Examples Of Borrow In A Sentence

borrowborrowingborrowedborrowborrowedborrowedborrowedborrow Milwaukee Journal Sentinelborrow Varietyborrow CNNborrow Rolling Stoneborrow Quartzborrow Washington PostborrowWSJborrow Los Angeles Times

These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘borrow.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback.

Major Periods Of Borrowingin The History Of English

Loanwords are words adopted by the speakers of one language from adifferent language . A loanwordcan also be called a borrowing. The abstract nounborrowing refers to the process of speakers adopting words froma source language into their native language. “Loan” and “borrowing”are of course metaphors, because there is no literal lendingprocess. There is no transfer from one language to another, and no”returning” words to the source language. They simply come to be usedby a speech community that speaks a different language from the onethey originated in.

Borrowing is a consequence of cultural contact between two languagecommunities. Borrowing of words can go in both directions between thetwo languages in contact, but often there is an asymmetry, such that more wordsgo from one side to the other. In this case the source languagecommunity has some advantage of power, prestige and/or wealth thatmakes the objects and ideas it brings desirable and useful to the borrowinglanguage community. For example, the Germanic tribes in the first fewcenturies A.D. adopted numerous loanwords from Latin as theyadopted new products via trade with the Romans. Few Germanic words, onthe other hand, passed into Latin.

The following list is a small sampling of the loanwords that came intoEnglish in different periods and from different languages.

What Is A Personal Loan

With a personal loan, you borrow a fixed amount of money and agree to pay it back over a period of time. You must pay back the full amount, interest and any applicable fees. You do this by making regular payments, called instalments. Personal loans are also called long-term financing plans, instalment loans and consumer loans.

Personal loans are typically used for specific purchases such as home renovations, furniture and cars or to consolidate other debts with higher interest rates. Most personal loans range from $100 to $50,000 with a term between 6 and 60 months.

Personal loans are available from traditional lenders, such as banks and credit unions, as well as alternative lenders such as payday lenders, title loan companies, private lenders and pawn shops.

Your lender may offer you a loan for more than what you need. Be careful not to borrow more than you can pay back.

You May Like: Prosper Loan Approval Time

I Germanic Period Or Pre

Latin

It can be deduced that these borrowings date from the time before theAngles and Saxons left the continent for England, because of verysimilar forms found in the other old Germanic languages . The source words are generally attested inLatin texts, in the large body of Latin writings that were preserved throughthe ages.

ancor 'anchor'butere 'butter' cealc 'chalk'ceas 'cheese' cetel 'kettle'cycene 'kitchen'cirice 'church' disc 'dish' mil 'mile' piper 'pepper' pund 'pound' sacc 'sack' sicol 'sickle'straet 'street' weall 'wall' win 'wine'

How Federal Student Loan Repayment Works

The standard repayment plan for federal student loans breaks up your balance into 10 years worth of payments. But only about 30% of borrowers paid off their federal or private loans within 10 years, according to a 2019 Student Loan Hero analysis.

Other federal repayment plan options include:

- Graduated repayment plan: Starts off with lower monthly payments that increase every 2 years payments are still made for 10 years

- Extended repayment plan: Draws out your repayment timeline to up to 25 years, with the option of fixed or graduated monthly payments

Deferment and forbearance could allow you to take a break from loan payments for a certain period if youre experiencing financial difficulty. But since interest will continue to accrue unless you have subsidized loans and youre in deferment these programs can leave you with a heftier balance when they end.

If youre looking for a way to lower payments or take more time to pay off your loans, one of the four income-driven repayment plans could be your best bet. Your options are:

These plans typically reduce your monthly bill to a percentage of your income, offering forgiveness after 20 or 25 years of payments though, youll likely have to pay income tax on the forgiven balance.

Its important to note that your student loan servicer will generally provide an interest rate discount of 0.25 percentage points if you choose to use autopay each month for your loan payments.

Recommended Reading: Usaa Refinance Car Loan

Solving An Investment Or Annuity

Good news! These are just variations on the loan theme.

For instance, a savings account is just a loan from you to thebank. The difference is that payments can move in either direction:you call them deposits when they increaseyour balance and withdrawals when theydecrease your balance. Because of the way P was originally defined,you count a withdrawal as a positive payment P and a deposit as anegative payment P.

