Compare Bad Credit Home Loans

Some mortgages are specifically designed to help lower credit applicants get into homes. Here are seven different mortgage options that may work for you:

| Mortgage Type | |

| 500 or 580 | Borrowers with credit scores from 500-620 |

| VA Loan* | |

| Buying a house in a rural area | |

| Conventional Loans | Borrowers with moderate to good credit |

| Freddie Mac Home Possible | |

| Borrowers who dont qualify for a conventional or government-backed loan |

*Each lender may have their own overlays for potentially higher minimum credit scores

Falling Short Of Va Loan Credit Requirements

Potential VA loan borrowers needn’t abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you’re considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If you’re ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: Does The Va Loan Cover Land

Find Out What Va Loan Credit Scores You Need

Having a good credit score can be an important part of getting a VA loan. Thats because lenders like Freedom Mortgage use your credit score to help determine your eligibility for a VA loan and set your interest rate.

Your credit score isnt the only information we use to help us decide whether you qualify for a VA loan. We look at the complete picture of your finances because we are committed to helping veterans, active-duty service members, and their families finance homes with VA loans.

Talk To Freedom Mortgage About Va Loans

Freedom Mortgage was the #1 VA Lender1 in the USA in 2021. To speak with one of our loan advisors about buying or refinancing a home with a VA loan, please visit our Get Started page or call .

1. Inside Mortgage Finance, 2021

Department of Veterans Affairs VA Loan Fact Sheet. Learn more at va.gov.The Consumer Finance Protection Bureau. Learn more at consumerfinance.gov

Last reviewed and updated September 2021 by Freedom Mortgage Corporation

Read Also: What Is My Student Loan Number

Va Loans With No Credit Score And Dti Requirements: High Dti

Many borrowers do not realize that the VA does not have a minimum debt to income ratio requirement. However, many lenders will have VA Overlays on debt to income ratios where they cap it between 41% to 50%. Gustan Cho Associates has gotten approve/eligible per automated underwriting system on VA borrowers with DTI exceeding 60%. As long as borrowers have strong residual income, the automated underwriting system will render an automated approval with higher DTI. Residual Income is very important when it comes to getting an approve/eligible per AUS for higher DTI borrowers. Gustan Cho Associates is one of the few national lenders with no overlays on debt to income ratios on VA Mortgages.

Will A Va Loan Have Funding Fees

Even though the VA loan comes with loads of benefits, you still have to pay a one-time funding fee.This funding fee will vary based on the amount of the down payment and your military category.It is primarily used to offset the cost to taxpayers since there isnt any PMI or down payment required.For Example: Someone in the Air Force who is applying for a VA loan for the first time without putting any money down would pay a different fee than someone else in the armed forces who put money down.If they were a Reservist or National Guard, they would probably pay about a quarter of a percentage point more in funding fees.You can give us a call at to see what your rates would look like or see this article about your VA funding fees.

You May Like: What Does It Mean To Refinance An Auto Loan

Ways To Improve Your Credit Score

In addition to speaking with a lender on how to get approved, work to pay off any debt , avoid getting any new loans or credit cards, and always pay all of your bills on time. Doing so, will increase your credit score over time.

How To Apply For A Va Loan

You can shop around and apply for a VA loan through a lender of your choice once you obtain the VA COE. You will need the COE to confirm you have met the service requirements necessary to get a VA loan. You will need one every time you apply for a VA loan. There are a couple of ways to get yours:

