Applying For A Va Loan

Applying for a VA loan is different from applying for a conventional mortgage, and this affects the home-buying process.

The VA recommends working with a real estate agent whos familiar with VA loans and getting prequalified with a lender before making an offer.

There are a number of steps to applying for a VA loan, including

- Obtaining a certificate of eligibility, which verifies to the lender that you meet minimum eligibility requirements.

- Comparing offers from different VA lenders to find the best interest rate and most affordable fees for you.

- Submitting a loan application and providing financial information, including pay stubs and bank statements.

- Obtaining a VA appraisal, which is ordered by the lender.

Your credit information, income and the value of the home will be reviewed, and then the lender will either approve or deny your loan. Make sure your purchase agreement has a clause called a VA option clause, which allows you to avoid financial penalties if the home doesnt appraise high enough.

When your loan is approved, the lender will choose a representative to conduct a closing, during which the money can be released and the property transferred to you.

Meet The Minimum Property Requirements

In most cases, you can use a VA loan to buy only a primary residence – that is a home where you intend to live. The Department of Veterans Affairs also has minimum property requirements for single-family houses that the home needs to meet. A VA-approved appraiser will inspect the home to establish its value and make sure it is safe, sound, and sanitary.

There are also requirements if you want to purchase a condo or a townhouse with a VA loan. Typically, the condominium or townhouse community needs to be on the Department of Veterans Affairs’ list of approved properties.

How Long Will It Take To Get My Loan Approved

Montana Capital Car Title Loan provides instant loan approval. You will receive conditional consent based on your fundamental data.

The speed of the loan approval process is directly proportional to the level of provision of information and important documents to applicants. The faster you provide the documents for verification, the faster we can complete the process.1

After all your documents have been verified by the team and you have submitted the signed loan contract, you can expect to get money in one business day.2

Also Check: How To Get First Loan

How To Get Guaranteed Loan Approval

Guaranteed home loans offer more people a chance at homeownership, but can everyone qualify? Guaranteed loan approval depends on the type of loan youre applying for and your mortgage lender, but many borrowers can qualify for a guaranteed loan even if they dont have the cash reserves or an impressive credit score.

What Are The Requirements For Va Loan Programs

- You have completed at least 90 days of active duty service.

- You have at least six years of service in the Reserves or National Guard .

- You have served at least 181 days of active duty service during peacetime.

- You have 90 days of cumulative service under Title 10 or Title 32. For Title 32 service, at least 30 of those days must have been consecutive.

- Youre the spouse of a military service member who died in the line of duty, or as a result of a service-related disability.

You May Like: How To Know How Much Home Loan I Can Get

Understand Va Loan Limits

The VA eliminated the VA loan guarantee limits for veterans with full entitlement. This means you may be able to qualify for a VA loan with no maximum home price and no down payment. This change does not guarantee you will be approved for a larger amount. You will still need to meet the lender’s credit, financial, and income requirements to get your VA loan approved. Read more about VA loan limits.