Example 7:

At the end of every month, you put $100 into a mutualfund that pays 6%, compounded monthly. How much will you have at theend of five years?

Solution: P = $100, i = 6%/12 = .005, A = 0 . Use equation 1:

but reverse the sign of P in the formula,because the payments are going to increase the balance and not reduceit as in a loan.

B_n = A^N +

B_60 = 0 +

B_60 = $6977.00

At the end of five years youll have $6977.00.

An annuity is acontract, usually with an insurance company, for you to receive afixed amount of money at stated intervals, usually monthly. This isalso the same as a loan, except that the payments move only oneway.

Whole life insurance works this way once you cash it in: you cantake the cash value of the insurance or use it to buy an annuity. Youcan also purchase the annuity with a lump sum.

Example 8:

You want to purchase a 20-year annuity that will pay $500 amonth. If the guaranteed interest rate is 4%, how much will theannuity cost?

Solution: P = 500, i = 4%/12 = .00333 N =20×12 = 240. Use equation 4:

A = $82,510.93

How Private Student Loan Repayment Works

Repayment plans on private student loans typically range from five to 15 years.

These loans dont come with the same range of repayment programs, so you wont have the option to choose an income-driven plan. Plus, private lenders wont cover your interest payments during certain periods, as is possible with federal direct subsidized loans.

You could, however, generally receive an autopay discount, and lenders often provide access to at least some forbearance if you need to postpone payments. Lenders may offer 12, 18 or 24 months of forbearance over the course of your loan term, for instance.

If your credit and income qualifies you, or if youre able to use a cosigner, you could refinance your student loans later if a better interest rate is available to you through a different lender.

Also Check: Rv Loan Rates Usaa

Finding Other Loan Numbers

Equation 1 showed how to find the currentbalance, or payoff amount, on a loan. But more likely you want to knowwhat the payment amount will be for acertain number of payments, or how many paymentsof a certain amount will be required. The mostobvious times when youd ask these questions are when youre buying acar on a 3-year or 4-year loan , or a house on a 30-yearloan.

The next two sections show how you can find both the number ofpayments N and the payment amount P by doing some algebra onequation 1. When the loan is paid off, the remainingbalance B_n = 0, so set B_N to 0 in equation 1and solve for either P or N.

Usury And Predatory Protections

Several federal and state consumer protection laws protect consumers against predatory and usury loan tactics used by lenders. The Truth In Lending Act, Real Estate Settlement Act and the Home Owners Protection Act federally protect borrowers against predatory lenders.

Many states enacted companion consumer predatory and usury protection acts to protect borrowers. Both parties benefit because lenders make reasonable interest repayment rates and borrowers receive a much-needed loan.

Several federal and state consumer protection laws protect consumers against predatory and usury loan tactics used by lenders.

Recommended Reading: Credit Needed To Refinance Home

Examples Of Loan In A Sentence

loanloanloanloanloanedloanloanThe Salt Lake Tribuneloan National Reviewloan NBC Newsloan Los Angeles Timesloan Washington Postloan The New Yorkerloan WSJloan The New Republicloan The New Yorkerloan The Christian Science Monitorloan The Salt Lake Tribuneloan Forbesloan Forbesloan USA TODAYloan alloan Quartz

These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘loan.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback.

Examples Of Payoff In A Sentence

payoffpayoffpayoffpayoffspayoffpaid offpaid offpayoffchicagotribune.compayoffAllurepayoff Washington Postpayoff Wiredpayoff BostonGlobe.compayoffUSA TODAYpayoff oregonlivepayoff Allurepay off CBS Newspay off courant.compay off Forbespay off sun-sentinel.compay off Anchorage Daily Newspay off Washington Postpay off chicagotribune.compay off CNN

These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘payoff.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback.

You May Like: Navy Federal Auto Loan Pre Approval Hard Inquiry

Payment Amount For An Investment

Suppose you have a goal, and you need to map out a plan for how toreach it. In other words, you know a future value F that you want toreach, by making N periodic payments P that earn interest i.

