What Types Of Loans Are Eligible

Previously, only payments on Direct Loans and Direct Consolidation Loans could count toward the 120 qualifying payments for forgiveness. Payments made on loans from the Federal Family Education Loan program and the Federal Perkins Loan program were not eligible. You can consolidate these loans into Direct Consolidation Loans, but any previous payments would not carry over.

Under TEPSLF, FFEL and Perkins loans still must be consolidated into Direct loans. However, payments that were made before consolidation on these loans will now count toward the required payments for PSLF. This change will affect payments retroactive to October 1, 2007. ED estimates that the average borrower could receive 23 additional qualifying payments.

If I Qualify What Steps Do I Need To Take

Changes to the loan forgiveness program will take place in two parts.

The agency will first loosen some of the rules that had prevented eligible borrowers from discharging their loans, via a limited waiver. The government, for example, will allow payments on any of a person’s loans to count toward the total number required for forgiveness.

The Public Service Loan Forgiveness waiver will be available to borrowers who have direct loans, Federal Family Education Loans and Perkins Loans.

Parent PLUS loans are not eligible under the limited waiver.

The department said it would automatically credit borrowers who already have direct loans and have proved they work in an eligible field. Others who haven’t enrolled in the program or have ineligible federal loans will have to apply for forgiveness, which may require them to consolidate their loans. Borrowers will have until October 2022 to apply.

To find out more about loan consolidation, visit StudentAid.gov/Manage-Loans/Consolidation.

The Education Department also plans to review all Public Service Loan Forgiveness applications that had been denied and to give federal employees automatic credit toward forgiveness.

Other changes will come about more slowly via regulations made by “rule-making,” a lengthy and complicated bureaucratic back-and-forth between the government and other stakeholders.

For more information, visit StudentAid.gov/PSLFWaiver.

What Is Public Service Loan Forgiveness How Did It Originate

The Public Service Loan Forgiveness is a program that was launched in 2007 in an effort to steer more college graduates into public service. As long as they made 10 years of payments on their federal student loans, the program promised to erase the remainder.

The program, however, has proved anything but forgiving. Before Wednesdays announcement, only 16,000 borrowers had seen their debt forgiven via the program, according to the Education Department. About 1.3 million people are trying to have their debts discharged through the program.

One of the most problematic pieces of Public Service Loan Forgiveness: Many borrowers had the wrong type of loan and didn’t realize they weren’t eligible for relief.

When the loan forgiveness program was first introduced, many of the loans offered from the federal government were Family Federal Education Loans , or loans made through private entities but insured by the federal government.

The government stopped offering those loans in 2010 and now relies on direct loans the kind eligible for forgiveness. The Education Department said about 60% of borrowers with an approved employer hold FFEL loans.

You May Like: Can I Refinance My Car Loan With The Same Lender

Tax Consequences From Student Loan Forgiveness

It’s important to note that while these “secret” student loan forgiveness options could be helpful to some borrowers, for others they may result in tax consequences .

However, President Biden recently signed the American Recovery Act, which makes all loan discharge and student loan forgiveness, regardless of loan type or program, tax free. This is in effect through December 31, 2025. State taxes may vary, so the information below may still apply for your state tax return.

What happens is the forgiven amount of the student loan is added to the borrowers taxable income for the year. So, if you had $50,000 in student loans forgiven under these repayment plans, it is considered income. If you made $35,000 working, your total income for the year would now be $85,000. The result? A higher tax bill.

However, for many borrowers, this tax bill is much more manageable than the original debt itself, so the plan makes sense. Using a very simple example, here is what the tax bill will look like in both scenarios:

As you can see, with these repayment plans, you’ll owe an additional $11,377 in Federal Income Tax in the year you do it. However, that’s cheaper than paying the original $50,000 plus interest. Furthermore, there are options to work out a repayment plan with the IRS if you need to, which may also be helpful in your situation.

Student Loan Discharge Options

There are also ways to get your student loans discharged in some circumstances. We consider student loan discharged to be a little bit different than forgiveness, both due to the nature of the way the loan is eliminated and the potential taxability surrounding it.

There are various discharge options you may qualify for.

