Is It Smart To Pay Off Student Loans Early

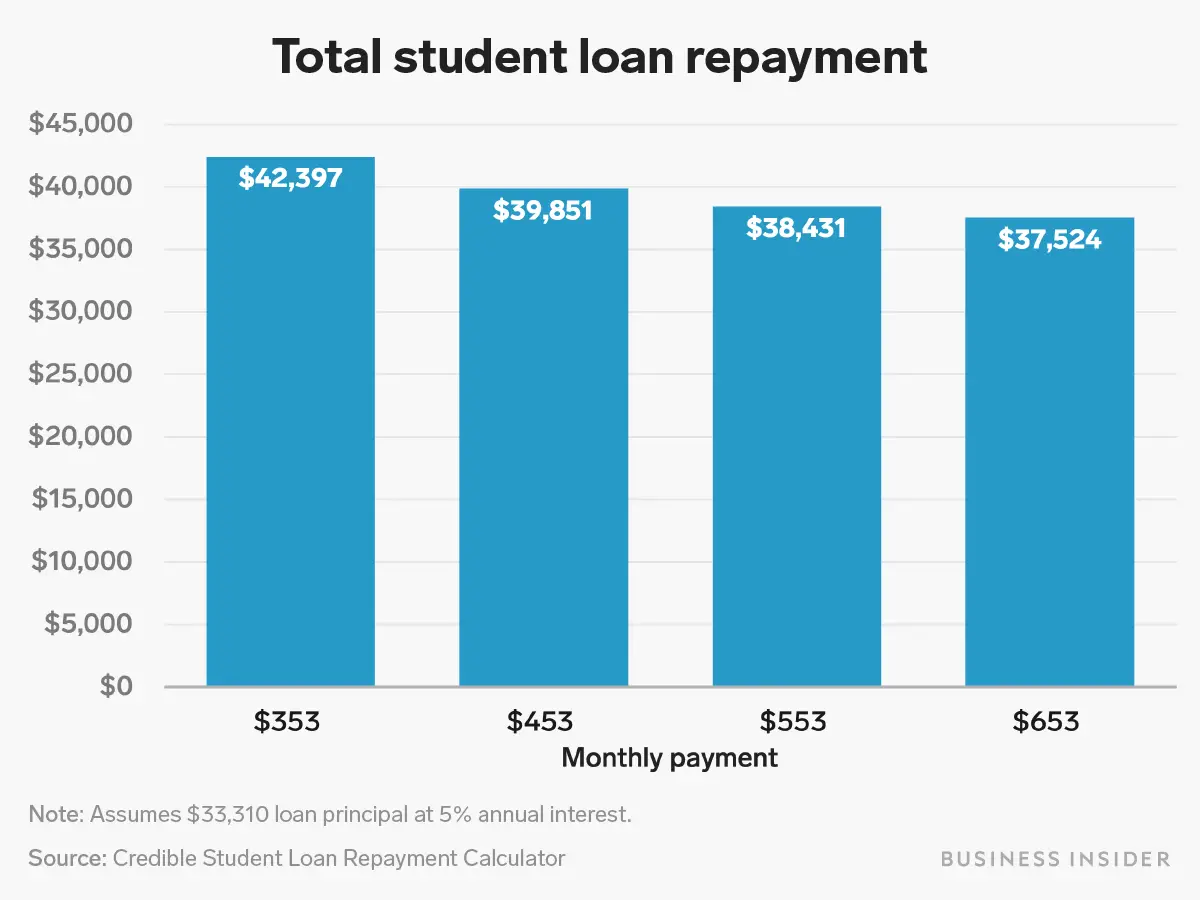

Yes, paying off your student loans early is a good idea. … Paying off your private or federal loans early can help you save thousands over the length of your loan since you’ll be paying less interest. If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans.

Average Medical School Student Loan Payment

- Standard repayment plan $3,533

- Refinance into 10-year loan at 5% $2,912

- Refinance into a 5-year loan at 4% $5,057

With an average medical school debt of $251,600, new doctors must cope with sizable monthly student loan payments. But they typically earn a lot, too, once they have completed their residencies.