To find P or N in this situation, proceed almost likesolving a loan.Take equation 1, which for investments is

P B_n = A^N + --- i

Now set A=0 and B_n=F , and solve for the future value F:

P F = 0^N + --- i P F = --- i

and solve for P or N. Lets start by solving for P:

P --- = F i

Note: As with all these formulas, this oneassumes that you make each payment at the end of a period, so that youreach your goal on the day you make your last deposit.

Example 9:

Youre saving up for a down payment on a house. You expect to buy inabout five years, and youll be looking in the $250,000 range. Youneed to make at least a 10% down payment, plus $2500 for closingcosts. If your money fund pays 5.5%, posted and compounded everymonth, how much a month do you need to deposit?

Solution: N = 5×12 = 60 i = 5.5%/12 = .004583 F = 10% of $250,000 + $2500 = 27,500.Use equation 5:

P = iF /

P = .004585*27500 /

P = 399.24

You need to put almost $400 a month into thatmoney fund to meet your goal.

Storing The Iou And Documentation

Keep the original IOU in a safe place. When possible, make a copy of the IOU and keep the copy at another location. Preserving a scanned copy stored online also is a good idea. At the time of the loan, make a note on how the funds changed hands, listing if the loan was paid in cash, check, money order or another type of value. Be sure to record the details of the payment such as the check number. Keep all receipts. If a bank wire was used to send the funds, maintain a copy of the wire receipt with the IOU.

Read Also: Usaa Auto Loan

Senior Recalled From Loan Stay

Defender back from Chorley to boost Wanderers’ options for run-in

3 March 2022

Adam Senior has been recalled from his loan spell at Chorley to finish the season back with Wanderers.

Senior joined the Magpies towards the end of January and made five appearances for the play-off chasing National League North side.

The 20-year-old secured two man-of-the-match awards during his stay at Victory Park but now returns to the Whites for the end-of-season run-in and will provide a further defensive option in the absence of Gethin Jones, who is being given time off with his family following the loss of his mum, Karen.

With Gethin being away were a bit light in that area so Adam will come back now for the rest of the season, confirmed Whites boss Ian Evatt.

Hes done well again away at Chorley and he will be back with us and will get an opportunity at some stage.

Senior made two League One starts at right-back for Wanderers either side of Christmas after loan stays with Ashton United and York City earlier this season.

His return will boost numbers in the absence of Jones, with Elias Kachunga also close to making a comeback.

Kachunga has been absent since early January with a torn thigh muscle.

But the forward returned to full training for the first time today and will shortly be back in contention for a place in the Whites match-day squad.

Hes trained really well today. Saturday will come too soon but hes going to get there pretty quickly and give us a good option.

How A Loan Term Works

Your lender typically sets a required monthly payment when you take out a loan, such as a 60-month auto loan. That payment is calculated so that you pay off the loan gradually over the loans term. Your last payment will exactly cover what you owe at the end of the fifth year. This process of paying down debt is called amortization.

A loans term affects your monthly payment and your total interest costs. A long-term loan means you’ll pay less in principal each month because the total amount you borrowed is broken down over more months, so it can be tempting to choose one with the longest term available. But a longer term also results in more interest charges over the life of that loan.

You effectively pay more for whatever youre buying when you pay more interest. The purchase price doesnt change, but the amount you spend does.

Also Check: Usaa Mortgage Credit Score Requirements

How Do You Spell Principal On A Loan

Principal

. Likewise, which is correct principal or principle?

Use principal in reference to a person who is in leadership or to describe the importance of something use principle to refer to a standard, rule, or guiding belief. One popular mnemonic device to remember this difference is the isolation of pal from principal. The principal of your school is your pal ideally.

Also, what is principal on a loan? When you take out a loan, your payments are primarily broken up into two parts principal and interest. The loan principal is the amount you borrow and goes down as you begin to pay it back, while interest is the cost of borrowing the money.

Furthermore, what main principle means?

When used as an adjective, principal meansmain or primary, such as the principal finding in a study. On the other hand, principle is a noun that means a rule, tenet, or basic truth, such as the principle of gravity.

What is the full form of principal?

Options. Rating. PRINCIPAL. Principled Resourceful Intelligent Noble Considerate Innovative Persistent Able Leader. Academic & Science.

