, which was a record low.

- The interest rate on Federal Direct Stafford loans for graduate students for 2021-22 will be 5.284%, up from 4.3% in 2020-21.

- The interest rate on Federal Direct Grad PLUS loans and Federal Direct Parent PLUS loans for 2021-22 will be 6.284%, up from 5.3% in 2020-21.

The new interest rates will cost borrowers as much as an additional $590 per $10,000 borrowed on a 10-year repayment term.

Borrowers cannot borrow federal loans for next year now, before the interest rates increase, because the applicable interest rate is based on the loans disbursement date.

Recommended Reading: How Do Mortgage Lenders Determine Loan Amount