What Is Your Interest Rate

When calculating your monthly payments, youll want to look at the interest rate rather than the annual percentage rate because your monthly payments will not reflect your closing costs. Youll use your APR when calculating the overall cost of the loan.

Its important to shop around for the best interest rate available to you for the type of loan youre considering. Know that factors like your loan term, type of mortgage, down payment percentage, and credit score will all have an impact on your interest rate.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Are You Getting An Arm Or An Frm

Adjustable-rate mortgages start with lower initial interest rates, which then are adjusted with the market periodically after the introductory period. These can be a great option if you dont plan to stay in the home very long, or when the market rate is high but is expected to decrease before the introductory period ends. These are not a great option when market rates are very low and likely to increase after the introductory period, especially if you are planning on living in the house for many years.

Your interest rate with a fixed-rate mortgage wont change over time, which means your payment amounts are the same throughout the life of the loan. These are a great option when market rates are low and are expected to rise over the duration of the mortgage.

Read Also: Usaa Auto Loan Requirements

How Much Are You Putting Down

Your down payment will have a big impact on your mortgage loan estimate because it directly affects your monthly payments and even your interest rate. It can also affect whether or not youll need mortgage insurance.

Youll want to subtract this amount from the total sales price because the down payment is your contribution to purchasing the house, so the lender wont need to give you a loan to cover the full sales price because youre covering some of it.

A down payment is usually expressed as a percentage of the purchase price, so make sure youre converting that % back into whole dollars when you do the math for this calculation.

Your down payment can vary. First-time buyers often think that 20% is standard for a down payment, but thats not true. There are many mortgage programs that offer you the ability to put down far less even nothing in certain cases!

If you need to have a smaller down payment, see if you meet the criteria for any of the following loan programs:

- FHA loans can be approved with just 3.5% as a down payment.

- Conventional loans can be approved with as little as 3% as a down payment.

- USDA loans are available mostly in rural areas and enable buyers to put down zero percent of the price.

- VA loans enable eligible active duty military personnel and veterans to buy a home with zero percent down.

How To Calculate A Mortgage Loan Payment

There is a set formula that can be used to calculate a mortgage loan payment. It goes like this:

M = P

If that looks like Greek to you, dont worrythe point of the calculator above is so that you wont have to do this calculation yourselfbut it is helpful to know what the number you receive from our calculator truly represents. Here are what the components of the formula mean:

- M = The total monthly mortgage payment

- P = The principal balance of your mortgage loan, which is the entire loan amount that you are borrowing

- r = The monthly interest rate that you pay on your mortgage loan. When you get your rate from your lender, it will be expressed as an annual rate. To find out what the monthly rate is, youd divide your annual interest rate by the 12 months of the year. If your annual rate was 4.5%, you would divide .0045/12 to get your monthly rate of .00375.

- n = The total number of payments that you will make over the life of your mortgage loan. You can determine the total number of payments by multiplying the number of years of your mortgage loan by 12 months in a year. So, if you have a 15-year mortgage at a fixed rate, you would multiply 15 x 12 to get 180 total payments

When you plug your numbers into this formula, the biggest factors that affect the cost of your mortgage payment are the total cost of the home that youre buying, the amount of your down payment, and the length of the term of your mortgage loan.

Recommended Reading: Mortgage Loan Originator License California

Will You Need To Pay Mortgage Insurance On The Loan

If you put down less than 20%, you may need to pay mortgage insurance for a period of time, which is based on the loan amount.

Mortgage insurance protects lenders in the event that you stop making payments on your loan, so expect your lender to require it if your down payment is less than 20% on a conventional loan, or if youre taking out a FHA loan .

Your mortgage insurance amount will depend on various factors, including the amount of your down payment, your credit score, and which state the home is in.

Different banks and lenders have different ways of calculating this, but you can safely calculate your mortgage insurance rate to be somewhere between 0.25% and 1% of your mortgage loan amount annually. It will be split up and included in your monthly mortgage payments.

If you use a conventional loan, you can opt out of mortgage insurance once you own 20% of the homes equity, so paying for mortgage insurance may be a short-term expense, depending on your homes price and relative down payment. For FHA loans, however, the mortgage insurance typically lasts for the lifetime of the loan, unless you make a down payment of 10% or higher.