Read Also: What Car Loan Can I Afford Calculator

Who Is Eligible For Student Loan Forgiveness

The government previously restricted eligibility for the Public Service Loan Forgiveness program to only certain types of federal student loans and specific repayment plans.

However, through October 2022, borrowers who have made 10 years worth of payments while in a qualifying job such as positions in federal, state or local governments, a nonprofit organization or the U.S. military will now be eligible for loan relief no matter what kind of federal loan or repayment plan they have.

Past loan payments that were previously ineligible will now count, moving some borrowers closer to forgiveness. That is expected to especially help those borrowers with Federal Family Education Loans.

Among other changes, the department will allow military members to count time on active duty toward the 10 years, even if they put a pause on making their payments during that time.

Navy Student Loan Repayment Program

The Navy Student Loan Repayment Program is one of several Navy enlistment education incentive programs designed to pay federally guaranteed student loans through three annual payments during a Sailor’s first three years of service.

You must sign up for this program when you enlist, and your recruiter must include this program in your recruiting paperwork.

You can learn more about this program here.

Recommended Reading: Fha Loan Limits Fort Bend County

Whose Debt Has Been Forgiven

Since Biden took office in January, the administration has extended targeted relief to specific student loan borrowers rather than broad forgiveness for all. The total amount of loan discharges approved since January reached $9.5 billion as of August, affecting more than 563,000 borrowers, the Department of Education says.

Forgiveness so far has come through changes to rules, including:

-

$1.5 billion in relief with borrower defense debt cancellation, including through full relief for approved claims and expanded eligibility.

-

Loan discharges totaling $7.1 billion for 364,000 individuals who qualify as disabled. Data-matching against Social Security and Veterans Affairs data will automatically qualify future recipients.

-

Interest waived retroactively for 47,000 current and former active-duty service members who faced imminent danger or hostile fire pay for the period while they served. Data-matching will automatically qualify future service members for this benefit.

And while no loans were discharged for borrowers who are working toward forgiveness through existing payment programs, the 22 payments they miss during forbearance count toward the total needed to qualify. Public Service Loan Forgiveness, or PSLF, for example, requires 120 on-time payments while borrowers work in a qualifying job before the remaining balance is discharged.

Other Options For Student Loan Forgiveness

If none of the above ways work for you, there are other ways to get your student loans forgiven. Listed below are three situations where student loan forgiveness is possible.

Most people choose an income-based repayment plan instead. Your monthly payments could be as low as $0 and then youll earn forgiveness in 20 to 25 years.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Do I Qualify For Student Loan Forgiveness

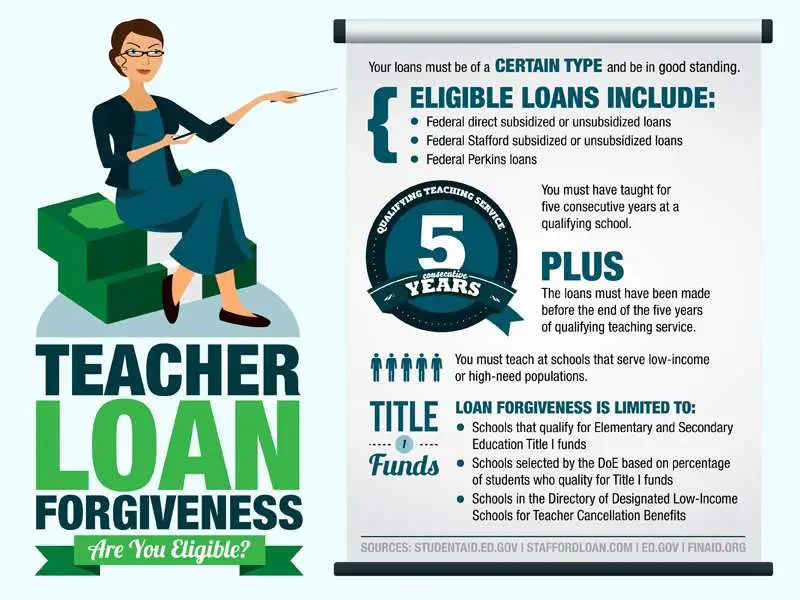

Most options for student loan forgiveness relate to federal student loans only. There is no student loan cancellation for private loans through the federal government. That said, contact your student loan servicer to inquire about private student loan cancellation. Here is a snapshot of how to qualify for popular types of student loan forgiveness:

How Do You Apply For Public Service Loan Forgiveness

Fill out and submit the Employment Certification Form each year, or as you change jobs.