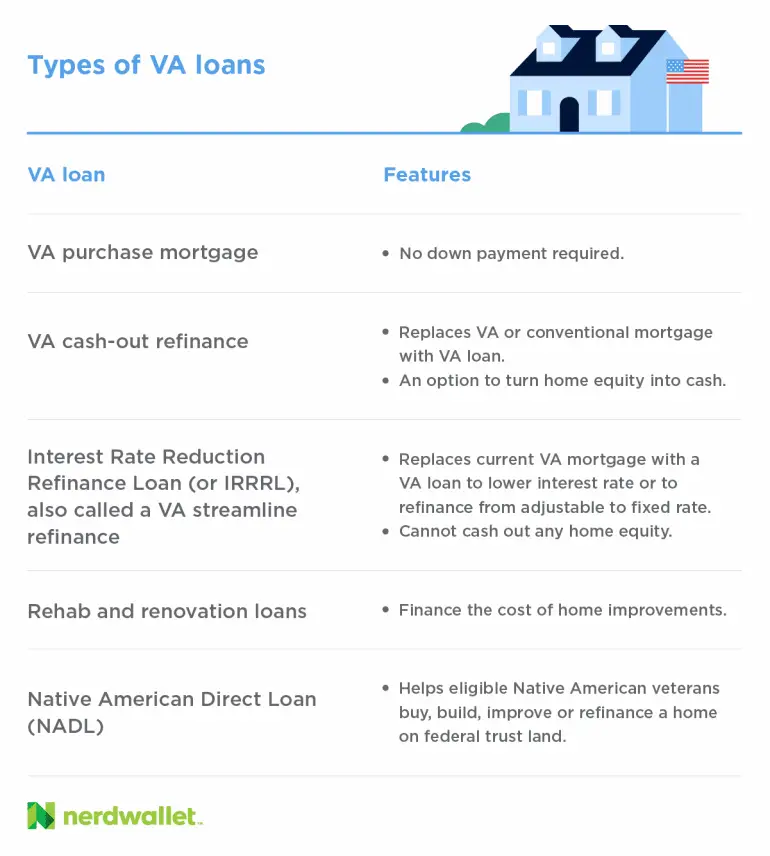

How Do Va Loans Work

The VA doesnt make loans, so borrowers must find a private lender that is part of the VA loan program and willing to offer affordable financing.

Different lenders have different qualifying criteria. But the VA encourages lenders to make VA loans available to all qualified veterans that apply. The government guarantees a portion of the loan to pave the way to easier approval. In most of the U.S., the government guarantees loans of up to $510,400 as of 2020 the guarantee means that if you dont pay, lenders are unlikely to lose money.

But that government guarantee doesnt protect you, the borrower, if you dont pay your mortgage. You can still lose your home to foreclosure if you dont repay your loan. If you do run into trouble as a VA mortgage holder, theres a dedicated VA staff to help.

Also Check: Are Small Business Loans Installment Or Revolving

Va Loan Rates By Credit Score

While it is not necessary for you to have an excellent credit score to qualify for VA loans, you must satisfy the lenders requirements by having a minimum credit score of 620.

VA loan rates depend upon many factors, like market conditions, your credit history, debt-to-income ratio, and credit score.

While some of these factors are out of your hands, you can definitely control your credit score. An applicant with a good credit score will be quoted a lower interest rate than an applicant with a bad or fair credit score, resulting in some major savings.

Heres an estimate of what your monthly payment and APR would look like with different credit scores.

| $871.00 |

Apply For A Certificate Of Eligibility

You’ll need a Certificate of Eligibility to prove to lenders that you are eligible for a VA loan. Veterans typically need a copy of their discharge or separation papers . Active duty personnel usually need a statement of service signed by their commander or other officer. You can apply for a Certificate of Eligibility through the VA website.

Surviving spouses also need to apply for a Certificate of Eligibility. The VA website has information on how surviving spouses can apply for a COE.

Read Also: Who Has The Cheapest Car Loan Rates

Wondering How To Qualify For A Va Home Loan

To qualify for a VA loan, the most important document youll need is your VA COE. However, you must remember that your COE is just one part of your eligibility. Ultimately, who qualifies for a VA loan depends on a number of additional factors as well.

You must also satisfy your lenders financial requirements and make sure the property meets all the MPRs.

Check out our Best Rated VA home loan lenders.

Verify Va Loan Eligibility

The first step to getting a VA Loan is determining if you are eligible. You must meet one of the following basic eligibility requirements:

- You served 90 days of service during wartime.

- You served 181 days during peacetime.

- You are an active-duty military personnel.

- You are the spouse of a veteran who died during their service or later because of it.

A military veterans character of discharge or service must be under other than dishonorable conditions .

Also Check: How To Get Car Loan Off Credit Report

What Credit Score Do You Need For A Va Loan

The VA doesnt impose a minimum credit score, but most lenders do. Most lenders prefer a score of at least 620, though some may approve credit scores in the high 500s. These lenders arent as common, so it helps if youre a good borrower in other respects.

Read more: VA Loan Credit Score Requirements for 2019

Who Are Va Loans Best For

When we think about VA loans, veterans, active military members, and their family members come to mind. But did you know that eight uniformed branches can take advantage of VA loans?

The eight branches that can qualify for VA home loans are:

10 Best VA Home Loans 2022

Compare 2022’s Best VA Home Loans. Federally Insured. 0% Down. Active Duty, Vet & Family. Tap to Compare Rates. No Money Down.

Comparing is quick, easy, and free!