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Also Check: Prosper Credit Requirements

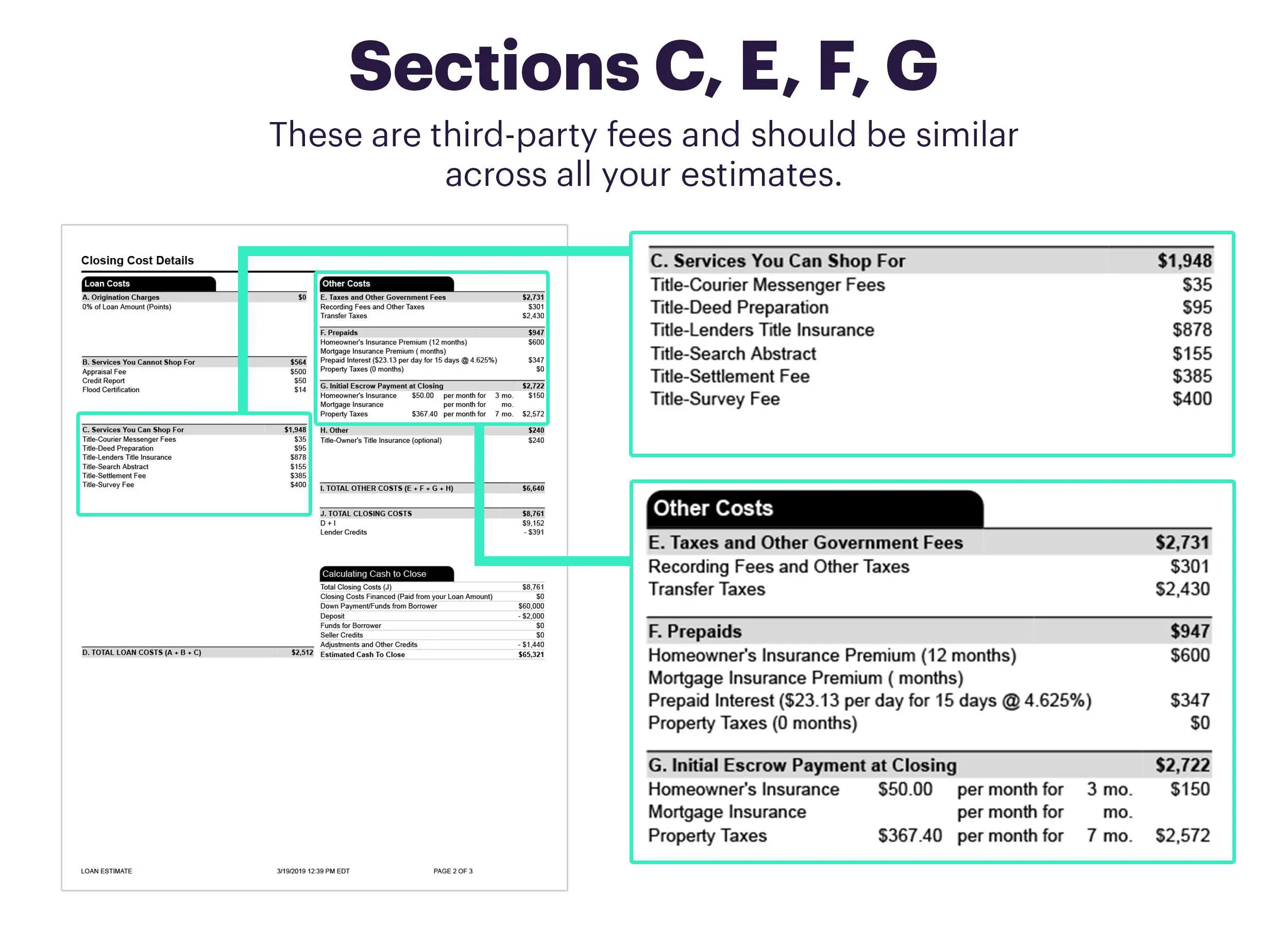

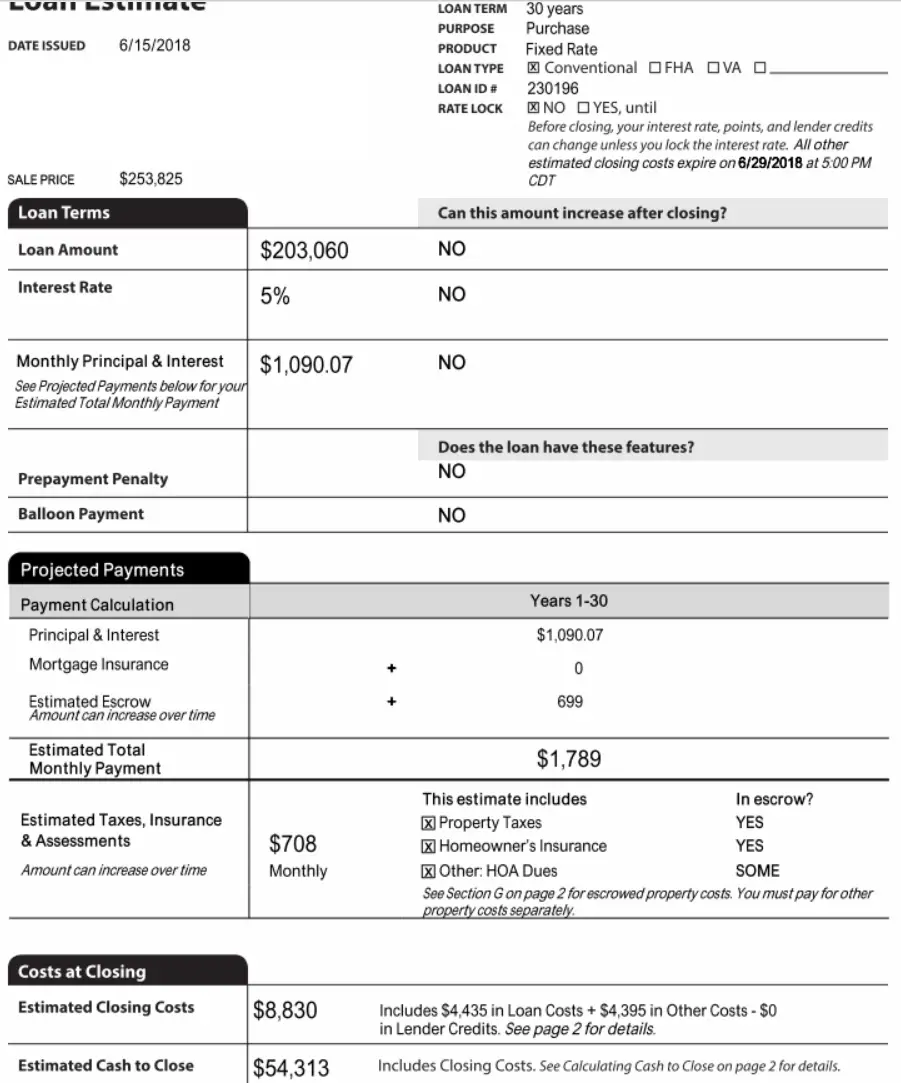

Whats Important To Know About The Loan Estimate

- A Loan Estimate isnt an indication that your loan application has been approved or denied.

- You dont need to have a signed contract for the property that youre receiving a Loan Estimate for.

- Youre not obligated to pay an application fee other than a reasonable fee for the lender to run a credit report.

- If your interest rate or loan details change, you may receive a revised Loan Estimate.

- An interest rate on your Loan Estimate is not a guarantee. Some lenders may lock your rate as part of issuing a Loan Estimate but others may not.

- If you choose to move forward with the loan and lender, you must convey your intent to proceed.

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

Read Also: Refinance My Fha Loan

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

You May Like: Using Va Home Loan For Investment Property

What Is Your Loan Term

Loan term is a fancy way of saying how long will you have to pay back the loan?

Mortgages are usually repaid in 30-year or 15-year increments, but you may be able to get a loan for other terms if you like.

There are benefits to both longer and shorter loan terms. Shorter terms mean higher monthly payments but less spent overall on the loan. Longer terms give you more time to pay and lower monthly payments, but also more spent overall on the loan in interest.

Not everyone can be approved for a shorter-term loan, as the monthly payments will be higher, but your income remains the same. Depending on how much you want to spend on a house, a longer loan term may be your only loan term option.

As an example, paying off a $100,000 loan over 30 years would mean a $278 principal payment each month. Paying off the same $100,000 loan over 15 years would mean a $555.56 principal payment each month. If your total budget to repay this hypothetical loan is $500 per month, then a 15-year loan term isnt feasible.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