If you tried to start paying off your medical school loans right after graduation on the standard 10-year repayment plan, youd be looking at monthly payments of $2,870. Many doctors cant afford to do that, and put their loans in forbearance or enroll in an income-driven repayment plan like REPAYE during residency.

| Repayment plan | |

|---|---|

| 10 years | $361,645 |

| Average monthly payment for $251,600 in medical school debt with a weighted average 6.6% interest rate at graduation. REPAYE estimates based on $56,000 salary during residency, $211,000 after residency. |

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

Don’t Miss: 646 Credit Score Car Loan

Your Student Loan Could Get Written Off Before You’re Done Paying

We can’t stress it enough: very few students will ever pay back the full amount that they owe especially if you have a Plan 2 loan.

If theres even a half-decent chance of your loan being wiped before you’ve cleared it, you could be throwing money away if you make extra voluntary repayments.

You can never predict exactly how much you’ll earn in the future, but there are some useful rules of thumb. If you have the qualifications and drive to pursue a very high-paying career, paying off your loan early could save you money .

If not, don’t put any spare cash towards extra Student Loan repayments put it to better use by building your own savings pot elsewhere.

Repaying Federal Student Loans

![Average Student Loan Payment [2021]: Cost per Month Average Student Loan Payment [2021]: Cost per Month](https://www.understandloans.net/wp-content/uploads/average-student-loan-payment-2021-cost-per-month.png)

A federal student loan is a financial aid program backed by the US Government. There are several types of federal student loans, including both subsidized and unsubsidized loans.

With a subsidized loan, the government pays interest on your behalf while your loans are in deferment, either an in-school deferment, economic hardship deferment, or unemployment deferment.

With an unsubsidized loan, interest is not subsidized, so it will continue to accrue.

Repayment plans for federal student loans are divided into two main categories: traditional repayment plans and four different income-driven repayment plans, which are based on your household income and family size.

Recommended Reading: Va Handbook Manufactured Homes

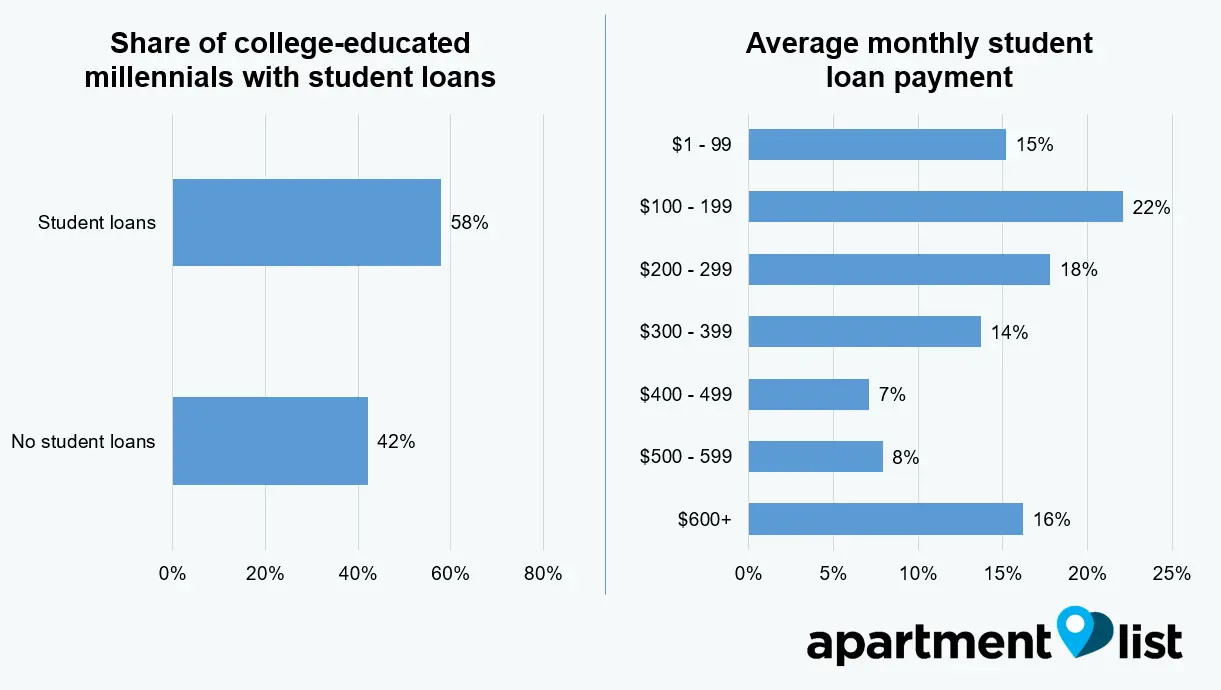

What The Average College Grads Debt Looks Like

Today, bachelors degree recipients with student loans graduate with an average debt of $37,172. Thats up from $20,000 just 13 years ago. And the mean debt for all people with outstanding student loans is $32,731.