Other Types Of Loan Terms

Loan terms can also be the characteristics of your loan, which your loan agreement would describe. You and your lender agree to specific conditionsthe “terms” of your loanwhen you borrow money. The lender provides a sum of money, and you repay that sum according to an agreed-upon schedule. Each of you has rights and responsibilities per the loan agreement if something goes wrong.

Some of the most common terms include the interest rate, monthly payment requirements, associated penalties, or special repayment provisions.

Recommended Reading: Fha Loan Limits Fort Bend County

How Do Student Loans Work: Private

Banks, online lenders, credit unions, colleges and state agencies provide private student loans.

Private loans dont have the same borrower benefits as federal loans. They also require a credit check, and applicants with good or excellent credit will get access to the lowest interest rates. Undergraduates who lack long credit histories will generally need a cosigner to take out private student loans.

While you should prioritize borrowing federal loans, private loans can be useful because they dont have the same borrowing limits and may offer lower interest rates, depending on your circumstances. Private loans can also fill funding gaps as a last resort to pay for college.

How To Write An I Owe You

An “I Owe You,” generally expressed using the initials “IOU,” is an informal document that states the terms and agreements of a loan between two parties. When it comes to repaying financial obligations, some people, especially family members, can practice “selective memory.” In the future, that person who received the loan might not remember borrowing any money or may remember that he owes a much smaller amount than the original loan.

Recommended Reading: When Can You Refinance Fha Loan

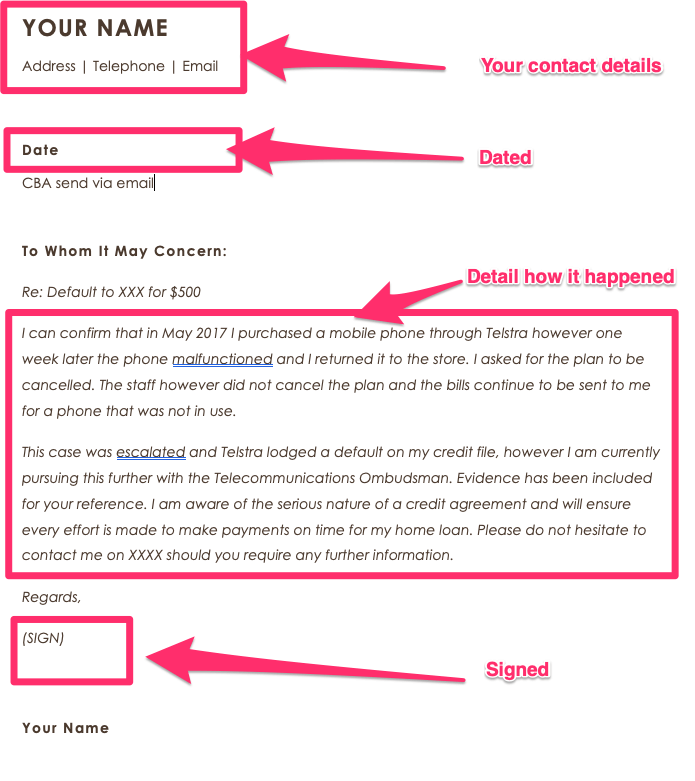

Letter Doesnt Need To Be Long

This letter doesnt need to be long, and if you dont have enough for three paragraphs that is fine. Just say what needs to be said according to the banks qualifications and thats it.

You want to showcase yourself as a person that they would want to lend money too. Dont ramble and dont say too much. Give your contact information at the bottom of the letter and end with the proper closing. Here is a sample letter to help you with formatting.

Other Accounts On File

If there are other accounts on file, you should also mention it in the letter. The bank needs to see that by giving you a loan, you are already a valuable part of their banking group. If you have many accounts and do a great deal of business with this specific location, you may get preference over someone who doesnt deal with this bank.

The first paragraph needs to get right to the point. The letter needs to state why the money is needed. Banks are becoming increasingly picky with who they lend money too. The goal of a letter of this nature is to make sure that they get a clear picture of how responsible and able to repay the loan the individual is.

Also Check: Usaa Auto Refinance Phone Number