You May Like: Upstart Second Loan

A Guide To Private Mortgage Insurance

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Its a myth that you need to put down 20% of a homes purchase price to get a mortgage. Lenders offer numerous loan programs with lower down payment requirements to fit a variety of budgets and buyer needs. If you go this route, though, expect to pay for private mortgage insurance . This added expense can drive up the cost of your monthly mortgage payments and, overall, makes your loan more expensive. However, its almost unavoidable if you dont have a 20% or more down payment saved up.

Private Mortgage Insurance

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: Fha Mortgages Refinance

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

You May Like: Sss Loan Eligibility

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

The Best Home Loan Option For You

Any good calculator will help determine what might be a good loan product for you based on what you might qualify for. Youll usually see several options.

Its worth noting that you must qualify, so dont take what the mortgage calculator says as gospel. A Home Loan Expert will better be able to tell you what you qualify for when they take a more detailed look at your financial history. However, it does give you a starting point in terms of things to think about.

Recommended Reading: How To Stop A Student Loan Garnishment

What You Should Know

- If you put less than a 20%down paymenton your conventional mortgage, you are required to pay for private mortgage insurance

- Private mortgage insurance protects the lender in the case that you are not able to make yourmortgage paymentsand thus default on the loan

- PMI rates range, on average, from 0.55% to 2.25% of the original loan amount

- Your PMI premiums can be removed once you build 20% equity in your home

- There are different types of PMI, which include borrower-paid mortgage insurance, lender-paid mortgage insurance, single premium mortgage insurance, and split-premium mortgage insurance

- Government-backed loans such as FHA-loans require mortgage insurance premiums