How Does Bankruptcy Affect Parent Plus Loan Eligibility

Filing bankruptcy does not automatically stop you or your spouse from borrowing a Parent PLUS Loan. Federal law prohibits the Department of Education from denying you access to Federal Student Aid because you filed bankruptcy or are currently in bankruptcy. 11 USC § 525.

However, the Higher Education Act allows them to deny your loan application if you have an “adverse credit history.” An adverse credit history includes current delinquency of 90 or more days on any debt or a “default determination, bankruptcy discharge, foreclosure, repossession, tax lien, wage garnishment, or write-off of a Title IV debt” within the last five years.

Start Planning Now For Handling A Parent Plus Loan In Retirement

Because there is no Parent PLUS loan forgiveness in retirement, you need to start planning now. Whether youre in retirement already, or whether youre a few years out, carefully consider whether consolidating or refinancing a Parent PLUS loan might be the right move for you.

If youre able to reduce your monthly payments and invest at least some of the difference, it could help you improve your cash flow and grow your nest egg so that the debt isnt weighing on you as heavily.

Parent Plus Loan Repayment For Borrowers On Social Security

Repayment of student debt is difficult if you are living on social security. However, low payments and student loan forgiveness are both possibilities.

One of the fastest-growing segments of student loan borrowers is senior citizens. Many seniors worry that Parent PLUS loans will consume the social security checks they need to survive.

Some face huge bills and major sacrifices. Others, despite their best efforts, find their social security checks garnished due to student loans.

The good news for student loan borrowers living on social security is that if they take the right steps, the odds are pretty good that they may never have to make a student loan payment again.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Look Into Student Loan Forgiveness

As with the ICR plan, parents can also qualify for the Public Service Loan Forgiveness program, PSLF for short, if they consolidate their loans through the Direct Loan Consolidation program.

With PSLF, you can obtain forgiveness of the full balance of your student loans if you meet the following criteria:

- Work full-time for a qualifying employer, which includes government organizations at any level and not-for-profit 501 organizations. Volunteers for AmeriCorps and Peace Corps are also eligible.

- Get on an income-driven repayment plan for parents, thats the ICR plan.

- Make 120 qualifying monthly payments.

With this type of forgiveness, itll take about 10 years, which is 40% the amount of time required to get forgiveness through the ICR plan.

Parent Plus Loan Forgiveness With Public Service Loan Forgiveness

While ICR is a good fit for some, the 25-year timeline can be hard to swallow. Another option through the federal government is the PSLF program. Parents who work full-time for certain government entities or nonprofits for 10 years are then eligible for loan forgiveness.

Borrowers need to be on an income-driven repayment plan to qualify for PSLF, so parents will still need to first apply for a Direct Consolidation Loan, and then apply for ICR. Once approved for the ICR Plan, submit the PSLF Employment Certification form.

This repayment strategy is an excellent fit for parents who already have made a career in a PSLF qualifying position or industry.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Options If Your Parent Plus Loan Is Denied

Not everyone will qualify for a parent PLUS loan, but if youre denied you can try these alternatives:

- Get an endorser for your Parent PLUS Loan. This is equivalent to a co-signer: someone with non-adverse credit who agrees to repay the loan if you dont.

- Document extenuating circumstances. Some examples of extenuating circumstances: adverse information thats incorrect, older than reported, or for accounts that are part of a bankruptcy settlement or otherwise resolved. Start the credit appeal process to provide proof of your extenuating circumstances. Youll also need to complete PLUS credit counseling.

If these steps dont work, and your parent PLUS loan is denied, even that can have an upside. Students whose parents cant get PLUS loans can gain access to more federal student loans.

A dependent first-year student can only borrow up to $5,500 in federal student loans per school year, for example. But that limit goes up to $9,500 if the students parents were denied PLUS Loans.

Wait For Loan Forgiveness

Like other federal student loans, Parent PLUS Loans can qualify for different types of forgiveness programs. The two most common forgiveness programs for parents are the Public Service Loan Forgiveness Program and Income-Driven Repayment Forgiveness.

Under the PSLF Program, parents who work in public service can have their loans forgiveness after 10 years of making qualifying payments. If you’re interested in this option, be sure to read up on the PSLF eligibility requirements.

For those who don’t work for the government or a nonprofit, you can get your student loan debt forgiven after 25 years of payments. The income-contingent repayment plan offers parents that have Direct Consolidation Loans forgiveness after they make 300 monthly payments. The drawback with this option is that you’ll have to pay taxes on the amount forgiven.