To put it in context, we looked at what else you could buy with that sum. Todays average student loan balance could buy a brand new Audi A4, pay for a 141-guest wedding, or score four 50-yard line tickets to the big game. Its also equal to an 18% down payment on a $205,000 house which was the median home value in the U.S. in November 2017.

Other Ways To Make Money

Its tempting to think that a part-time job is the only way to actually earn extra money while at uni. But that couldnt be further from the truth.

There are hundreds of weird and wonderful ways to make money at uni , including setting up your own business, using paid online survey sites and even selling your old stuff.

In fact, there are even a fair few ways to earn free money too. Thats the dream, right?

The moral of the story is: if you have a brainwave and think youve found an ingenious way to make money, go for it! As long as its within the confines of the law, of course

Don’t Miss: What’s Needed To Qualify For A Home Loan

Utilize A Student Loan Repayment Plan

If you have student loan debt from federal student loans, there are quite a few student loan repayment plans that you can implement. The most common is the 10-year standard repayment plan, but there is also the graduated repayment plan or the extended repayment plan.

Other federal student loan repayment plans include income-driven repayment plans, which only require your monthly student loan payments to be a reasonable percentage of your income.

If you have debt from private student loans, there arent as many repayment plans for you to utilize, but you may be able to work something out if you communicate with your lender.

Educational Loan Minimum Monthly Payments

Some educational loans have a minimum monthly payment. Please enter the appropriate figure in the minimum payment field. Enter a higher figure to see how much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment.

Read Also: How Long Does The Sba Loan Take To Process

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Recommended Reading: Does Upstart Allow Co Signers

Will You Owe More Or Less Than The Average Student Loan Payment

Knowing the average college loan payment is interesting, but it’s not as important as knowing how much you will personally have to pay for your student debt.

A number of factors affect the amount of your payment and whether your personal financial obligations will be more or less than the average student loan payment. Here are some of the key considerations that determine what you’ll owe each month on your school loans.

How Much Is Too Much Debt

Its safe to say that going beyond the average loan amount is when you venture into dangerous territory as a borrower.

The more debt you have, the higher your monthly payment is, which means youll start eating into your budget for other living expenses. This is how people get burdened with high payments that they cant afford to make.

Think about it, even doubling the average loan amount , means that your payments have the potential to exceed $800 a month. Thats rent for some students, and frequently, the amount of an entire paycheck for entry-level positions.

While theres no cut and dry number that determines too much debt, these are some questions to ask yourself before you take on more:

- Will your estimated monthly payments be more than you can afford?

- Do you anticipate having trouble finding full time, entry-level position within six months of graduation?

- Is 10-20% of your monthly loan amount going to fit into your budget?

If you feel like taking out additional student loans will leave you in a bad financial situation, dont do it.

Additionally, thanks to interest and fees, the longer it takes you to pay off your student loans, the more youre actually paying on them. Keep that in mind when youre estimating your payments. If you can stick to a loan amount with a lower payment, you might be able to put more of your income towards paying it off faster.

Also Check: Capital One/auto Pre Approval

Ways To Lower Your Federal Student Loan Payment

If youre struggling with your student loan debt or are concerned about any future financial hardship, youre not alone. More than 11% of adult student loan borrowers said they missed at least one payment between January and July 2020, according to the Education Data Initiative.

Thankfully, borrowers who are struggling with their federal student loan payments have multiple options for making them more manageable on a variety of budgets. Income-driven repayment plans, student loan consolidation, and Public Service Loan Forgiveness can lower your federal student loan payments.

Can You Go To Jail For Not Paying Student Loans

Can You Go to Jail for Not Paying Student Loan Debt? You can’t be arrested or sentenced to time behind bars for not paying student loan debt because student loans are considered “civil” debts. This type of debt includes credit card debt and medical bills, and can’t result in an arrest or jail sentence.