FedLoan Servicing will review your information and let you know if you qualify. They might ask for more information, like pay stubs, W-2s or other documentation.

FedLoan Servicing will let you know how many qualified payments you have made, and how many payments you will need to make until you qualify for forgiveness.

Currently, there is no limit on the amount forgiven under PSLF. The full amount of your federal student loans is eligible for forgiveness.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Students To Service Program

If youre in your last year of medical service, you could qualify for significant loan assistance from the Students to Service Program. This student loan forgiveness program provides up to $120,000. To qualify, youll commit to working as a primary health care provider at an approved site for three years.

Npr Exclusive: Troubled Public Service Loan Forgiveness Program Will Get Overhaul

“Borrowers who devote a decade of their lives to public service should be able to rely on the promise of Public Service Loan Forgiveness,” said U.S. Secretary of Education Miguel Cardona in a press release announcing the changes. “The system has not delivered on that promise to date, but that is about to change for many borrowers who have served their communities and their country.”

Up to this point, to qualify for PSLF, borrowers have had to meet a handful of requirements:

- Working in a public-sector job.

- Making 120 on-time student loan payments.

- Participating in a qualified repayment plan.

- Having a specific type of loan, known as federal Direct Loans.

Now, the department says, it will use its authority to give borrowers a time-limited waiver essentially relaxing several of these rules retroactively, so that previously disqualified loan payments can now be counted toward forgiveness.

The department estimates that this waiver could have an enormous impact on borrowers, with roughly 22,000 immediately eligible to have their loans erased automatically. Another 27,000 borrowers could likewise see their debts disappear if they’re able to prove they were working in public service at the time they made payments that had been declared ineligible. By comparison, 16,000 borrowers have had their loans forgiven under PSLF since the program was created.

Read Also: What To Do If Lender Rejects Your Loan Application

Borrower Defense To Repayment Rule

How to qualify: Your college or university misled you or engaged in other misconduct. You may need to demonstrate that your school violated state law related to your student loans or the educational services provided. With borrower defense to repayment, you can get partial student loan cancellation or total student loan cancellation.

How to apply:Apply for student loan cancellation due to borrower defense to repayment.

Borrower Defense To Repayment

If you believe that the school you attended misled you or engaged in misconduct in violation of certain laws, the federal student loans you obtained to attend that school may be eligible for forgiveness, called Borrower Defense to Repayment. Learn more about the process, eligibility requirements and how you can apply.

Recommended Reading: What Is The Commitment Fee On Mortgage Loan

Not Eligible For Total And Permanent Disability

If you believe you qualify for one of the programs other than the Total and Permanent Disability Discharge, complete and submit a loan forgiveness, cancellation, or discharge application form.

All forms are in Portable Document Format . In order to view PDF files, you must first download the free Acrobat Reader software. Detailed instructions for downloading and installing the Acrobat Reader are located on the Adobe website.

Federal Employee Student Loan Repayment Program

The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency.

This plan allows Federal agencies to make payments to the loan holder of up to a maximum of $10,000 for an employee in a calendar year and a total of not more than $60,000 for any one employee.

It’s important to note that an employee receiving this benefit must sign a service agreement to remain in the service of the paying agency for a period of at least 3 years.

An employee must reimburse the paying agency for all benefits received if he or she is separated voluntarily or separated involuntarily for misconduct, unacceptable performance, or a negative suitability determination under 5 CFR part 731. In addition, an employee must maintain an acceptable level of performance in order to continue to receive repayment benefits.

Furthermore, you must sign up for this program when you’re hired. You can’t go back to your HR department after you’re already employed and ask for it.

You can learn more about this program here.