- Apply online through the VAâs eBenefits portal

- Apply by mail

You May Like: How Long Does It Take To Get An Sba Loan

Whats The Minimum Credit Score For Va Home Loan Approval

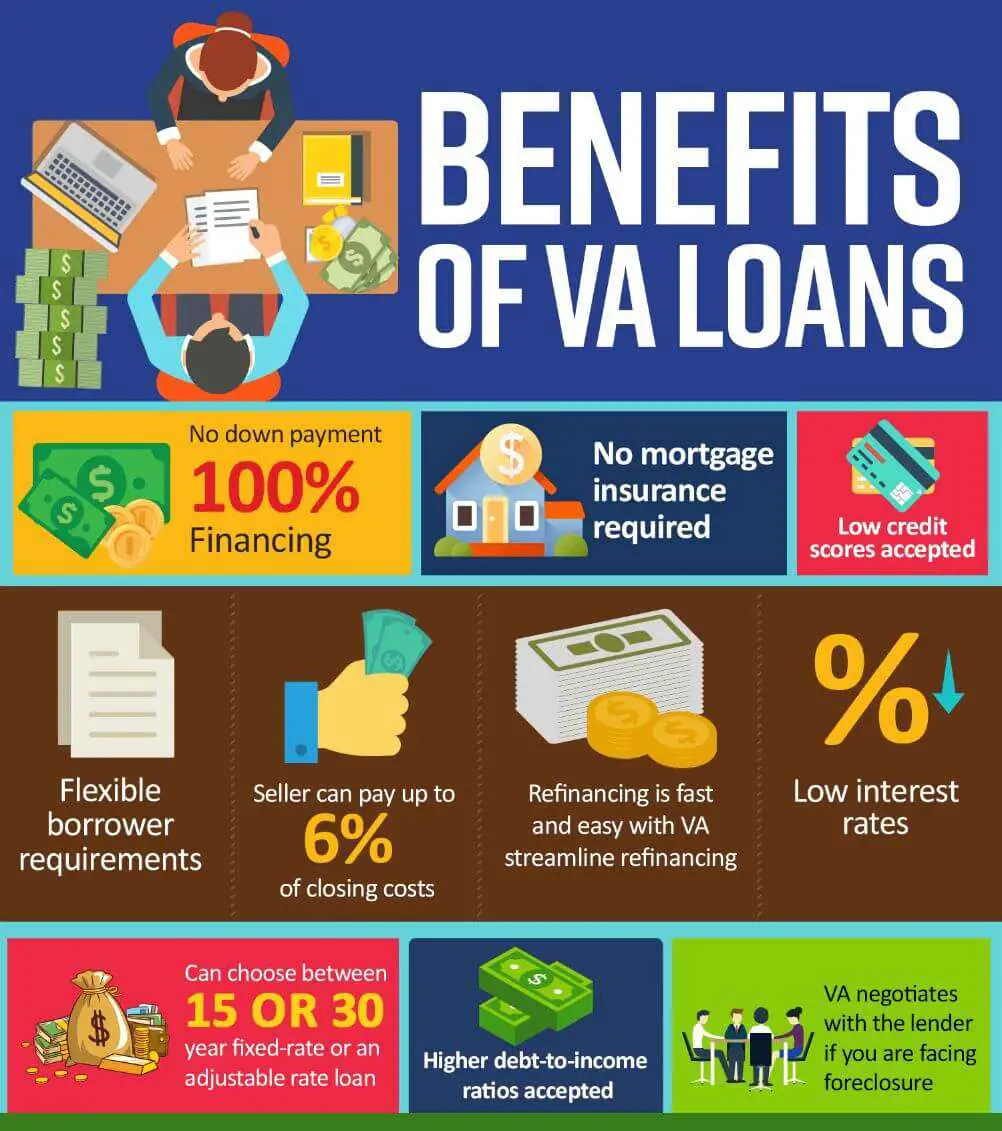

Through the VA home loan program, millions of veterans and service members have become homeowners. VA loans are favored for the following reasons: lower mortgage rates, no PMI required, no down payment necessary, and, to an extent, no minimum credit score requirements.

While the Department of Veteran Affairs does not set a minimum credit score, lenders will have their minimum standard. Read on to understand what this means and how flexible credit score requirements with a VA loan works.

Va Loan Credit Score Under 620

Some mortgage programs have minimum credit score requirements imposed by the government agency that mandates the program. For example, applicants for the FHA loan must have at least 580 to qualify, unless the borrower wants to put down a larger down payment.

Veterans Affairs doesnt establish minimum requirements, but most lenders require a minimum credit score of 640. Nonetheless, there are mortgage lenders that will approve candidates with lower credit scores. The Department of Veteran Affairs doesnt mandate any requirements, so if a lender lowers its standard, its at their discretion.

On the VA eligibility page, the borrowers must meet satisfactory credit, sufficient income, and a valid COE to qualify for a VA guaranteed home loan. Homebuyers with a credit score below 620 should work with a lender to find out whether they qualify and how to bump their credit score. A handful of VA lenders will allow poor credit scores, even below 580, to get approved for a loan.