You May Like: Can You Refinance With Fha Loan

How To Use This Calculator

Youll get the most accurate results if you enter your loan amounts separately with their precise interest rates, but you can also estimate or use the sample loan amounts and interest rate provided.

You may have a mix of federal and private loans. If you dont know how much you owe, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.

This calculator assumes youll be paying monthly for 10 years once repayment begins, which is the standard term for federal loans and many private loans.

Enter the total amount you borrowed for each loan. You can enter up to three loans for each year youre in school, up to four years. Its possible to include 12 loans total.

Enter the interest rate for each loan amount. Your interest rates will vary depending on whether your loans are federal or private, the year you borrowed and, in some cases, your credit score. Check with your federal loan servicer or your private lender to find out your interest rate.

Interest will accrue daily on unsubsidized federal and private loans while youre in college. The total amount accrued will capitalize and be added to your total loan amount when repayment begins. During repayment, interest will continue to accrue and will be included as part of your monthly bill amount.

Select Yes if you have a subsidized federal loan or No if you have an unsubsidized federal loan or a private loan.

Average Student Loan Payments

An appropriate monthly payment is based on multiple variables. The indebted students income is a significant factor in determining monthly payments. The total debt and interest rate as well as the borrowers repayment timeline may all affect the dollar amount of their monthly payments.

- $393 is the average monthly student loan payment.

- 10% of your gross income should go toward paying off debts according to federal guidelines.

- $393 is 10% of $47,160.

- 36% of income is the maximum amount that should go toward paying off debt according to the same federal guidelines $393 is 36% of $13,100.

- Financial experts and the federal government list 10 years as the ideal timeline for paying off undergraduate student loan debt.

- The mean starting salary for among all new graduates is $55,800.

- 10% of the mean starting salary is $465.

- The most commonly used federal student loans have an interest rate closer to 3%.

- The average debt per borrower is $36,140 the majority of undergraduate borrowers owe less than $30,000.

- The average debt per enrolled student is $30,000. These are the only parameters available for some historical data.

| Monthly Payment |

|---|

| $34,800 |

You May Like: Usaa Vehicle Refinance

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Student Maintenance Loans Guide 2022

The Maintenance Loan will probably be your main source of cash while you’re at uni. But how does it all work? And how much money will you get? Allow us to explain.

Credit: Roman Samborskyi , Bayliss photography Shutterstock

According to our National Student Money Survey, the Maintenance Loan is one of the main sources of money for students while they’re at uni.

So, as you’ll almost certainly be taking one out, it makes sense for you to get clued up on the eligibility criteria, the application process and how big a Maintenance Loan you’ll get, as well as how to pay it back and what to do if your loan isn’t enough.

In trademark Save the Student fashion, we’ve got you covered read on and we’ll answer all of your questions to make sure you get the most out of your Maintenance Loan.

You May Like: Sss Loan Requirements

How To Estimate Your Student Loan Payment

Once you take out a federal or private loan, your loan servicer will be able to provide you with your estimated loan repayment amounts.

Before taking out a student loan, its a good idea to use a student loan calculator to get an estimate of your monthly payment. Simply enter the estimated amount you plan on borrowing, plug in an interest rate, and select a loan term.

For instance, youll be able to see that a $10,000 loan with a 5% interest rate and a standard 10-year repayment term will result in an estimated $106 monthly payment. However, a 6% interest rate for the same loan will increase this amount to $111 per month. That extra $5 per month may not seem like a drastic difference, but over the course of 10 years, itll add nearly $600 in additional interest. This is why its important to always shop for the best student loan rates.

How Do You Get Your Student Loans Forgiven

The U.S. government will currently forgive, cancel, or discharge some or all of an individual’s student loan debt only under a number of specific circumstances. Teachers in low-income schools and public service employees may be eligible for forgiveness of a portion of their debt. People who are disabled may be eligible for discharge of the debt. In August, the U.S. Department of Education said it would cancel $5.8 billion in student loans for borrowers who qualify as having a total and permanent disability.

The Federal Student Aid office indicates that those who think they may qualify for loan forgiveness should contact the student loan servicer for their loans. That is the company that handles the loan payments.

As noted above, a federal emergency relief measure suspended student loan repayments from March 2020, and the deadline has now been moved to May 1, 2022. Collections on payments that are in default also were halted. This is a suspension of repayment, not a cancellation or even a reduction of the debt.

You May Like: Refinance Auto Loan Usaa