- The U.S. Public Health Service

- The National Oceanic and Atmospheric Administration

But, when are VA loans a wise choice?

VA mortgages might be the best choice if you dont have enough funds to make a downpayment or you can qualify at a comparatively lower interest rate.

Don’t Miss: How To Get 10000 Loan Instantly

What Happens After I Apply

You can start a VA loan application in just a few minutes. But the full loan process generally takes about 30-45 days on average.

After the initial application, your mortgage continues through the underwriting process. This is when your lender takes a closer look at your credit report and supporting documentation. It also evaluates the property to ensure your new home is a safe investment.

The underwriting process

As the home buyer, you can request a home inspection at this time. An inspection isnt required, but its highly recommended to uncover costly hidden problems.

In your purchase agreement, you can include a clause that states the sale is subject to a satisfactory home inspection. If the home inspection report reveals issues, you can ask the seller to fix these issues before proceeding with the mortgage loan.

A home appraisal is required by mortgage lenders. This involves a third-party appraiser visiting the property and estimating its value. As a general rule of thumb, you cant borrow more than a property is worth.

If the home appraises for less than the purchase price, youll have to pay the difference out-of-pocket or renegotiate the sales price with the seller.

The underwriting process also involves a title search to look for potential title issues.

Finally, the underwriter will review your income, assets, and debts before issuing a final approval and scheduling a closing date.

Final approval and closing

A sample of your closing costs include:

Requirements For Other Beneficiaries

Heres a list of documents youll need, depending upon your service type.

- Current/Former Activated National Guard/Reservist DD Form 214

- Current Non-Activated National Guard/Reservist Statement of service

- Discharged National Guard NGB Form 22 and 23.

- Discharged Army Reserve DARP Form FM 249-2E or ARPC Form 606-E

- Discharged Navy Reserve NRPC 1070-124

- Discharged Air Force Reserve AF 526

- Discharged Marine Corps Reserve NAVMC HQ509 or NAVMC 798

- Discharged Coast Guard Reserve CG 4174 or 4175

Recommended Reading: How To Ask For Student Loan Forgiveness

What Is The Va Guarantee

The US Department of Veterans Affairs guarantees a certain amount of the loan. This means that if a borrower defaults in any way on paying back the loan, the department will pay back a certain amount to the lender, depending upon your VA loan entitlement.

This VA guarantee makes it easy for lenders to provide mortgages at lower interest rates.

How To Close On A Va Loan

When you apply for a VA loan, you must meet certain requirements. These requirements include owning a safe, structurally sound, and clean primary residence. A mortgage lender will assess your finances and order a VA appraisal to determine whether or not your home meets these requirements. Once the appraisal has been approved, closing on the loan can begin.

Don’t Miss: How To Cancel Zoca Loan

Va Loan Credit And Income Eligibility

The VA doesnt set a minimum credit score requirement for a VA loan. However, some lenders may only approve borrowers with a credit score of 620 or higher. To be eligible for a VA loan, your income must also be consistent and stable. You need to provide your most recent pay stubs, tax returns from the last two years, and information about other income sources

How Do I Request A Coe

You can request a COE through your lender or by mail.

Through your lender

Your lender may be able to use an online system to get your COE. Ask your lender about this option.

To request a COE by mail, fill out a Request for a Certificate of Eligibility and mail it to the address for your regional loan center. You can find the address on the last page of the form. Please note that mail requests may take longer than requesting a COE through your lender.

Recommended Reading: Will Ally Refinance My Auto Loan

Car Title Loans In Burke Virginia

When it comes to the monthly expenditure, costs in America are not the same. With inflation and unemployment, the situation is constantly changing. New obstacles appear regularly and your budget is constantly sailing on strong waves.

Thus, when a lot of things happen in your month and your bills exceed your budget, the first thing that comes to mind is to find a quick and easy way to borrow more money and cover all the unexpected expenses.

Usually, when people think about short-term loans, the most common options are payday loans and auto equity loans, but the short repayment period of payday loans creates financial stress for many people.

Getting a personal loan from auto loan companies like Montana Capital Car Title Loans is a better option. With their cheap, easy, and streamlined cash loans, anyone in Burke, VA can get short-term financing without worrying about their credit score.1

So, if you are going through hard times and you have a car by your side, you can consult our team to know more about these secured personal loans and get yourself funded.