Recommended Reading: Car Refinance Rates Usaa

Newssearch Your School: Put Your College Through A Financial Stress Test

Unlike student loans, with Parent Plus, its difficult to get a payment plan based on a familys income. That means that if a parent loses a job or suffers a significant pay cut they may be stuck with monthly bills that they cannot afford.

More than 1 in 8 parents will default on the loans, according to the most recent government estimates. Nonetheless, colleges and universities continue to offer parents the loans, and Congress allows them to borrow, even when administrators can see from a familys financial records that they have little possibility of repaying them.

For more of NBC News’ in-depth reporting,

Last spring, in the face of the coronavirus pandemic-induced economic meltdown, the federal government allowed students and parents with college loans to temporarily stop making payments without accruing interest. But that reprieve is scheduled to end on Dec. 31. Neither President Donald Trump nor President-elect Joe Biden has addressed the possibility of extending the deadline.

Policy experts only expect the situation to get worse for Plus borrowers during the pandemic. Millions of Americans have lost their jobs or have had their hours cut this year, and states face gaping budget holes, which in the past have led to huge cuts to higher education. The result has been spiking tuition, which in turn has led to increased student loans.

There is currently no limit on the amount parents can borrow, as long as the money is used for college-related expenses.

Parent Plus Student Loan Forgiveness

Non-profit private colleges now charge a minimum of $46,950 for fees, room and tuition and these costs are skyrocketing by the day.

Many parents at this point will jump in to save the day. Their dream is for their child to have a brighter future than they have had. Parents know this future can be built on the bedrock of solid tertiary education. So, some will tap on home equity and raid their retirement funds. But if you do not have such assets, you will go into private debt or get a Federal Parent Plus Loan.

The outcome of these decisions has a very bleak outlook for you. While a student can get a student loan, a parent on the verge of retirement has no chances of getting a retirement loan.

So most parents getting into debt to finance their childrens education are most probably going to be a financial burden to them in the future. Unfortunately, research shows that Millennials have slim chances of out-earning their hard-working parents, so taking on that debt yourself might be an impossible task.

But here is how you can fight back:Most parents getting parent plus loans debt to finance their childrens education are likely going to be face a financial burden to them in the future.

Don’t Miss: Will Va Loans Cover Manufactured Homes

Can You Gift Money To Help Pay Off Your Childs Student Loans

One way you can help your children pay off their student loans is by gifting them money to make payments. Youll want to be clear that the money is to be used for student loan repayment and nothing else.

You can gift small amounts for birthdays and holidays, as well as if you get a tax refund. If youre looking at gifting a sizable amount, though, be aware of the gift tax. You can gift up to $15,000 without any issues, but if you go over that amount, your gift will count as part of your annual exclusion. Youll have to file a return and fill out Form 709 with the IRS. The good news? Youll only be hit with a gift tax after you reach your lifetime limit of $11.4 million.

Theres some confusion as parents can avoid the gift tax by making applicable payments for higher education, such as tuition, directly to the university. However, the current tax code doesnt consider student loan payments as part of those qualified expenses.

Public Service Loan Forgiveness For Parent Plus Loans

Parent borrowers may be eligible for Public Service Loan Forgiveness after making 120 qualifying payments .

Parent PLUS loans are eligible if they are in the Direct Loan program or included in a Federal Direct Consolidation Loan. The borrower must work full-time in a qualifying public service job.

Eligible repayment plans include standard repayment and income-driven repayment plans . If a borrower repays their loans under the standard repayment plan for 10 years, there will be nothing left to forgive. So, the borrower will need to repay their loans in an income-driven repayment plan to earn some forgiveness under public service loan forgiveness.

If a borrower consolidates their Parent PLUS loans into a Federal Direct Consolidation Loan, the consolidation loan will be eligible for income-contingent repayment, as noted above.

Another option is the Temporary Expanded Public Service Loan Forgiveness program, which was enacted by the Consolidated Appropriations Act, 2018 . A Federal Direct Consolidation Loan that repaid a Federal PLUS Loan is eligible for TEPSLF if some or all of the 120 qualifying payments were made under a graduated repayment or extended repayment plan, provided that the last year of payments were at least as much as the borrower would have paid under an income-driven repayment plan.

Read Also: Usaa Car Loan Apr

Featured Student Loan Provider

Citizens

Citizens offers loan options for undergrad, grad students and parents with competitive rates, flexible terms and interest rate discounts.