Your credit score fluctuates, for better or worse, and improving your score can be a long road. Paying your bills, staying on budget, and avoiding high balances on credit cards can help you achieve homeownership. However, that doesnt mean that youre out of luck if you have bad credit.

Contact the Cain Mortgage Team to find out about your eligibility!

Image source: Pixabay

Recommended Reading: How To Cancel Zoca Loan

Can You Get A Better Credit Score

If your credit score is lower than the minimum your lender requires for a VA loan, this does not mean you cannot qualify for a VA loan in the future. You can look for ways to improve your credit score and try again!

Here are some of the factors credit reporting agencies such as Equifax, Experian and TransUnion use to calculate your credit score. Your credit score is influenced by things like

- Payment history. Lenders like to see that you have a record of paying your bills in full and on time. A good payment history can increase your credit score. A history of paying bills late may decrease your score.

- Length of credit history. The length of time of your credit history affects your score. When you have consistently made your payments over a long period of time, this can raise your score.

- Having different types of loans such as credit card, mortgages, and car payments can influence your credit score.

- Bankruptcy. Your credit score can suffer if youve ever filed for bankruptcy. It is possible to improve your score after a bankruptcy and veterans can qualify for a VA loan after bankruptcy too.

- Errors and mistakes. Sometimes your credit report contains mistakes that might lower your credit score. These mistakes can include on-time payments that have been reported as late, incorrect account balances, incorrect credit limits, and more. Contact the credit reporting agencies if you see errors and request that they fix them.

Va Home Loan Requirements

Meeting the requirements for a home loan shift when using your VA benefits.

VA home loans are insured by the U.S. Department of Veterans Affairs. They offer 100% financing and no mortgage insurance, making them a great option for members of the U.S. Armed Forces who serve to protect our security. The Department of Veterans Affairs doesnt issue the loans. Rather, borrowers acquire a loan by applying for a mortgage with a VA-approved lender.

GETTING A VA LOAN

Don’t Miss: How Much Is The Average Student Loan Interest Rate

What Credit Score Do I Need For A Va Loan

The U.S. Department of Veteran’s Affairs doesnt have a minimum credit score requirement. Instead, they have their VA-approved lenders, like PenFed, review the borrower’s entire loan profile that includes creditworthiness. Lenders offering VA loans to borrowers typically have a credit score requirement.

How Your Credit Score Factors Into Your Va Home Loan

Your lender uses your credit score as one factor in determining an interest rate for your mortgage. In most cases, the lower your credit score is, the higher your interest rate will be. For example, a borrower with a 780 credit score might qualify for an interest rate half a percentage point lower than someone with a 650 credit score. An interest rate increase adds to the monthly payment and the overall amount you’ll pay over the life of the loan.

Your credit score also helps the lender determine other loan terms, like the length of the mortgage and whether you qualify for a fixed or adjustable rate.

Read Also: Will Bankruptcy Clear Student Loan Debt

What Credit Score Do You Need For A Va Home Loan

There are lots of benefits that come with VA loans, especially if you have full entitlement no down payment, no mortgage insurance, and no loan limits for qualifying veterans, just to name a few.

Theres also no minimum VA home loan credit score set by the U.S. Department of Veterans Affairs , which insures VA mortgages.

The private lenders who loan those mortgages, on the other hand, do set minimums. But these can vary significantly from one company to the next.

This guide will break down the general score requirements and how you can increase your chances of qualifying for this 0% down loan program.

Bad Credit Mortgage Loans Faq

What mortgage company works with bad credit?

Different mortgage lenders will see your application differently, so its important to shop around when you have bad credit. Online mortgage lenders have opened up more choices for many low credit score borrowers. Be sure to work with one that is licensed by the Nationwide Mortgage Licensing System .

Can I get a home loan with a 500 credit score?

It is possible to find an FHA lender willing to approve a credit score as low as 500. You may also be able to find a non-QM conventional lender with a 500 credit score minimum. But you wont have many choices, and youll need to be prepared to make a larger down payment. Itll also help if you have few other debts compared to your monthly income.