File Your Application And Submit Your Documentation

Fill out your chosen VA lender’s full application and begin submitting your financial documentation. They’ll need:

- Your bank statements.

- Recent W-2s and pay stubs to prove your income.

It’s best if you have these gathered and organized before applying so this step doesn’t slow you down or delay your purchase.

Also Check: Best Credit Union For Car Loan

Learn More About Eligibility And Va Loan Applications

VA loans are a great way for veterans, military personnel, and surviving spouses who qualify to buy or refinance a home. The benefits of VA loans include 0% down payments, no mortgage insurance, flexible credit scores, and competitive interest rates.

How you apply for a VA loan is similar to the way you apply for other types of mortgages. There are some differences, however. Read on to learn more about how to apply for a VA loan!

Service During Peace Time

Anyone serving from July 26, 1947 June 26, 1950 and February 1, 1955 August 4, 1964, those enlisted from May 8, 1975 September 7, 1980, and Officers from May 8, 1975 October 16, 1981 need to have served at least 181 days of continuous active duty without a dishonorable discharge, or less than the 181 days if due to a service-connected disability.

If you were separated from service after September 7, 1980 :

1. 24 months of continuous active duty with other than dishonorable discharge

2. At least 181 days or completed full term of active duty with other than dishonorable discharge

3. At least 181 days of active duty and discharged for hardship, convenience of the Government, early out, a RIF , or compensable service-connected disability

4. Less than 181 days active duty is allowable if discharged for a service-connected disability

5. If you meet the service minimums, you are entitled to the VA loan benefit.

You May Like: How Do I Get Out Of Car Loan

Necessities To Get Approved For Title Loans In Burke Va

- Applicants must be over 18 years of age and have a valid ID to prove their eligibility.

- If you are residing in Burke and seeking a title loan, you must provide proper documents of address in the city.

- Candidates must prove their identity as US citizens and must present a valid government-issued photo ID with clear credentials.

- Applicants must also submit a clean eligible vehicle title with no liens registered in their name.

- Lastly, candidates need to present some proof of having consistent and reliable earnings.

What Is The Va Loan Limit

The VA home loan limit is the maximum amount an applicant can borrow without making a downpayment. However, an applicant with full entitlement is not restricted to any VA loan limits, meaning they can borrow as much as they qualify for.

What is entitlement?

Remember when we said that the VA will pay a certain amount to the lenders if the borrower defaults in any way?

This certain amount is called entitlementit can be either $36000 or 25% of the loan amount. A borrower who has not used their VA loan benefits or has repaid their previous loan fully has full-entitlement.

Also Check: How To Apply For Student Loan Deferment

% Loan To Equity Value

You dont need any equity to refinance your VA loan into a lower rate or take cash out in most cases. In fact, with a VA Streamline loan, you can refinance up to 120% of your homes value for changing your term or lowering your rate. This means you can refinance even if you owe more on your home than its worth.

You’ll Need This Information:

- Social Security numbers for you, your spouse, and your qualified dependents

- Your military discharge papers

- Insurance card information for all insurance companies that cover you, including any coverage provided through a spouse or significant other. This includes Medicare, private insurance, or insurance from your employer.

- Gross household income from the previous calendar year for you, your spouse, and your dependents. This includes income from a job and any other sources. Gross household income is your income before taxes and any other deductions.

- Your deductible expenses for the past year. These include certain health care and education costs.

Note: You don’t have to tell us about your income and expenses when you apply. But if youre not eligible based on other factors, well need this information to decide on your application.

Were sorry. Something went wrong when we tried to load your saved application.

Llene la solicitud para Beneficions de Salud .Usted o alguien con poder legal para representarlo tiene que firmar la forma, e incluir la fecha en que fué firmada.

- Si esta usando un poder legal, tendra que incluir una copia de la forma con su solicitud.

- Si firma con una X, 2 personas que usted conoce tienen que tambien firmar acertando que lo vieron firmar la forma.

Puede mandar su solicitud por correo a esta dirección:

Health Eligibility Center2957 Clairmont Rd., Suite 200Atlanta, GA 30329

Recommended Reading: How Do Home Loan Interest Rates Work