Multi-year approval option available for qualified applicants. Multi-Year approval provides an easy way to secure funding for additional years in school without completing a full application and impacting your credit score each year.

Choose between our student or parent loan options with competitive interest rates and flexible payment terms.

Limits

Loans from $1,000 to $295,000 depending on education level.

Rates

Variable rates as low as 1.03% APR* and fixed rates as low as 3.49% APR* including all available discounts.

Fees and Terms

No application or origination fees. 5, 10, or 15 year options available. Rate and Repayment Examples.

Please be advised that the operator of this site accepts advertising compensation from companies that appear on the site, and such compensation impacts the location and order in which the companies are presented.

Parent Plus Loan Eligibility Denials And Limits

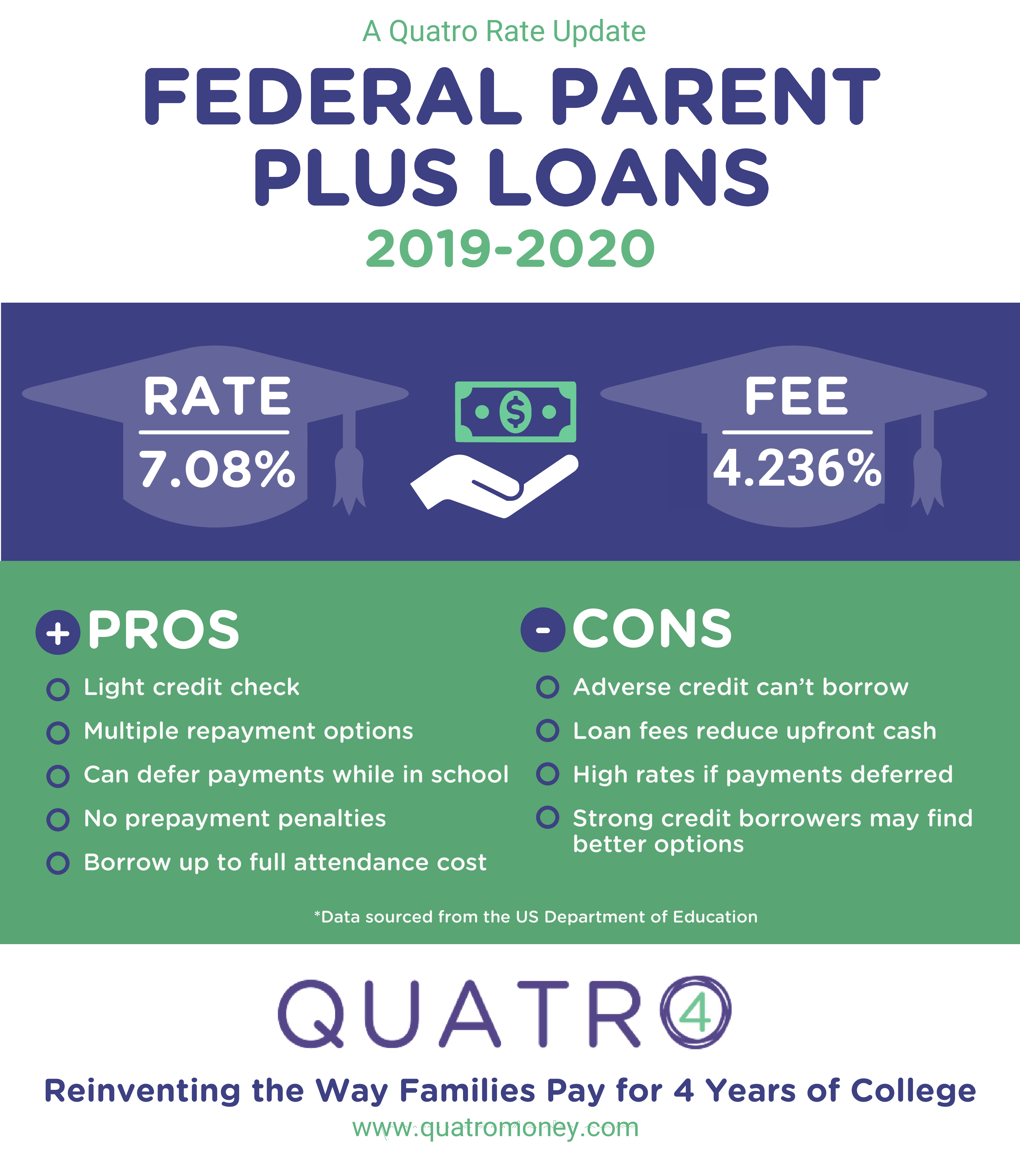

Many parents want to help fund their childs college education. One common way to do this is through the Federal Parent PLUS Loan. Like with other student loans, the Parent PLUS Loan offers advantages to private student loans, including safer repayment terms and the option to enroll in repayment programs. As the name suggests, this loan goes to the parent of a dependent college student and limits how much debt the student will have to take on. But, parents with bad credit may not qualify. Parents should be aware of Parent PLUS Loan eligibility requirements, because a denial can impact their childs ability to finish college and can create more debt for the child. Parents and students also need to evaluate the cost of higher education carefully, because PLUS Loan amounts can be dangerously high at some schools.