Also Check: How Do I Find Out My Auto Loan Account Number

Broad Forgiveness Is In Limbo

Although Biden has voiced support for broad student loan forgiveness, he has not yet offered a specific proposal or amount. Depending upon pending legal interpretation, Biden could use executive authority to cancel debt or ask that Congress pass a bill doing so.

Members of Congress have urged Biden to cancel $50,000 in debt per borrower, but the president has reiterated that if he used his authority for broad loan forgiveness, it would not be for more than $10,000 per borrower.

“I expect that any forgiveness issued by Biden, if any, will not be unilateral amongst all student loan borrowers,” Jan Miller, president of Miller Student Loan Consulting, said in an email. “The only way broad forgiveness for all is happening is if Biden makes it happen via executive order, … Biden hasn’t been very keen on forgiveness from the start, so I suspect the chances are low.”

No provision in Bidens 2022 budget proposal included broad student loan forgiveness, lessening the odds it will become reality. He had proposed forgiveness in the following instances during his presidential campaign:

-

If you attended a public college or university. Attendees of private historically Black colleges and universities and additional minority-serving institutions would also be eligible.

-

If you used the loans for undergraduate tuition.

-

If you earn less than $125,000. Bidens plan references a phaseout of this benefit but does not offer further details.

Student Loans: Whats Next

This wont be the last of student loan forgiveness. Some believe that student loan forgiveness is still alive. The Biden administration plans to help more student loan borrowers get student loan relief through student loan forgiveness. However, dont expect wide-scale student loan cancellation in the near-term. Biden has been focused on targeted student loan cancellation, which focuses on specific groups of student loan borrowers, including those who fall in each of these categories. In the meantime, its essential that you know that student loan relief from the Covid-19 pandemic will end permanently on January 31, 2022. This means you must be prepared to start paying student loans again beginning February 1, 2022. Make sure you understand all your options for student loan repayment now so that youre fully prepared in advance.

Make sure you know these popular ways to save money with your student loans:

You May Like: Does Va Loan Work For Manufactured Homes

Who Is Eligible For President Biden Student Loan Forgiveness

On October 6, 2021, the Department of Education , under the Biden administration, announced temporary changes to the Public Service Loan Forgiveness program called Temporary Expanded Public Service Loan Forgiveness . With these changes, the ED intends to make more people eligible for PSLF. In fact, ED estimates that 550,000 federal student loan borrowers could receive credit for payments that were previously ineligible. Continue reading to learn if you are eligible for Biden student loan forgiveness!

Laurel Taylor: $10000 Would Be Great But Dont Count On It

Based on all the relief that student borrowers have been given in the last year, there will be some debt forgiveness, according to a former Google executive who founded a student loan repayment platform. The question is, how much?

I think the $10,000 in forgiveness is likely, but Im cautious about anything more than that, says Laurel Taylor, CEO and founder of FutureFuel.io.

Even forgiving just $10,000 in student debt would completely eliminate student loans for about 16 million people. It would make a huge difference, especially for those who are most likely to default, Taylor says.

But no borrower should depend on that possibility, Taylor cautions: it might not pass anytime soon, or at all. Biden is examining whether he has the executive authority, but the bottom line is that there is a lot of confusion. Thats what were seeing on our platform when our users are engaging with their student debt, says Taylor.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Is There More Student Loan Forgiveness Coming

Part of President Joe Bidens campaign pitch was that he was going to offer some sort of forgiveness to student loan borrowers, but as of April 2021, Biden hasnt sorted that question out.

He told a February CNN Town Hall meeting that Im prepared to write off a $10,000 debt, but not $50,000, but has not followed up on that with any legislative proposal.

Instead, a month later, he asked Education Secretary Miguel Cardon to prepare a report that details a presidents authority to cancel $50,000 in student loan debt without approval from Congress.

According to student loan expert Mark Kantrowitz, the $10,000 cancellation would wipe out all student loan debt for about 14.5 million borrowers. The $50,000 cancellation would erase debt for about 36 million borrowers.

One thing to be aware of is that currently, whatever amount of loan is forgiven is counted as taxable income. That may change as new legislation comes out and possibly changes loan forgiveness programs.