Can I get a home equity loan with a 500 credit score?

This is unlikely, as most lenders require a credit score in the 600s or higher for a home equity loan. You may find exceptions if you have a very low debt-to-income ratio and lots of equity. A home equity loan is a second mortgage thats secured by the value of your home.

What credit score is considered bad credit?Can a cosigner help me get approved?

A co-signer or co-borrower might help you get mortgage-approved with bad credit if the lender is willing to average both scores. However, some lenders only consider the lower of the two credit scores on an application. So make sure you shop around and ask about different lenders policies.

How do mortgage lenders afford bad credit loans?

Also Check: Can Dependents Get Va Loan

Is There A Credit Score Requirement For A Va Loan

Keeping track of your finances and getting in the habit of paying bills on time can set you up for a good future. These simple tasks can really effect your credit score and ultimately your loan eligibility.

Your credit score is important when applying for a VA home loan. A credit score is basically the numerical representation of your credit history and creditworthiness. Credit scores are used to determine two things when it comes to VA loans:

The minimum credit score requirement will vary depending on which lender you choose to get your VA loan through.

Va Loan Credit And Income Eligibility

The VA doesnt set a minimum credit score requirement for a VA loan. However, some lenders may only approve borrowers with a credit score of 620 or higher. To be eligible for a VA loan, your income must also be consistent and stable. You need to provide your most recent pay stubs, tax returns from the last two years, and information about other income sources

Read Also: How To Find Out Where My Student Loan Is From

Good Credit Means Better Mortgage Rates Today

While having a low credit score does not completely disqualify you from getting a VA home loan, having a higher score is helpful. You can get better loan terms and better mortgage rates today than you would with less than fair credit. It is at the discretion of the lender to decide the percentage offered to each borrower. In general, those individuals with excellent credit get offered the best rates. However, many homeowners and homebuyers are taking advantage of the current mortgage rates trend which shows the rates decreasing.

How Much Can You Gross Up Disability Income On A Va Loan

Regardless of their disability rating, disabled veterans with VA loan eligibility are qualified for a VA home loan if they fulfill the requirements for the loan. While standards differ, veterans generally must meet minimum service criteria, have a good credit score, satisfy the minimum income limits, and possess an acceptable debt-to-income ratio. The debt-to-income ratio is the minimum mortgage payments on all your debts divided by your gross monthly income before taxes are taken out, without factoring in any other debts.

One of the advantages of applying for a VA loan as a disabled veteran is that you may gross-up your disability income by 25% to be eligible. A rise in income might be the difference between approval and denial of a loan. Lenders typically prefer a credit score of 620, but having a lower credit score isnt an immediate ban, especially if its from a lender like FHA Lend that will accept VA credit scores as low as 500.

To demonstrate to lenders that youll be able to make your payments while keeping up with other obligations, its critical to generate consistent, dependable revenue. The interest rates for these loans are typically lower than those for traditional mortgage financing. There are several benefits to be gained from them that arent available in a regular mortgage, including:

You May Like: Where To Apply For Small Business Loan

Va Loan Spots Requirement

At VA Loan Spot, we use three credit scores collected from all three of the major credit bureaus, Equifax, TransUnion and Experian. From those three credit scores, we choose your middle score to determine your qualification. For example, if we pull a 530, 540 and 560, we will use the 540 credit score.

The minimum credit score we approve of is a 530. If your middle score ends up being a 530 or higher, youre going to have a chance at approval with VA Loan Spot. If you do not meet this requirement, we do welcome explanations or stories behind your credit score. We understand life throws unexpected things at us, and if your circumstance is justified, we will still approve you.

No Money Out Of Pocket On Home Purchase

A Veteran with a VA Loan can purchase a home with their VA Loan with zero down payment and zero closing cost and no money out of pocket:

- The government made a point that Veterans can qualify for VA Loan with bad credit

- This is because most military personnel who served our country oversees lacked credit

- Especially established good credit

- Many Veterans did not have any money saved for a down payment on a home purchase

To honor our men and women in uniform, the United States government created the VA Loan Program as a way of rewarding and thanking our Veterans after the completion of their service in helping them become homeowners with a VA Loan.

Recommended Reading: How To Take Out Personal Loan With Bad Credit