You May Like: What Is An Rv Loan

Students Cannot Directly Take Over Parent Plus Loans

According to the U.S. Department of Education, the Parent PLUS loan belongs to the parentno matter who is making the payment each month.

This means that none of the federal consolidation or repayment programs available to the the student will apply to the portion of their debt that is technically owned by the parents.

This can seem like a major bummerare students just stuck carrying debt in their parents name forever until the balance is paid off? Not quite. There are some other options.

Look Into Refinancing Parent Plus Loans

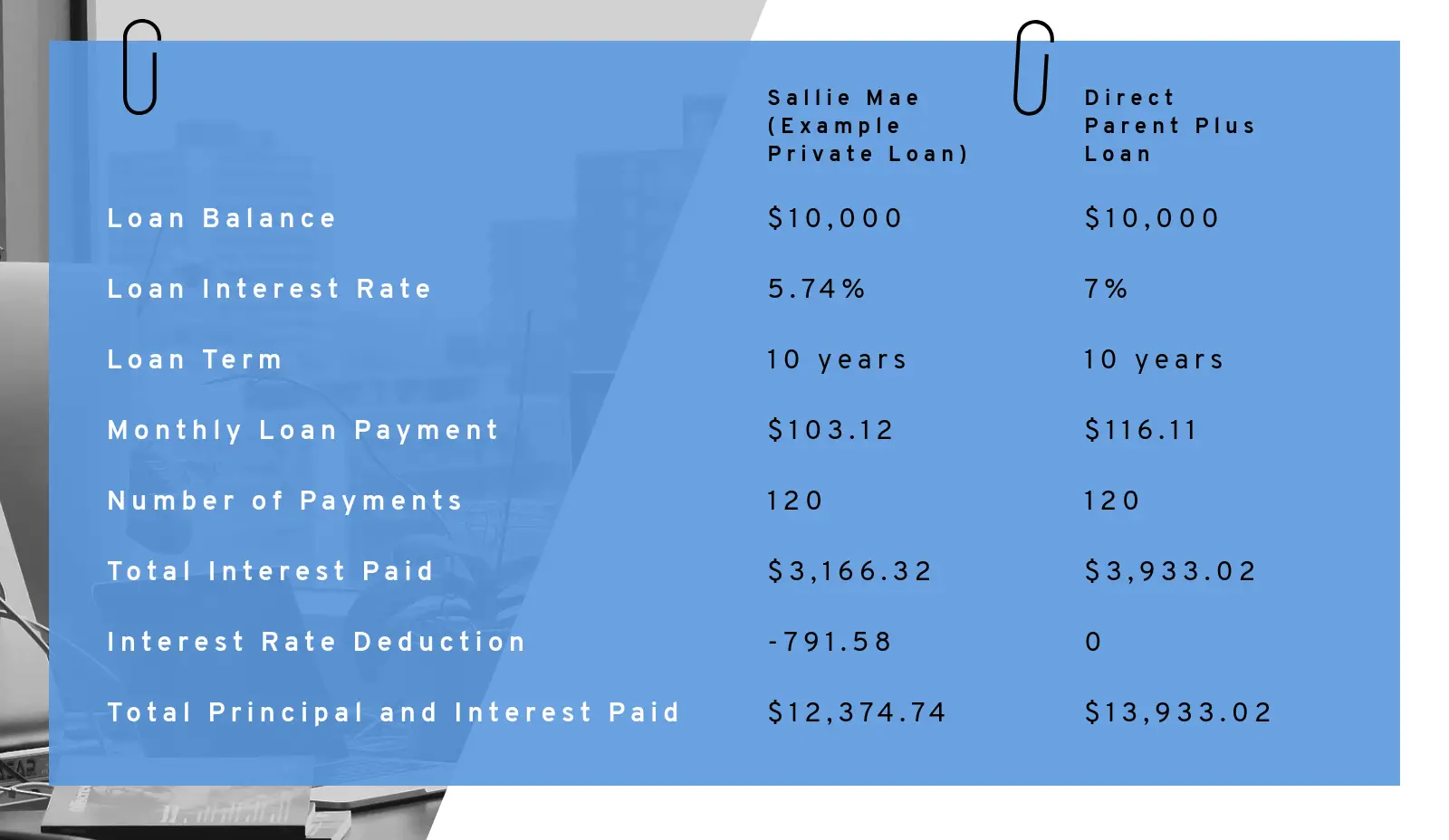

Student loan refinancing can be a good option if you have parent PLUS loans. Through refinancing your student loans with a private lender, you merge all your loans into one and ideally receive a better interest rate.

Considering the high rates for PLUS loans, refinancing could save money and help pay off your loans much faster. Parent PLUS borrowers are often especially attractive candidates for refinancing, as they might have a stronger credit profile and more income than new graduates.

Typically, refinancing companies want you to have a good credit score, stable employment and enough income to pay back your loans. However, when refinancing, you give up federal loan protections, such as payment plan flexibility and the option to pursue an income-driven plan. Depending on your situation, the benefits of refinancing may outweigh the costs.

Another option is to refinance your parent PLUS loans into loans in your childs name, which switches the responsibility to them. This is available through online lenders like Laurel Road and SoFi.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Danger : Plus Loans Aren’t Eligible For Most Income

The federal government offers four different income-driven repayment plans for student loans. They limit monthly payments to a percentage of the student’s discretionary income . If the student makes those payments for a certain number of years , any remaining loan balance will be forgiven.

Parent PLUS loans, however, are eligible for only one of these plans, Income-Contingent Repayment , and only after the parent has consolidated their parent loans into a federal direct consolidation loan. An ICR plan limits payments to no more than 20% of discretionary income, to be paid over a term of 25 yearswhich is a long time horizon for the average parent.

Getting Your Name Off A Cosigned Loan

How To Get Rid Of A Parent Plus Loan Without Paying For It

Even though there are tons of tremendous Federal Student Loan Forgiveness Programs on offer this year, Parent PLUS Loans remain the one type thats far harder to get discharged.

Unfortunately, the Government seems to have taken the opinion that Parents dont deserve the same kinds of benefits that their children have access to, and even though this is one of the fastest growing categories for student loan debt, it doesnt look like any major changes will be introduced as long as President Trump remains in office.

However, while it is difficult to discharge a Parent PLUS Loans, its not impossible, and this page will explain exactly what you need to do to get rid of that debt as quickly and affordably as possible.

Also Check: Does Va Loan Work For Manufactured Homes

Offer To Cosign The Loan

When you transfer Parent PLUS Loan debt to your child, they must meet the student loan refinance companys eligibility requirements. If they havent had the chance to build their income or credit history enough, that may be difficult or even impossible.

However, you could offer to cosign the loan. Cosigning wont release you from your legal obligations while your child will be the primary borrower, if they stop making payments, youre still legally responsible for paying the debt.

As a cosigner, youll also continue to have the debt on your credit reports, which could continue to impact your ability to get credit when you need it.

But going this route can be a temporary solution while your child gets on their feet financially. And if they can afford the monthly payments, it will relieve you of that burden.

When your child is ready, they can refinance the loan again in their name only. Alternatively, some private lenders offer cosigner release, which allows your child to remove you from the loan once they meet certain payment and creditworthiness requirements.

Other Requirements For A Parent Plus Loan

The parent and dependent student must also satisfy the general eligibility requirements for federal student aid and federal student loans.

- Students must be enrolled in school on at least a half-time basis

- Male students must have registered with the Selective Service

- Students and parents must be U.S. citizens or nationals, permanent residents, or eligible noncitizens

- Students and parents cant be in default on a federal student loan

- Parent PLUS Loan proceeds must be used for educational purposes

Read Also: Usaa Auto Loan Rates And Terms

Ask Yourself How You Want To Help Your Child With Loan Repayment

Parent PLUS borrowers face the unique situation of paying for their childs education while trying to manage their own retirement savings. Unfortunately, doing both can spread some borrowers thin.

Whether you have parent PLUS loans or you want to help your children pay back their loans, there are a variety of ways to help without compromising your retirement plans.

Understanding your options, having a plan in place and thinking of you and your child as partners in paying back the loan are ways to ensure that both of your financial futures are protected.

If youre assisting your child with loan repayment, seek the best repayment option.